Financial Statements Are Typically Prepared In The Following Order

In the intricate world of finance, where billions change hands daily and fortunes are made and lost on the strength of a single report, understanding the bedrock principles of financial reporting is paramount. A clear, consistent, and methodical approach is crucial for investors, creditors, and regulators alike. The order in which financial statements are prepared is not arbitrary; it is a carefully constructed process designed to ensure accuracy and provide a comprehensive view of a company's financial health.

This article delves into the typical sequence in which financial statements are prepared, explaining the rationale behind this order and its significance in financial analysis. Understanding this sequence is fundamental for anyone involved in financial decision-making, from seasoned analysts to students just beginning their journey into the complexities of accounting.

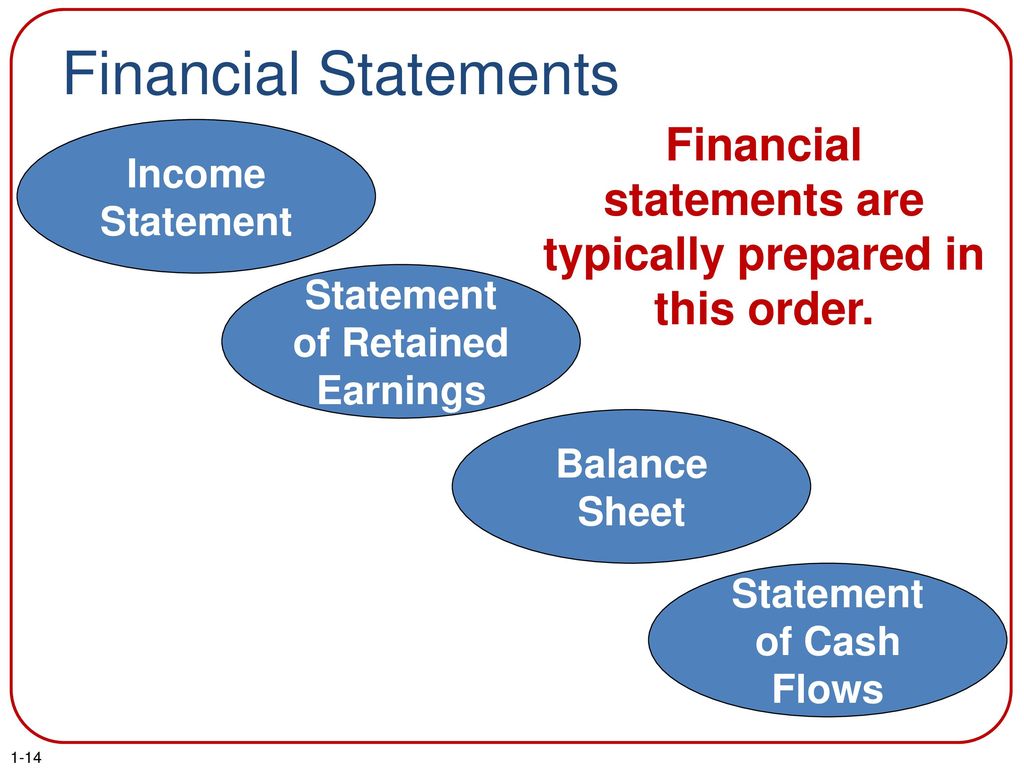

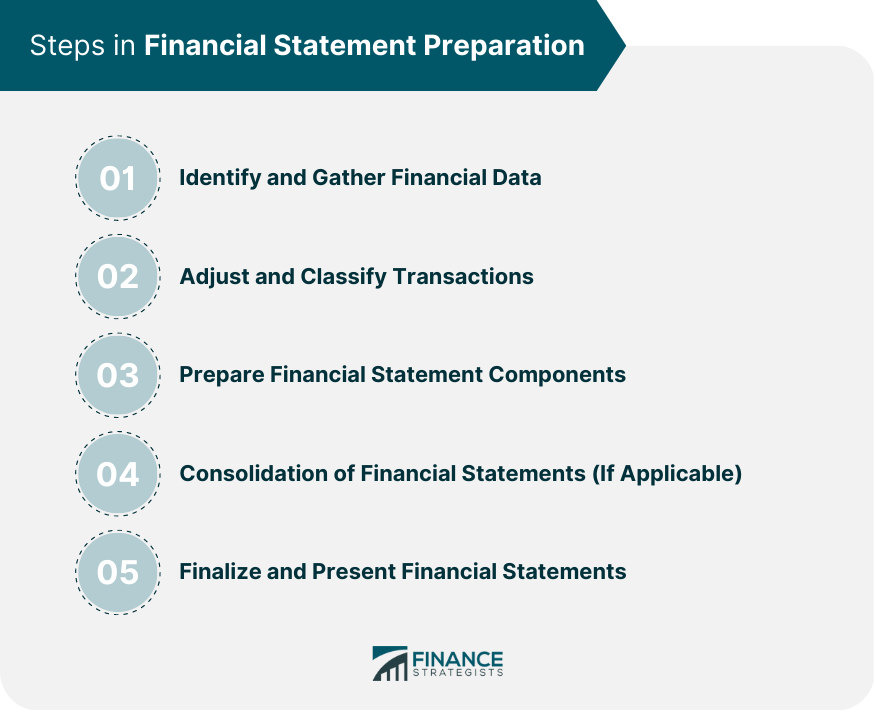

The Order Unveiled: A Step-by-Step Approach

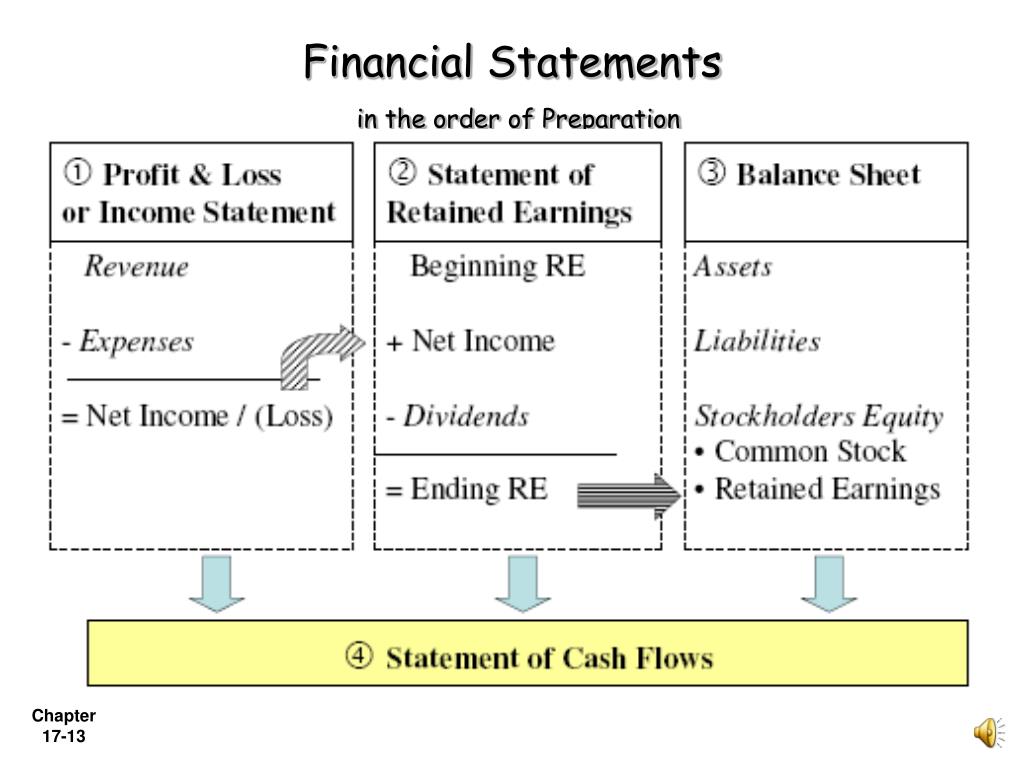

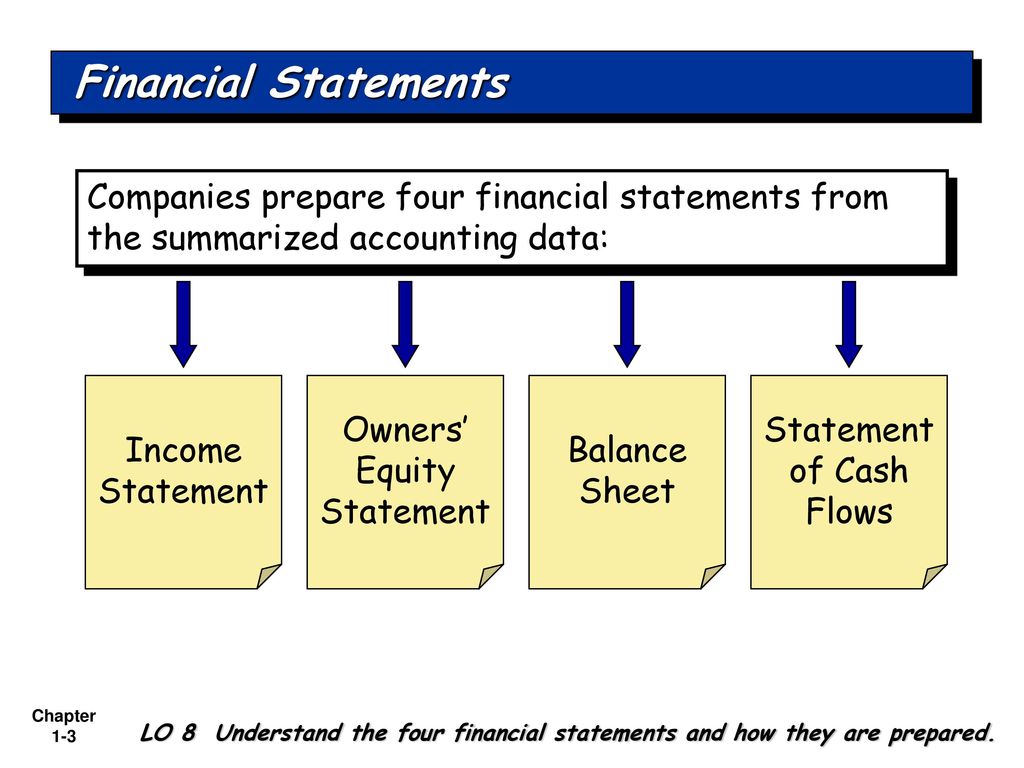

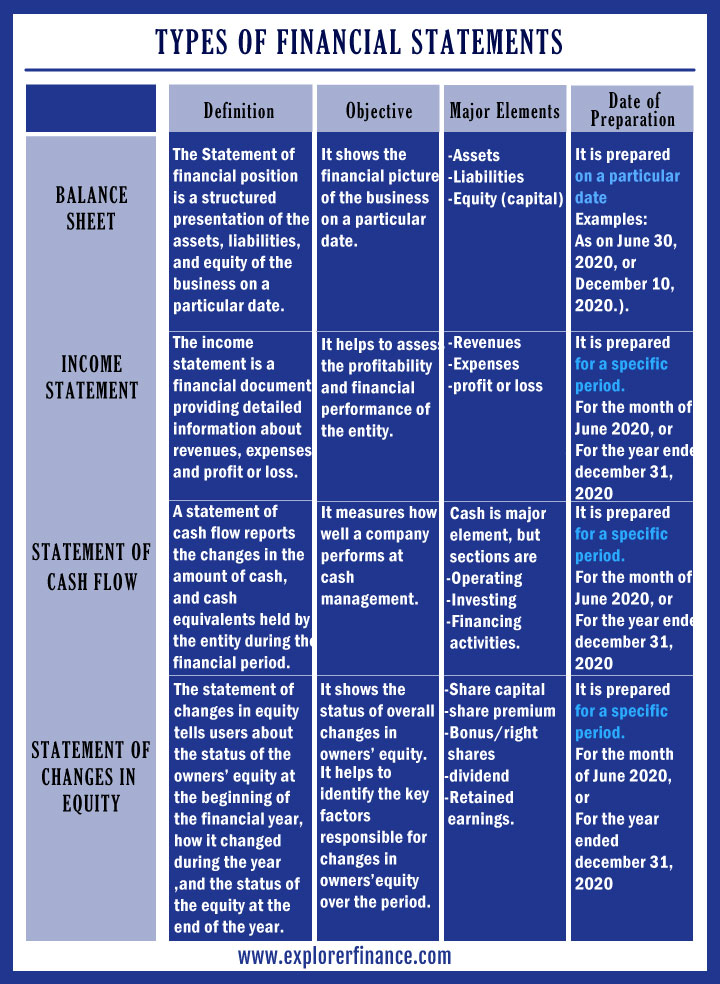

Financial statements are typically prepared in a specific order to ensure the information flows logically and accurately. This order reflects the dependencies between the statements and allows for a comprehensive analysis of a company's financial performance and position. The generally accepted order is: Income Statement, Statement of Retained Earnings (or Statement of Changes in Equity), Balance Sheet, and finally, the Statement of Cash Flows.

1. The Income Statement: Profitability at a Glance

The Income Statement, often referred to as the Profit and Loss (P&L) statement, is typically prepared first. It summarizes a company's revenues, expenses, gains, and losses over a specific period, ultimately arriving at a net income or net loss figure. The accuracy of this figure is crucial as it directly impacts the other financial statements.

The information required to prepare the income statement is gathered from the company’s accounting records, including sales data, cost of goods sold, operating expenses, and interest expenses. The net income calculated on the income statement is a critical input for the statement of retained earnings.

