Ebitda To Levered Free Cash Flow

In the intricate world of corporate finance, understanding a company's true financial health requires navigating a labyrinth of metrics. While EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) has long been a favored proxy for cash flow, increasingly, analysts and investors are turning their attention to Levered Free Cash Flow (LFCF), a more refined measure offering a clearer picture of a company's financial flexibility and ability to generate value for its equity holders.

This shift towards LFCF highlights a growing recognition that EBITDA, while useful as a starting point, can mask crucial financial realities, especially in capital-intensive industries or those with significant debt obligations. This article will delve into the nuances of both metrics, exploring their strengths, limitations, and the critical reasons why LFCF is gaining prominence as a more robust indicator of a company's financial prowess.

The Allure and Limitations of EBITDA

EBITDA is widely used due to its simplicity and its ability to provide a quick overview of a company's operating profitability. It essentially measures a company's earnings before the impact of financing decisions (interest), accounting decisions (depreciation and amortization), and tax regime.

This makes it easier to compare the operating performance of different companies, even if they have varying capital structures or are subject to different tax rates. By stripping out these elements, EBITDA allows analysts to focus on the core profitability of a business.

However, EBITDA has several significant limitations. The most notable is its failure to account for capital expenditures (CAPEX), which are essential for maintaining and growing a business, particularly in industries like manufacturing, telecommunications, and energy. It also ignores changes in working capital, such as increases in inventory or accounts receivable, which can significantly impact a company's cash flow. Furthermore, it doesn't factor in debt service.

"EBITDA is a deeply flawed metric," warns a recent report from Moody's Investor Service. "It can provide a misleading picture of a company's financial health, particularly for highly leveraged companies."

Levered Free Cash Flow: A More Realistic View

LFCF, on the other hand, offers a more comprehensive view of a company's cash-generating ability after accounting for all essential cash outflows. It represents the cash flow available to equity holders after all debt obligations and capital expenditures have been met.

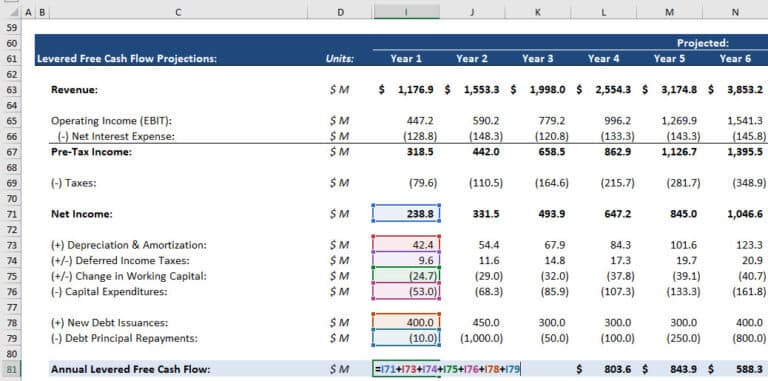

The formula for LFCF typically involves starting with net income, adding back non-cash charges like depreciation and amortization, subtracting capital expenditures, and accounting for changes in working capital. Finally, it deducts mandatory debt repayments.

