Fidelity Retirement Calculator Score

:max_bytes(150000):strip_icc()/FidelityRetirementCalculator-583f571e3df78c0230c057a2.jpg)

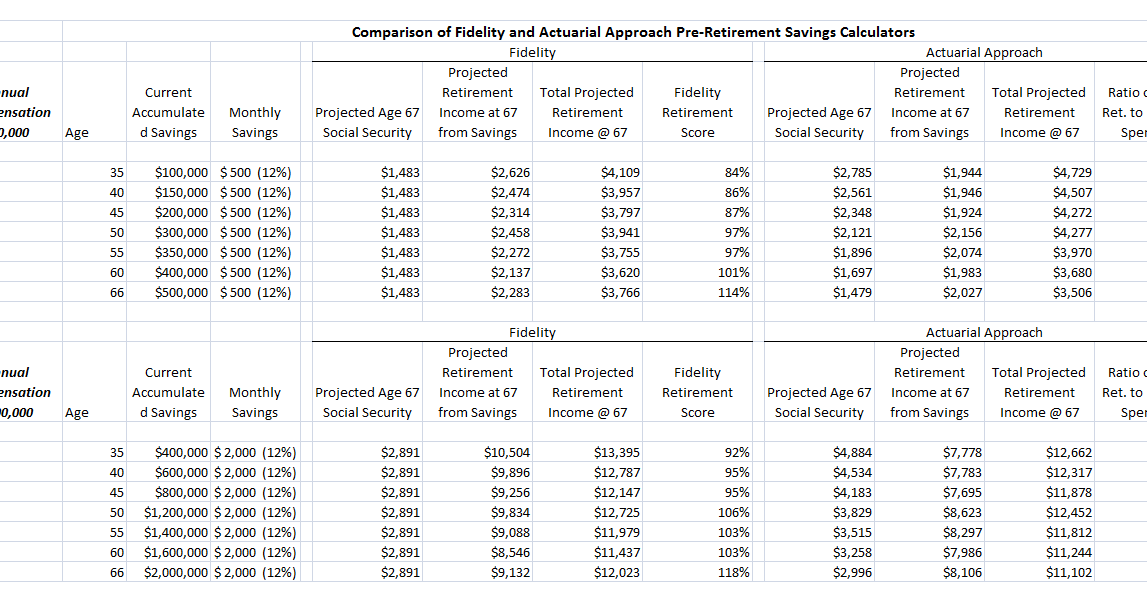

The looming specter of retirement insecurity continues to haunt millions of Americans, a reality underscored by recent analyses of retirement planning tools. Fidelity Investments, a major player in the retirement savings industry, offers a widely used retirement calculator intended to help individuals assess their preparedness.

However, scrutiny of the Fidelity Retirement Calculator Score reveals a complex picture, prompting questions about its efficacy in accurately predicting retirement readiness and highlighting the persistent challenges individuals face in securing a comfortable future.

