Exchanges Of Assets For Assets Have What Effect On Equity

In the intricate world of finance, seemingly simple transactions can ripple through a company's balance sheet, impacting its overall financial health. One such transaction, the exchange of assets for assets, often flies under the radar, yet its effect on equity is a crucial consideration for investors and analysts alike. Understanding these nuances is critical for accurately assessing a company's true value and potential.

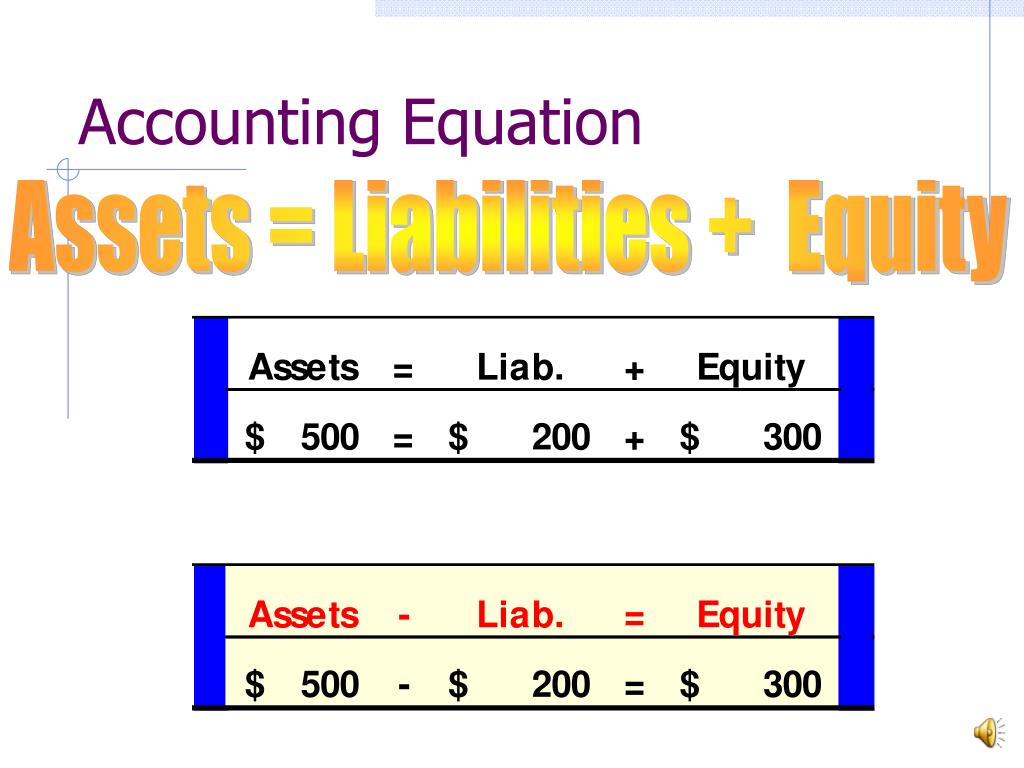

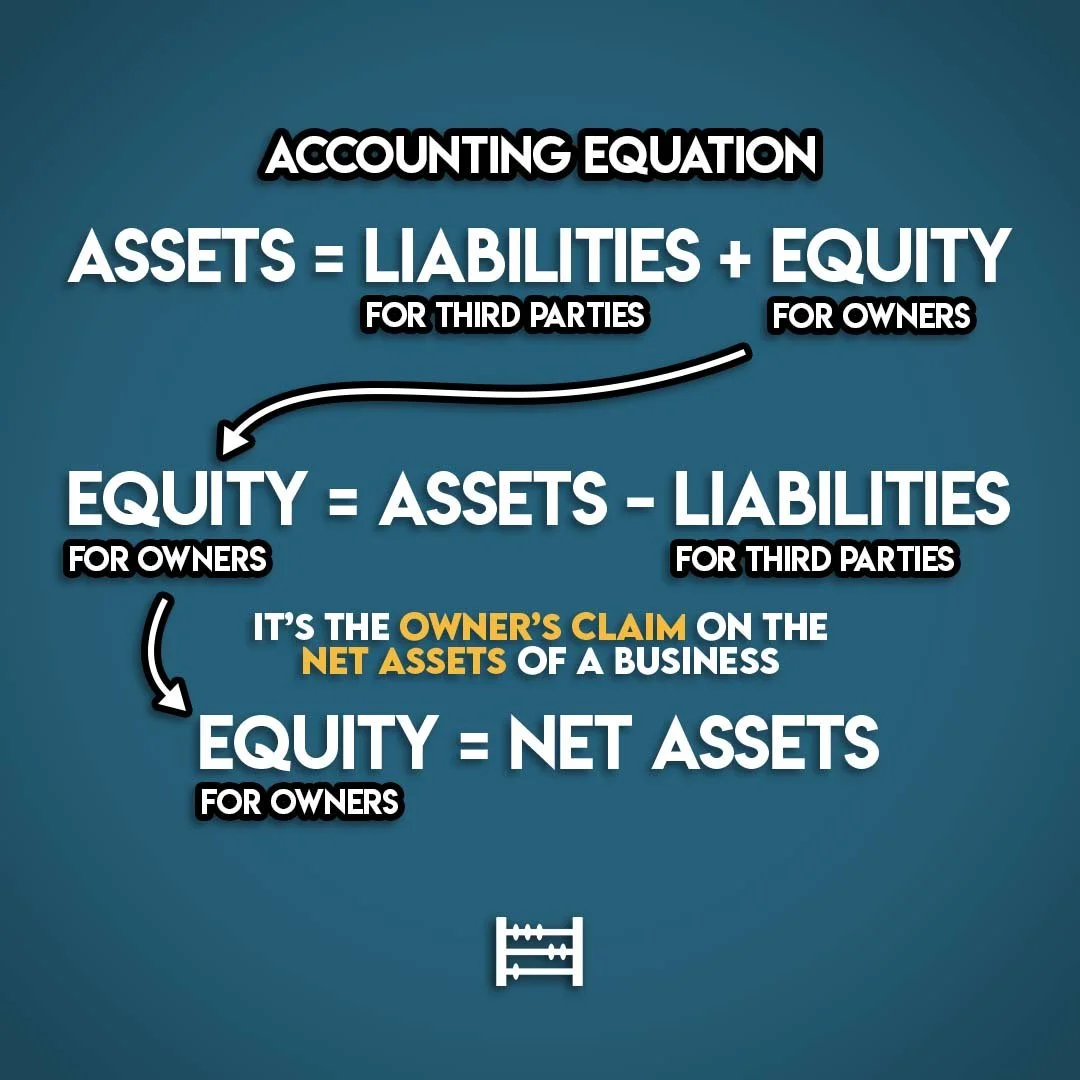

