First Republic Bank Current Cd Rates

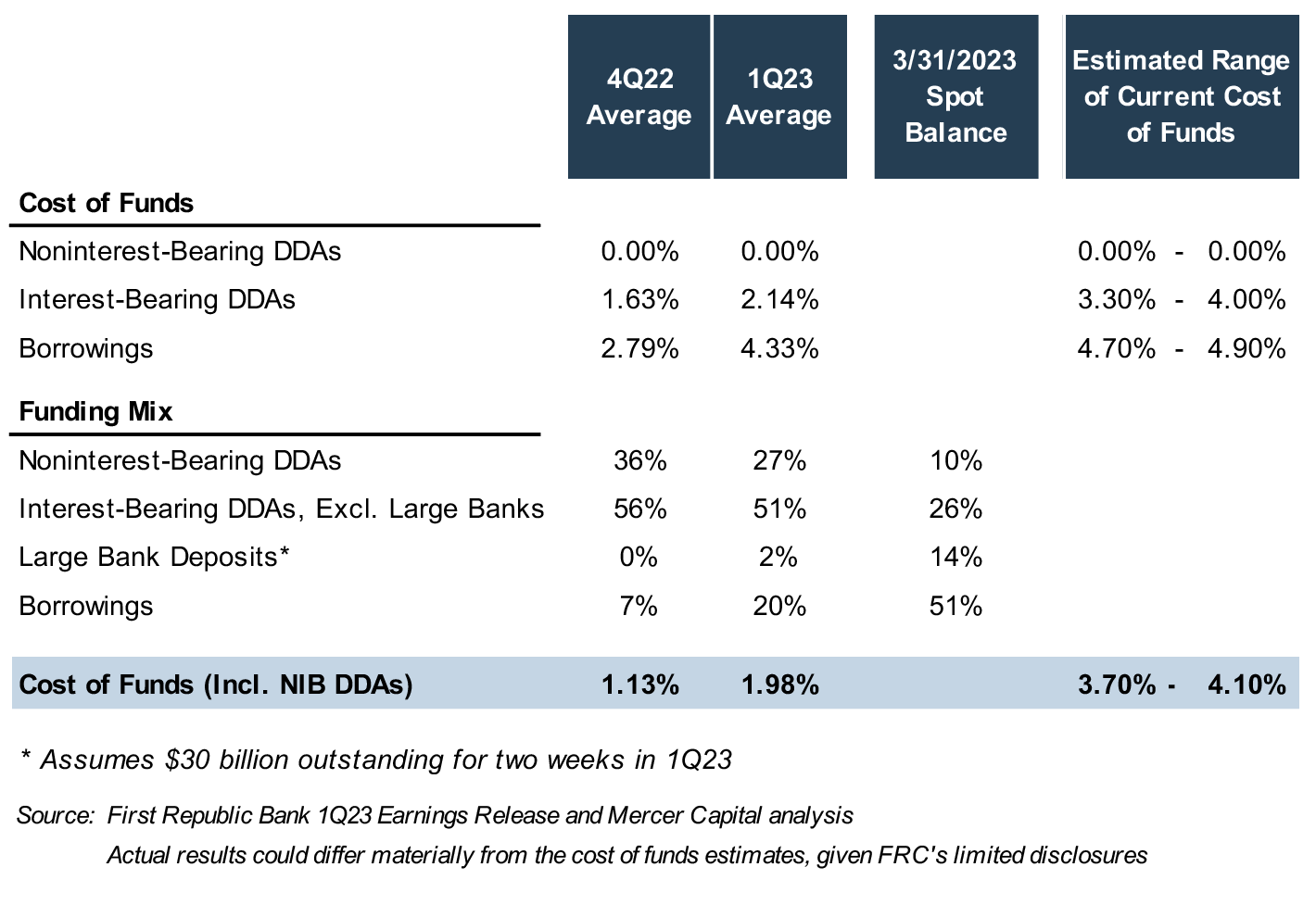

First Republic Bank, now operating under JPMorgan Chase following its acquisition, has adjusted its Certificate of Deposit (CD) rates. Depositors are urged to review current offerings as rates fluctuate in response to market conditions.

This article provides a concise overview of the current CD rates offered under the JPMorgan Chase umbrella for former First Republic Bank customers. Understanding these rates is crucial for investors seeking to maximize returns on their savings.

