Edward Jones Advisory Solutions Reviews

For investors seeking personalized financial advice, Edward Jones Advisory Solutions has emerged as a popular, yet often scrutinized, option. The program, designed to provide ongoing investment management and guidance, has garnered both praise for its accessibility and criticism regarding its fees and performance relative to other investment platforms.

This article delves into a comprehensive review of Edward Jones Advisory Solutions, examining its structure, cost, performance, and overall value proposition for investors. By analyzing publicly available data, expert opinions, and client experiences, we aim to provide a balanced perspective on whether this advisory program meets the needs of a diverse range of individuals seeking financial security.

Understanding Edward Jones Advisory Solutions

Edward Jones Advisory Solutions is a fee-based advisory program where clients pay a percentage of their assets under management (AUM) for ongoing advice and investment management. This differs from traditional commission-based models, where advisors earn money from the sale of specific financial products.

The program typically involves an initial consultation to assess the client's financial goals, risk tolerance, and time horizon. Based on this assessment, an Edward Jones financial advisor constructs a personalized investment portfolio using a mix of stocks, bonds, mutual funds, and exchange-traded funds (ETFs).

According to Edward Jones's website, the program offers ongoing monitoring of the portfolio, regular performance reviews, and adjustments as needed to align with the client's evolving financial situation. This continuous management distinguishes it from simply purchasing individual investments on one's own.

Fees and Costs: A Critical Examination

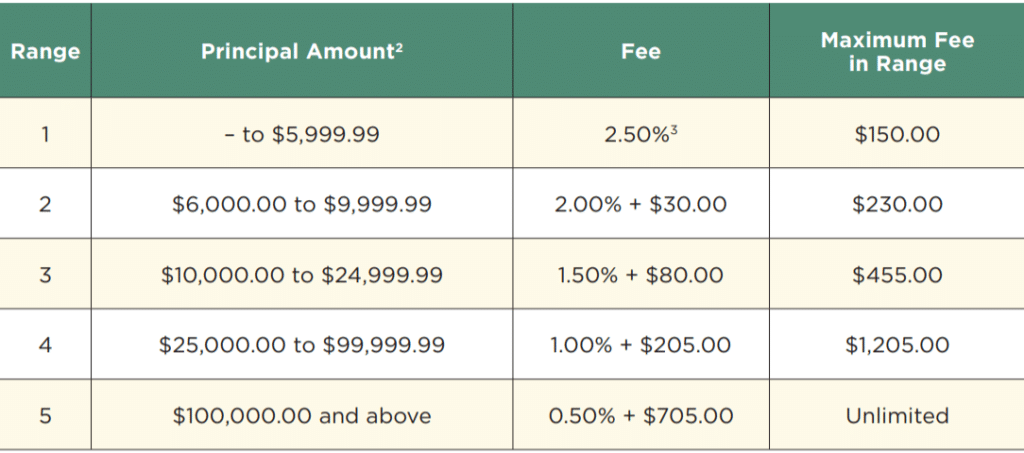

One of the most frequently cited concerns surrounding Edward Jones Advisory Solutions is its fee structure. The advisory fee, charged as a percentage of AUM, can range from approximately 1.35% to 1.50% annually, depending on the account size.

This fee is in addition to the expense ratios charged by the underlying investments within the portfolio, such as mutual funds and ETFs. This layered fee structure can significantly impact overall returns, particularly over the long term.

Critics argue that these fees are higher than those charged by other advisory platforms, including robo-advisors and some independent registered investment advisors (RIAs). They suggest that investors should carefully compare the fees and services offered by different providers to ensure they are receiving fair value.

Performance: Measuring Against Benchmarks

Evaluating the performance of Edward Jones Advisory Solutions requires a nuanced approach. Individual client results will vary based on their specific investment objectives, risk tolerance, and the composition of their portfolios.