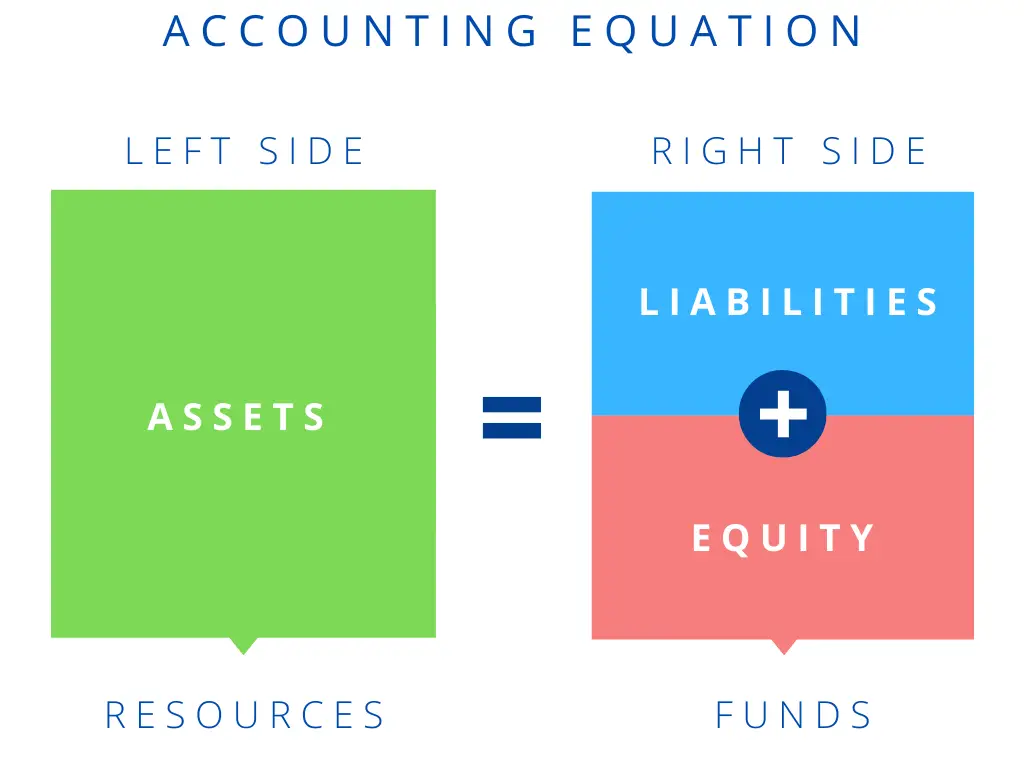

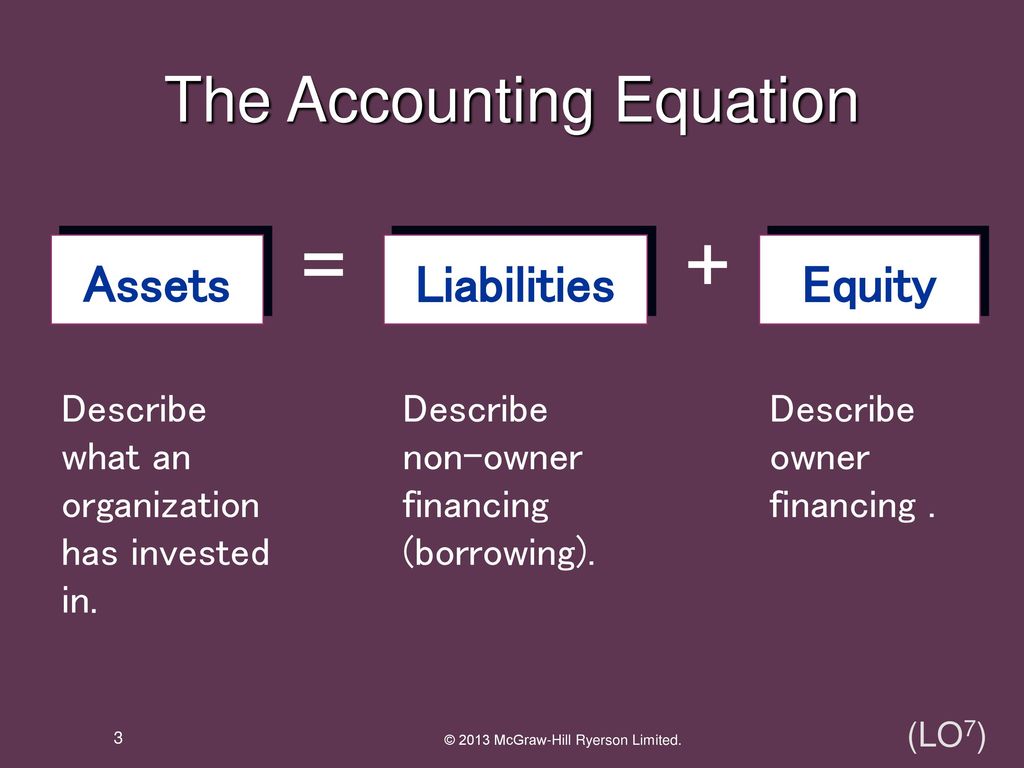

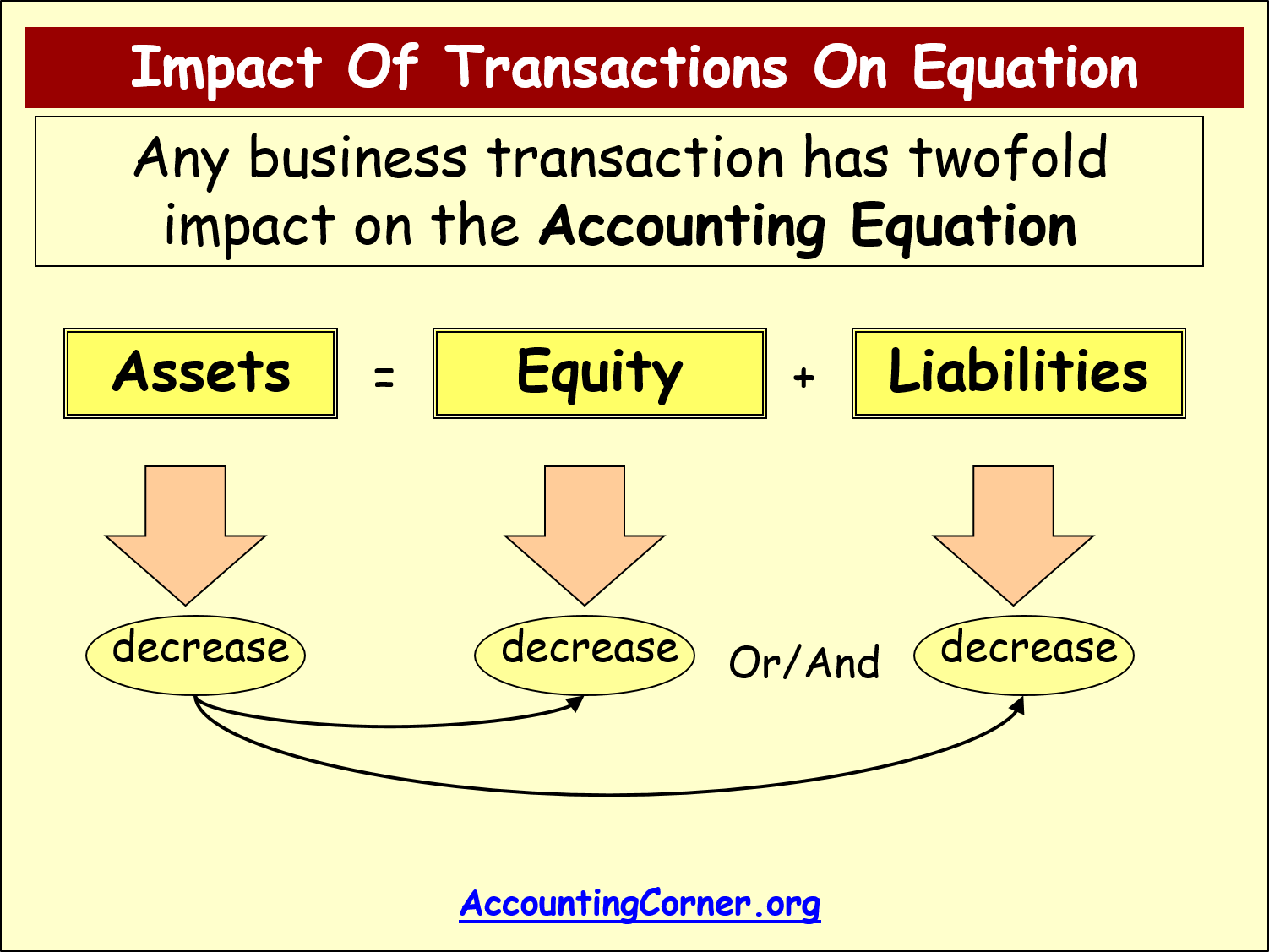

This article delves into the effects of asset-for-asset exchanges on a company's equity. Specifically, we will analyze how these transactions impact the accounting equation (Assets = Liabilities + Equity) and the key factors that determine whether such exchanges bolster, diminish, or leave equity unchanged. Expert opinions and real-world examples will be used to illustrate the subtle yet significant consequences of these financial maneuvers.

