Economic Conditions Affecting Business

Businesses across the nation are facing a harsh reality: economic conditions are rapidly tightening, impacting profitability and future prospects. Inflation, rising interest rates, and persistent supply chain disruptions are squeezing businesses of all sizes.

This article examines the current economic pressures affecting businesses, detailing the immediate challenges and potential impacts on the broader economy.

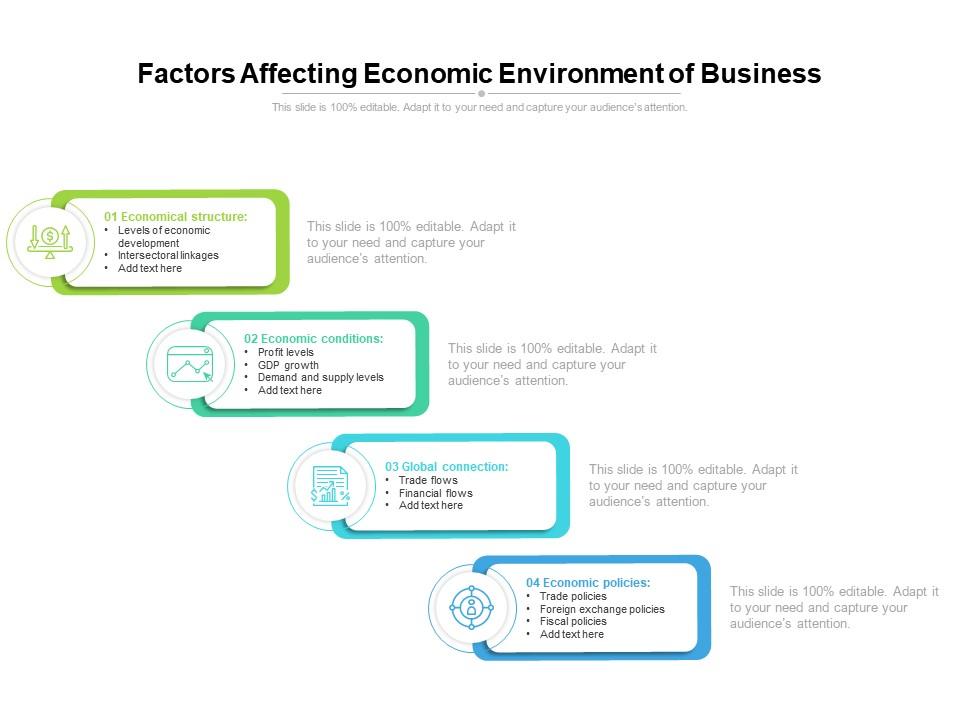

The Inflationary Squeeze

Inflation remains stubbornly high. The Consumer Price Index (CPI) rose by 3.4% in April, according to the Bureau of Labor Statistics, exceeding initial forecasts and maintaining pressure on businesses to raise prices.

Many businesses are struggling to pass these costs onto consumers, leading to reduced profit margins. Smaller businesses are particularly vulnerable, lacking the bargaining power of larger corporations.

Fuel costs are also impacting transportation and logistics. Businesses are dealing with increase operating expenses.

Interest Rate Hikes

The Federal Reserve has been aggressively raising interest rates to combat inflation. This impacts business operation.

Higher borrowing costs are making it more expensive for businesses to invest in expansion, equipment upgrades, and even day-to-day operations. This affects capital expenditure and slows down operation.

According to a recent survey by the National Federation of Independent Business (NFIB), 31% of small business owners cited rising interest rates as their top concern.

Supply Chain Disruptions Persist

While some supply chain bottlenecks have eased, disruptions continue to plague businesses. Geopolitical tensions, labor shortages, and logistical challenges are still ongoing.

These disruptions lead to delays, increased costs for raw materials, and difficulty meeting customer demand. Many businesses are forced to seek alternative suppliers, often at higher prices.

The Global Supply Chain Pressure Index, though lower than its peak in 2021, remains elevated, indicating ongoing strain on global supply networks.

Labor Market Challenges

The labor market remains tight, with unemployment at 3.9% in April. Businesses are still struggling to attract and retain workers, driving up labor costs.

Wage inflation is adding to the overall inflationary pressures, creating a feedback loop that is difficult to break. Businesses are implementing different strategies to handle labor demands.

Many businesses are investing in automation and technology to reduce their reliance on human labor. This may lead to restructuring and redundancy.

Impact on Specific Sectors

Certain sectors are particularly vulnerable to the current economic climate. Retail businesses are facing reduced consumer spending due to inflation.

The housing market is cooling down as higher interest rates make mortgages more expensive. Construction and real estate businesses are feeling the effects.

The hospitality industry, still recovering from the pandemic, is facing rising costs and staffing shortages, impacting profitability. Many hotels and restaurants are increasing prices to stay afloat.

What's Next?

The Federal Reserve is expected to continue monitoring inflation data and may implement further interest rate hikes. Businesses should prepare for continued economic volatility.

Companies need to focus on cost management, improve operational efficiency, and explore new strategies to mitigate the impact of these challenging economic conditions. Many are exploring alternative business strategies.

The coming months will be crucial in determining the long-term impact of these economic pressures on the business landscape.

Businesses need to remain agile and adapt to the evolving situation.

![Economic Conditions Affecting Business 5 Economic Indicators That Affect Business Success [2023 Guide]](https://bradfordjacobs.com/wp-content/uploads/2023/02/economic-indicators-that-affect-business-success.jpg)