Easy Accounting Software For Small Business

For small business owners, juggling daily operations with managing finances can be a daunting task. Recognizing this challenge, a growing number of user-friendly accounting software solutions are emerging, promising to simplify financial management and empower entrepreneurs to focus on growth.

These easy-to-use platforms aim to democratize accounting, making it accessible even to those without formal training. The rise of these solutions marks a significant shift, potentially reshaping how small businesses approach their finances and ultimately impacting their success.

What's Driving the Trend?

Several factors are fueling the demand for simplified accounting software. Cloud-based technology has made these platforms more accessible and affordable, eliminating the need for expensive hardware and complex installations.

Moreover, the increasing complexity of tax regulations and financial reporting requirements necessitates tools that can automate tasks and minimize errors. Small business owners are seeking solutions that save time, reduce stress, and provide a clear understanding of their financial health.

Key Features and Benefits

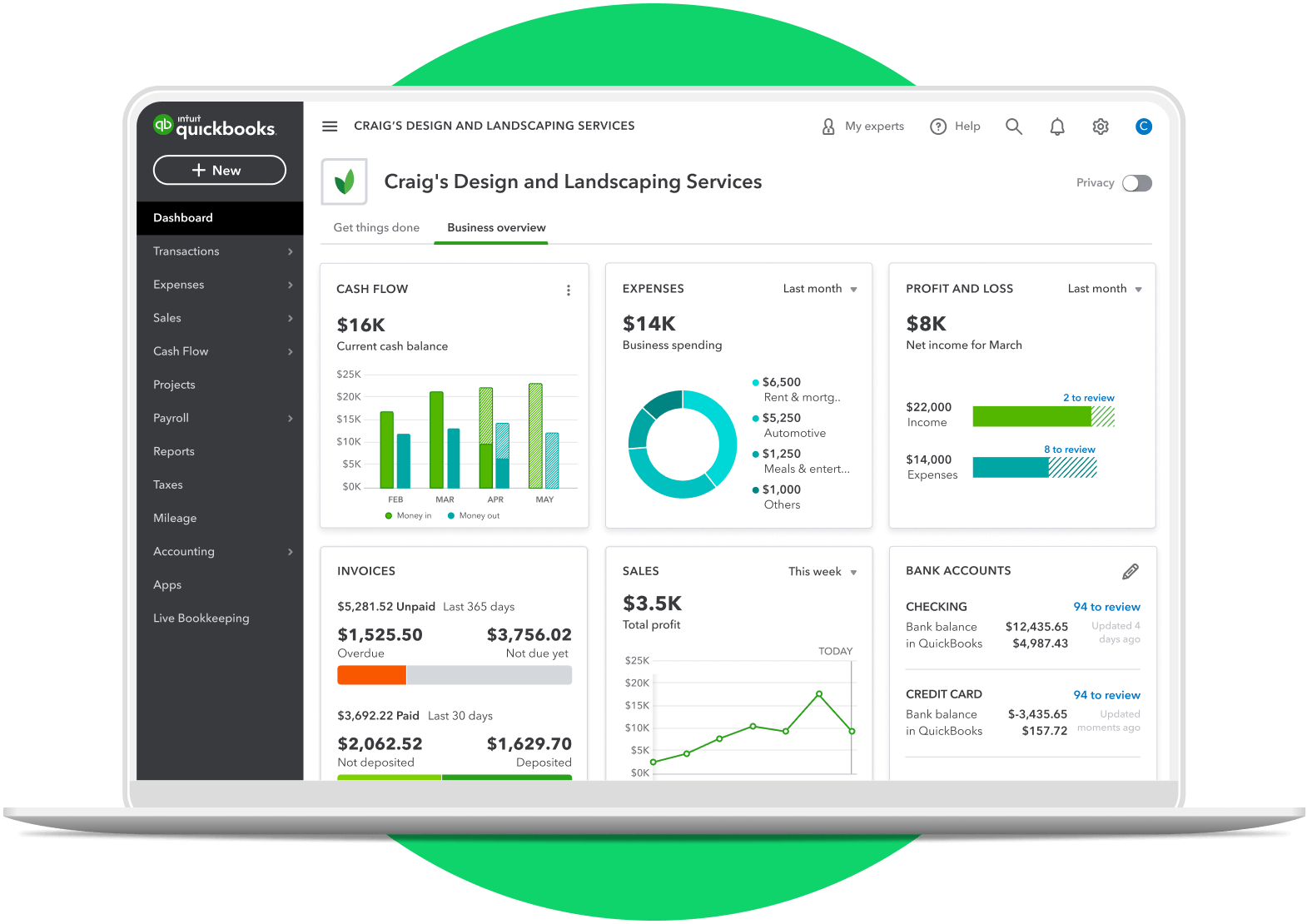

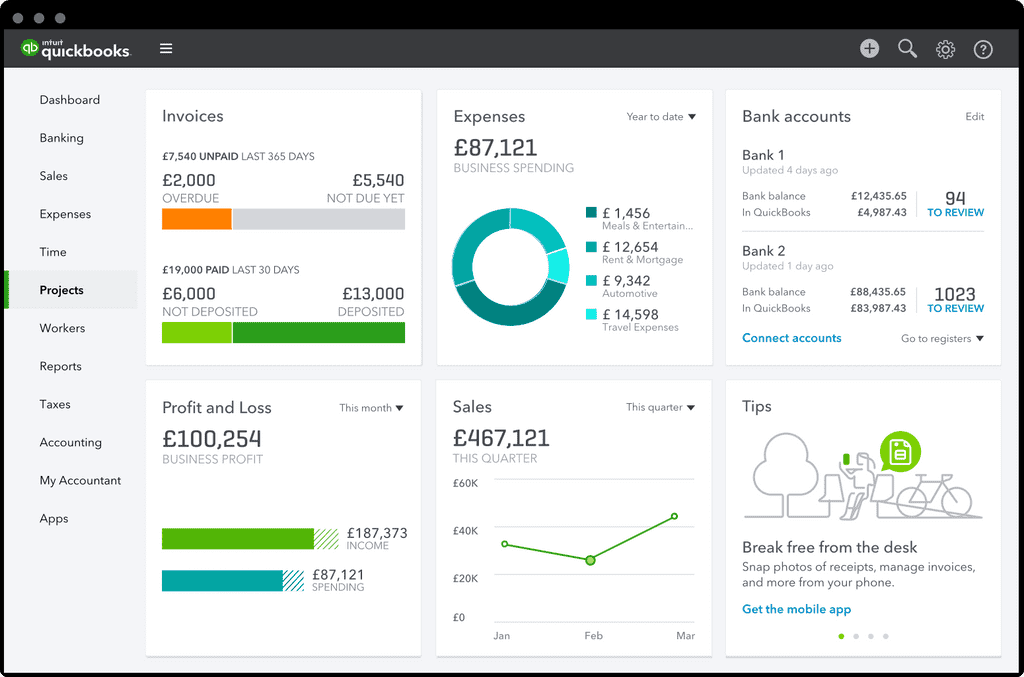

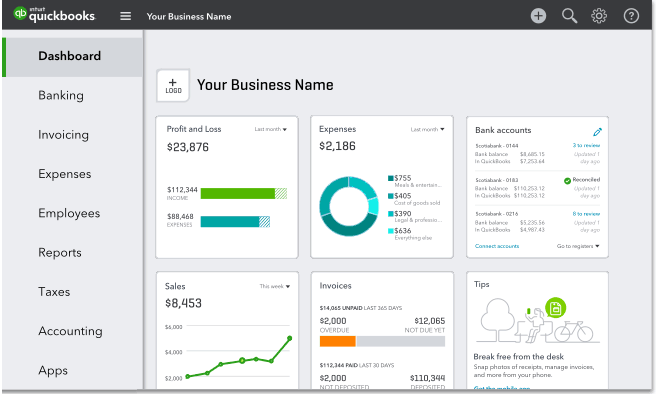

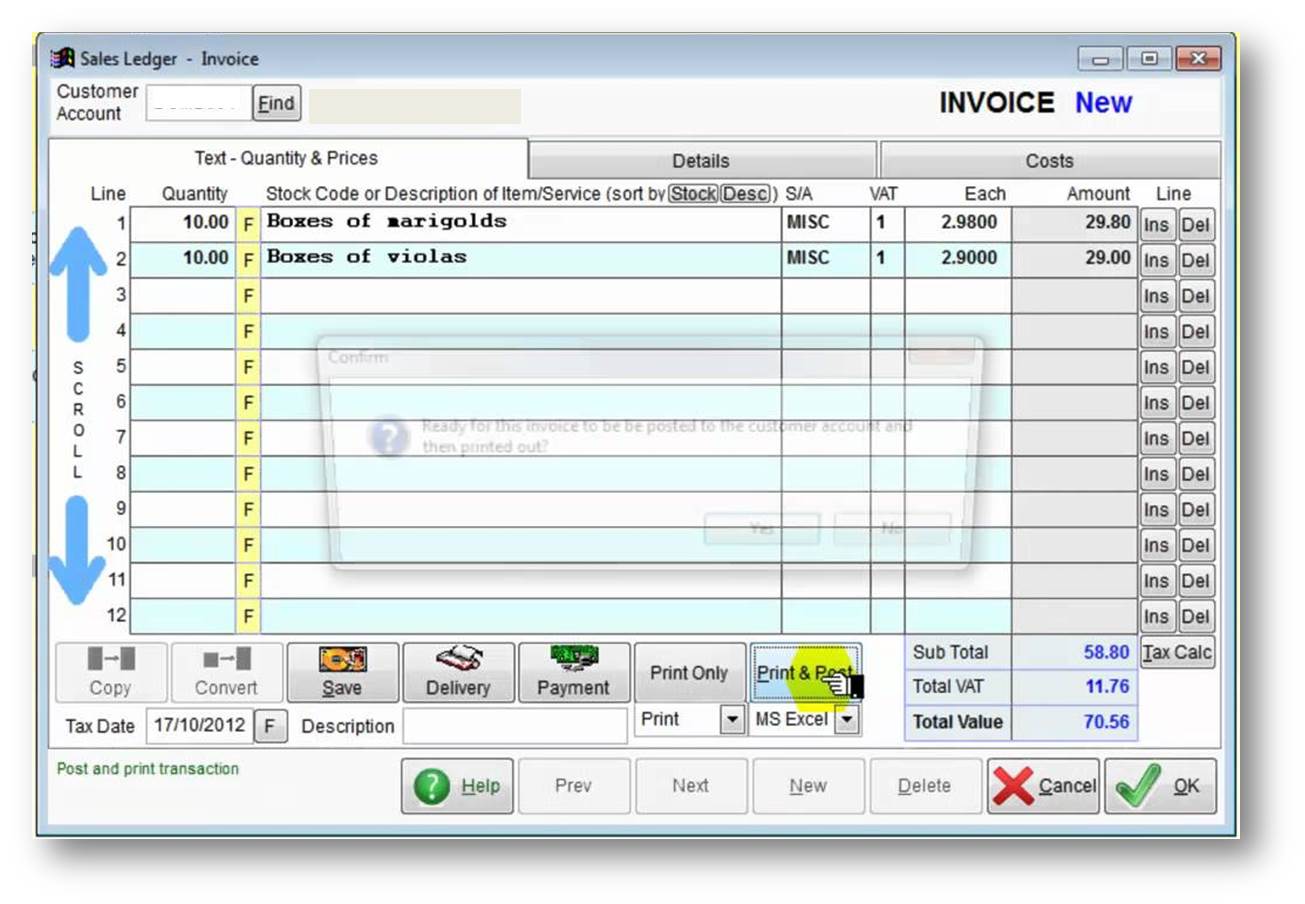

These software solutions typically offer a range of features designed for ease of use. Common functionalities include invoice generation, expense tracking, bank reconciliation, and basic financial reporting.