Understanding the Basics: Asset-for-Asset Exchanges

An asset-for-asset exchange occurs when a company trades one asset for another, without involving cash or liabilities. Common examples include swapping real estate properties, exchanging equipment, or trading investments.

The core question is whether these exchanges lead to a change in equity. Under most accounting standards, including Generally Accepted Accounting Principles (GAAP) and International Financial Reporting Standards (IFRS), the answer hinges on the concept of commercial substance.

The Critical Role of Commercial Substance

Commercial substance refers to whether the exchange alters the future cash flows of the company. If the exchange is expected to change the amount, timing, or risk of the company's future cash flows, it possesses commercial substance.

In essence, the new asset must offer a demonstrably different economic benefit than the old asset. If there is no commercial substance, the exchange is essentially recorded at the book value of the old asset, and no gain or loss is recognized.

Exchanges with Commercial Substance

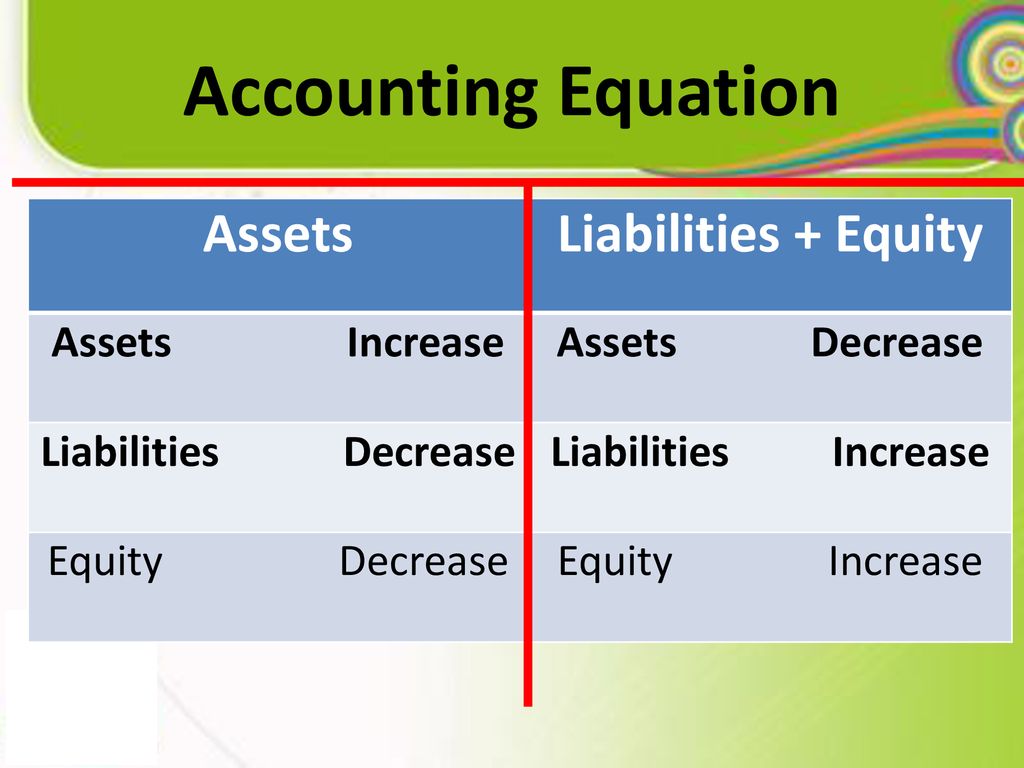

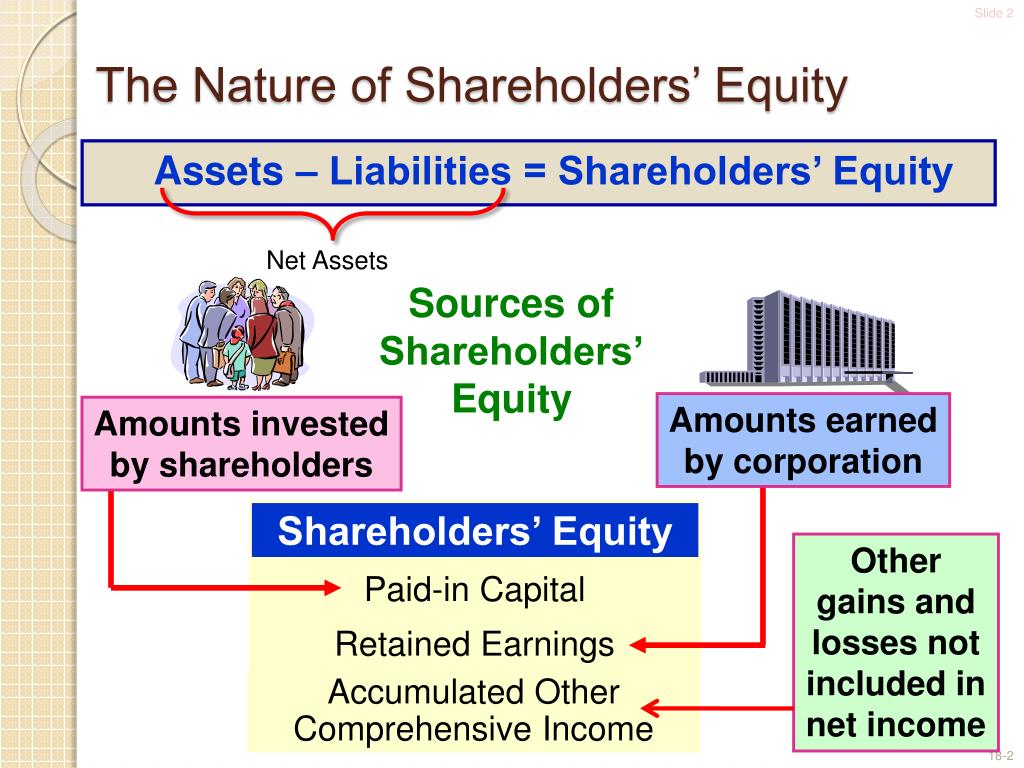

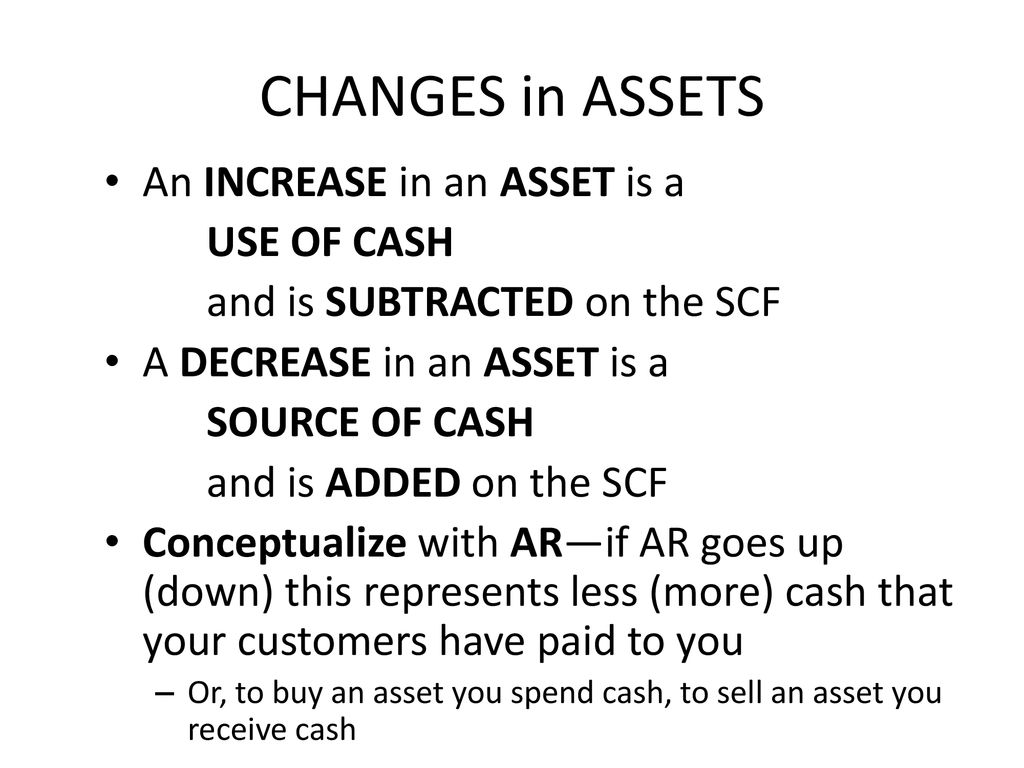

When an asset-for-asset exchange has commercial substance, any difference between the fair value of the asset received and the book value of the asset given up is recognized as a gain or loss in the income statement. This gain or loss directly impacts retained earnings, a component of equity.

A gain increases retained earnings, thereby increasing equity. Conversely, a loss decreases retained earnings and reduces equity. Therefore, exchanges with commercial substance can directly and materially influence a company's equity position.

Exchanges without Commercial Substance

If the exchange lacks commercial substance, the asset received is recorded at the book value of the asset given up, with no gain or loss recognized. In this scenario, the exchange has no immediate effect on equity.