Understanding the Fidelity Retirement Calculator

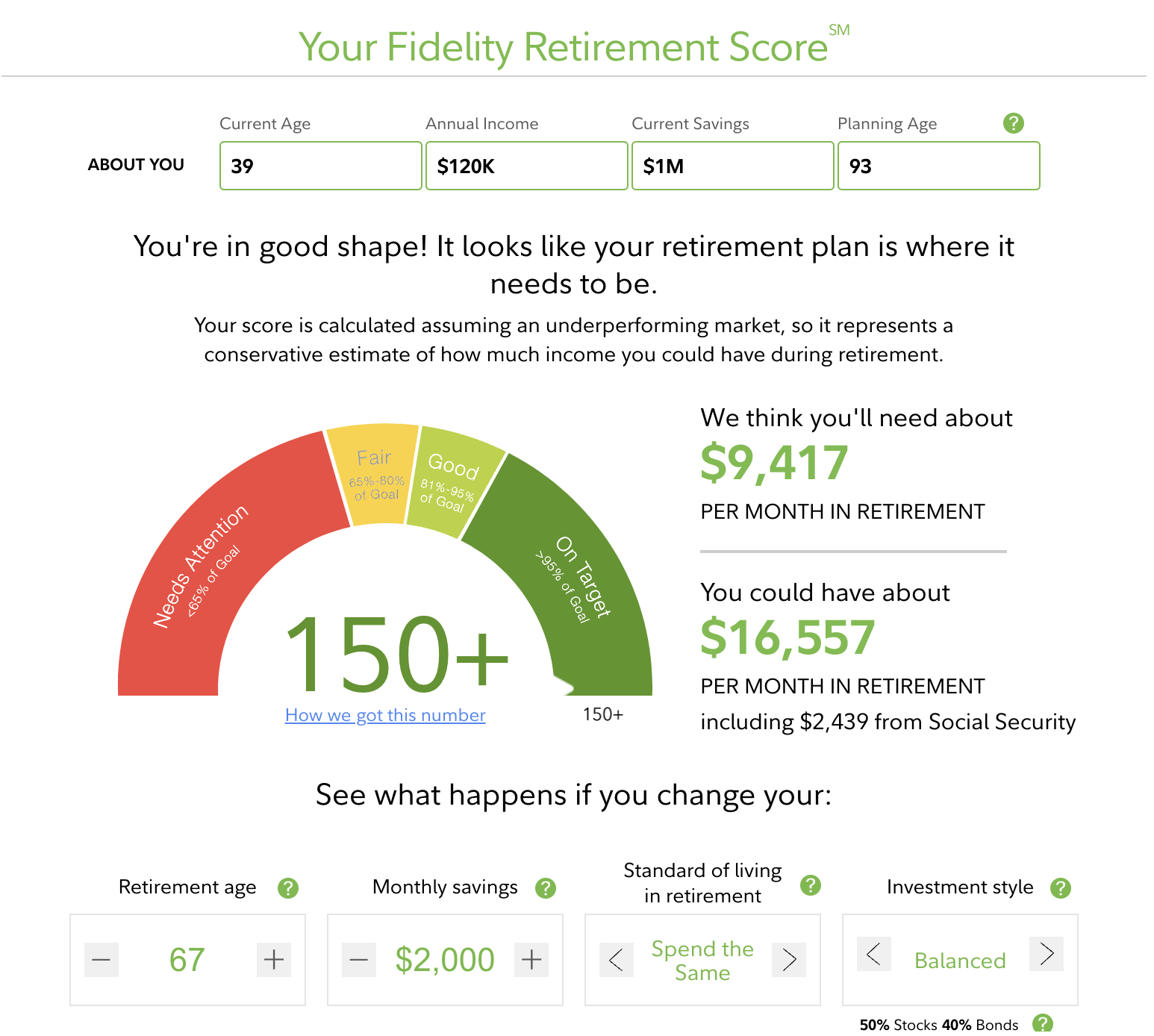

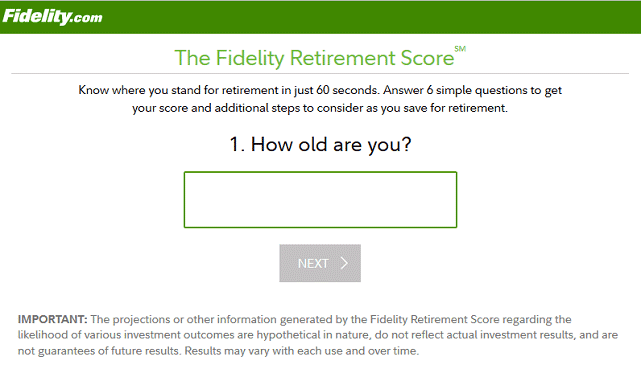

The Fidelity Retirement Calculator is a digital tool designed to estimate the likelihood of an individual achieving their retirement goals. It considers factors such as current age, income, savings, planned retirement age, and risk tolerance to project a retirement income and assess its adequacy.

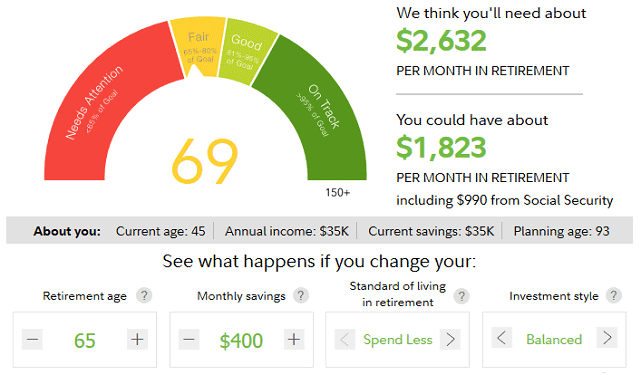

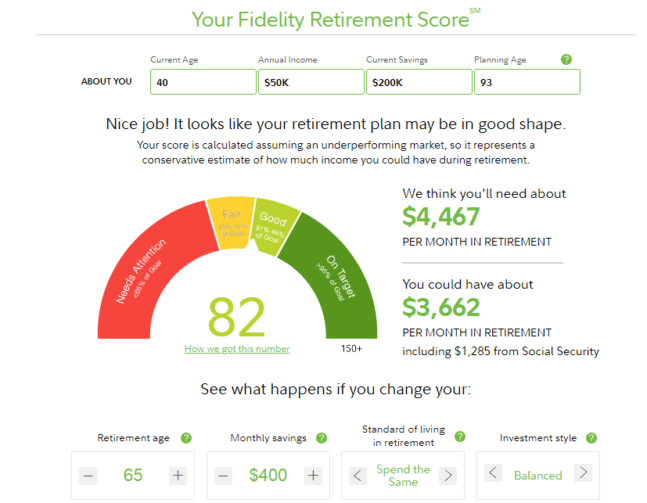

The calculator generates a score, often expressed as a percentage, representing the probability of meeting retirement income needs. A higher score indicates a greater likelihood of a financially secure retirement.

