Estimated Cost To Start A Small Business

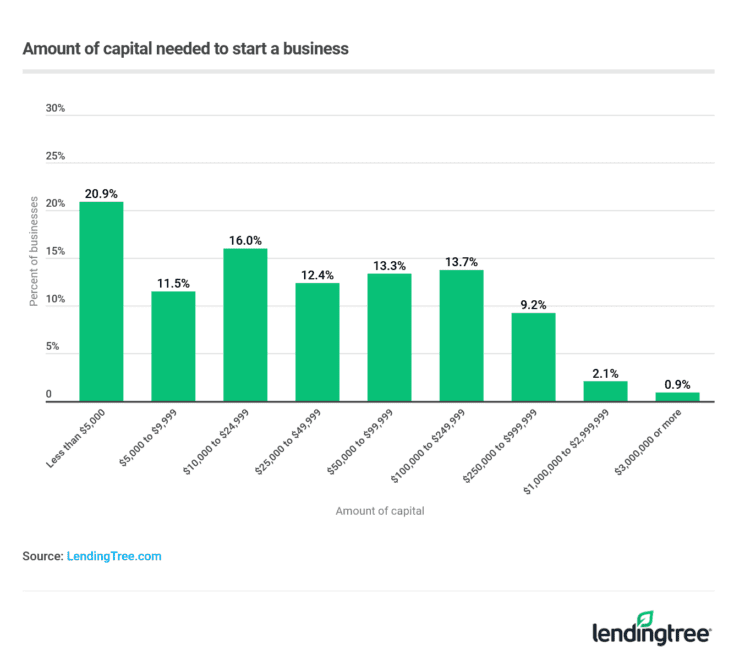

The dream of owning a small business, of being your own boss and building something from the ground up, is a powerful lure for many. However, the path to entrepreneurship is often paved with financial realities that can quickly temper that initial enthusiasm. A major hurdle is understanding the true cost to start a small business.

This article delves into the estimated costs associated with launching a small business. It draws on data from industry reports, government resources, and expert analyses to provide a comprehensive overview of the expenses entrepreneurs can expect to face. The aim is to equip aspiring business owners with the knowledge necessary to make informed decisions and navigate the financial complexities of starting a business.

