How Much Can You Send Through Walmart To Walmart

In today's interconnected world, the ability to quickly and reliably send money to family and friends is more crucial than ever. Walmart's Walmart to Walmart money transfer service offers a convenient solution, but understanding its limitations is paramount for users. This article delves into the specifics of transaction limits, fees, and other factors affecting the service, providing a comprehensive guide for those seeking to utilize this popular money transfer option.

This comprehensive guide unveils the specific limitations of the Walmart to Walmart money transfer service, addressing critical aspects such as maximum send limits, fee structures based on transaction amounts, and geographic restrictions. Furthermore, it will explore alternative money transfer services, offering a balanced perspective for consumers to make informed financial decisions.

Understanding Walmart to Walmart Send Limits

The core question for users revolves around how much money they can actually send through Walmart to Walmart. Generally, the maximum send limit is $2,500 per transaction. However, this limit can vary depending on several factors.

State laws and individual store policies can influence the maximum amount allowed. It's always advisable to check with the specific Walmart location or consult the official Walmart website for the most up-to-date information regarding send limits in your area.

Certain circumstances may warrant additional scrutiny or documentation. Large transfers might require identification verification to comply with anti-money laundering regulations.

Fees Associated with Transfers

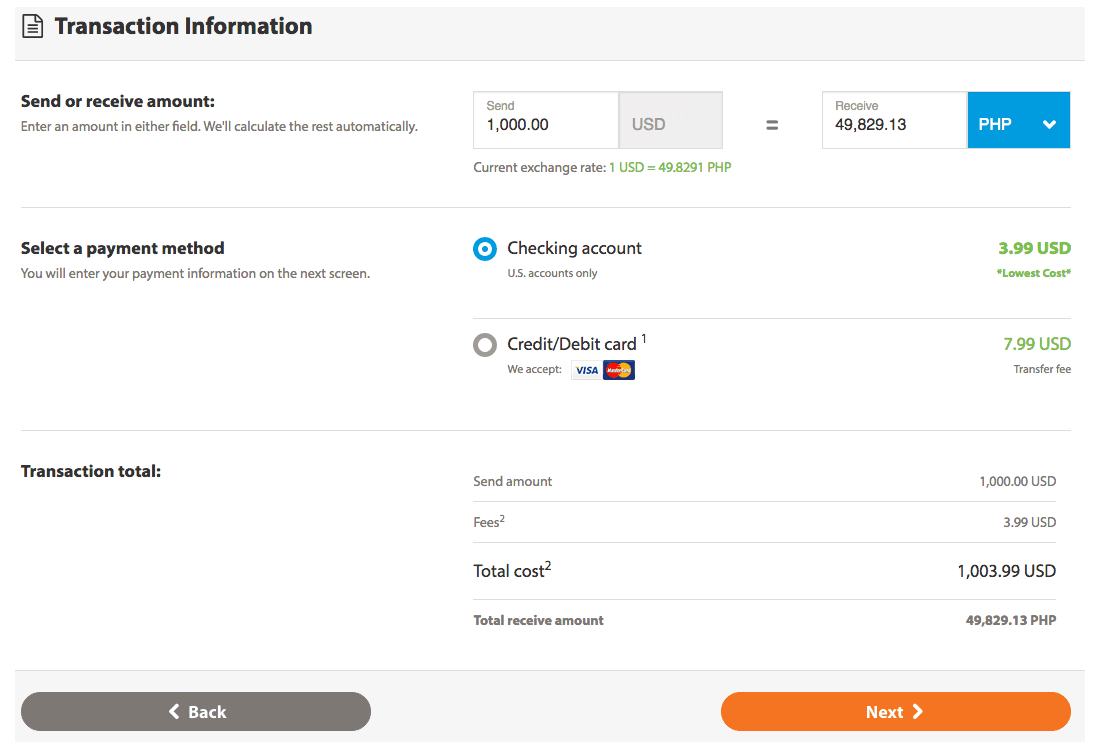

While the convenience of Walmart to Walmart is appealing, it's crucial to understand the associated fees. The fee structure is typically tiered, meaning the cost increases as the amount you send increases.

For smaller transfers, the fees might be relatively low, making it a cost-effective option. However, for larger amounts approaching the $2,500 limit, the fees can become a significant percentage of the total transaction.

