Easy Small Business Accounting Software

Small business owners are scrambling for affordable solutions as tax season looms. A new wave of easy-to-use accounting software promises to simplify financial management and ease the burden on entrepreneurs.

This surge in accessible accounting tools aims to empower small businesses, granting them control over their finances without requiring extensive accounting knowledge or expensive professional assistance.

The Problem: Accounting Overwhelm

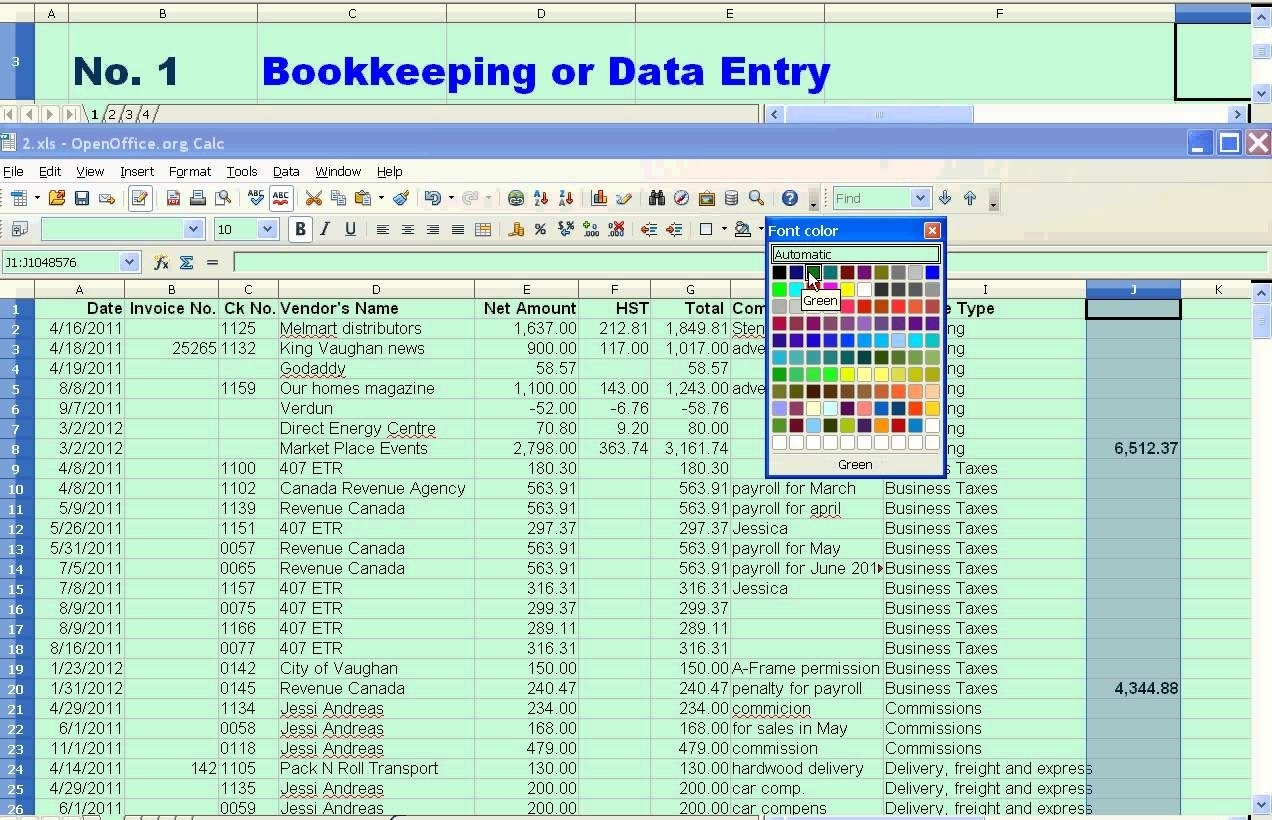

Many small business owners lack the time or expertise for complex accounting. Traditional methods are often time-consuming and prone to error.

A recent survey by Gusto found that 40% of small business owners spend over 80 hours per year on bookkeeping. This translates to lost productivity and potential financial missteps.