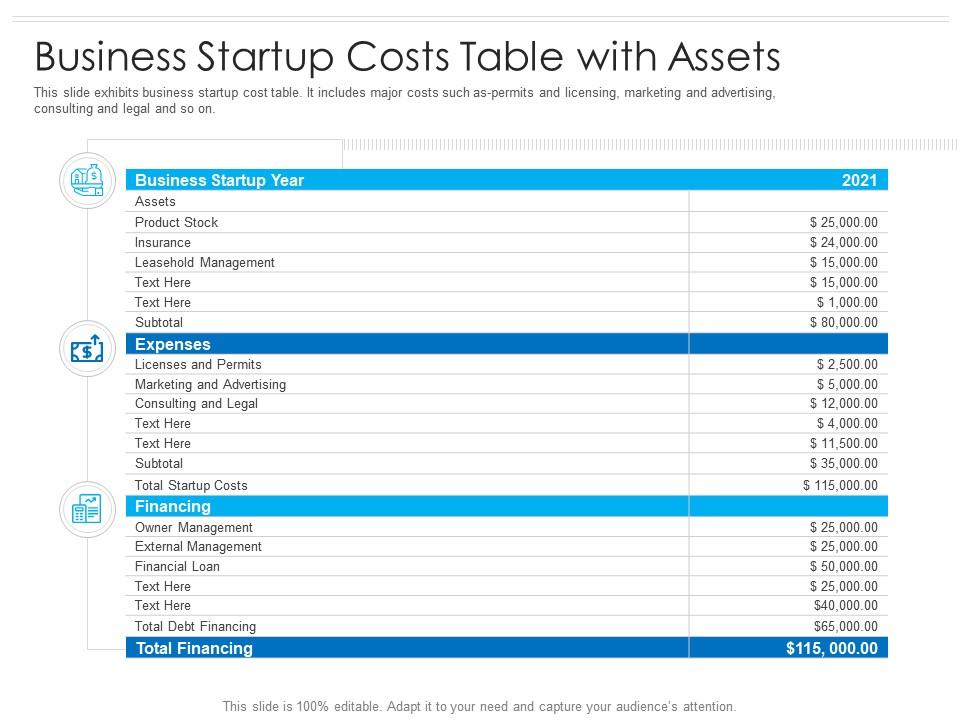

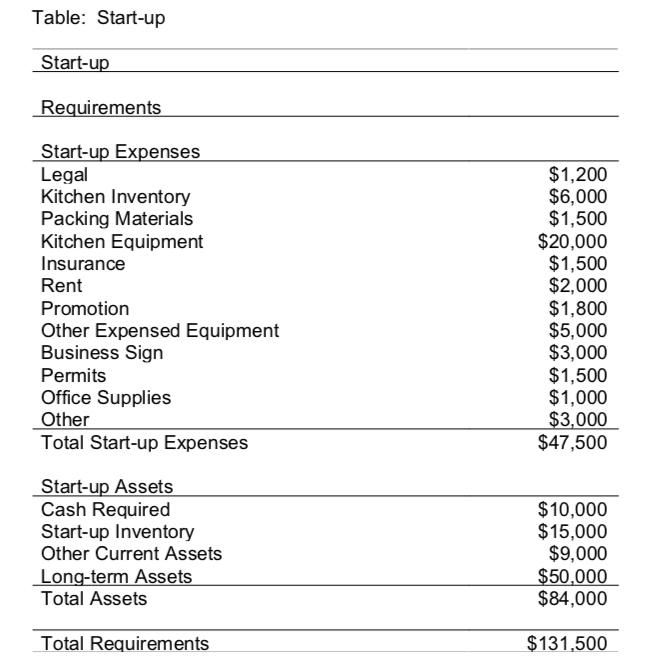

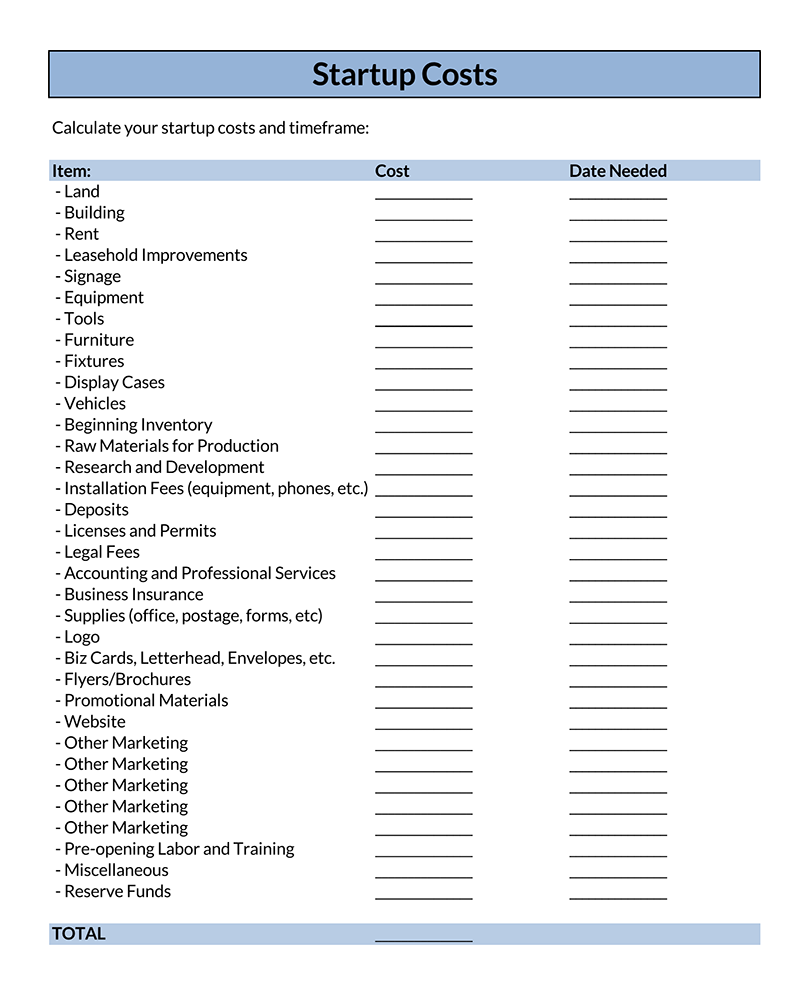

Understanding the Initial Investment

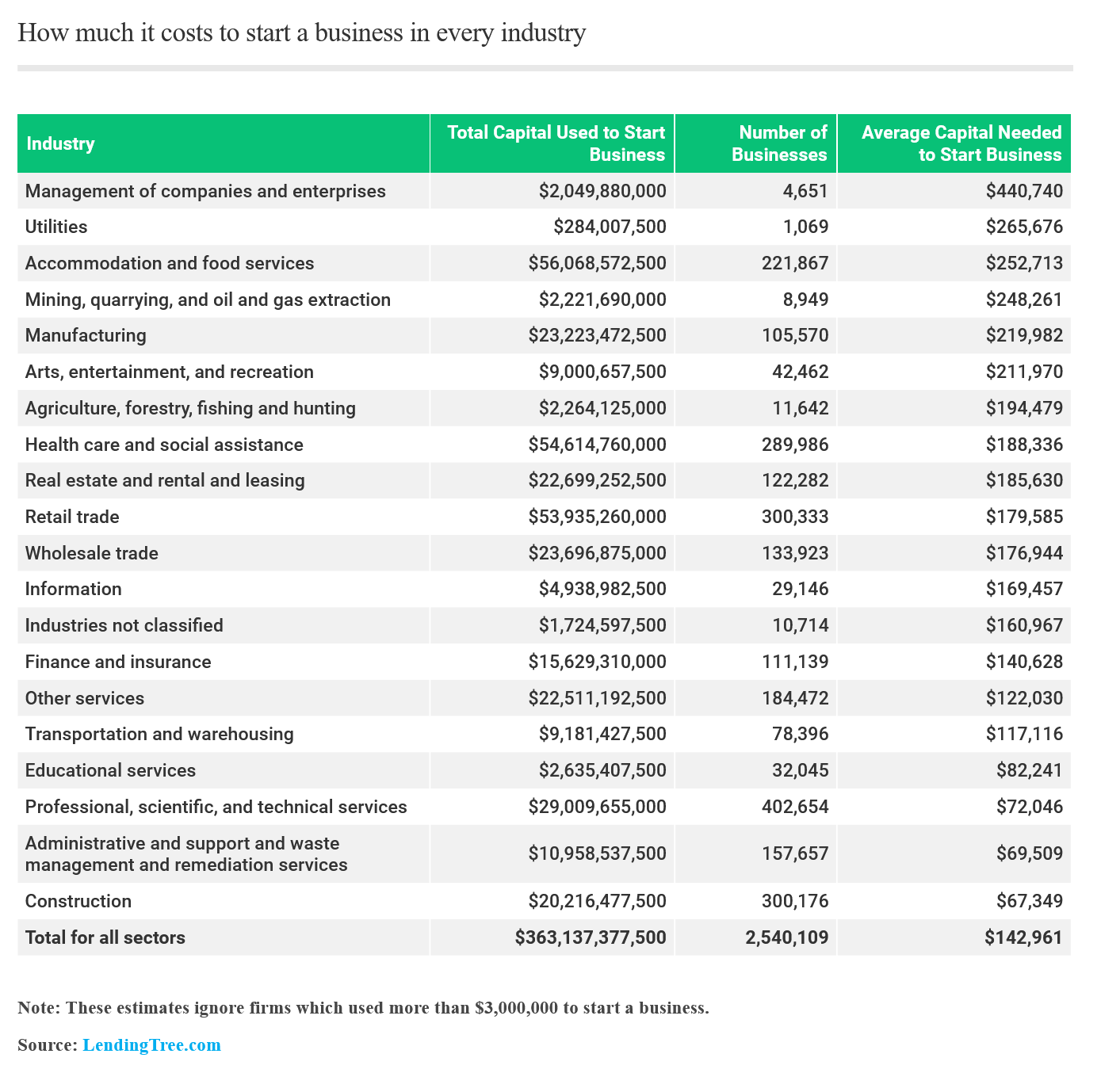

Determining the startup cost for a small business is not a straightforward process. Costs can vary widely depending on the industry, business model, location, and growth strategy.