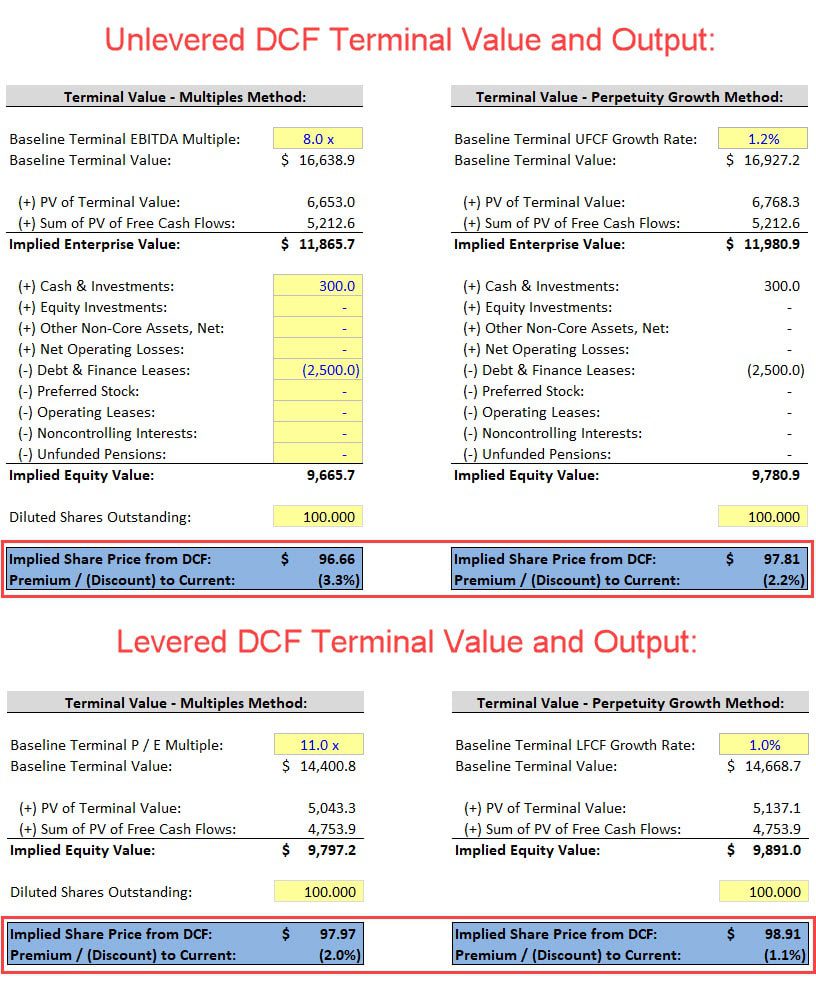

This detailed approach provides a more accurate picture of the cash available to a company to reinvest in the business, pay dividends, or repurchase shares. It is a key metric in valuation models, particularly discounted cash flow (DCF) analysis, as it represents the actual cash flow available to equity investors.

The Calculation and its Significance

Calculating LFCF begins with net income. This is then adjusted by adding back depreciation and amortization, as these are non-cash expenses that reduce net income but do not represent actual cash outflows.

Next, capital expenditures (CAPEX) are subtracted. CAPEX represents investments in property, plant, and equipment, which are essential for maintaining and growing a business. Changes in working capital (accounts receivable, inventory, and accounts payable) are also factored in to reflect the impact of these short-term assets and liabilities on cash flow.

Finally, mandatory debt repayments are deducted. This is a critical step, as it reflects the cash outflow required to service a company's debt obligations. The resulting figure represents the cash flow available to equity holders, giving a much clearer picture of a company's financial strength than EBITDA alone.

Industry Variations and the Importance of Context

The relative importance of EBITDA and LFCF can vary significantly depending on the industry. In capital-intensive industries like manufacturing, telecommunications, and energy, LFCF is often a more critical metric due to the significant capital expenditures required to maintain operations and grow the business.

In contrast, in industries with lower capital intensity, such as software or consulting, EBITDA may be a more useful starting point for analysis. However, even in these industries, it is essential to consider changes in working capital and debt obligations to get a complete picture of a company's financial health.

Analysts at Goldman Sachs have emphasized the importance of considering industry-specific factors when evaluating financial metrics. "There is no one-size-fits-all approach to financial analysis," they note in a recent research report. "The most relevant metrics will vary depending on the industry and the specific characteristics of the company being analyzed."

Looking Ahead: The Future of Financial Analysis

The increasing focus on LFCF reflects a broader trend towards more rigorous and comprehensive financial analysis. Investors and analysts are demanding more transparency and a deeper understanding of the underlying drivers of a company's financial performance.

While EBITDA will likely remain a useful starting point for analysis, LFCF is poised to become an increasingly important metric for evaluating a company's financial health and its ability to generate value for equity holders. This shift necessitates a more nuanced approach to financial analysis, one that takes into account the specific characteristics of each company and its industry.

Ultimately, the move towards LFCF signifies a commitment to a more realistic and sustainable assessment of corporate value, acknowledging the importance of capital investments and debt obligations in shaping a company's long-term financial viability.