Evaluate The Digital Remittances Company Remitly On Remittance

The aroma of freshly brewed coffee hung heavy in the air, mingling with the rhythmic clatter of keyboard keys. Maria, a hardworking nurse in Seattle, smiled faintly as she finalized a transaction on her laptop. A few clicks, a confirmation code, and another month’s worth of support was on its way to her family back in the Philippines. This time, she used Remitly, hoping it would be faster and cheaper than her usual method. The anxiety of distance, a constant companion, eased just a fraction.

Remitly has emerged as a significant player in the digital remittance landscape, revolutionizing how people send money across borders. But how well does it truly perform when evaluated against the key metrics of speed, cost, reliability, and user experience? This article delves into a comprehensive evaluation of Remitly’s remittance services, examining its strengths, weaknesses, and overall impact on the lives of migrants and their families.

The Rise of Remitly: A Digital Disruptor

Founded in 2011, Remitly was born from a personal need. Matt Oppenheimer, the founder, witnessed the struggles his friends faced while sending money to family in East Africa. He envisioned a digital solution that would bypass the inefficiencies and high costs of traditional money transfer services.

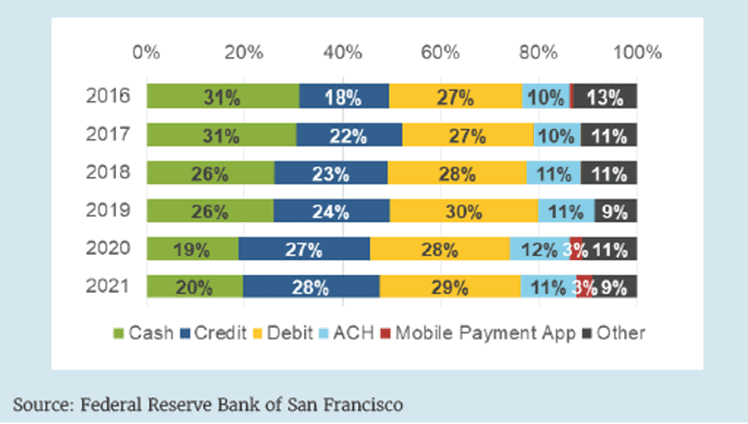

Traditional methods, often reliant on brick-and-mortar agents, could be time-consuming, expensive, and inconvenient. Remitly sought to leverage technology to streamline the process, offering a mobile-first experience accessible to anyone with a smartphone and internet connection.

The company's focus on key remittance corridors, particularly those connecting the United States and Europe to countries in Asia and Latin America, allowed it to tailor its services to specific needs and regulations.

Evaluating Remitly's Performance: Key Metrics

Speed: Delivering Money with Urgency

In the world of remittances, speed is paramount. Often, these funds are needed for urgent needs, such as medical expenses or school fees. Remitly offers various delivery options, including express transfers that can arrive within minutes.

While the exact timeframe varies depending on the destination country and payment method, Remitly generally boasts faster transfer speeds than traditional methods. Many users report receiving funds within hours, a significant advantage over waiting days or even weeks.

However, occasional delays can occur due to unforeseen circumstances, such as bank processing times or compliance checks. These instances, while infrequent, can be frustrating for senders and recipients alike.

Cost: Minimizing the Burden

Remittance costs can significantly erode the value of the money being sent. High fees and unfavorable exchange rates disproportionately affect low-income families who rely on these funds.

Remitly strives to offer competitive pricing, often undercutting the fees charged by traditional money transfer operators. The company’s pricing structure is transparent, with fees and exchange rates clearly displayed before a transaction is initiated.

Promotional offers and tiered pricing based on transfer volume can further reduce costs for frequent users. However, exchange rates can fluctuate, and hidden fees can sometimes arise, necessitating careful scrutiny before confirming a transaction.

Reliability: Ensuring Funds Arrive Safely

The reliability of a remittance service is non-negotiable. Senders need to be confident that their money will reach its intended recipient safely and securely.

Remitly employs robust security measures, including encryption and fraud detection systems, to protect against unauthorized access and fraudulent activities. The company is licensed and regulated by various financial authorities, adhering to strict compliance standards.

While incidents of fraud are rare, they can occur. Remitly offers a money-back guarantee in certain circumstances, providing a degree of protection for users.

User Experience: Simplicity and Accessibility

A user-friendly interface is essential for attracting and retaining customers. Remitly’s mobile-first design prioritizes simplicity and accessibility, catering to a diverse user base.

The Remitly app is intuitive and easy to navigate, even for those with limited technological proficiency. Multiple language options and responsive customer support further enhance the user experience.

However, some users have reported occasional glitches or technical issues with the app, which can be frustrating. Furthermore, reliance on mobile technology can exclude individuals with limited access to smartphones or internet connectivity.

Remitly's Impact: Transforming Lives and Communities

The impact of digital remittances extends far beyond individual transactions. These funds play a vital role in supporting families, fueling economic growth, and reducing poverty in developing countries. The World Bank estimates that remittances to low- and middle-income countries reached $626 billion in 2022.

By reducing the cost and increasing the speed of remittances, companies like Remitly contribute to this positive impact. Families receive funds more quickly and efficiently, enabling them to meet their essential needs and invest in their futures.

In a press release, Remitly stated that they are "committed to making the remittance process more accessible and affordable for everyone." The company also participates in various initiatives aimed at promoting financial inclusion and empowering migrants.

Challenges and Opportunities: Navigating the Future

Despite its successes, Remitly faces several challenges. Increased competition from other digital remittance providers, evolving regulatory landscapes, and fluctuating exchange rates all pose potential threats.

Furthermore, the ongoing need to combat fraud and money laundering remains a constant concern. Investing in advanced security technologies and strengthening compliance programs is crucial for maintaining trust and integrity.

However, the opportunities for growth are significant. Expanding into new markets, developing innovative products and services, and forging strategic partnerships can help Remitly solidify its position as a leading player in the digital remittance industry.

Conclusion: A Bridge Across Borders

Remitly has undoubtedly transformed the way people send money across borders. By leveraging technology to streamline the remittance process, the company has made it faster, cheaper, and more convenient for millions of users.

While challenges remain, Remitly’s commitment to innovation and customer satisfaction positions it well for continued success. Its contribution to facilitating crucial financial flows to families around the world should be considered a commendable achievement.

As Maria watched the confirmation screen on her laptop, a sense of relief washed over her. She knew her family would receive the money soon, bridging the distance and providing much-needed support. In that moment, Remitly was more than just a company; it was a lifeline, connecting her to the people she loved most.