However, experts generally agree that understanding the key components of the initial investment is crucial for any aspiring entrepreneur.

Legal and Regulatory Fees

One of the first expenses to consider is the cost of establishing your business legally. This includes registering your business name, obtaining necessary licenses and permits, and setting up your business structure (sole proprietorship, partnership, LLC, etc.).

The Small Business Administration (SBA) provides resources to help entrepreneurs understand the legal requirements in their area. These costs can range from a few hundred dollars for a simple sole proprietorship to several thousand for more complex structures.

Office Space and Equipment

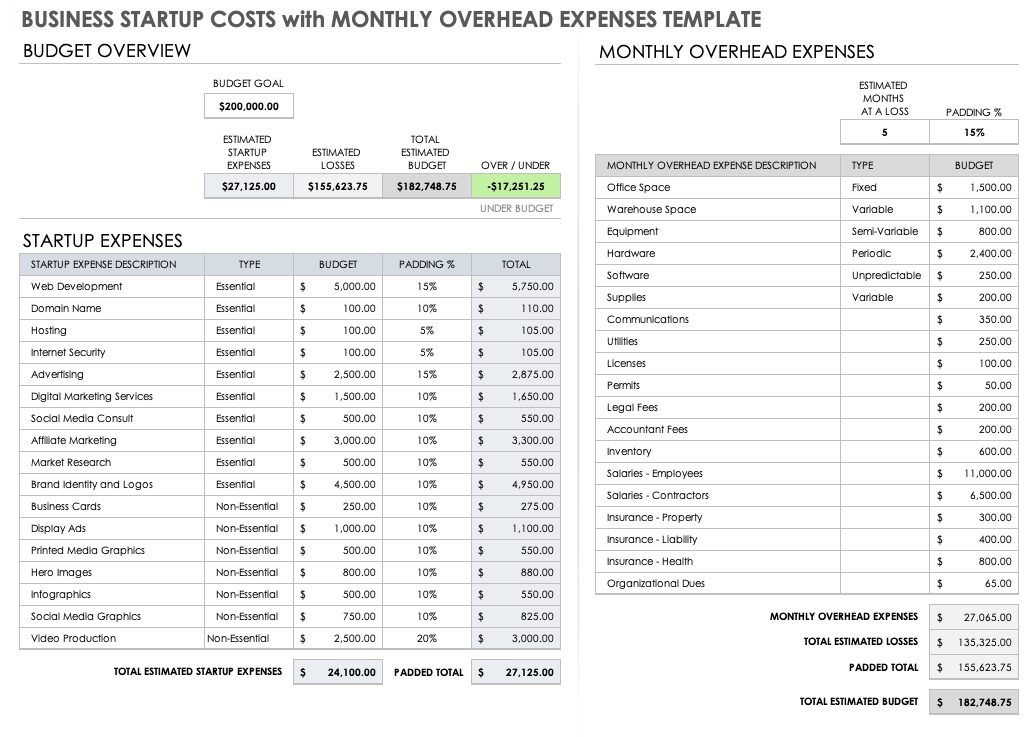

The need for physical office space and equipment will significantly impact startup costs. A home-based business or a virtual office arrangement can drastically reduce overhead.

However, businesses that require a physical storefront, office, or manufacturing facility will face substantial expenses, including rent, utilities, and equipment purchases or leases. Consider costs for computers, furniture, and specialized equipment relevant to the business.

Inventory and Supplies

For businesses that sell physical products, inventory is a major investment. The cost of goods sold can quickly deplete initial capital, especially if you need to stock up on inventory before launching.

Careful planning and inventory management are essential to avoid overspending. Explore options like drop shipping or just-in-time inventory to minimize upfront costs.

Marketing and Advertising

Attracting customers is essential for any new business. Marketing and advertising are critical investments.

