Fiscal Policy Involves Increases Or Decreases In

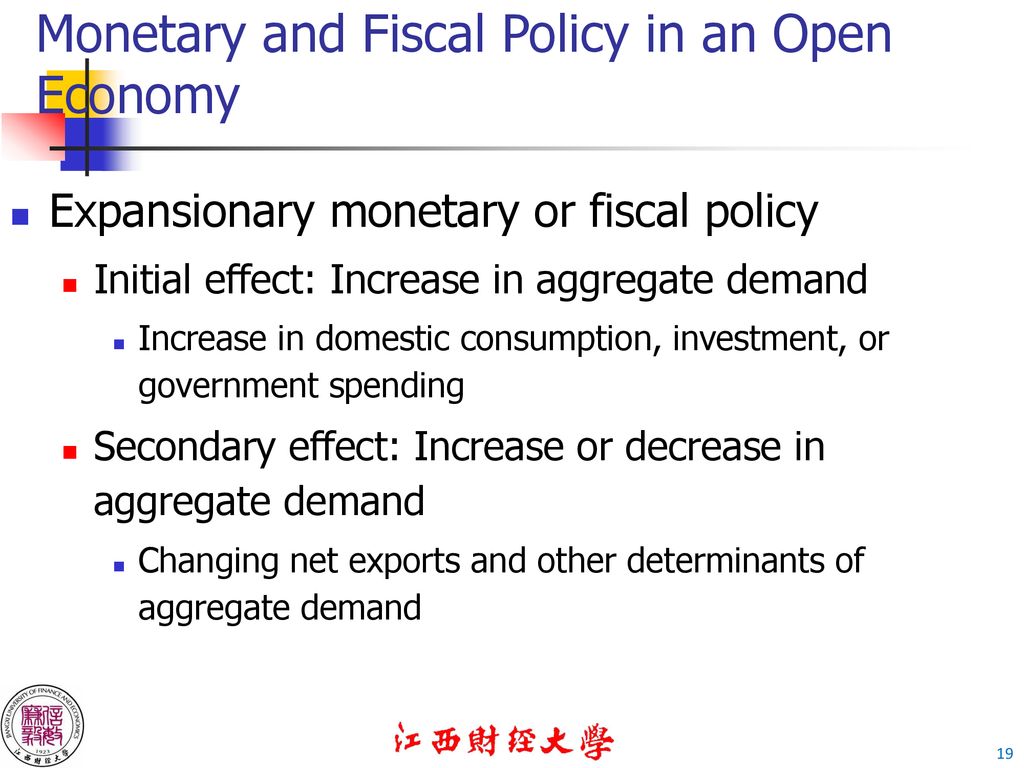

The government's use of fiscal policy, involving deliberate adjustments in government spending and taxation, remains a central tool in managing the economy. These actions, designed to influence aggregate demand and economic activity, are constantly scrutinized for their potential impact on individuals, businesses, and the overall financial health of the nation. Recent debates have centered on the appropriate direction and magnitude of these adjustments in the face of evolving economic conditions.

Fiscal policy, at its core, involves the government strategically altering its spending levels and tax rates to influence a nation's economy. This article examines the mechanics of fiscal policy, its potential impacts, and the ongoing debates surrounding its use. Understanding fiscal policy is crucial for anyone seeking to grasp the forces shaping our economic landscape.

