Ethereum Solana Staking Uk Regulatory Clarity

The regulatory landscape surrounding cryptocurrency staking continues to evolve in the United Kingdom, creating both opportunities and uncertainties for platforms like Ethereum and Solana. Recent developments suggest a growing need for clear guidelines to protect investors and foster innovation within the digital asset space.

At the heart of this discussion is the concept of staking, where users lock up their cryptocurrency holdings to support the operation of a blockchain network and earn rewards in return. This article examines the current state of staking in the UK, focusing on the regulatory considerations surrounding Ethereum and Solana, two prominent platforms utilizing this mechanism. The analysis will also explore the potential implications for investors, businesses, and the broader cryptocurrency market.

Staking: A Primer

Staking, in essence, is the process of actively participating in transaction validation (similar to mining) on a proof-of-stake (PoS) blockchain. Users "stake" their tokens, contributing to the network's security and earning rewards in proportion to the amount staked.

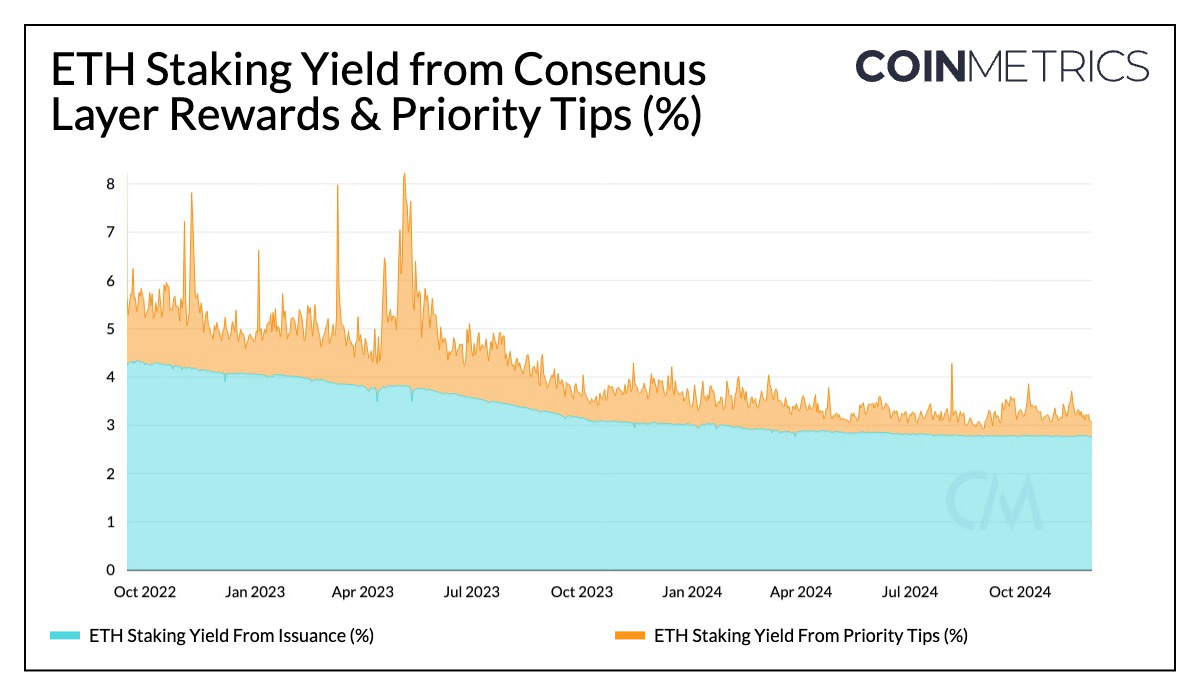

Platforms like Ethereum and Solana rely heavily on staking to maintain network integrity and validate transactions. These platforms differ in their technical implementations and reward structures, but the underlying principle remains the same: users earn passive income by contributing to the network's operation.

The UK's Regulatory Approach

The UK's regulatory stance on cryptocurrency is still developing. The Financial Conduct Authority (FCA) is the primary body responsible for regulating financial services in the country, and its approach to cryptocurrency has been cautious.

Currently, there isn't specific legislation addressing cryptocurrency staking directly. However, the FCA has issued statements indicating that staking activities may fall under existing regulations, depending on the specific characteristics of the offering.

This ambiguity has created uncertainty for businesses operating in the staking space. Companies are unsure whether their staking services constitute regulated financial activities, and if so, what compliance requirements they must meet.

Ethereum and Solana Staking in the UK

The lack of clear regulatory guidelines poses specific challenges for platforms like Ethereum and Solana in the UK. Users engaging in staking activities on these platforms are subject to the existing financial regulations, but the specific interpretation and enforcement remain unclear.

Ethereum, after its transition to Proof-of-Stake (PoS) through the Merge, relies heavily on staking. Users stake their ETH to validate transactions and secure the network, earning rewards in the process. The sheer size of the Ethereum network and the significant volume of ETH staked in the UK highlights the importance of regulatory clarity.

Similarly, Solana also utilizes a PoS consensus mechanism, and its staking ecosystem is actively used in the UK. The faster transaction speeds and lower fees associated with Solana have attracted a significant user base, increasing the need for clear regulatory guidelines.

Calls for Regulatory Clarity

Industry participants are increasingly calling for the FCA to provide clearer guidance on cryptocurrency staking. They argue that clarity is essential to foster innovation, attract investment, and protect consumers.

"We need a clear framework that allows responsible innovation to flourish while ensuring appropriate consumer protection," says a representative from CryptoUK, a leading industry association.

Without clarity, companies may be hesitant to offer staking services in the UK, potentially stifling the growth of the cryptocurrency industry. Furthermore, unclear regulations could expose consumers to risks, such as fraud or platform insolvency.

Potential Impacts and Future Outlook

The future of cryptocurrency staking in the UK hinges on the development of a comprehensive regulatory framework. A clear and well-defined framework would provide businesses with the certainty they need to operate and innovate, while also protecting consumers from potential risks.

The FCA's upcoming regulatory proposals are highly anticipated. Industry stakeholders hope that these proposals will address the specific challenges associated with cryptocurrency staking and provide a clear path forward.

Ultimately, the goal is to create a regulatory environment that fosters innovation while ensuring responsible consumer protection. This will be crucial for the long-term success of the cryptocurrency industry in the UK.