This can include building a website, creating marketing materials, running online ad campaigns, and participating in local events. A budget of $500 - $5,000 should be considered for initial marketing efforts depending on scope.

Salaries and Wages

If you plan to hire employees, factor in salaries, wages, and benefits. Even if you're the only employee initially, consider how you'll pay yourself.

Many business owners start with a minimal salary or reinvest initial profits back into the business. Remember to include payroll taxes and benefits such as health insurance in your calculations.

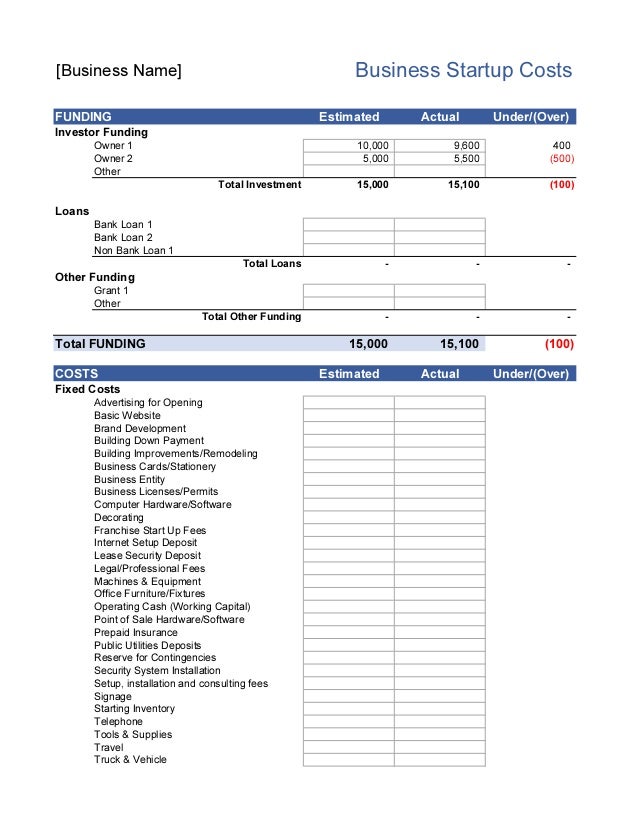

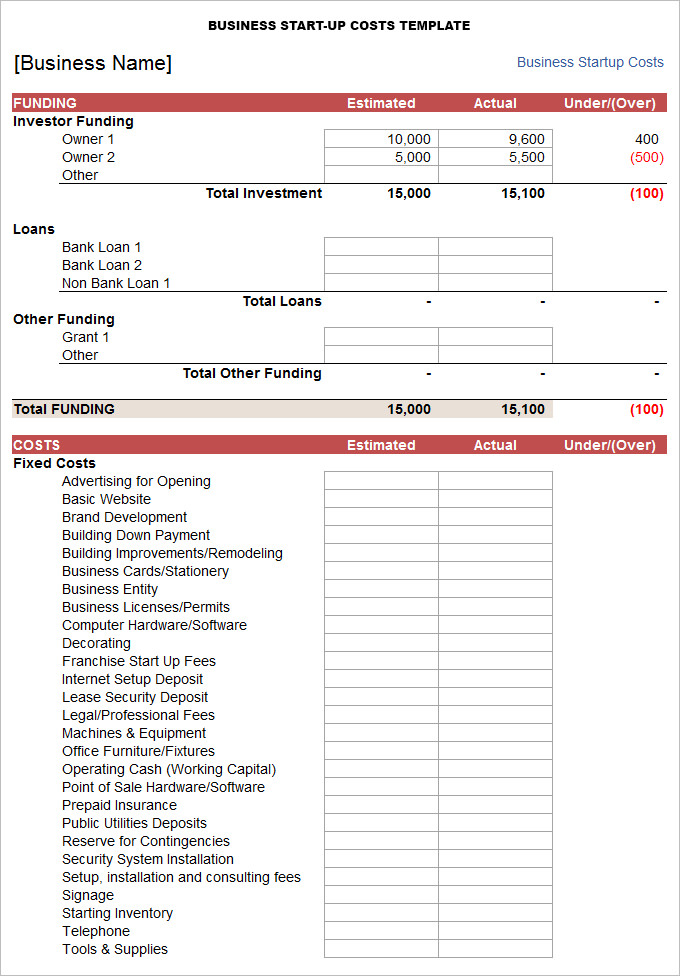

Funding Your Startup

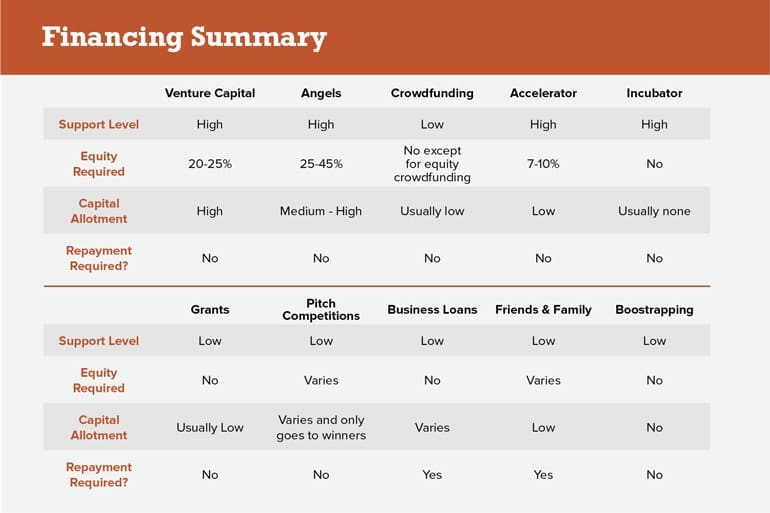

Once you've estimated your startup costs, the next step is to secure funding. There are several options available to small business owners. These include personal savings, loans, grants, and investments.

The SBA offers loan programs designed to support small businesses, often with more favorable terms than traditional bank loans. Grants are another source of funding, though they can be highly competitive and often require specific qualifications.

Industry-Specific Cost Considerations