Current CD Rate Overview

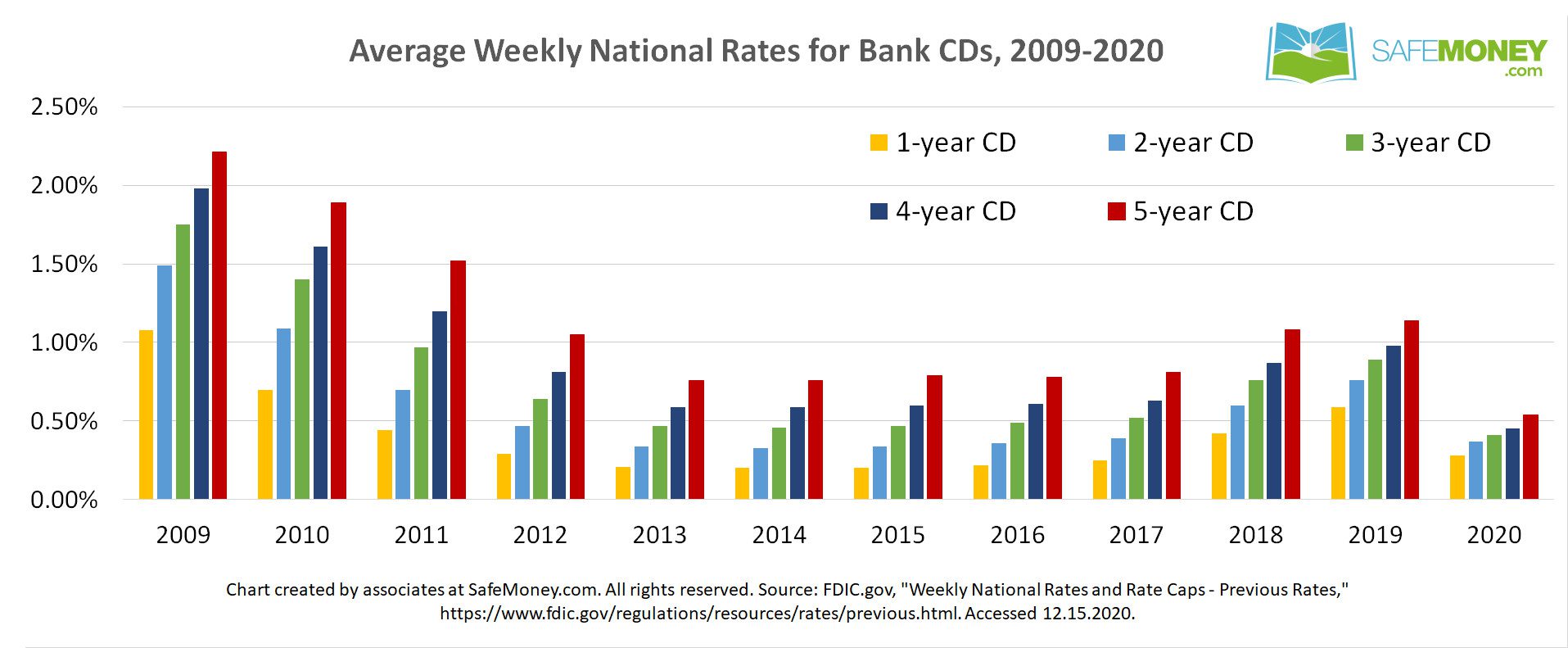

As of today, October 26, 2023, JPMorgan Chase is offering various CD terms. These range from short-term options to longer-term investments. Rates are subject to change and may vary based on deposit amount.

Key CD Terms and Rates

Here's a snapshot of sample CD rates. Remember to check the JPMorgan Chase website or contact a branch for the most up-to-date figures:

