Fintech Choosing A Cloud Services Provider

The fintech industry, known for its agility and disruptive innovation, faces a critical decision point: choosing the right cloud services provider. This choice isn't just about infrastructure; it's about securing the future of financial services in an increasingly digital world.

The stakes are incredibly high, with security breaches, regulatory compliance, and scalability concerns looming large.

A wrong decision can lead to catastrophic consequences, undermining customer trust and hindering growth.

The Nut Graf: Cloud's Central Role in Fintech's Evolution

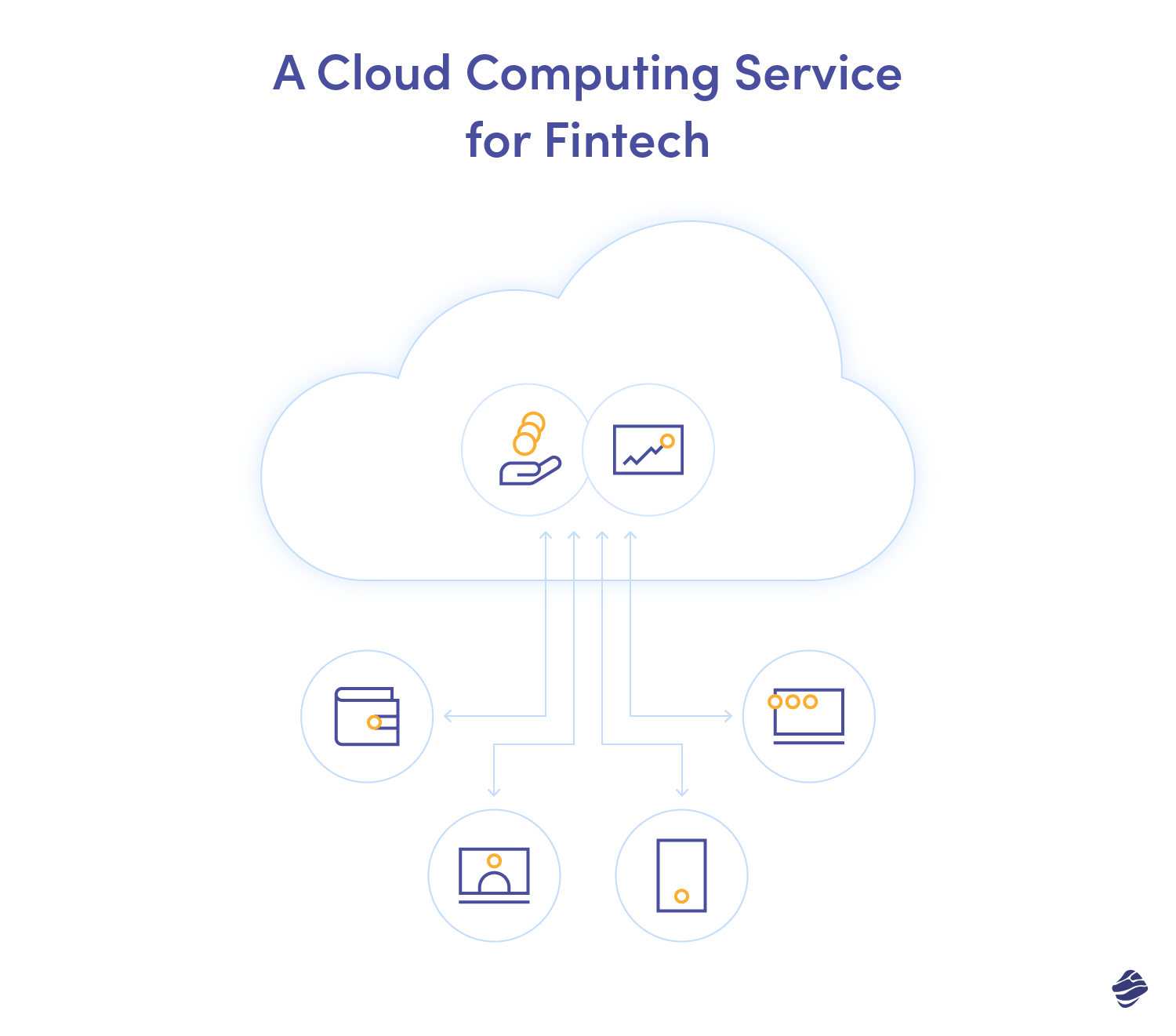

Fintech companies are fundamentally reshaping the financial landscape, leveraging technology to provide innovative solutions for payments, lending, investing, and more. At the heart of this transformation lies cloud computing, offering the scalability, flexibility, and cost-effectiveness that fintechs need to thrive.