Understanding Fiscal Policy

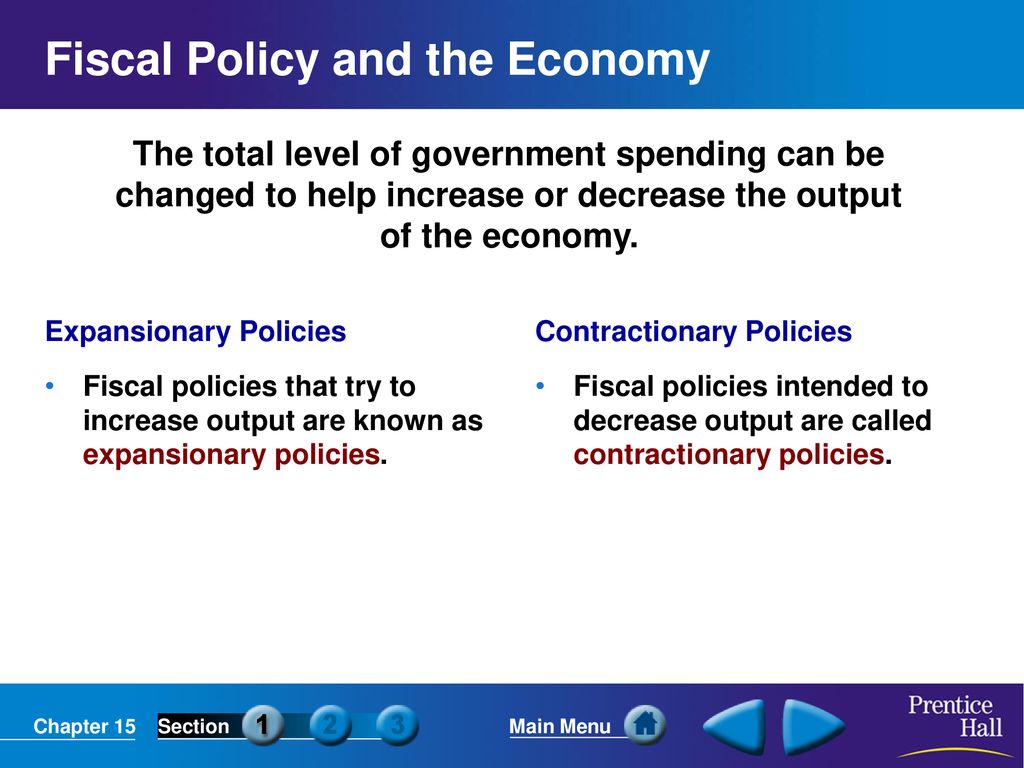

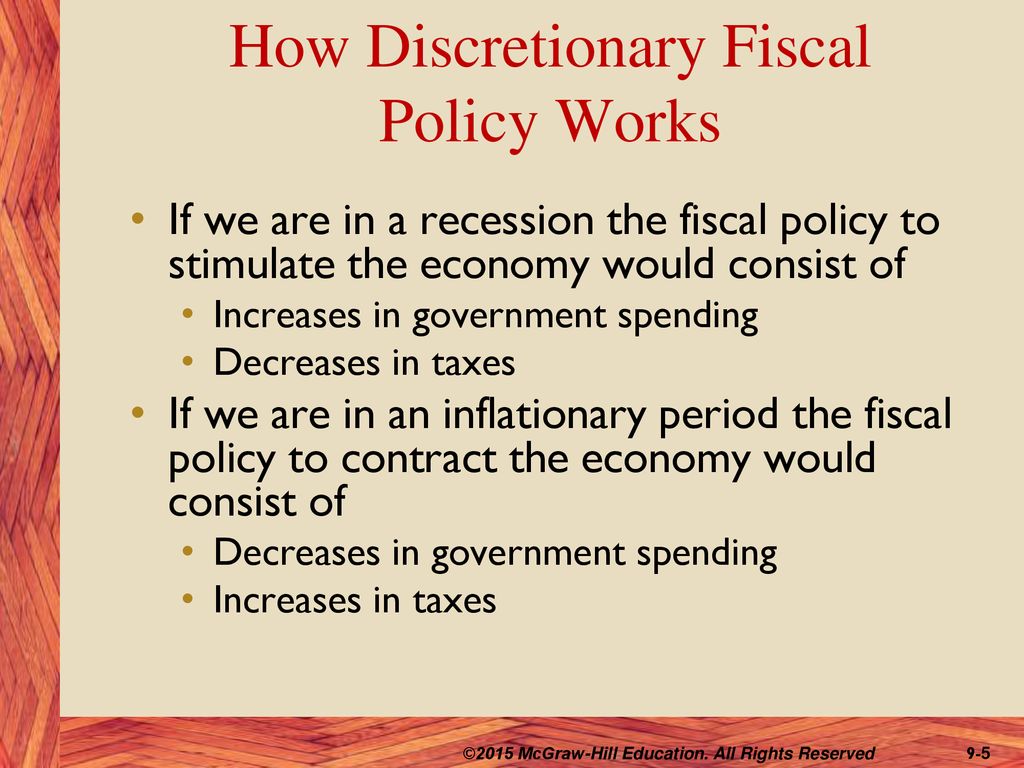

Fiscal policy is primarily implemented through two main levers: government spending and taxation. Increases in government spending, whether on infrastructure projects, social programs, or defense, inject money into the economy, stimulating demand. Conversely, tax cuts leave more disposable income in the hands of individuals and businesses, theoretically encouraging spending and investment.