2. Statement of Retained Earnings: Tracking Equity Changes

Next comes the Statement of Retained Earnings, which details the changes in a company's retained earnings over a period. Retained earnings represent the accumulated profits that have not been distributed to shareholders as dividends. This statement starts with the beginning retained earnings balance, adds the net income from the income statement, and subtracts any dividends paid to arrive at the ending retained earnings balance.

In some cases, a more comprehensive Statement of Changes in Equity is prepared, encompassing all changes in equity accounts, including common stock, preferred stock, and additional paid-in capital. This statement is particularly useful for companies with complex equity structures or those that have undergone significant equity transactions.

3. The Balance Sheet: A Snapshot of Financial Position

The Balance Sheet, sometimes called the Statement of Financial Position, is prepared after the statement of retained earnings. It presents a company's assets, liabilities, and equity at a specific point in time. The balance sheet adheres to the fundamental accounting equation: Assets = Liabilities + Equity.

The retained earnings balance from the statement of retained earnings is a critical component of the equity section of the balance sheet. Therefore, the balance sheet cannot be accurately prepared until the statement of retained earnings is complete. The balance sheet provides a snapshot of a company's financial health, showing what it owns (assets), what it owes (liabilities), and the owners' stake in the company (equity).

4. Statement of Cash Flows: Understanding Cash Movement

The final statement to be prepared is the Statement of Cash Flows. This statement tracks the movement of cash both into and out of a company during a specific period. It categorizes cash flows into three main activities: operating activities, investing activities, and financing activities.

Preparing the statement of cash flows often requires information from the income statement and the balance sheet, as well as additional details about specific transactions. This statement is crucial for assessing a company's liquidity and solvency, providing insights into its ability to generate cash and meet its obligations.

The Interconnectedness of Financial Statements

The order in which financial statements are prepared highlights their interconnectedness. The net income from the income statement flows into the statement of retained earnings, and the ending retained earnings balance is then reflected on the balance sheet. The statement of cash flows uses information from both the income statement and the balance sheet to explain changes in cash balances.

This interdependency underscores the importance of accuracy and consistency in financial reporting. Errors in one statement can cascade through the others, leading to misleading or inaccurate financial information.

The Importance for Stakeholders

Understanding the order and the content of financial statements is vital for various stakeholders. Investors use these statements to assess a company's profitability, financial position, and cash flow generation capabilities. Creditors rely on them to evaluate a company's creditworthiness and ability to repay its debts.

Management uses financial statements to monitor the company's performance, make strategic decisions, and ensure compliance with regulatory requirements. Regulators, such as the Securities and Exchange Commission (SEC) in the United States, use these statements to oversee the financial reporting process and protect investors.

"Financial statements are the language of business," says Dr. Anya Sharma, a professor of accounting at the University of California, Berkeley. "Understanding how these statements are prepared and how they relate to each other is essential for anyone involved in the world of finance."

Looking Ahead: The Future of Financial Reporting

The landscape of financial reporting is constantly evolving, driven by technological advancements, globalization, and changing regulatory requirements. One significant trend is the increasing adoption of eXtensible Business Reporting Language (XBRL), which allows for the electronic transmission of financial data.

Another important development is the growing emphasis on non-financial information, such as environmental, social, and governance (ESG) factors. Investors are increasingly demanding that companies disclose information about their sustainability practices and social impact, recognizing that these factors can have a significant impact on long-term financial performance.

Despite these changes, the fundamental principles of financial reporting, including the order in which financial statements are prepared, remain critical. A solid understanding of these principles is essential for navigating the complexities of the modern financial world and making informed decisions. As financial reporting continues to evolve, the need for clear, consistent, and transparent information will only become more pronounced.

:max_bytes(150000):strip_icc()/dotdash_Final_Financial_Statements_Aug_2020-01-3998c75d45bb4811ad235ef4eaf17593.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Financial_Statements_Aug_2020-02-6a82acc4cf2d4434a77899c09d49e737.jpg)

![Financial Statements Are Typically Prepared In The Following Order [Solved] The following is the complete set of fina | SolutionInn](https://s3.amazonaws.com/si.question.images/image/images9/524-B-A-I-S(1384)-1.png)

:max_bytes(150000):strip_icc()/dotdash_Final_Financial_Statements_Aug_2020-03-aac8341b98da4fd3a4f13ed3ee7fa053.jpg)

![Financial Statements Are Typically Prepared In The Following Order [Solved] Required: Prepare statement of financial | SolutionInn](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2023/10/652e9b83c49de_1697553281450.jpg)