Safeguard Card Reviews Complaints Consumer Reports

For decades, Safeguard has been a household name, synonymous with identity theft protection and peace of mind. However, a growing chorus of consumers are voicing concerns, alleging deceptive practices and inadequate service. These complaints, coupled with unsettling trends identified in recent consumer reports, raise serious questions about the efficacy and ethical conduct of the company's services.

This article delves into the mounting criticisms against Safeguard, examining specific complaints filed with consumer protection agencies and analyzing data from independent reports. It will explore the nature of the allegations, the company's response, and what consumers can do to protect themselves. The goal is to provide a comprehensive overview of the current controversy surrounding Safeguard and its impact on the identity theft protection industry.

Mounting Consumer Complaints

A significant number of consumers have reported issues with Safeguard's services, painting a picture far removed from the promised peace of mind.

Common complaints revolve around difficulty canceling subscriptions, unexpected charges, and failure to effectively address identity theft incidents. Some have even alleged that Safeguard misrepresented the scope of its coverage and the speed of its response.

"I tried to cancel my subscription for months," says Sarah Miller, a former Safeguard customer from Ohio. "They kept charging my card, and it was almost impossible to get in touch with customer service. It felt like a deliberate attempt to trap me."

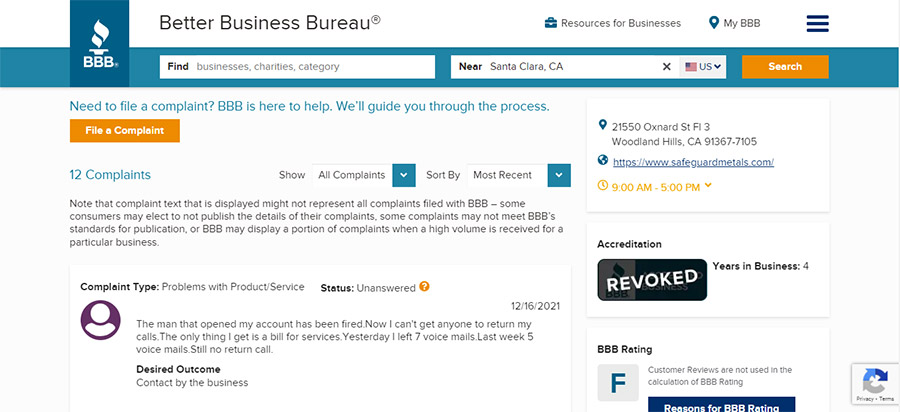

The Better Business Bureau (BBB) has received hundreds of complaints against Safeguard, resulting in a lower-than-average rating for the company. Many of these complaints echo Miller's experience, highlighting issues with billing practices and customer service responsiveness.

Specific Allegations and Concerns

Several specific allegations stand out among the complaints lodged against Safeguard.

One recurring issue is the difficulty in canceling subscriptions, with customers reporting being bounced between departments, facing long wait times, and encountering resistance from customer service representatives. Some customers have even claimed that Safeguard continued to charge their cards even after they had explicitly requested cancellation.

Another concern is the effectiveness of Safeguard's identity theft monitoring. Some consumers have reported that the company failed to detect fraudulent activity in a timely manner, leading to significant financial losses and credit damage.

Furthermore, concerns have been raised about the transparency of Safeguard's pricing. Customers have alleged that they were not adequately informed about all the fees associated with the service, leading to unexpected charges on their credit card statements.

Consumer Reports Analysis

Independent consumer reports have also shed light on potential shortcomings in Safeguard's services. While specific reports may vary in their methodologies and conclusions, a consistent theme emerges: not all identity theft protection services are created equal.

Consumer Reports, a highly respected organization known for its unbiased product testing and evaluations, has analyzed the effectiveness of various identity theft protection services, including Safeguard.

While Consumer Reports' findings on Safeguard are not publicly available without a subscription, their general guidance on selecting identity theft protection services is relevant.

Consumer Reports advises consumers to carefully consider their individual needs and circumstances before purchasing any identity theft protection service. They also recommend comparing the features, pricing, and reputation of different providers to make an informed decision.

Safeguard's Response

Safeguard has acknowledged the consumer complaints and has stated that it is committed to addressing the concerns.

In a statement released to the media, a Safeguard spokesperson said: "We take all customer feedback seriously and are continuously working to improve our services. We are actively investigating the complaints regarding cancellation difficulties and billing issues and are taking steps to resolve them promptly."

The company also emphasized its commitment to providing effective identity theft protection, stating that it utilizes advanced technology and experienced professionals to monitor and protect customers' identities.

However, critics argue that Safeguard's response is insufficient and that more substantive changes are needed to address the underlying issues. Some consumer advocates have called for greater transparency in pricing, easier cancellation processes, and more proactive monitoring of fraudulent activity.

Protecting Yourself

Regardless of whether you are a current Safeguard customer or considering subscribing to an identity theft protection service, it is crucial to take proactive steps to protect yourself from identity theft.

Regularly monitor your credit reports, review your bank statements, and be cautious about sharing personal information online. Consider placing a security freeze on your credit reports to prevent unauthorized access.

If you have experienced issues with Safeguard, consider filing a complaint with the Better Business Bureau and the Federal Trade Commission (FTC). These agencies can investigate unfair or deceptive business practices and take enforcement action against companies that violate consumer protection laws.

Looking Ahead

The controversy surrounding Safeguard underscores the importance of due diligence when choosing an identity theft protection service. Consumers should carefully research different providers, read reviews, and compare features and pricing before making a decision.

The identity theft protection industry is constantly evolving, with new technologies and threats emerging regularly. Companies that fail to adapt to these changes and address consumer concerns risk losing their credibility and market share.

Ultimately, the responsibility for protecting oneself from identity theft rests with the individual. By staying informed, being vigilant, and taking proactive steps, consumers can minimize their risk and safeguard their financial well-being. The future of Safeguard, and indeed the entire identity theft protection industry, hinges on its ability to regain consumer trust and deliver on its promises.