E8 Retirement Pay At 20 Years

For service members reaching the pinnacle of the enlisted ranks, the calculation of retirement pay is a significant factor in their post-military financial planning. A recent update focuses on how an E8, a Senior Non-Commissioned Officer, with 20 years of service can expect their retirement pay to be calculated.

This article delves into the specifics of military retirement, focusing on the retirement pay calculation for an E8 with 20 years of service. It examines the various factors involved, offering service members and their families a clear understanding of what they can anticipate upon retirement.

Understanding the Basics of Military Retirement

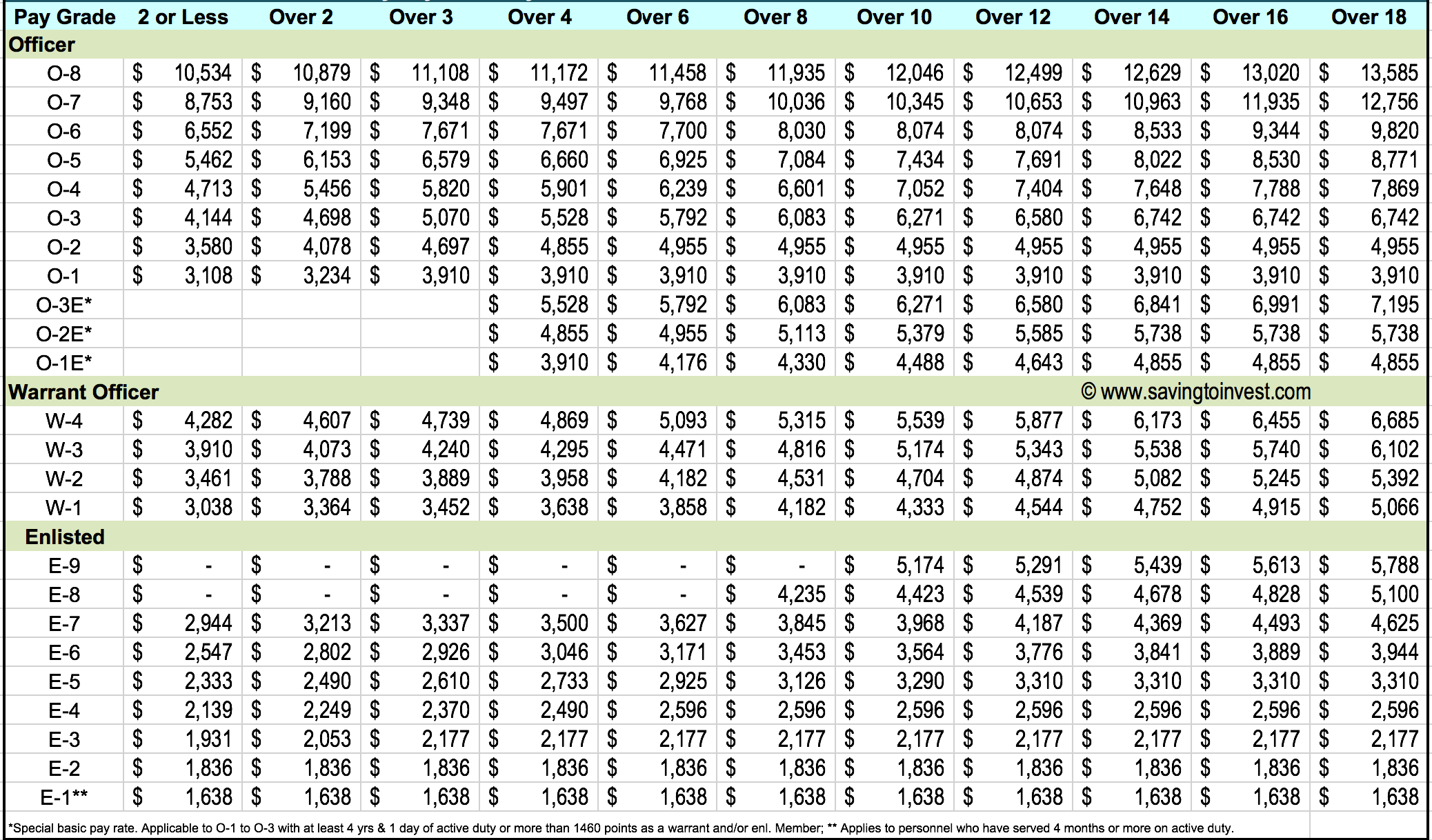

Military retirement pay isn't a fixed amount, but is determined by a number of variables. These include the service member's final pay, years of service, and the retirement system under which they fall.