Key Inputs and Assumptions

The accuracy of any retirement calculator hinges on the quality of the input data. Fidelity's tool is no exception.

Users must provide realistic estimates of their future income, expenses, and investment returns. These projections are inherently uncertain, making the calculator's output susceptible to significant variations.

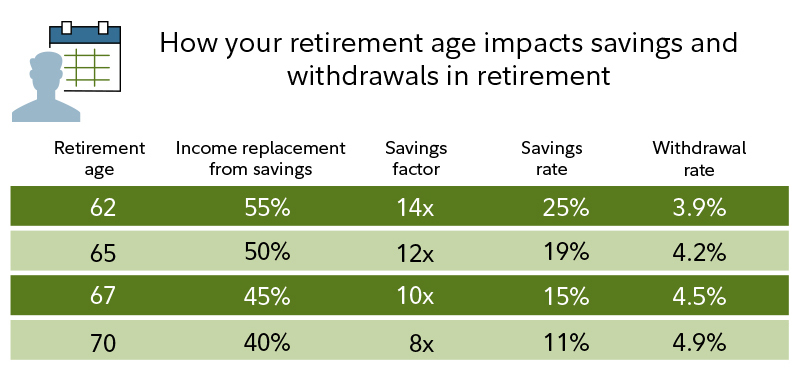

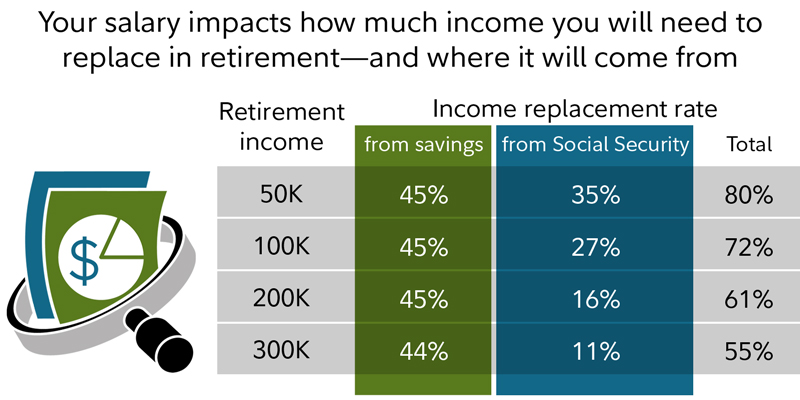

Moreover, the calculator relies on certain assumptions about inflation, investment performance, and lifespan, which may not accurately reflect individual circumstances or future market conditions.

Concerns and Criticisms

Despite its widespread use, the Fidelity Retirement Calculator has faced criticism regarding its potential to oversimplify complex financial realities. One concern is the reliance on generic assumptions that may not be applicable to all users.

For instance, the calculator may assume a standard inflation rate or a uniform rate of return on investments, which can lead to inaccurate projections for individuals with unique financial situations or investment strategies.

Furthermore, some argue that the calculator may not adequately address the impact of unexpected events, such as job loss, healthcare expenses, or market downturns, which can significantly affect retirement savings.

"Retirement calculators are valuable tools, but they should be used as a starting point, not a definitive answer," states certified financial planner, Sarah Miller.

Data and Reality: Are We Saving Enough?

Data consistently reveals a significant retirement savings gap among Americans. According to a recent study by the Employee Benefit Research Institute (EBRI), many workers are falling short of their retirement savings goals, raising concerns about their long-term financial security.

The Fidelity Retirement Calculator Score often reflects this reality, with many users receiving scores that indicate a low probability of achieving their desired retirement lifestyle. This can be a wake-up call for individuals who have not been actively saving for retirement.

However, it also underscores the need for more comprehensive financial education and access to resources that can help individuals make informed decisions about their retirement savings.

Expert Perspectives and Alternative Tools

Financial advisors emphasize the importance of using retirement calculators as part of a broader financial planning strategy. They recommend consulting with a qualified advisor to develop a personalized retirement plan that takes into account individual circumstances and goals.

Several alternative retirement calculators are available, each with its own strengths and weaknesses. Some calculators offer more sophisticated features, such as Monte Carlo simulations, which can provide a range of possible retirement outcomes based on different market scenarios.

Others focus on specific aspects of retirement planning, such as Social Security optimization or tax-efficient withdrawal strategies.

Moving Forward: Enhancing Retirement Security

Addressing the retirement savings crisis requires a multi-faceted approach. This includes promoting financial literacy, encouraging early savings, and expanding access to affordable retirement plans.

While the Fidelity Retirement Calculator Score can serve as a useful tool for assessing retirement readiness, it is essential to recognize its limitations and supplement it with professional financial advice.

Ultimately, securing a comfortable retirement requires proactive planning, disciplined savings, and a commitment to long-term financial well-being. Improvements in Fidelity's Retirement Calculator, along with other industry resources, will play a vital role in helping individuals navigate the complexities of retirement planning and achieve their financial goals.