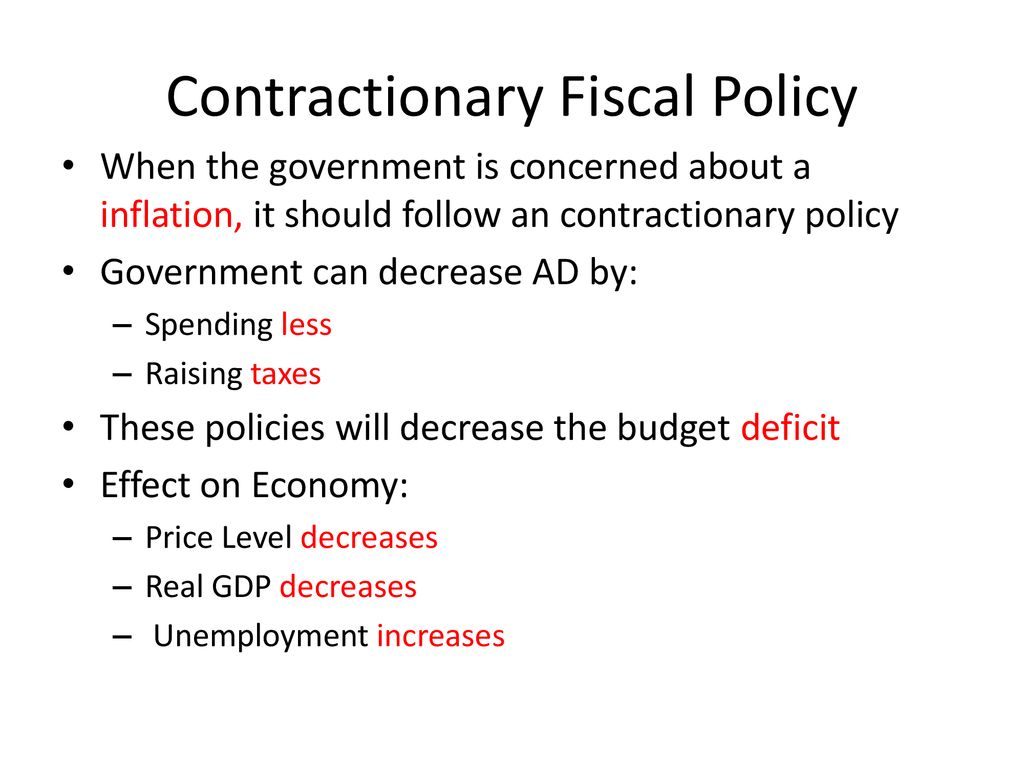

Conversely, decreases in government spending or tax increases are designed to cool down an overheating economy. This is a strategic way to manage inflation and prevent unsustainable growth.

Keynesian Economics and Fiscal Policy

The theoretical underpinnings of modern fiscal policy largely stem from Keynesian economics. John Maynard Keynes argued that during economic downturns, governments should actively intervene to compensate for insufficient private sector demand.

This intervention, he believed, could break the cycle of recession and restore economic stability. The argument is that increased government spending will boost demand, even if it means taking on debt in the short term.

The Impact of Fiscal Policy

The impact of fiscal policy is multifaceted and can be felt across various sectors of the economy. Increased government spending can create jobs, boost consumer confidence, and stimulate business investment.