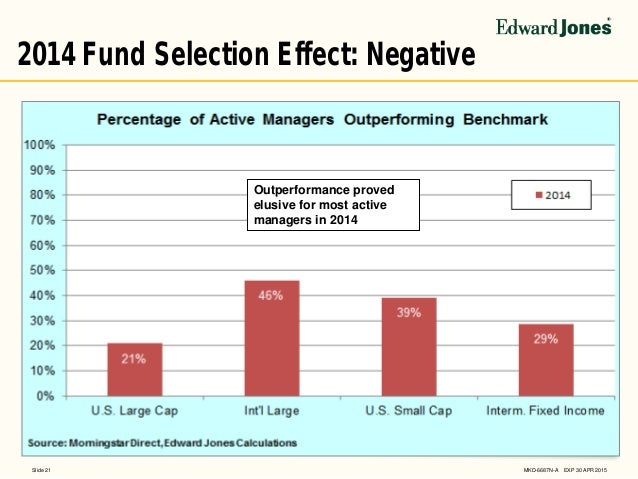

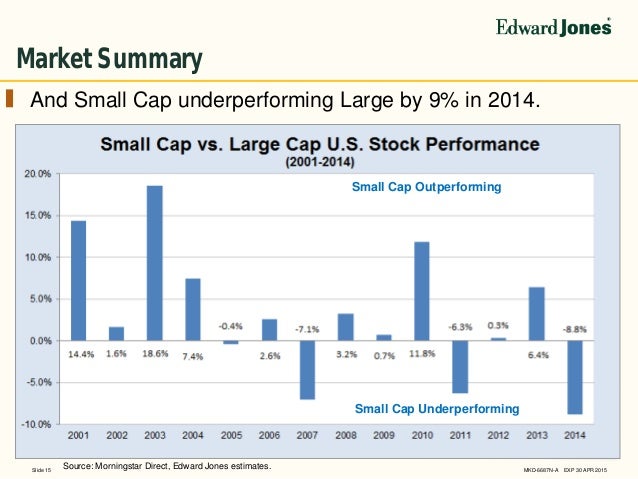

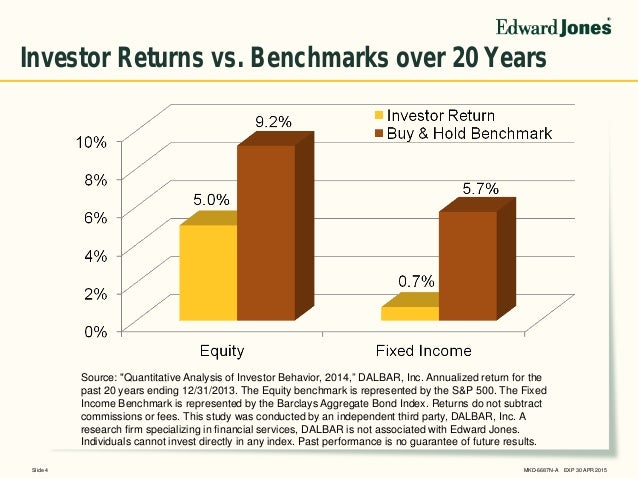

However, independent analyses have attempted to compare the performance of Edward Jones advisory accounts against relevant market benchmarks. These studies often reveal that, after accounting for fees, the performance of Edward Jones Advisory Solutions may not consistently outperform comparable benchmarks.

Some reports suggest that the program's emphasis on actively managed mutual funds, which tend to have higher expense ratios, can contribute to underperformance relative to passively managed index funds. Investors should request detailed performance reports and compare them against appropriate benchmarks to assess the value they are receiving.

The Advisor Relationship: A Key Differentiator

A key selling point of Edward Jones Advisory Solutions is the personalized relationship clients have with their financial advisor. Unlike robo-advisors that rely solely on algorithms, Edward Jones provides access to a human advisor who can offer individualized guidance and support.

For some investors, particularly those who are new to investing or prefer face-to-face interactions, this personal touch can be invaluable. The advisor can help clients understand complex financial concepts, make informed decisions, and stay on track toward their financial goals.

However, the quality of the advisor relationship can vary significantly depending on the individual advisor's experience, expertise, and commitment to client service. It is crucial for investors to thoroughly vet their advisor and ensure they feel comfortable and confident in their ability to provide sound financial advice.

Alternatives to Edward Jones Advisory Solutions

Investors considering Edward Jones Advisory Solutions should also explore alternative investment management options. Robo-advisors offer automated portfolio management at a significantly lower cost, typically ranging from 0.25% to 0.50% of AUM.

Independent RIAs can provide personalized financial advice and investment management, often with more transparent fee structures and a wider range of investment options. Discount brokerages also offer access to a vast array of investment products at low costs, allowing investors to build and manage their own portfolios.

The best choice for each investor will depend on their individual needs, preferences, and financial circumstances. It's essential to carefully weigh the pros and cons of each option before making a decision.

Looking Ahead: The Future of Advisory Services

The financial advisory landscape is constantly evolving, driven by technological advancements, changing investor expectations, and increasing regulatory scrutiny. Edward Jones, like other advisory firms, must adapt to remain competitive.

The company may need to consider lowering its fees, enhancing its technology platform, and expanding its investment offerings to better serve the needs of its clients. Transparency and value will be key differentiators in the future of advisory services.

Ultimately, the success of Edward Jones Advisory Solutions will depend on its ability to deliver consistent performance, provide exceptional client service, and justify its fees in a rapidly changing market. Investors are increasingly empowered to make informed choices, and they will demand greater value and transparency from their financial advisors.

![Edward Jones Advisory Solutions Reviews Edward Jones - Legit Investment Service? [Reviews]](https://nobsimreviews.com/wp-content/uploads/2018/10/Snip20181019_51.png)