Walmart's website provides a fee calculator to help users estimate the cost before initiating a transfer. Be aware that fees can fluctuate, so always confirm the exact amount at the time of the transaction.

Factors Affecting Transaction Limits

Several factors can impact the maximum amount you're allowed to send through Walmart to Walmart. One major consideration is compliance with regulatory requirements.

Financial institutions are obligated to adhere to anti-money laundering (AML) regulations. This often translates to enhanced due diligence for larger transactions, including verifying the sender's identity and the purpose of the transfer.

Individual send limits may also be in place to prevent fraud. These limits are designed to protect both the sender and the receiver from potential scams or unauthorized transactions.

Geographic Restrictions and Availability

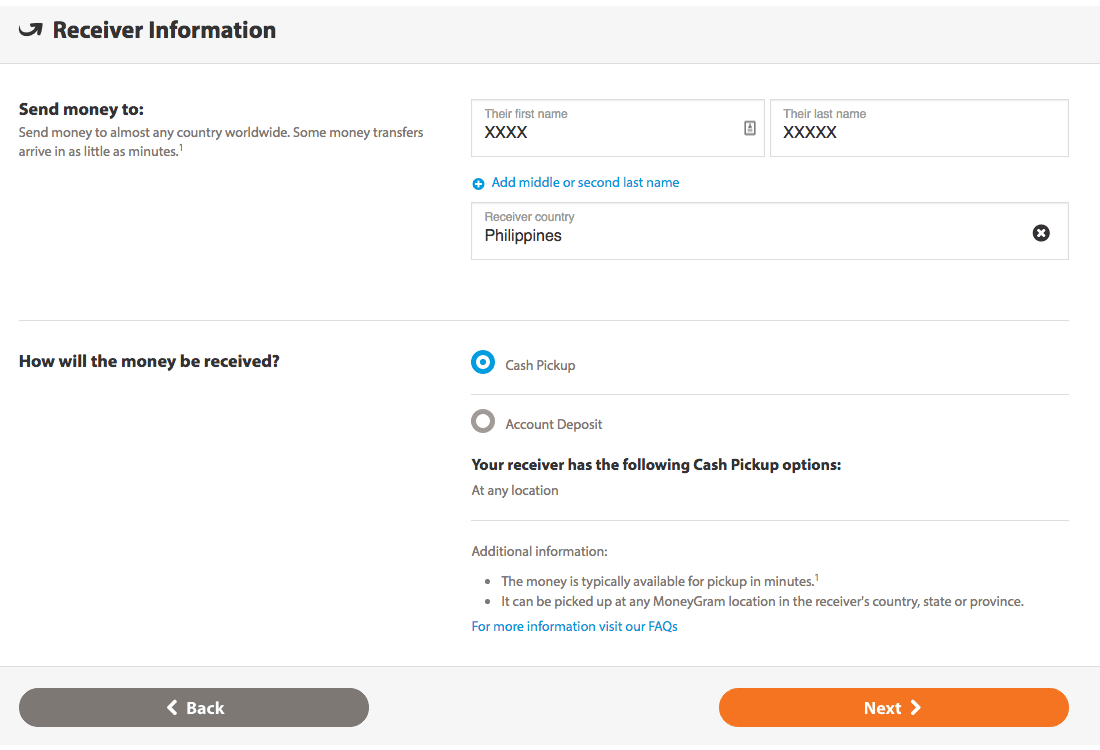

Walmart to Walmart offers domestic transfers within the United States and to Puerto Rico. It is a key element to know geographic restrictions apply.

While the service is widely available across Walmart stores nationwide, availability can vary depending on local regulations and store operations. Check to make sure the location you're going to offers this service.

