Financial Software For Small Business

Small businesses are facing unprecedented financial pressures. New, accessible financial software is offering a lifeline.

This technology promises to streamline operations, improve cash flow, and empower entrepreneurs to make data-driven decisions, potentially saving countless businesses from financial ruin.

The Urgent Need

A recent National Federation of Independent Business (NFIB) survey revealed that 22% of small businesses cite inflation as their single most important problem.

Rising costs are squeezing margins and hindering growth, making effective financial management more critical than ever. Traditional methods are proving insufficient.

What's Available?

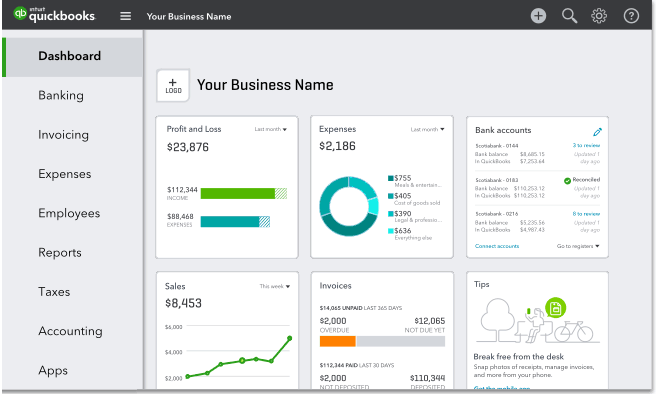

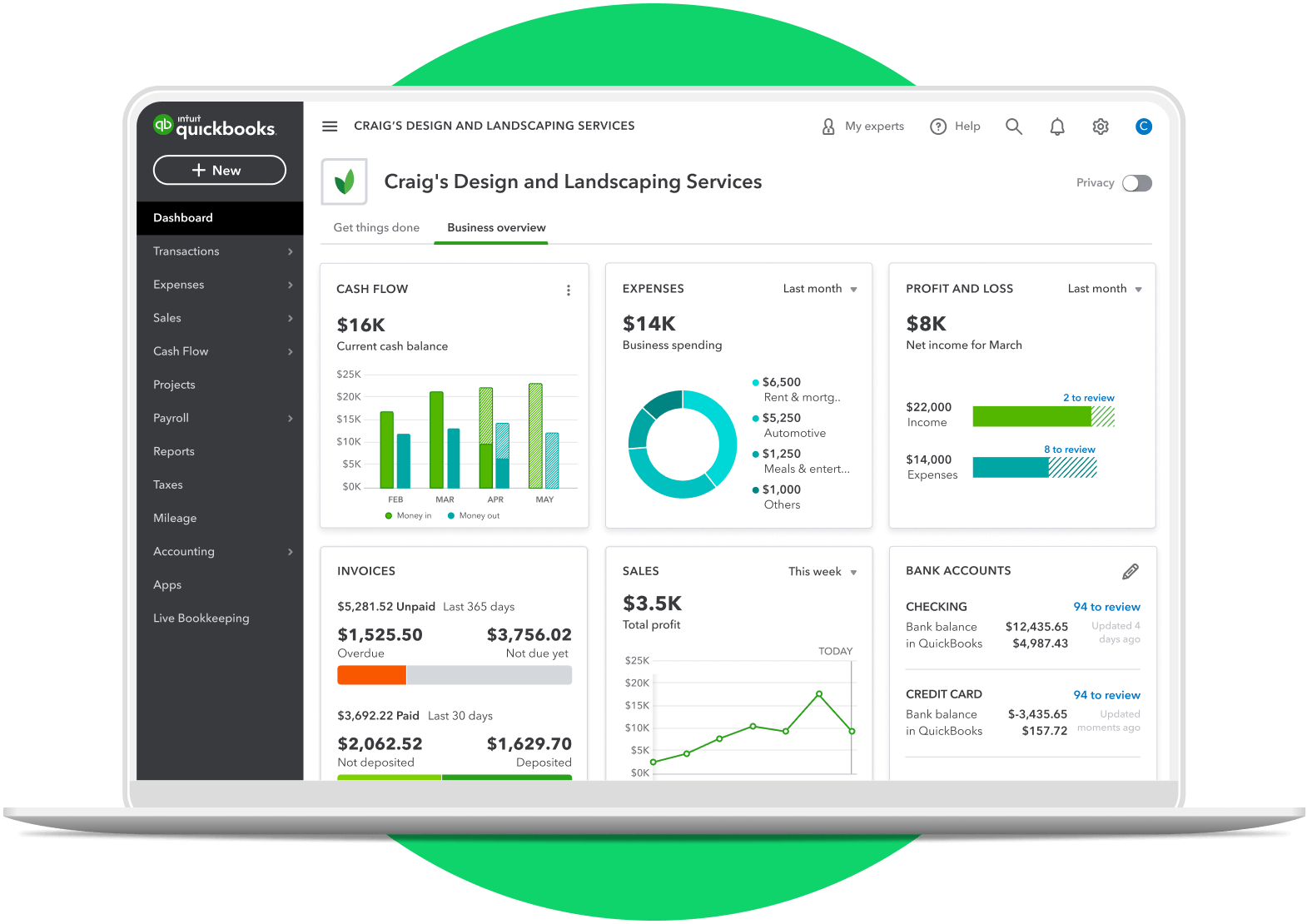

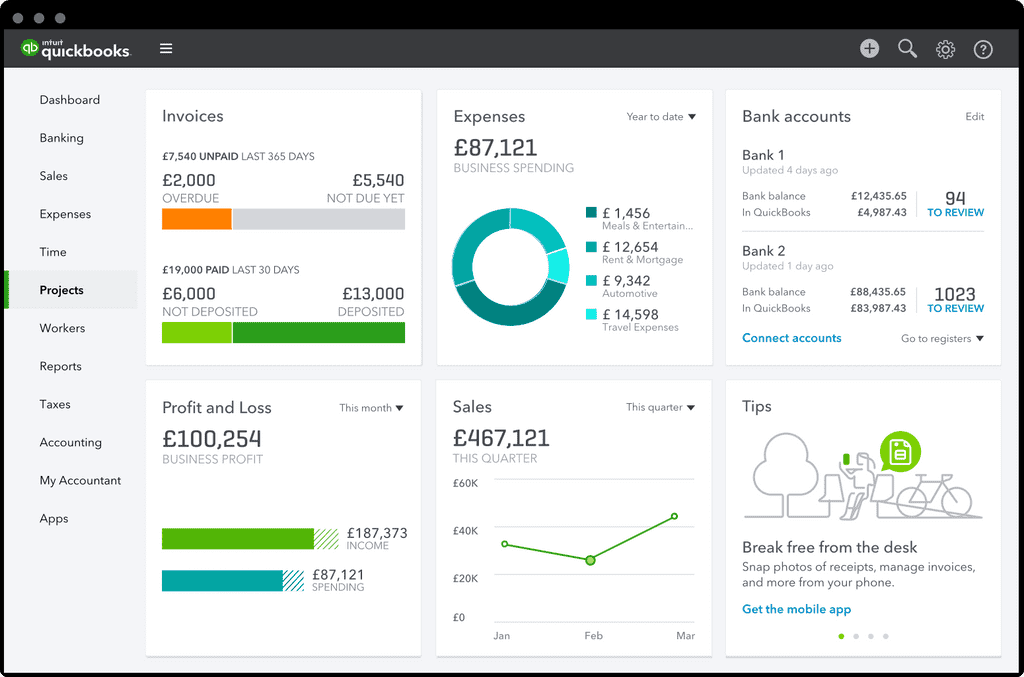

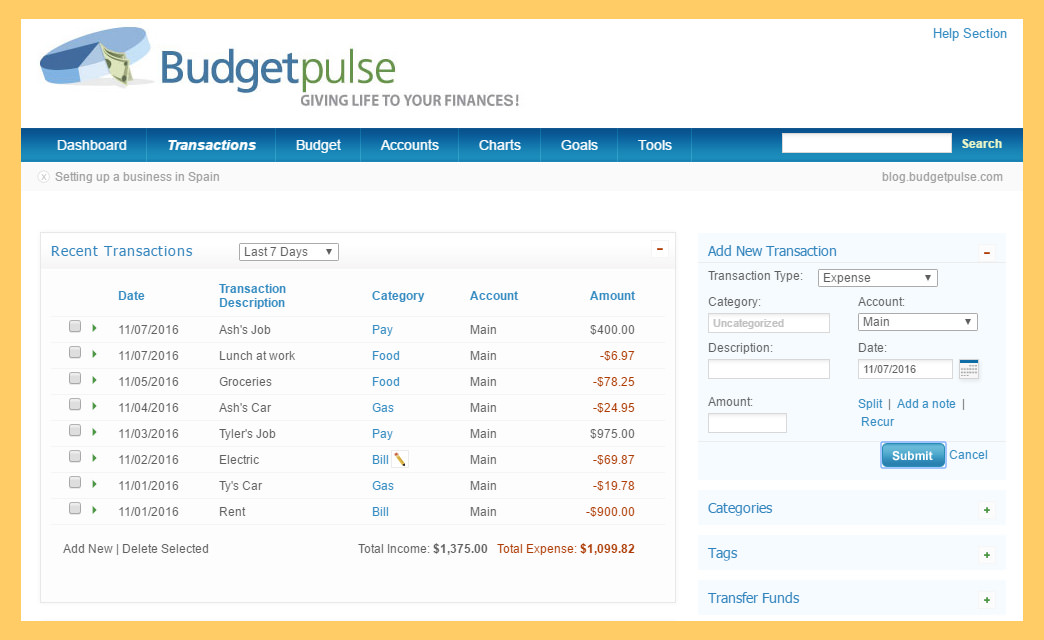

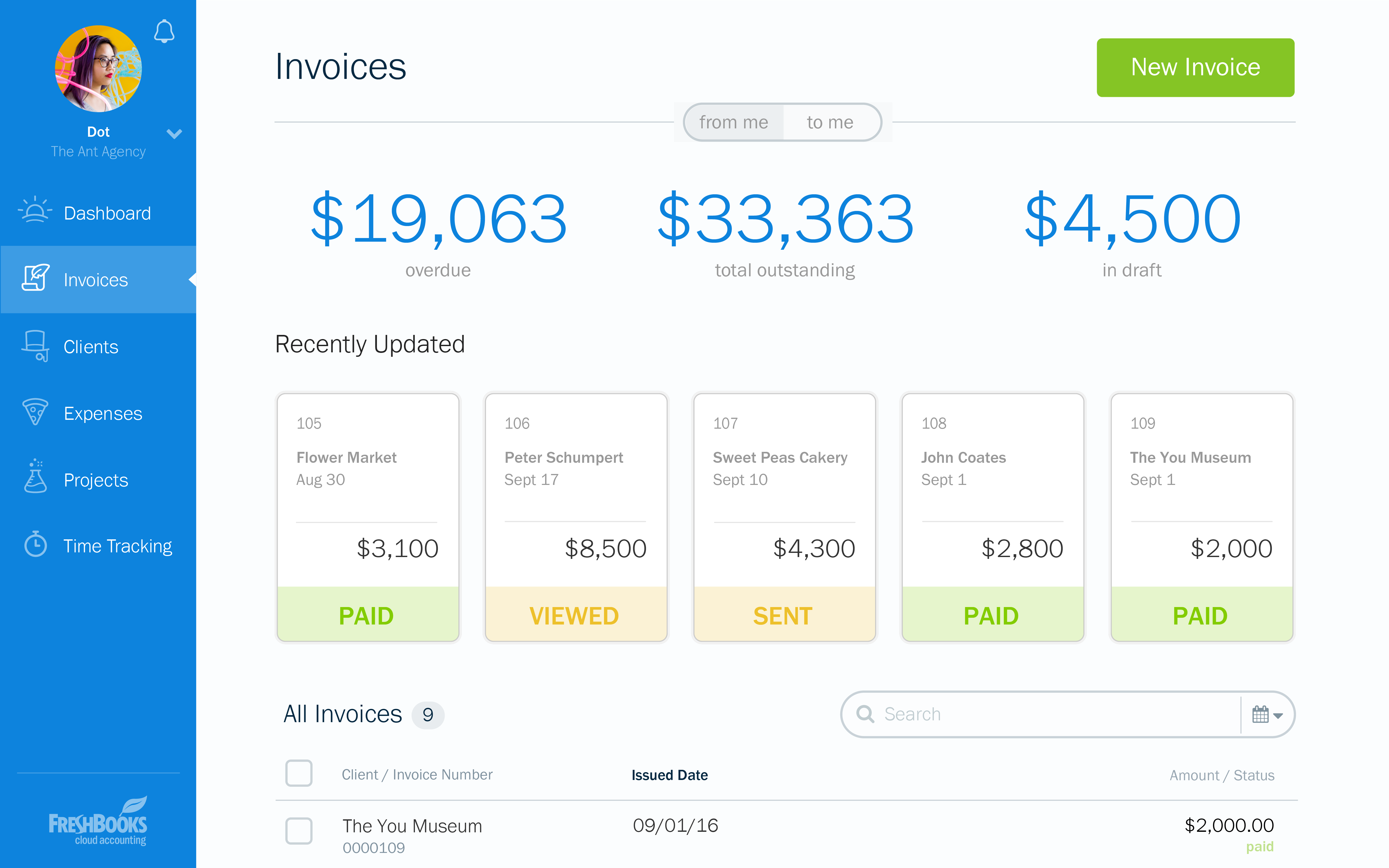

