Financial Advisor Northwestern Mutual Job Description

Northwestern Mutual is aggressively recruiting Financial Advisors, promising significant income potential and comprehensive training. Competition is fierce as individuals vie for these coveted roles amidst economic uncertainty.

The opportunity offers a chance to build a thriving practice with a Fortune 100 company, but demands significant commitment and entrepreneurial drive.

Financial Advisor Role: What’s at Stake

The Financial Advisor position at Northwestern Mutual is a sales and client management role focused on providing financial security solutions. Responsibilities include building and maintaining a client base, assessing financial needs, and recommending appropriate insurance and investment products.

Advisors work to achieve sales targets and provide ongoing service and support to their clients. Success is heavily reliant on self-motivation and networking ability.

Key Responsibilities

The role involves prospecting for new clients through networking, referrals, and community involvement. Advisors conduct in-depth financial needs analyses to understand client goals and risk tolerance.

Based on the analysis, advisors develop personalized financial plans and recommend suitable products, including life insurance, disability income insurance, annuities, and investment options. They must maintain a strong understanding of Northwestern Mutual's product offerings and financial market trends.

Advisors are responsible for providing ongoing service and support to existing clients, including policy reviews, claim assistance, and investment updates. They must adhere to all regulatory requirements and maintain ethical business practices.

Who They're Looking For

Northwestern Mutual seeks individuals with a strong work ethic, excellent communication skills, and a passion for helping others. The ideal candidate is a self-starter with an entrepreneurial mindset and a desire to build a long-term career.

While prior financial services experience is beneficial, it is not always required. Northwestern Mutual provides extensive training and development programs to equip new advisors with the necessary knowledge and skills.

Successful advisors often possess a bachelor's degree in business, finance, or a related field, but candidates from diverse backgrounds are encouraged to apply. Strong interpersonal and networking skills are crucial for building and maintaining a client base.

Training and Development

Northwestern Mutual offers a comprehensive training program for new Financial Advisors. This includes classroom instruction, mentorship from experienced advisors, and ongoing professional development opportunities.

The training covers topics such as financial planning principles, product knowledge, sales techniques, and compliance regulations. Advisors are also provided with resources and support to help them build their practices.

Continued professional development is essential for staying current with industry trends and maintaining required licenses and certifications. Northwestern Mutual supports advisors in pursuing designations such as Certified Financial Planner (CFP).

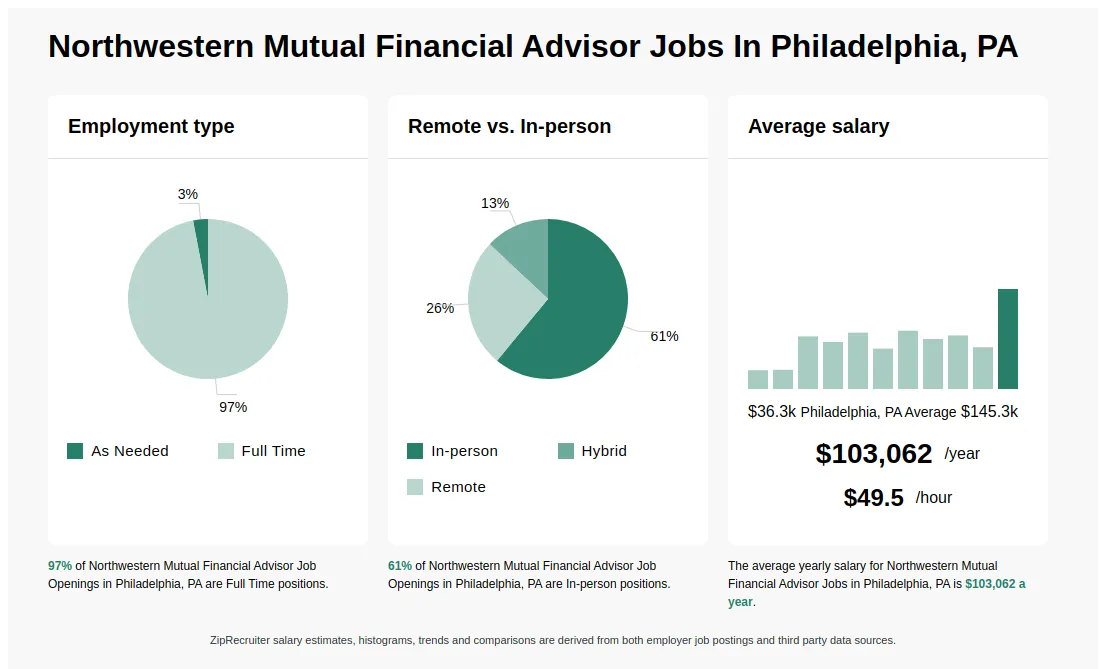

The Compensation Structure: Potential and Realities

The compensation structure for Financial Advisors at Northwestern Mutual is primarily commission-based. Income is directly tied to sales performance and client retention.

While this offers the potential for high earnings, it also means that income can fluctuate, especially during the initial stages of building a practice. A strong emphasis is placed on building a sustainable client base for long-term financial security.

Benefits typically include health insurance, retirement plans, and other employee perks. Northwestern Mutual also offers performance-based incentives and recognition programs.

Location, Location, Location

Financial Advisor positions are available at Northwestern Mutual offices across the United States. Recruitment efforts are often targeted at specific geographic areas based on market needs and growth opportunities.

The location of an advisor's office can significantly impact their ability to build a client base. A strong local presence and community involvement are often key to success.

Potential candidates are encouraged to research the market dynamics and competitive landscape in their desired location. Understanding the local demographics and financial needs can help advisors tailor their services and marketing efforts.

When is the Right Time to Apply?

Northwestern Mutual actively recruits Financial Advisors throughout the year. The company conducts ongoing information sessions and recruiting events to attract potential candidates.

Individuals interested in the position should monitor the Northwestern Mutual careers website and attend local recruiting events. Preparing a strong resume and practicing interview skills are essential for standing out from the competition.

The timing of an application can be influenced by economic conditions and market trends. Periods of economic uncertainty may drive increased demand for financial planning services, creating more opportunities for advisors.

The Bottom Line: Is This the Right Career Path?

The Financial Advisor role at Northwestern Mutual offers a challenging but rewarding career path for individuals with the right skills and drive. Success requires a significant investment of time and effort, but the potential for financial independence and professional fulfillment is substantial.

Consider the demanding sales targets and entrepreneurial nature of the role before applying. Building a successful practice takes time, persistence, and a strong commitment to client service.

Interested candidates should visit the Northwestern Mutual careers website or contact a local recruiting office for more information and application details. The company is actively seeking qualified individuals to join its team of financial professionals.