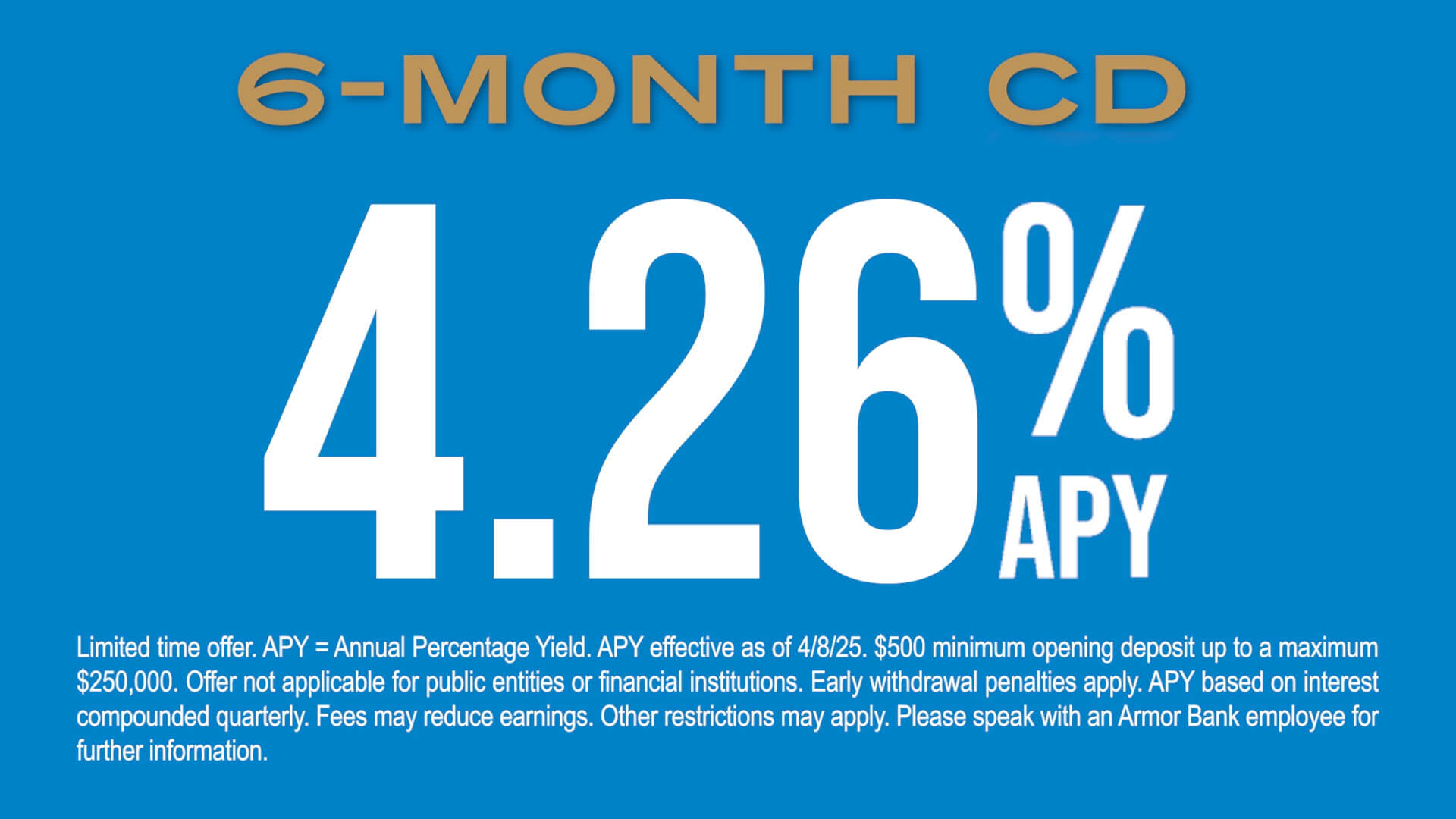

- 3-Month CD: Currently offering around 4.00% APY (Annual Percentage Yield).

- 6-Month CD: The APY is approximately 4.25%.

- 1-Year CD: Rates hover around 4.50% APY.

- 2-Year CD: Expect an APY of about 4.00%.

- 5-Year CD: The APY is approximately 3.75%.

These rates are for illustrative purposes only. Actual rates available to you will be determined at the time of purchase.

Important Considerations

CDs are a type of savings account that holds a fixed amount of money for a fixed period. In return, the bank pays interest. Early withdrawals usually incur penalties.

JPMorgan Chase may offer different rates for jumbo CDs. These typically require larger minimum deposits. Consider consulting with a financial advisor to determine if CDs are the right investment choice for your individual circumstances.

Remember to compare rates from different banks and credit unions. This helps ensure you are getting the best possible return on your investment.

Where to Find More Information

The most accurate and up-to-date CD rates can be found on the JPMorgan Chase website. You can also visit a local branch.

Contacting a bank representative directly is recommended. This allows you to discuss your specific financial needs.

Be sure to inquire about any special offers or promotional rates that may be available. These are often time-sensitive.

What's Next

Monitor CD rates regularly. Market conditions are always in flux. JPMorgan Chase is expected to continue adjusting its rates.

Carefully review the terms and conditions of any CD before investing. Pay close attention to early withdrawal penalties.

Former First Republic Bank customers with existing CDs should have received communication from JPMorgan Chase regarding the transition. Contact them directly with any concerns.