What Credit Score Do You Need For A Chase Card

For consumers eyeing the perks and rewards of a Chase credit card, a crucial first step is understanding the credit score requirements. Gaining approval isn't solely about income; your creditworthiness, as reflected in your credit score, plays a pivotal role. A solid credit score significantly increases your chances of being approved.

The threshold for approval varies depending on the specific Chase card you're targeting. While there's no universal minimum score, most Chase cards are geared towards individuals with good to excellent credit. Understanding these requirements can save applicants time and potential negative impacts on their credit reports from unnecessary applications.

Generally, a credit score of 670 or higher is considered "good" and opens the door to many Chase card options. This range includes "good" (670-739), "very good" (740-799), and "excellent" (800+) credit score categories. However, certain premium cards require scores in the "very good" to "excellent" range to qualify.

Navigating the Chase Card Landscape

Chase offers a range of credit cards tailored to different needs and spending habits. These include travel rewards cards, cashback cards, and cards designed for building or rebuilding credit. Each card has specific approval criteria, making it crucial to research individual card requirements.

For instance, the highly sought-after Chase Sapphire Preferred card typically requires a credit score in the 700s or higher. Similarly, the Chase Sapphire Reserve, known for its premium benefits, often necessitates a score closer to 740 or above. These cards are geared towards individuals with a proven track record of responsible credit management.

On the other hand, options like the Chase Freedom Unlimited and Chase Freedom Flex, while still requiring good credit, may be more accessible to those with scores closer to the lower end of the "good" range. These cards offer attractive cashback rewards and can be a good entry point into the Chase rewards ecosystem.

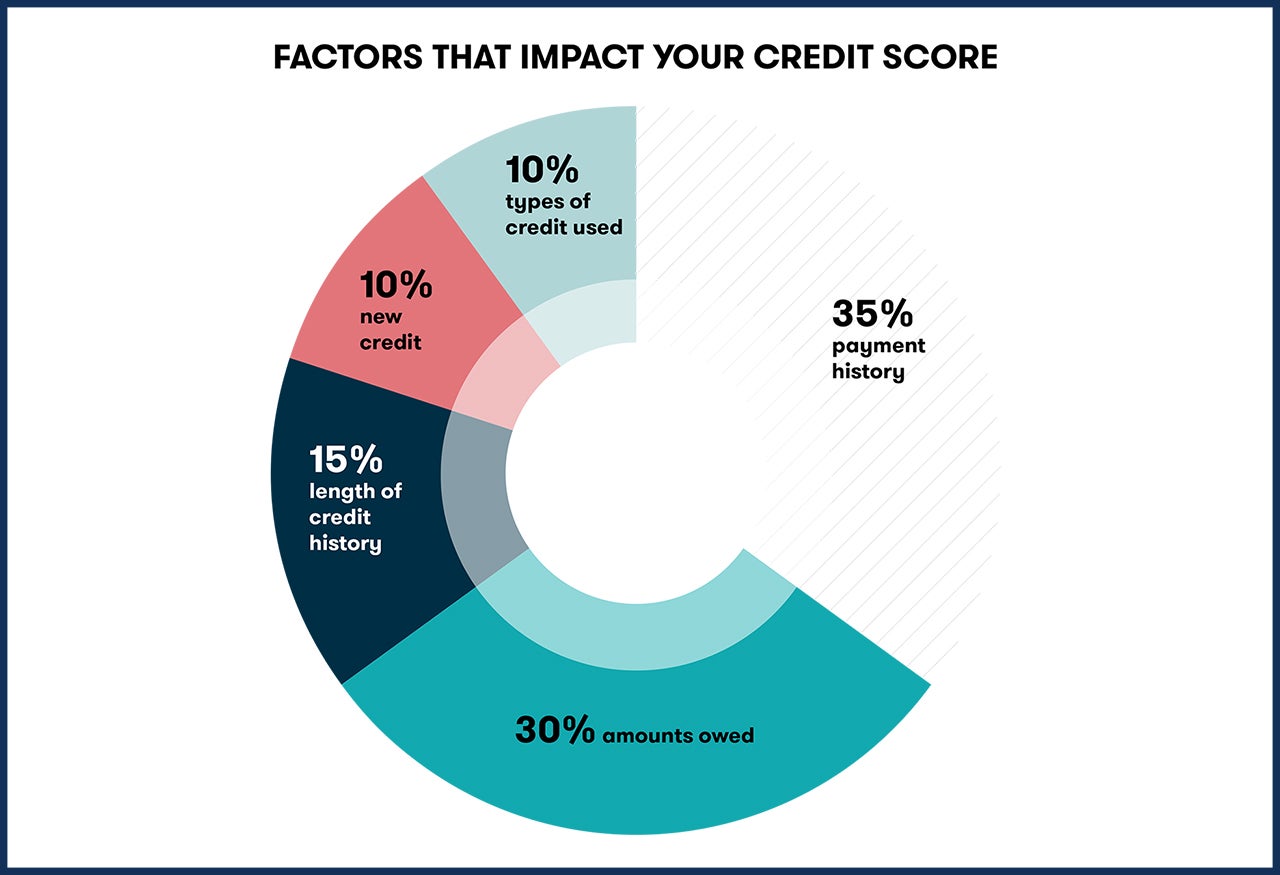

Factors Beyond Credit Score

While your credit score is a primary factor, Chase also considers other aspects of your financial profile. This includes your income, employment history, and overall credit history. A stable income and a long history of responsible credit use can strengthen your application, even if your credit score is slightly below the ideal range.

Chase also evaluates your debt-to-income ratio (DTI). A lower DTI indicates that you're not overextended with debt and are more likely to manage credit responsibly. This is a significant consideration for lenders assessing your ability to repay your debts.

Furthermore, Chase's infamous "5/24 rule" can impact your approval odds. This rule states that if you've opened five or more credit cards (from any bank, not just Chase) in the past 24 months, Chase will likely deny your application, regardless of your credit score.

Checking Your Credit Score

Before applying for any Chase credit card, it's prudent to check your credit score. You can obtain free credit reports from the three major credit bureaus – Equifax, Experian, and TransUnion – through AnnualCreditReport.com.

Reviewing your credit report allows you to identify any errors or inaccuracies that could negatively impact your score. Addressing these issues before applying can significantly improve your chances of approval. Monitor your credit score regularly to stay informed about your creditworthiness.

Many credit card issuers and financial institutions also offer free credit score monitoring services. These services can provide valuable insights into your credit health and alert you to any changes that may affect your score.

Ultimately, understanding the credit score requirements for Chase cards is crucial for maximizing your approval odds. By checking your credit score, addressing any issues, and understanding the specific requirements of the card you're interested in, you can increase your chances of successfully joining the Chase cardholder community. Preparation and a proactive approach are key to navigating the credit card application process successfully.

:max_bytes(150000):strip_icc()/ink-business-unlimited_blue-8f442e3126b64a608c6e5b0f9b0e29db.jpg)