Dave Ramsey Student Loan Payoff Calculator

The weight of student loan debt continues to burden millions of Americans, shaping their financial futures and impacting broader economic trends. With outstanding balances reaching staggering heights, individuals are desperately seeking strategies and tools to navigate this complex landscape and find a path towards financial freedom.

At the center of this ongoing struggle is the Dave Ramsey Student Loan Payoff Calculator, a resource that has garnered both significant praise and critical scrutiny. This article will delve into the calculator's functionality, its underlying principles, and the varying perspectives surrounding its effectiveness in addressing the student loan crisis.

Understanding the Ramsey Approach

The Dave Ramsey Student Loan Payoff Calculator is based on the principles of Dave Ramsey's well-known "snowball method." This debt reduction strategy prioritizes paying off the smallest debt first, regardless of interest rate.

The idea is that achieving early wins by eliminating smaller debts provides motivation and builds momentum to tackle larger, more daunting loans. Users input their loan details, including balances, interest rates, and minimum payments, and the calculator generates a personalized repayment plan.

How the Calculator Works

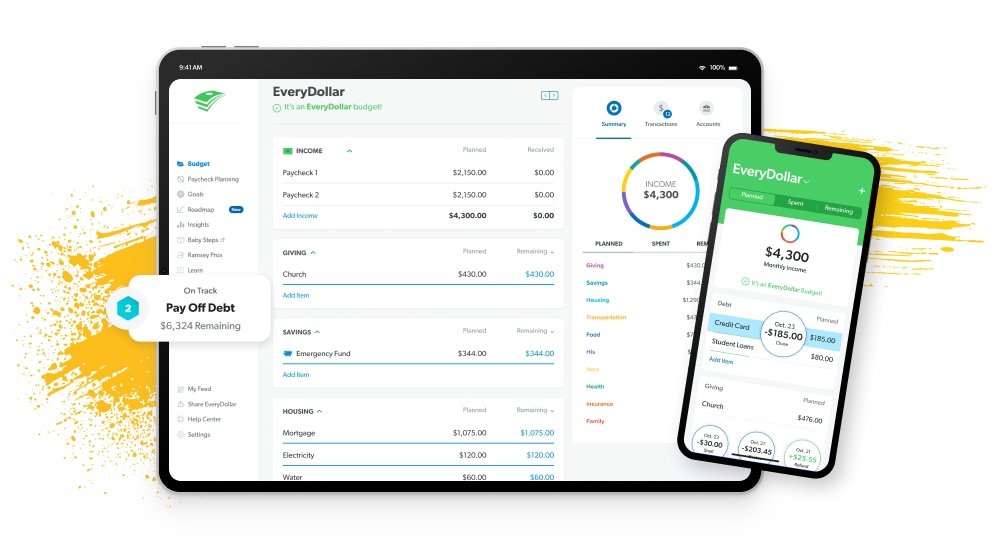

The calculator’s user interface is designed to be simple and straightforward. Users enter information such as the total amount of their student loan debt, the interest rates associated with each loan, and the minimum monthly payments required.

Based on these inputs, the calculator then projects a timeline for repayment, highlighting how quickly users can become debt-free if they follow the snowball method and allocate any extra money towards their debts. It visually demonstrates the impact of additional payments on reducing the overall repayment time.

The Snowball Method: Pros and Cons

Proponents of the snowball method emphasize the psychological benefits. The quick wins from paying off smaller debts can be incredibly motivating, keeping borrowers engaged in the repayment process.

Ramsey often highlights testimonials from individuals who credit the snowball method with helping them achieve significant debt reduction. These success stories serve as powerful endorsements for his approach.

Critics, however, argue that the snowball method isn't always the most financially efficient approach. From a purely mathematical standpoint, the avalanche method – which prioritizes paying off debts with the highest interest rates first – typically results in lower overall interest payments.

Financial experts like Suze Orman have argued that while motivation is important, borrowers should prioritize minimizing the total cost of their debt. Paying off high-interest loans quickly saves money in the long run, even if the initial wins aren't as immediate.

Alternatives and Considerations

The Dave Ramsey Student Loan Payoff Calculator is just one tool among many available to borrowers. Government resources, such as the Federal Student Aid website, offer various repayment plan options, including income-driven repayment plans that adjust monthly payments based on income and family size.

These plans may be more suitable for borrowers with lower incomes or those working in public service, as they can lead to loan forgiveness after a certain period of qualifying payments.

Borrowers should also consider seeking advice from qualified financial advisors who can assess their individual circumstances and provide personalized recommendations. A financial advisor can help navigate the complexities of student loan repayment and identify the most appropriate strategies.

The Bottom Line

The Dave Ramsey Student Loan Payoff Calculator provides a framework for tackling student loan debt, emphasizing motivation and behavioral changes. However, borrowers should be aware of the potential financial implications of the snowball method and explore all available repayment options.

Ultimately, the best approach to student loan repayment depends on individual circumstances, financial goals, and risk tolerance. A combination of strategies, along with careful planning and consistent effort, is often the key to achieving long-term financial success.

As the debate surrounding student loan debt continues, tools like the Dave Ramsey Student Loan Payoff Calculator will likely remain a topic of discussion. Understanding the pros and cons of different repayment strategies is crucial for borrowers seeking to navigate the complexities of their debt and build a secure financial future.