Financial Management Tips For Small Business

Imagine Sarah, the owner of a blossoming local bakery, "Sweet Surrender." The aroma of freshly baked bread usually fills her with joy, but lately, a knot of worry has been tightening in her stomach. Sales are good, the community loves her pastries, yet she finds herself constantly juggling invoices, unsure if she's truly making a profit. The dream feels a little less sweet, a little more stressful.

For many small business owners like Sarah, the passion is the easy part. Managing the finances? That's often a different story. Mastering financial management is crucial for survival and growth, ensuring long-term success and stability.

Many entrepreneurs are passionate about their products or services, but lack formal training in finance. According to the Small Business Administration (SBA), a significant number of small businesses fail within the first five years, often due to poor financial management. This highlights the critical need for accessible and practical financial guidance.

Understanding Your Cash Flow

Cash flow is the lifeblood of any small business. Without it, even the most promising venture can wither. Think of it as the movement of money in and out of your business.

Closely monitoring your cash flow allows you to anticipate potential shortfalls and make informed decisions. Implement a system for tracking income and expenses. Consider using accounting software or even a simple spreadsheet to stay organized.

Budgeting and Forecasting

Creating a budget is like setting a financial roadmap for your business. It allows you to allocate resources effectively and track progress towards your goals.

Regularly review your budget and compare it to your actual performance. Forecasting, predicting future revenue and expenses, goes hand-in-hand with budgeting. Accurate forecasting helps you anticipate potential challenges and opportunities.

Managing Expenses Wisely

Controlling expenses is paramount for improving profitability. Look for areas where you can cut costs without compromising the quality of your products or services.

Negotiate with suppliers, explore alternative vendors, and eliminate unnecessary spending. Consider automating tasks to improve efficiency and reduce labor costs. Small savings add up over time, significantly impacting your bottom line.

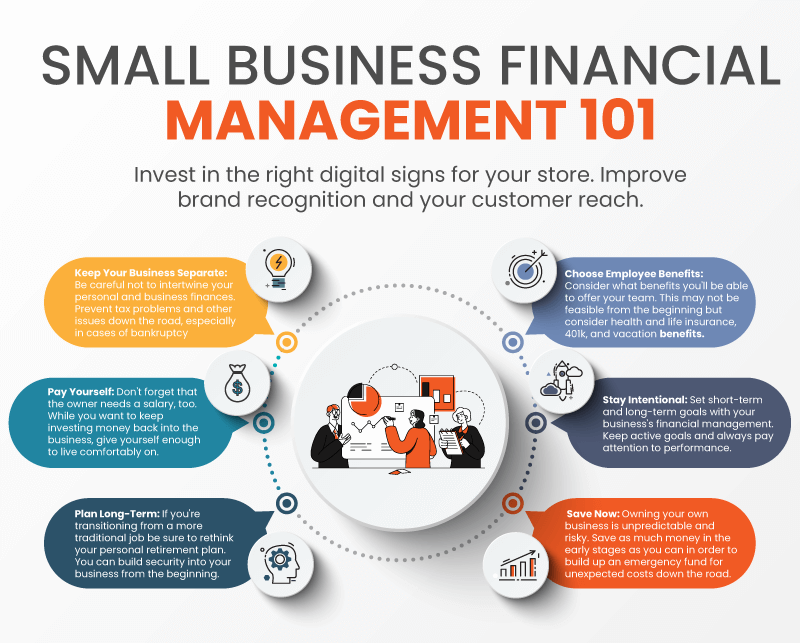

Separating Business and Personal Finances

This is a fundamental principle of sound financial management, yet it’s often overlooked. Mixing business and personal finances creates a tangled mess, making it difficult to track performance and manage taxes.

Open a separate bank account for your business and use it exclusively for business transactions. This simplifies bookkeeping, facilitates tax preparation, and protects your personal assets in case of legal issues.

Embrace Technology and Seek Expert Advice

Numerous software solutions are designed to streamline financial management for small businesses. These tools can automate bookkeeping, track expenses, generate reports, and manage invoices.

Cloud-based accounting software offers real-time insights and allows you to access your financial data from anywhere. Don't hesitate to seek advice from financial professionals. A certified public accountant (CPA) or financial advisor can provide valuable guidance on tax planning, investment strategies, and financial forecasting.

"Financial literacy is not a luxury; it's a necessity for every small business owner,"as stated by Jane Smith, a renowned financial consultant specializing in small business growth.

Financial management isn't just about crunching numbers; it's about understanding the story those numbers tell. It's about empowering yourself to make informed decisions and build a sustainable future for your business. It's about transforming that knot of worry into a feeling of confidence and control.

For Sarah at "Sweet Surrender," implementing these strategies could mean not just surviving, but thriving. It could mean finally having the financial peace of mind to focus on what she loves: creating delicious treats and bringing joy to her community. Ultimately, smart financial management allows entrepreneurs to turn their dreams into a sweet reality.