Fidelity National Financial Vs Fidelity Investments

Imagine walking down Wall Street, the heart of American finance, and hearing the names Fidelity echo from every corner. But wait, which Fidelity are we talking about? It's a common question, a source of occasional confusion even among seasoned investors. Two financial powerhouses share this iconic name: Fidelity National Financial and Fidelity Investments.

While both operate in the financial realm and boast the Fidelity moniker, they are distinctly different entities, serving different purposes and catering to different aspects of the financial world. Understanding their unique roles is crucial for anyone navigating the complex landscape of investments, real estate, and financial services.

A Tale of Two Fidelities

Let's delve into the stories of these two financial titans. Fidelity Investments, the more widely recognized of the two, is a powerhouse in asset management and brokerage services. Fidelity National Financial, on the other hand, specializes in title insurance and real estate-related services.

Fidelity Investments: The Investment Giant

Founded in 1946 by Edward C. Johnson II, Fidelity Investments has grown into a global financial services provider. They offer a vast array of services including mutual funds, retirement planning, brokerage accounts, and investment advice. Fidelity Investments manages trillions of dollars in assets, making it one of the largest asset managers in the world.

Think of them as the go-to firm for individual investors seeking to grow their wealth through stocks, bonds, and other investment vehicles. They cater to everyone from novice investors just starting their journey to seasoned professionals managing complex portfolios. Fidelity Investment is committed to guiding their clients throughout their financial career.

"Our mission is to inspire better futures and deliver better outcomes for the customers and communities we serve." - Fidelity Investments Official Statement

Fidelity National Financial: Protecting Your Property Rights

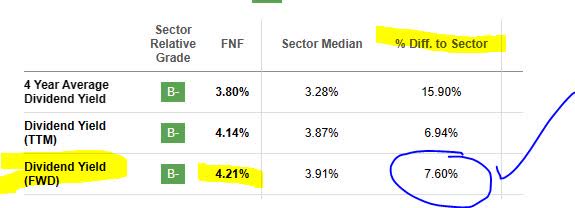

Fidelity National Financial (FNF) is a leading provider of title insurance and transaction services to the real estate and mortgage industries. The company traces its roots back to 1847, eventually evolving into the powerhouse it is today. They are the unsung heroes who ensure that property transactions go smoothly and that your ownership rights are protected.

When you buy a home, Fidelity National Financial works behind the scenes to research the property's history, identify any potential claims or liens, and issue title insurance policies. This insurance protects you from financial loss in case of title defects or disputes. FNF’s critical service gives home buyers peace of mind.

FNF operates a large amount of title companies. Chicago Title, Commonwealth Land Title, and Al title are operated by FNF.

Key Differences Summarized

To put it simply, if you're looking to invest in the stock market or plan for retirement, you'd turn to Fidelity Investments. If you're buying a home and need title insurance, you'd likely encounter Fidelity National Financial. Understanding this distinction is crucial.

Consider it like this: Fidelity Investments helps you build your financial future, while Fidelity National Financial safeguards your real estate investments. Each plays a vital role in the financial ecosystem, but their focus and services are distinct. One is the investor's ally, and the other is the homeowner's safeguard.

Navigating the Financial Landscape

The existence of two prominent financial institutions sharing the Fidelity name can sometimes lead to confusion. However, by understanding their respective roles, individuals can confidently navigate the financial landscape. Before using their services, always double-check which Fidelity company you're engaging with.

Both Fidelity Investments and Fidelity National Financial have established strong reputations in their respective fields. Their commitment to client service, innovation, and integrity has solidified their positions as leaders in the financial industry. They will continue to shape the future of finance for years to come.

So, the next time you hear the name Fidelity, remember that it represents not one, but two distinct and powerful entities, each contributing to the financial well-being of individuals and businesses alike. Each is a testament to the enduring power of financial innovation and client-focused service.

/vanguard-vs-fidelity-79ef56a1f0b14abf9b51368e4c5185d0.jpeg)