However, selecting a cloud services provider is a complex undertaking that demands careful consideration of security, compliance, performance, and cost. With multiple players vying for market share, fintech firms must navigate a landscape filled with competing claims and nuanced offerings.

This article will delve into the key factors influencing cloud provider selection in the fintech industry, explore the strengths and weaknesses of leading providers, and offer insights into the future of cloud adoption in financial services.

Security: A Non-Negotiable Priority

For fintech companies, security is paramount. They handle sensitive financial data, making them prime targets for cyberattacks.

According to a report by IBM, the financial services industry experiences the highest average cost of data breaches, exceeding other sectors by a significant margin.

Therefore, a cloud provider's security posture is a critical consideration.

Key Security Features

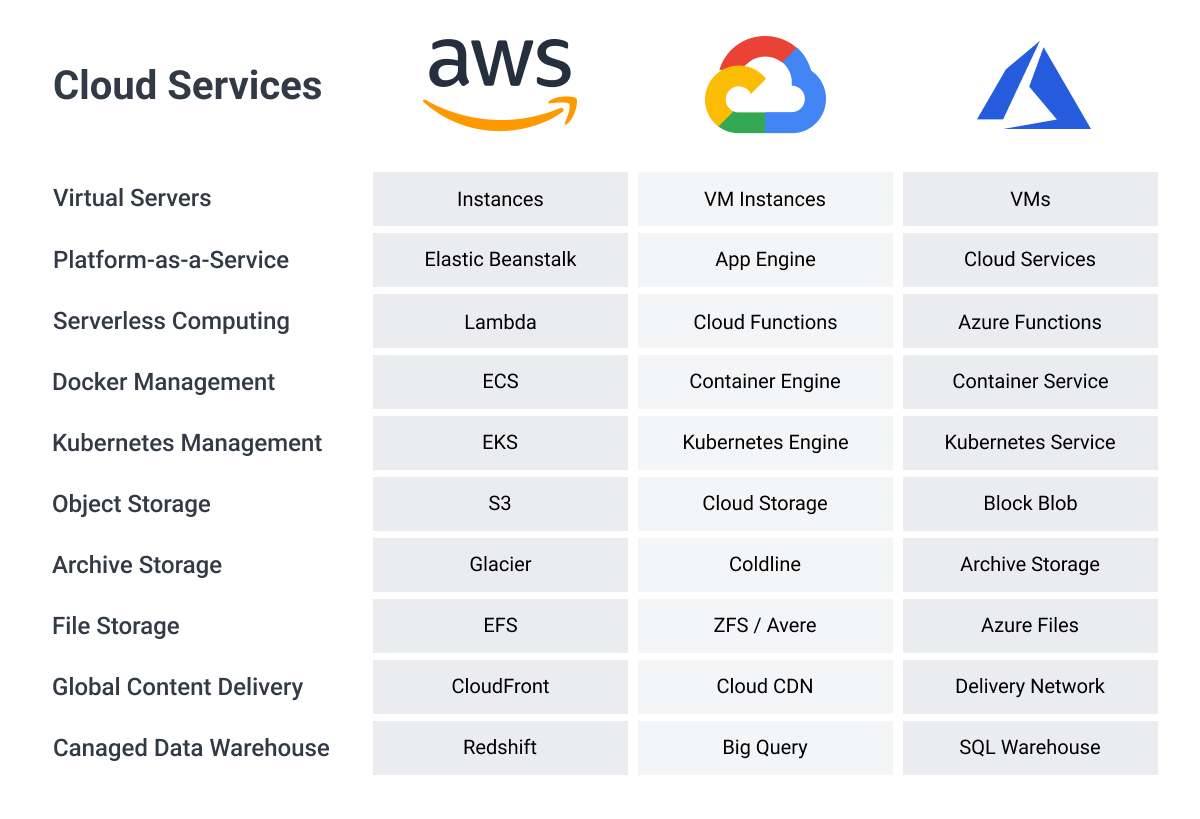

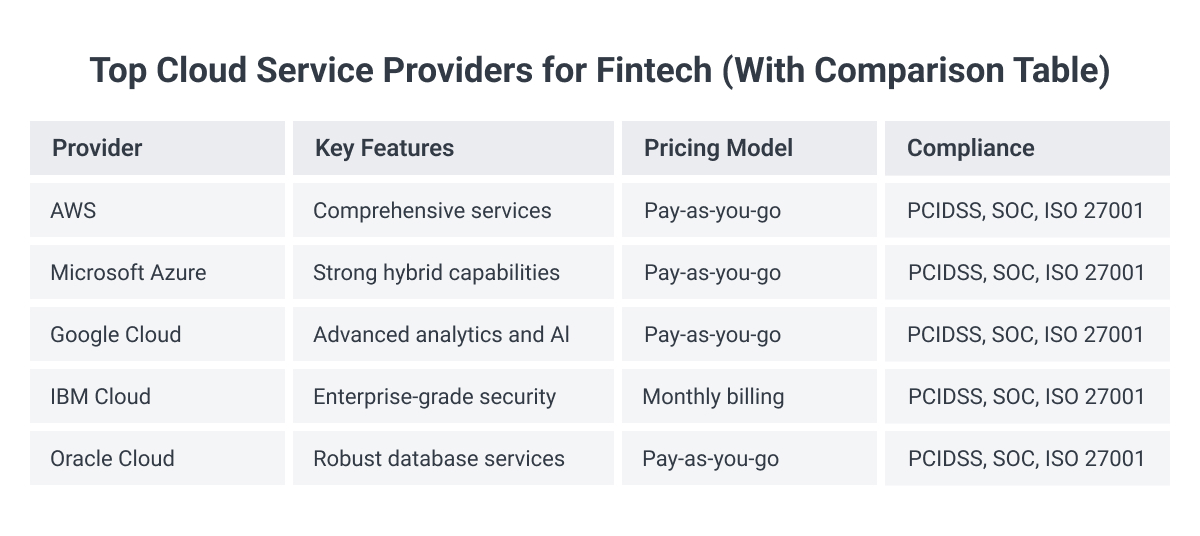

Robust encryption, multi-factor authentication, and intrusion detection systems are essential. Amazon Web Services (AWS), Microsoft Azure, and Google Cloud Platform (GCP) all offer advanced security features, but their implementation and management require expertise.

Compliance with industry standards such as PCI DSS (Payment Card Industry Data Security Standard) and GDPR (General Data Protection Regulation) is also vital.

Cloud providers must demonstrate a commitment to data privacy and regulatory compliance.

"Security is not just a feature; it's a fundamental requirement. We need a cloud provider that understands the unique security challenges of the fintech industry," says Sarah Chen, CTO of a leading online lending platform.