It's crucial to note that while the transaction itself doesn't affect equity, the underlying assets and their future performance still matter. If the newly acquired asset subsequently generates higher profits than the old asset would have, equity will indirectly benefit over time through increased retained earnings.

Factors Influencing the Equity Impact

Several factors determine the extent to which an asset-for-asset exchange impacts equity. The presence or absence of commercial substance is paramount, as discussed above.

The fair value of the assets involved is another critical consideration. Fair value is the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date.

The book value of the assets being exchanged is also important. The difference between fair value and book value determines the size of any gain or loss recognized if commercial substance exists. Finally, the tax implications of the exchange can also impact equity. Depending on the jurisdiction and the specific circumstances, gains may be taxable, which would reduce the net impact on retained earnings.

Examples and Case Studies

Consider a real estate company that exchanges an older apartment building with a book value of $5 million for a newer building with a fair value of $7 million. If the exchange has commercial substance, the company would recognize a gain of $2 million, increasing retained earnings and, consequently, equity.

Conversely, imagine a manufacturer swapping an outdated machine with a book value of $1 million for a slightly more efficient machine with a fair value also estimated at $1 million. If the exchange lacks commercial substance, there would be no impact on equity at the time of the transaction.

"The key is to meticulously assess whether the exchange leads to a tangible change in future cash flows. Without that, recognizing a gain or loss could distort the company's financial picture," explains Dr. Anya Sharma, a professor of accounting at the University of Chicago's Booth School of Business.

Potential for Manipulation

The subjective nature of determining commercial substance can create opportunities for earnings management. Companies might structure exchanges to avoid recognizing losses or to artificially inflate profits.

Auditors play a crucial role in scrutinizing these transactions to ensure they are accounted for appropriately and that the assessment of commercial substance is reasonable and supportable.

The Long-Term View

While the immediate impact of asset-for-asset exchanges on equity is important, it's also essential to consider the long-term implications. Even exchanges that have no immediate effect on equity can significantly influence a company's future profitability and growth potential.

For example, acquiring a more efficient piece of equipment, even if recorded at the book value of the old equipment, could lead to lower operating costs and higher profits in the long run, indirectly boosting equity through retained earnings. Investors should therefore look beyond the immediate accounting treatment and assess the strategic rationale behind these exchanges.

Conclusion

The impact of asset-for-asset exchanges on equity is contingent upon the presence of commercial substance, the fair value and book value of the assets involved, and any associated tax implications. Understanding these factors is critical for accurate financial analysis and investment decision-making.

While these transactions can be complex, a thorough understanding of the principles outlined above will equip investors and analysts with the tools to assess the true impact of these exchanges on a company's financial health and long-term prospects. Careful consideration and diligent due diligence are paramount.