This is where easy accounting software steps in to help businesses save time and money by automating routine tasks.

The Solution: User-Friendly Software

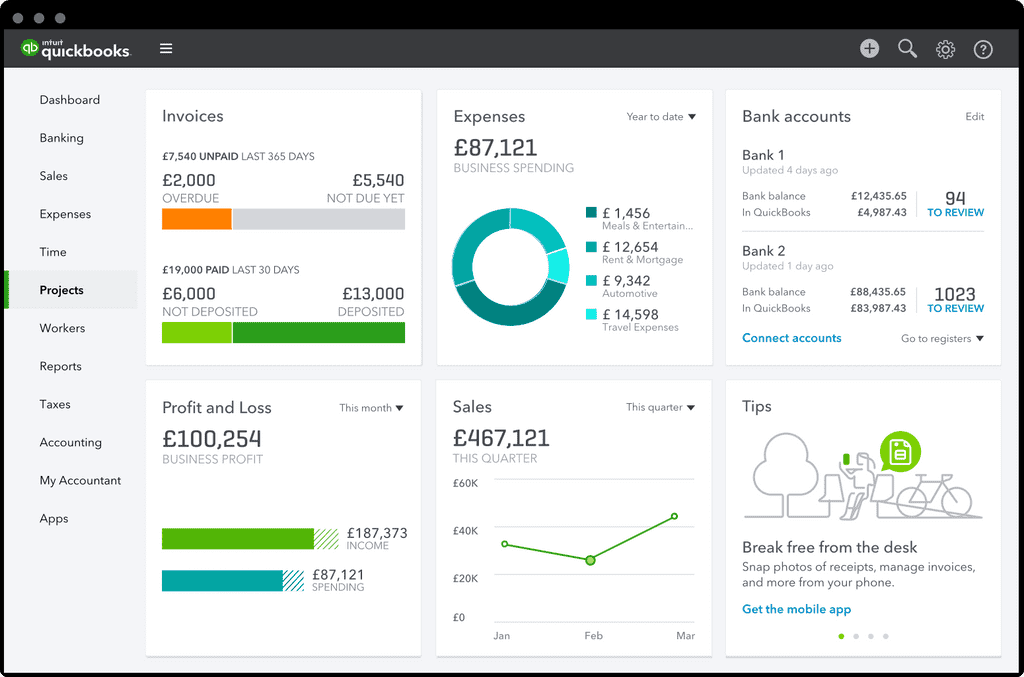

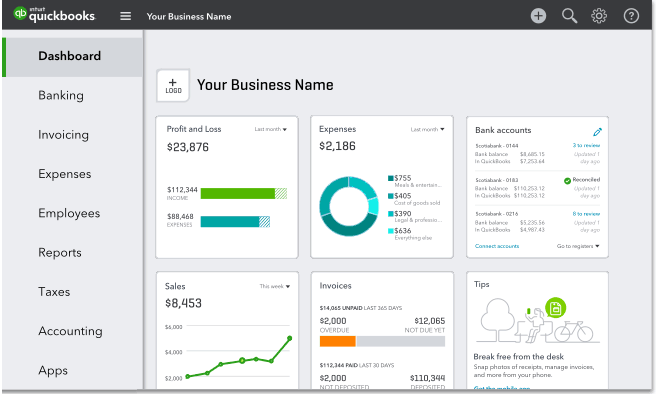

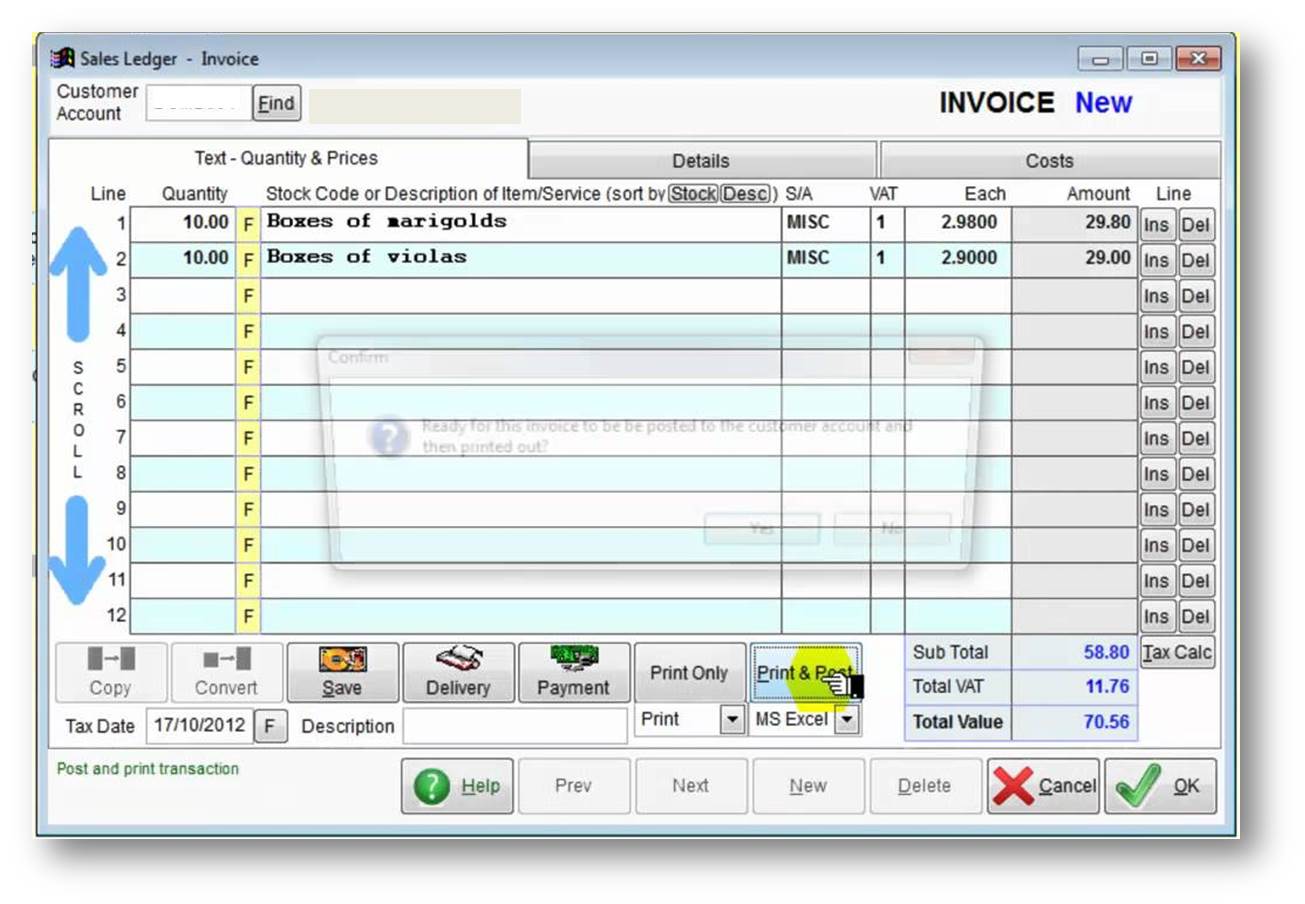

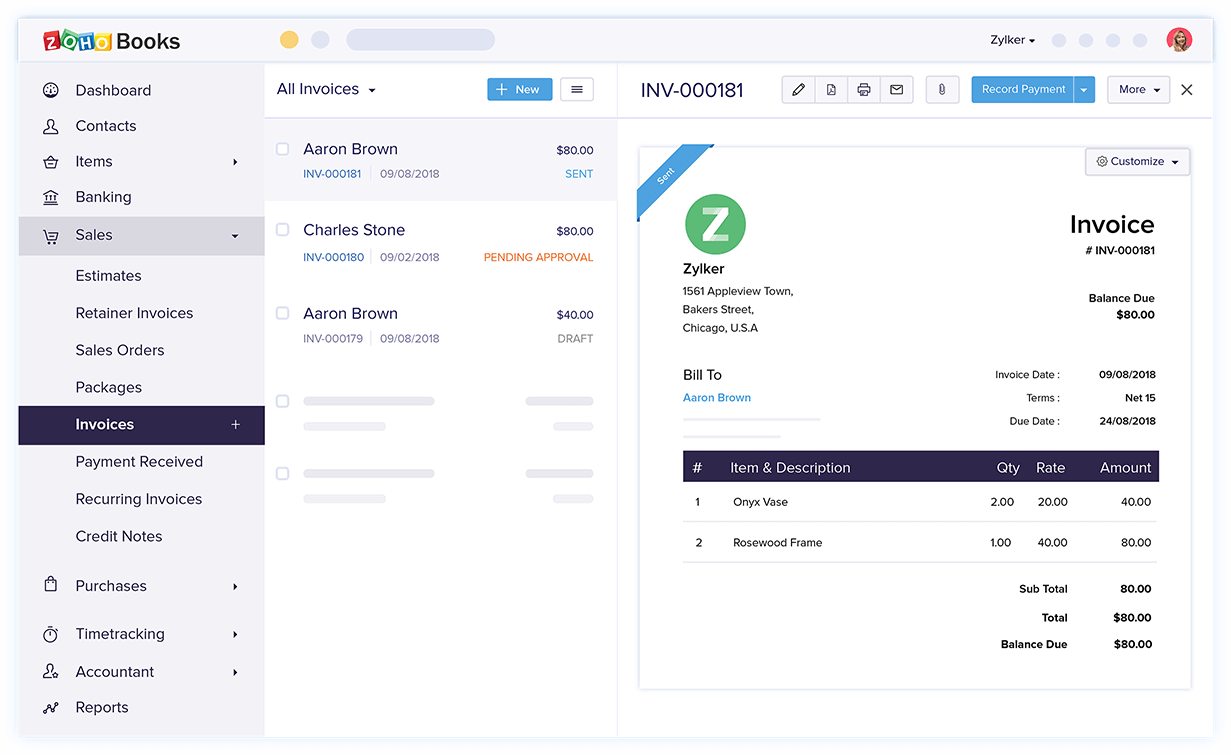

New software options like Zoho Books, QuickBooks Self-Employed, and Xero Small Business are gaining traction.

These platforms boast intuitive interfaces, automated invoice generation, and simplified expense tracking. Most importantly they also integrate with other business tools.

Pricing varies, but many offer free trials or basic plans for under $20 per month. This makes them significantly more accessible than hiring a full-time accountant.

Key Features to Look For

When selecting software, prioritize features that align with your business needs. These include invoice management, expense tracking, and bank reconciliation.

Also consider integration capabilities with other tools like payment processors and CRM systems.

Reporting features are vital for tracking profitability and making informed business decisions. Make sure your selection enables you to generate reports.

The Impact: Empowering Entrepreneurs

Small business owners report significant time savings and improved financial clarity. Early adopters have seen reductions in errors and increased efficiency.

"I was spending hours each week on bookkeeping," says Maria Rodriguez, owner of a local bakery. "Now, with Zoho Books, I can manage everything in minutes."

The accessibility of these tools is also leveling the playing field, allowing smaller businesses to compete more effectively. It helps provide access to tools normally only available to larger companies.

The Risks: Considerations Before Switching

While promising, these solutions aren't a silver bullet. Data security is a paramount concern.

Ensure the chosen software has robust security measures and complies with relevant data privacy regulations. A data breach could be extremely costly.

Also, be aware of the learning curve, even with user-friendly interfaces. Proper training and support are crucial for successful implementation.

Next Steps: Evaluate and Implement

Small business owners should research and compare different software options. Take advantage of free trials to test the user experience.

Consult with a financial advisor or accountant to determine the best solution for your specific needs. Seek out support to help with implementation.

The deadline for many tax-related tasks is fast approaching, so prompt action is crucial to avoid penalties and ensure compliance.