Compliance: Navigating the Regulatory Maze

The financial services industry is heavily regulated, and fintech companies must comply with a complex web of rules and regulations. Cloud providers must be able to support these compliance requirements.

This includes providing audit trails, data residency options, and tools for monitoring and reporting.

According to a report by Accenture, 89% of fintech executives cite regulatory compliance as a significant challenge in cloud adoption.

Meeting Regulatory Demands

Microsoft Azure, with its strong focus on enterprise customers, often highlights its compliance certifications and its ability to meet the stringent requirements of financial institutions.

AWS also offers a comprehensive suite of compliance services, but it may require more effort to configure and manage.

GCP is rapidly catching up, but some fintech companies may find its compliance offerings less mature compared to its competitors.

Performance and Scalability: Handling Peak Loads

Fintech applications often experience fluctuating workloads, with peak demand during trading hours or promotional periods. Cloud providers must offer the performance and scalability needed to handle these fluctuations without compromising user experience.

This requires a robust infrastructure, low latency, and the ability to automatically scale resources up or down as needed.

According to data from Statista, the global fintech market is expected to reach $305 billion by 2025, indicating a growing need for scalable cloud solutions.

Optimizing Performance

AWS, with its extensive global network of data centers, is often considered the leader in terms of performance and scalability. Its diverse range of services allows fintech companies to fine-tune their infrastructure for optimal performance.

