I Can T Pay My Credit Cards Anymore

The stack of bills sat on Maria’s kitchen table, each a colorful rectangle representing a promise she could no longer keep. Sunlight streamed through the window, illuminating the stark reality: she was drowning in debt, the cheerful hues mocking her mounting anxiety. The weight of it all felt heavier than the textbooks she used to carry to college, a burden that threatened to pull her under.

Across the country, millions of Americans are grappling with the same daunting situation: the inability to pay their credit card bills. It’s a silent epidemic fueled by rising living costs, stagnant wages, and the allure of easy credit. Understanding the causes, consequences, and potential solutions to this crisis is crucial for both individuals and the economy as a whole.

The Road to Debt

Maria’s story is not unique. After graduating with a degree in education, she landed her dream job as a teacher, but her starting salary barely covered her student loans and rent. Credit cards became a lifeline, initially used for necessities like groceries and gas.

“It was so easy to swipe,” she confessed, her voice barely above a whisper. “I didn’t really think about the interest rates at first. I just needed to get by.”

According to the Federal Reserve, the average credit card interest rate hovers around 20%, a number that can quickly turn manageable debt into an insurmountable burden. Unexpected expenses, like a car repair or a medical bill, only exacerbated the situation.

The pandemic further complicated matters. While some were able to save money during lockdowns, others, like Maria, faced job insecurity and increased financial pressure. Many relied on credit cards to bridge the gap, pushing them deeper into debt.

The Ripple Effect

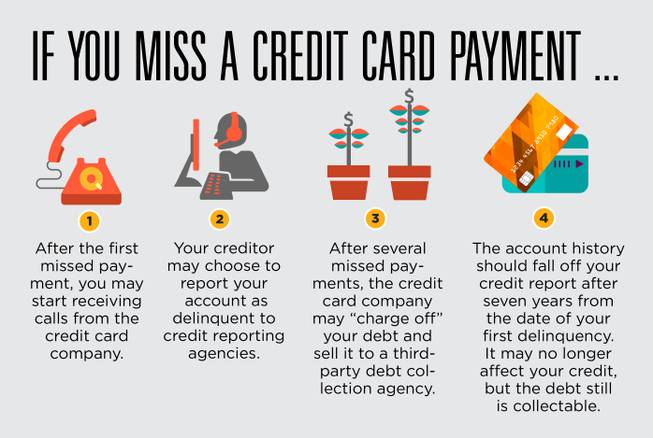

The consequences of credit card debt extend far beyond individual financial hardship. Missed payments negatively impact credit scores, making it harder to secure loans for essential purchases like a house or a car. This can create a vicious cycle, trapping individuals in a state of financial insecurity.

Furthermore, high levels of consumer debt can dampen economic growth. When people are burdened with debt, they have less disposable income to spend, leading to decreased demand for goods and services. This can negatively affect businesses and the overall economy.

"Household debt is a critical indicator of economic health," explains Dr. Emily Carter, an economist at the Center for Responsible Lending. "When consumers are overextended, it can create instability in the financial system."

Finding a Way Out

While the situation may seem bleak, there are avenues for relief. Credit counseling agencies can provide guidance and support in managing debt. These organizations can help individuals create budgets, negotiate with creditors, and explore options like debt management plans.

Debt consolidation loans can also be a viable option for some. These loans allow individuals to combine multiple credit card debts into a single loan with a lower interest rate. However, it’s important to shop around and compare offers to ensure that the loan is truly beneficial.

For Maria, seeking help from a financial advisor proved to be a turning point. Together, they created a budget, identified areas where she could cut expenses, and negotiated a lower interest rate with her credit card companies.

Looking Ahead

Addressing the credit card debt crisis requires a multi-pronged approach. Financial literacy education is crucial to equip individuals with the knowledge and skills they need to manage their finances responsibly. Policies that promote fair lending practices and protect consumers from predatory lending can also play a significant role.

Moreover, addressing systemic issues like income inequality and rising living costs is essential to prevent future debt crises. By creating a more equitable society, we can reduce the financial pressures that lead individuals to rely on credit cards to make ends meet.

Maria is slowly but surely getting back on her feet. "It's not easy," she admits, "but I'm learning to be more mindful of my spending and to prioritize my financial well-being." Her journey is a reminder that even in the face of overwhelming debt, hope and recovery are possible with the right support and resources.