Easiest American Express To Get Approved For

American Express, renowned for its premium rewards and exclusive perks, often seems out of reach for those with limited or no credit history. Navigating the credit card landscape can be daunting, especially when seeking entry into the coveted Amex ecosystem. The question on many potential cardholders' minds is: which American Express card offers the easiest path to approval?

This article delves into the Amex card most accessible to individuals with fair or limited credit, examining its features, benefits, and eligibility requirements. Understanding these factors can empower individuals to make informed decisions and increase their chances of securing their first American Express card. We will analyze available data and expert opinions to provide a balanced perspective on this topic.

The Contender: American Express Cash Magnet® Card

The American Express Cash Magnet® Card frequently surfaces as a leading option for individuals aiming to get their first Amex card. It is important to note that approval is never guaranteed and depends on individual financial circumstances. However, the Cash Magnet® Card's eligibility criteria seem comparatively less stringent compared to Amex's premium offerings.

Why the Cash Magnet® Card?

Unlike some Amex cards that require excellent credit scores, the Cash Magnet® Card often accepts applicants with fair to good credit. This accessibility stems from its more straightforward rewards structure and lower risk profile for American Express. The card offers a flat-rate cash back rewards program, simplifying the earning and redemption process.

Furthermore, the Cash Magnet® Card typically does not come with the high annual fees associated with other Amex cards. This reduced financial barrier to entry makes it an attractive option for those building or rebuilding their credit. Many reports from online financial forums and blogs indicate successful applications from individuals with credit scores in the mid-600s.

Eligibility Requirements and Approval Factors

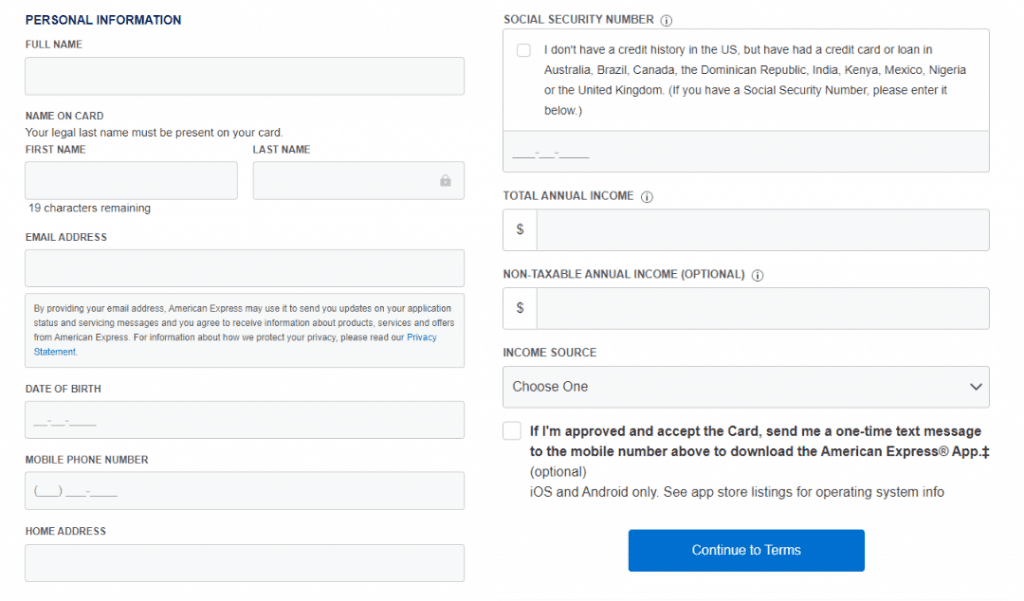

While the Cash Magnet® Card may be relatively easier to obtain, applicants still need to meet certain eligibility criteria. These typically include having a steady source of income, a valid Social Security number, and a reasonable credit history. American Express also considers factors such as debt-to-income ratio and payment history on other credit accounts.

Even with a fair credit score, factors such as recent bankruptcies or a history of late payments can negatively impact approval odds. Applicants should carefully review their credit reports and address any inaccuracies or outstanding debts before applying. Improving credit utilization and paying down existing balances can also strengthen an application.

Beyond the Cash Magnet® Card: Other Possibilities

Although the Cash Magnet® Card is frequently cited, other Amex cards may be accessible depending on individual circumstances. Secured credit cards, while not always offered directly by American Express, can serve as a stepping stone to building credit and eventually qualifying for an unsecured Amex card.

The Amex EveryDay® Credit Card, while no longer available for new applications, serves as a reminder that Amex's product offerings can change. Card options and their eligibility requirements can fluctuate. It is therefore wise to check the official American Express website for the most up-to-date information and explore alternative cards from other issuers.

Expert Perspectives and Data

Financial analysts often recommend the Cash Magnet® Card as a good entry point into the American Express ecosystem. Ted Rossman, Senior Industry Analyst at CreditCards.com, has noted that while approval isn't guaranteed, the card's requirements are less stringent than some other Amex products. Data from credit monitoring agencies also suggest a higher approval rate for the Cash Magnet® Card among individuals with fair credit scores compared to other Amex cards.

However, experts caution against solely focusing on getting approved for any credit card. Prioritizing responsible credit management, such as making on-time payments and keeping credit utilization low, is crucial for long-term financial health. "Building a solid credit foundation is more important than simply acquiring a specific credit card," emphasizes Sarah Chen, a certified financial planner.

Looking Ahead

The accessibility of American Express cards can evolve based on economic conditions and Amex's strategic priorities. Potential applicants should regularly monitor Amex's card offerings and compare them with other credit card options. Actively working to improve their credit profile will increase their chances of approval for a wider range of cards in the future.

Ultimately, the "easiest" American Express card to get approved for depends on an individual's unique financial circumstances. While the Cash Magnet® Card appears to be a strong contender, careful research and responsible credit management are essential for navigating the credit card landscape successfully. Remember to review the official terms and conditions on the American Express website.

![Easiest American Express To Get Approved For [YMMV] American Express Business Platinum 150,000/200,000 Pre-Approved](https://www.doctorofcredit.com/wp-content/uploads/2023/05/american-express-business-platinum-1024x479.png)