Azure also offers excellent performance, particularly for organizations that already use Microsoft products. GCP, with its innovative technologies like Kubernetes, provides a strong platform for containerized applications that require high scalability.

Cost: Balancing Efficiency and Innovation

While cost is a crucial factor, it shouldn't be the sole driver of cloud provider selection. Fintech companies need to consider the total cost of ownership, including infrastructure costs, management overhead, and potential risks.

A seemingly cheaper solution may end up being more expensive in the long run if it lacks the necessary security features or scalability.

Fintech companies must carefully analyze their needs and choose a cloud provider that offers the best value for their specific requirements.

Cost Optimization Strategies

Each cloud provider offers different pricing models, and fintech companies should carefully evaluate which model best suits their needs. Reservation instances, spot instances, and other cost optimization strategies can help reduce cloud spending.

However, these strategies require careful planning and monitoring.

Proper resource management and automation are essential for controlling cloud costs.

Looking Ahead: The Future of Cloud in Fintech

The adoption of cloud computing in the fintech industry is only accelerating. As fintech companies continue to innovate and disrupt the financial landscape, cloud will become even more critical to their success.

We can anticipate greater use of advanced technologies like AI and machine learning, which will require even more powerful and scalable cloud infrastructure.

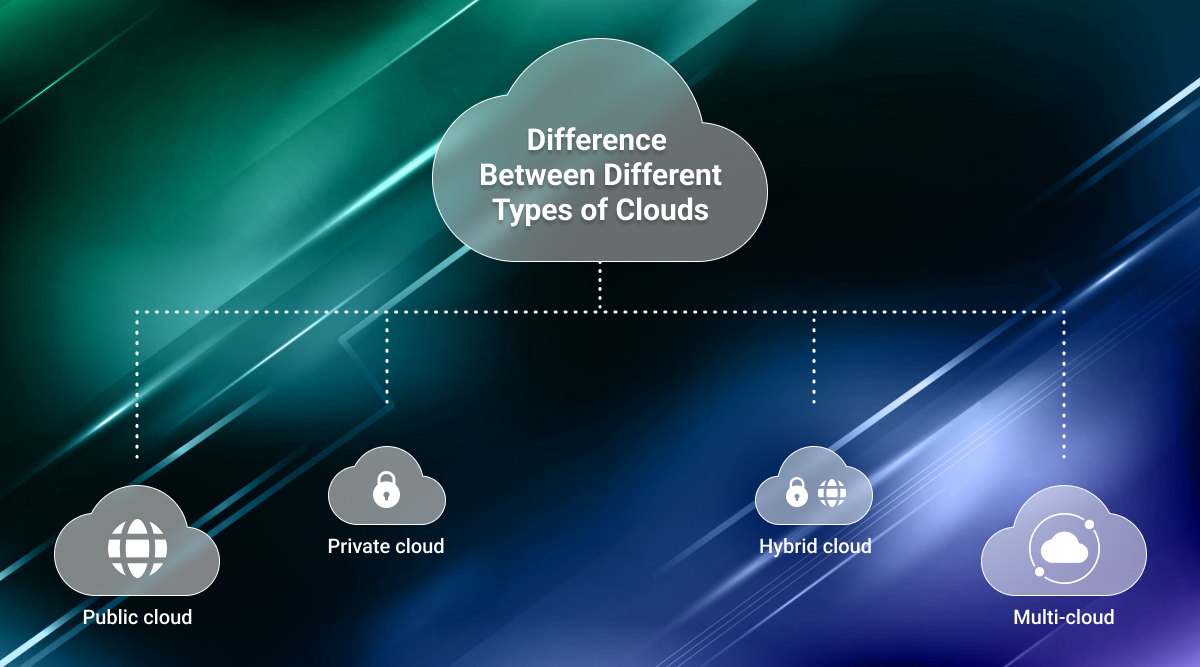

Hybrid and multi-cloud strategies are also likely to become more prevalent, allowing fintech companies to leverage the strengths of different cloud providers and avoid vendor lock-in.

Ultimately, the future of fintech is inextricably linked to the cloud. Choosing the right cloud partner will be a key determinant of success in this rapidly evolving industry.