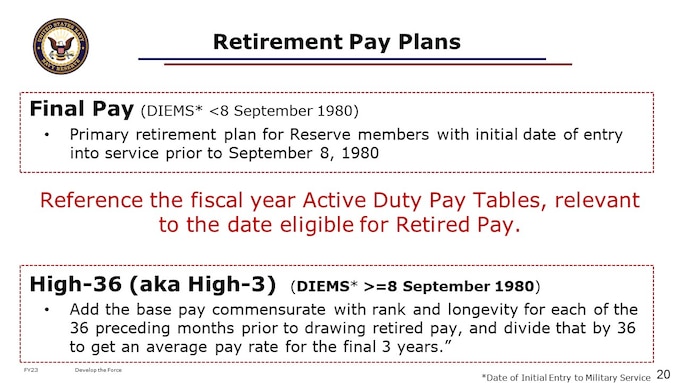

The most common retirement systems are High-3 and the Blended Retirement System (BRS). Understanding which system applies is crucial to calculating retirement pay.

The High-3 System

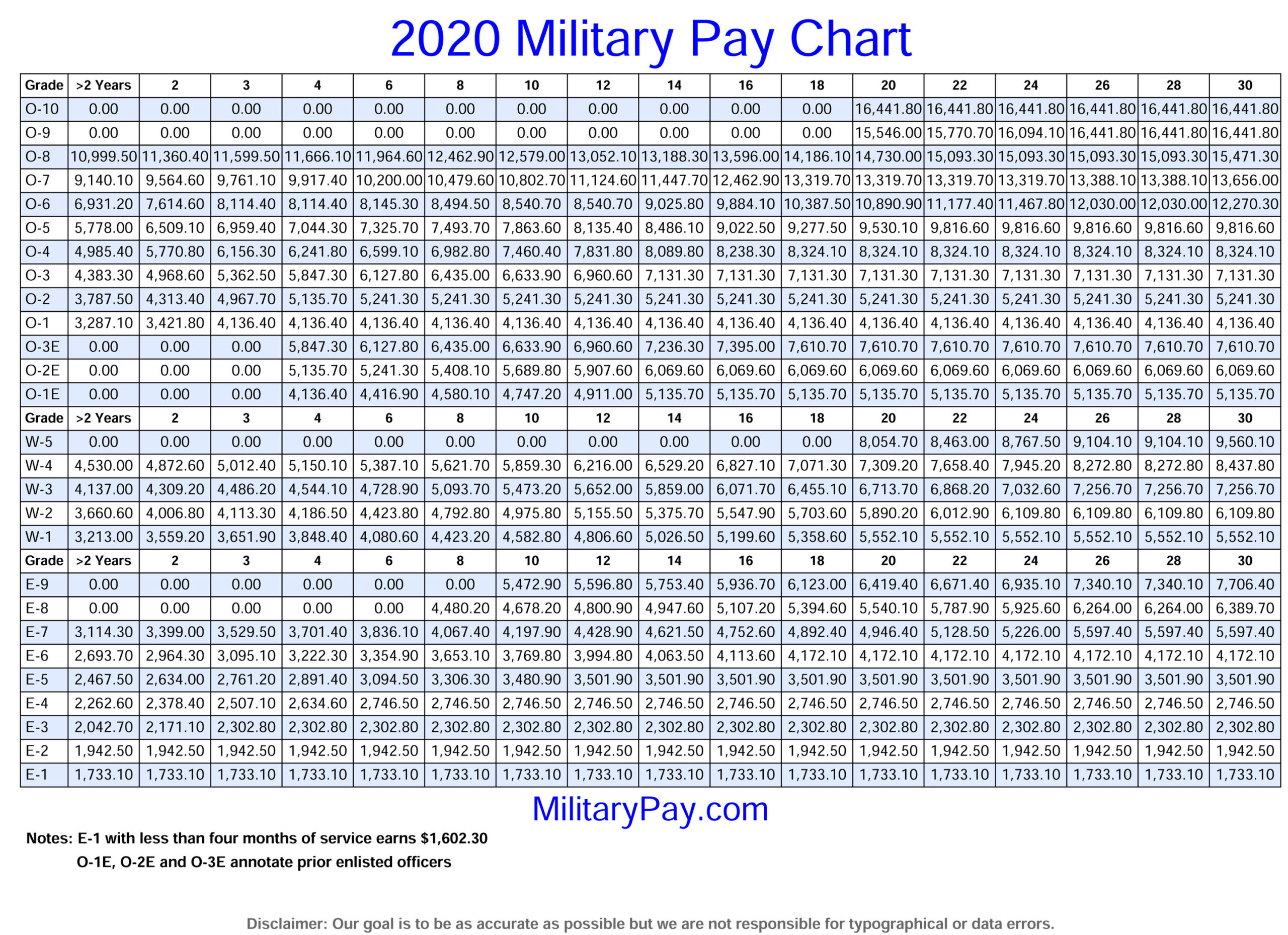

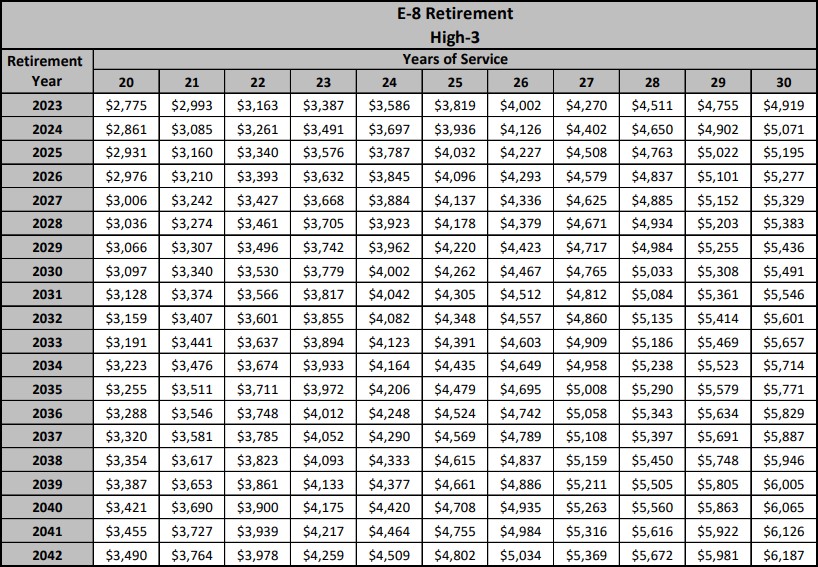

The High-3 system applies to those who entered military service before January 1, 2018. It calculates retirement pay based on the average of the highest 36 months of basic pay.

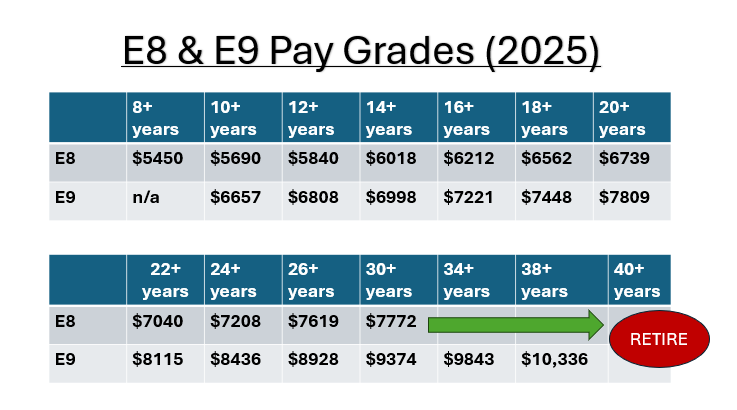

To calculate retirement pay under High-3, the average of the highest 36 months is multiplied by 2.5% for each year of service. Thus, for an E8 with 20 years of service, the calculation is average high-3 pay multiplied by 50% (2.5% x 20 years).

For example, if the average high-3 pay for an E8 is $6,000 per month, their retirement pay would be $3,000 per month before taxes and other deductions.

The Blended Retirement System (BRS)

The BRS applies to those who entered military service on or after January 1, 2018. This system blends a reduced defined benefit (pension) with a defined contribution (Thrift Savings Plan - TSP).

Under BRS, the multiplier is reduced to 2.0% per year of service. For an E8 with 20 years of service, the calculation is average high-3 pay multiplied by 40% (2.0% x 20 years).

Continuing the example, if the average high-3 pay for an E8 is $6,000 per month, their retirement pay under BRS would be $2,400 per month before taxes and other deductions. However, this is supplemented by TSP contributions accumulated over their career.

Impact of Rank and Time in Service

Rank plays a significant role in determining retirement pay due to its direct impact on basic pay. An E8 will naturally have a higher basic pay than a lower-ranking service member with the same years of service.