Several software solutions are gaining traction. These platforms offer features like automated bookkeeping, invoicing, expense tracking, and financial reporting.

QuickBooks Online, Xero, and Zoho Books are popular choices, catering to varying business needs and budgets. Many offer scalable plans.

Key Features and Benefits

Automated bookkeeping eliminates manual data entry, reducing errors and freeing up time. Real-time dashboards provide instant insights into key performance indicators (KPIs).

Efficient invoicing ensures timely payments and improves cash flow. Expense tracking simplifies tax preparation and identifies potential cost savings.

According to a Small Business Administration (SBA) report, businesses using financial software experienced a 15% increase in cash flow on average.

Adoption Challenges and Solutions

Some small business owners are hesitant to adopt new technology due to cost or lack of technical expertise. Many software vendors offer free trials and comprehensive support.

Training resources, online tutorials, and dedicated customer service teams are readily available. The initial investment is often outweighed by long-term savings and increased efficiency.

Cybersecurity is a critical concern. Businesses must choose software with robust security measures and prioritize data protection protocols.

Where and When?

These software solutions are accessible online, anytime, anywhere. Most are cloud-based, requiring only an internet connection and a device.

Implementation times vary depending on the complexity of the business and the chosen software. The entire process can take as little as a few days to a few weeks.

Now is the time for action. Delaying adoption could put businesses at a significant disadvantage.

Who Benefits?

Virtually every small business can benefit, regardless of industry or size. From startups to established enterprises, these tools empower entrepreneurs to take control of their finances.

Accountants and bookkeepers also benefit. The software streamlines their workflows and allows them to provide more value-added services to their clients.

Ultimately, the customers benefit as well. More efficient small businesses are more likely to survive, thrive, and provide goods and services at competitive prices.

The Road Ahead

The adoption of financial software is only expected to accelerate. The market is becoming more competitive, driving innovation and affordability.

Expect to see more AI-powered features, personalized dashboards, and seamless integration with other business tools. Further government initiatives may provide financial assistance to help businesses adopt these technologies.

Small business owners must act now to secure their financial future and navigate the challenging economic landscape. The future of small business may depend on it.