Many platforms also incorporate features like automated tax calculations and integration with other business tools. This all-in-one approach streamlines workflows and reduces the need for manual data entry.

According to a recent report by XYZ Research, businesses using simplified accounting software experienced a 20% reduction in bookkeeping time and a 15% improvement in cash flow management. These statistics highlight the tangible benefits these platforms can offer.

Who are the Key Players?

The market is becoming increasingly competitive, with both established players and new entrants vying for market share. QuickBooks Online remains a popular choice, known for its comprehensive features and established brand recognition.

Other notable options include Xero, which emphasizes user-friendly design and seamless integrations, and FreshBooks, specifically tailored for service-based businesses. Several smaller, niche platforms are also emerging, catering to specific industries or business models.

A spokesperson from Gartner, a leading research and advisory firm, stated that "the best software for a small business depends heavily on their specific needs and technical capabilities. A careful assessment of requirements is crucial before making a decision."

Impact on Small Businesses

The accessibility of easy accounting software has the potential to level the playing field for small businesses. By simplifying financial management, these platforms empower entrepreneurs to make informed decisions, track their progress, and secure funding more easily.

This can lead to increased profitability, improved sustainability, and ultimately, a stronger economy. Furthermore, it allows business owners to focus on their core competencies and growth strategies rather than being bogged down by administrative tasks.

A Human-Interest Perspective

Sarah Miller, owner of a local bakery, shared her experience: "Before switching to a cloud-based accounting system, I was spending hours each week on bookkeeping. Now, I can track my sales, manage my expenses, and even generate profit and loss statements with just a few clicks."

She added, "This has freed up so much time for me to focus on creating new recipes and growing my business. It's been a game-changer." Stories like Sarah's underscore the transformative potential of these technologies.

Looking Ahead

The trend towards simplified accounting software is likely to continue. As technology evolves, we can expect even more sophisticated features, such as artificial intelligence-powered insights and predictive analytics, to be integrated into these platforms.

For small business owners, embracing these tools can be a strategic advantage, enabling them to navigate the complexities of the financial landscape and achieve sustainable growth. Choosing the right software requires careful research and a clear understanding of your business's unique needs.