Furthermore, the more years of service, the higher the retirement multiplier. This incentivizes retention and rewards longer military careers.

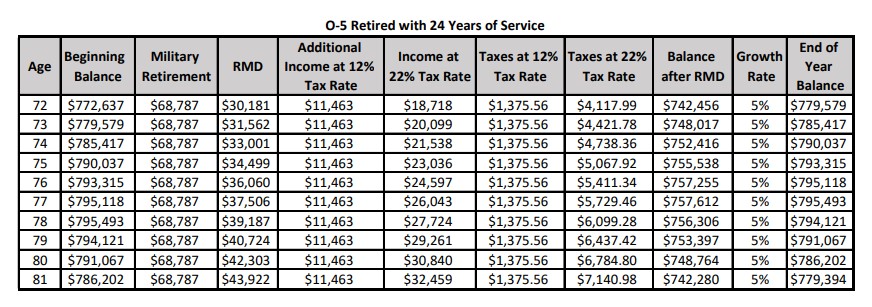

Additional Considerations: Taxes and Deductions

It's critical to remember that retirement pay is subject to federal and potentially state taxes. These taxes can significantly reduce the net amount received each month.

Additionally, deductions for health insurance (TRICARE) and other benefits will further reduce the amount. Planning for these deductions is crucial for an accurate financial forecast.

Seeking Professional Financial Advice

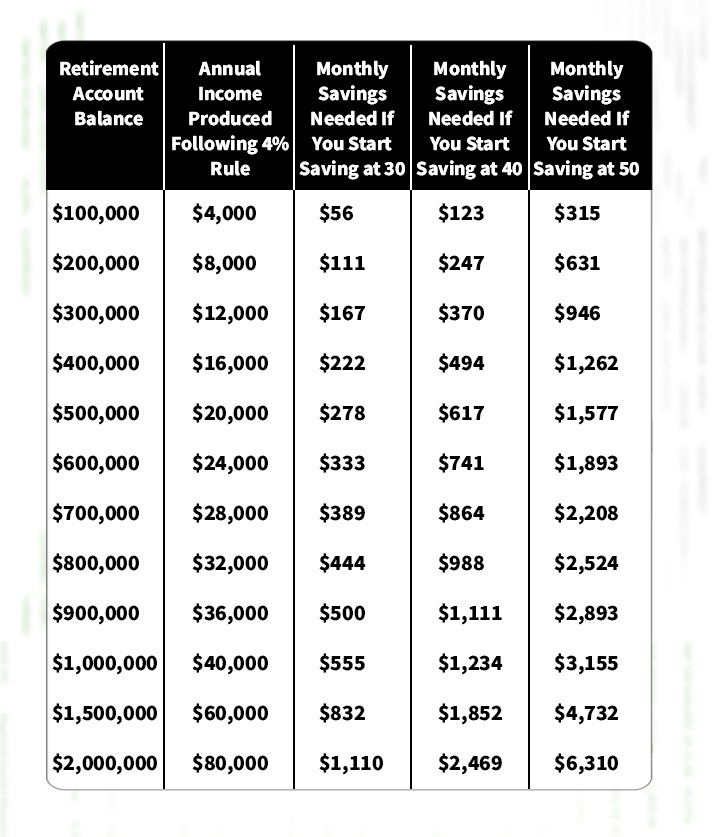

Given the complexities of military retirement, seeking professional financial advice is strongly recommended. A qualified financial advisor can help service members understand their options and create a personalized retirement plan.

They can also assist with understanding the nuances of the TSP, Roth IRA, and other investment vehicles. This allows for optimized savings and investments during and after military service.

Impact on the Military Community

Understanding retirement pay is vital for retaining experienced personnel. A clear and predictable retirement system incentivizes qualified individuals to remain in service longer, benefiting the military as a whole.

It also contributes to the financial stability of military families transitioning to civilian life. This stability enhances the overall well-being of the military community.

A Human Perspective

"Knowing what to expect upon retirement gave me peace of mind," says Master Sergeant (Retired) John Doe, who served for 20 years. "Planning early allowed me to transition smoothly into my next chapter."

His story highlights the importance of financial literacy and proactive planning for a successful military retirement.

Conclusion

Calculating retirement pay for an E8 with 20 years of service involves several factors, most notably the retirement system under which they fall. Whether under High-3 or BRS, understanding the specific calculations and potential deductions is crucial for effective financial planning.

By seeking professional financial advice and planning proactively, service members can ensure a secure and comfortable transition into retirement, recognizing their dedicated service to the nation.