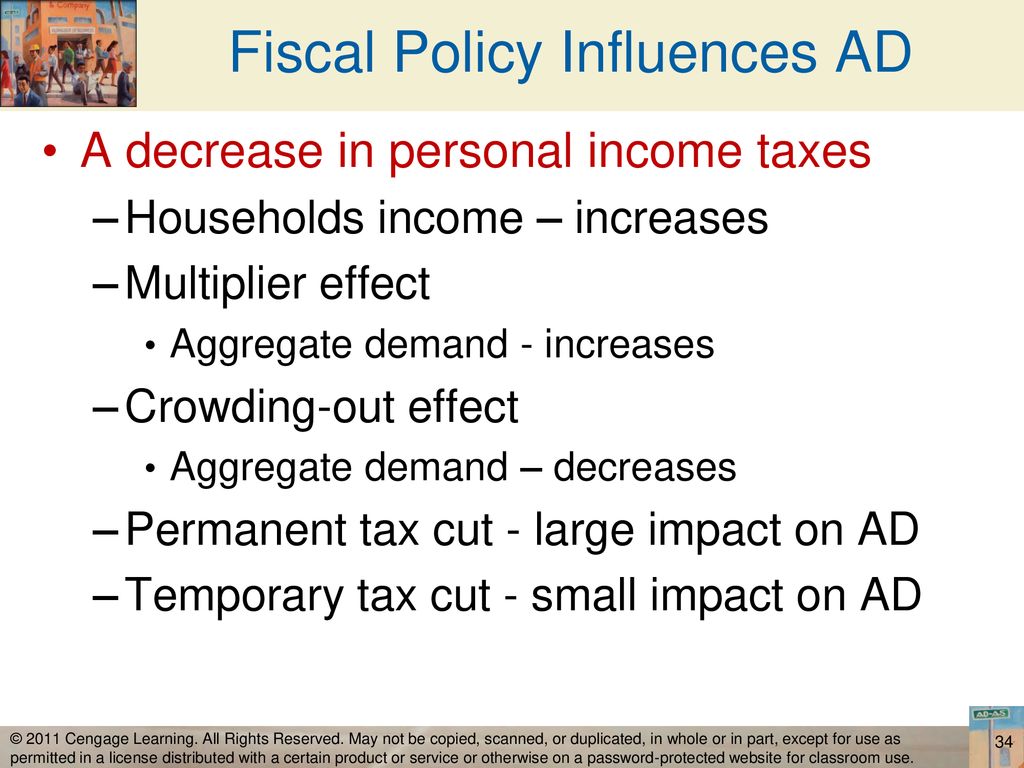

Tax cuts can lead to increased disposable income, potentially fueling consumption and economic growth. However, the effects of fiscal policy are not always immediate or uniform.

Factors such as the state of the economy, consumer sentiment, and the effectiveness of government programs can influence the ultimate outcome. Moreover, excessive government spending or tax cuts can lead to increased national debt and potential inflationary pressures.

Recent Fiscal Policy Actions

In recent years, various governments have implemented significant fiscal policy measures in response to economic challenges. For example, during the COVID-19 pandemic, many countries implemented large-scale stimulus packages to support businesses and individuals.

These packages often included direct payments to citizens, unemployment benefits, and loans to small businesses. The scale of these interventions was unprecedented, reflecting the severity of the economic crisis.

However, the long-term consequences of these measures, including increased national debt and potential inflationary pressures, are still being debated.

Debates and Controversies

Fiscal policy is not without its critics and controversies. One common argument is that government intervention can distort markets and lead to inefficient resource allocation. Critics also raise concerns about the potential for political motivations to influence fiscal policy decisions.

The debate surrounding the optimal level of government debt is another central point of contention. Some argue that high levels of debt can crowd out private investment and hinder long-term economic growth. Others contend that targeted investments in areas such as infrastructure and education can yield significant long-term benefits, even if they require borrowing.

The effectiveness of tax cuts in stimulating economic growth is also a subject of ongoing debate. Supply-side economists argue that tax cuts can incentivize work, investment, and innovation, leading to increased economic output. Others argue that the benefits of tax cuts primarily accrue to the wealthy, with limited impact on overall economic growth.

Conclusion

Fiscal policy remains a vital tool for governments seeking to manage their economies. Understanding its potential impacts, limitations, and associated controversies is essential for informed decision-making.

As economic conditions continue to evolve, the debate surrounding the appropriate role and application of fiscal policy will undoubtedly continue.

+by+any+combination+of..jpg)