It's critical to research the specific costs associated with your industry. A restaurant, for instance, will have drastically different startup costs than a consulting business.

Restaurants need to invest in kitchen equipment, restaurant licenses, and potentially a lease on a space. Consulting businesses may only need a laptop and internet connection.

Planning for the Unexpected

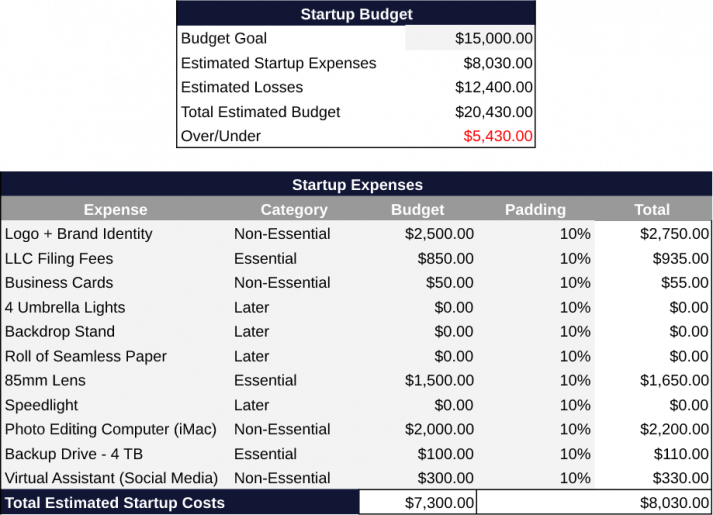

One of the most common mistakes new business owners make is underestimating the expenses or not having enough buffer in their budgets. Unexpected costs are inevitable.

It's prudent to have a contingency fund to cover unforeseen circumstances such as equipment malfunctions, unexpected repairs, or dips in sales. Experts recommend adding a 10-20% buffer to your estimated startup costs.

Looking Ahead

Starting a small business requires careful planning and financial discipline. By understanding the estimated costs associated with launching a business and exploring funding options, entrepreneurs can increase their chances of success.

Staying informed about industry trends, adapting to changing market conditions, and continually refining your business plan are essential for long-term sustainability. Success is the product of preparation.