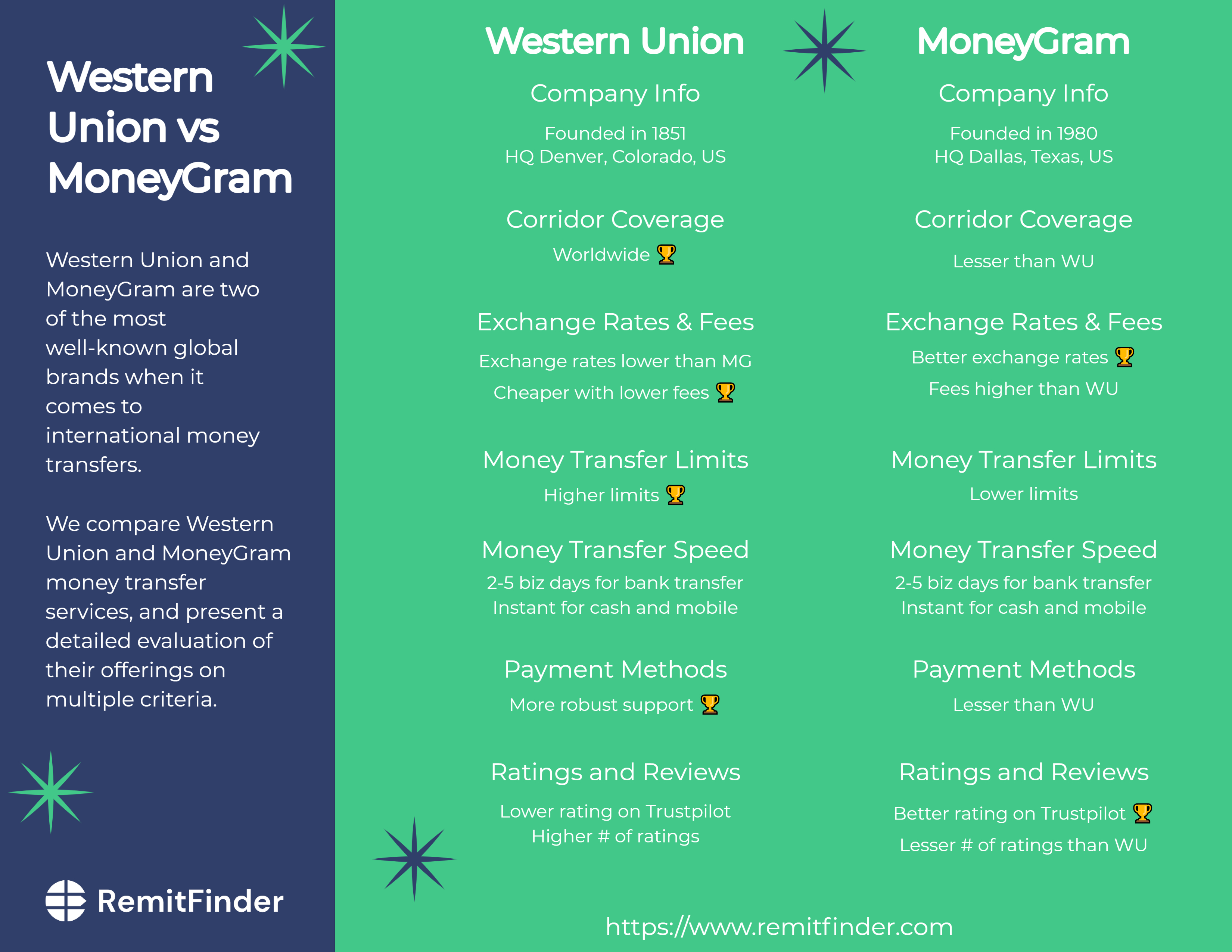

For international transfers, Walmart partners with other money transfer providers like MoneyGram and Western Union. These services have their own limits and fees.

Alternatives to Walmart to Walmart

While Walmart to Walmart is a popular choice, several alternative money transfer services exist. Services such as MoneyGram, Western Union, and online platforms like PayPal and Venmo offer different features and fee structures.

Each service has its own advantages and disadvantages. Online platforms may offer lower fees but require both the sender and receiver to have accounts, while traditional money transfer services might be more accessible to those without bank accounts.

Before choosing a service, carefully compare fees, transaction limits, and delivery options to find the best fit for your specific needs.

The Future of Money Transfers at Walmart

Walmart continues to adapt its financial services to meet evolving consumer demands. The company is investing in technology to streamline the money transfer process and enhance security.

Future developments could include increased transaction limits, expanded geographic coverage, and integration with mobile payment platforms. As regulations and technology evolve, Walmart will likely adjust its Walmart to Walmart service accordingly.

Staying informed about these changes is crucial for users who rely on this service for their money transfer needs. Consulting Walmart's official channels remains the best way to obtain the most up-to-date information on limits, fees, and availability.

/images/blogs/97-how-to-send-money-through-walmart/how-to-send-money-through-walmart-title.jpg)