For Contracts That Include More Than One Separate Performance Obligation

Imagine you're unwrapping a brand-new smartphone. It's more than just the device itself, isn't it? It's the promise of seamless connectivity, pre-installed software, maybe even a bundled cloud storage subscription or extended warranty. These aren't just extras; they're all part of the overall package, the "performance obligations" the company is promising you.

This seemingly simple scenario touches upon a complex area in accounting: how businesses should recognize revenue when a contract involves multiple deliverables. Accurately identifying and accounting for these separate performance obligations is crucial for providing a clear and transparent financial picture.

At its core, the principle revolves around allocating the transaction price of a contract to each distinct performance obligation and then recognizing revenue as those obligations are satisfied. This article delves into the intricacies of this vital accounting standard, highlighting its significance and practical implications for businesses across various industries.

The Evolution of Revenue Recognition

Before diving into the specifics of multiple performance obligations, it's helpful to understand the broader context of revenue recognition. For years, revenue recognition practices varied widely across different industries and jurisdictions. This lack of standardization led to inconsistencies and made it difficult to compare financial statements from different companies.

To address these issues, the Financial Accounting Standards Board (FASB) and the International Accounting Standards Board (IASB) collaborated to develop a comprehensive and converged revenue recognition standard. The result was Accounting Standards Codification (ASC) 606 and International Financial Reporting Standard (IFRS) 15, "Revenue from Contracts with Customers."

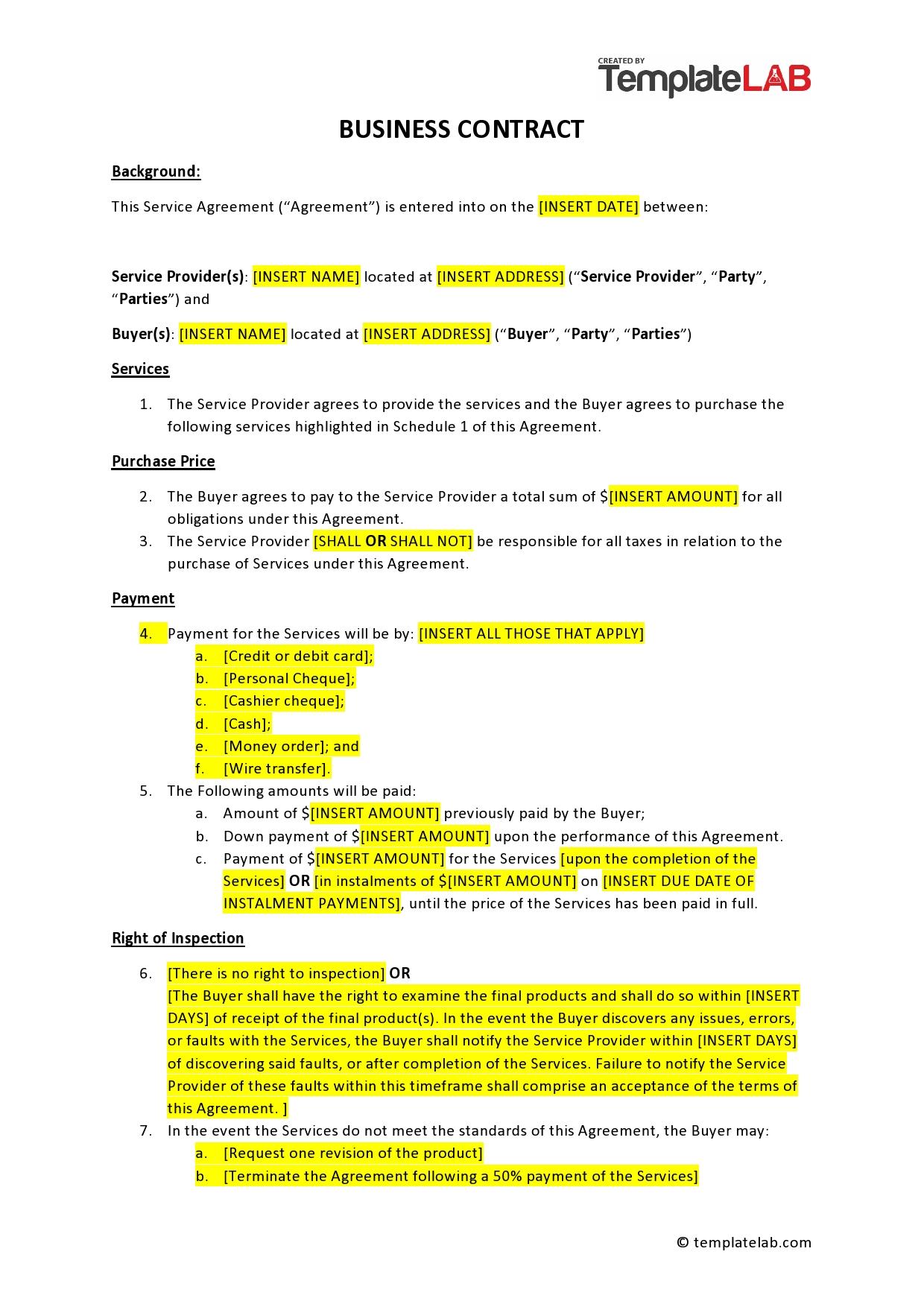

These standards provide a five-step framework for recognizing revenue, which includes identifying the contract with a customer, identifying the performance obligations in the contract, determining the transaction price, allocating the transaction price to the performance obligations, and recognizing revenue when (or as) the entity satisfies a performance obligation. The focus of this article is on step two – identifying those all-important performance obligations.

Identifying Performance Obligations: More Than Meets the Eye

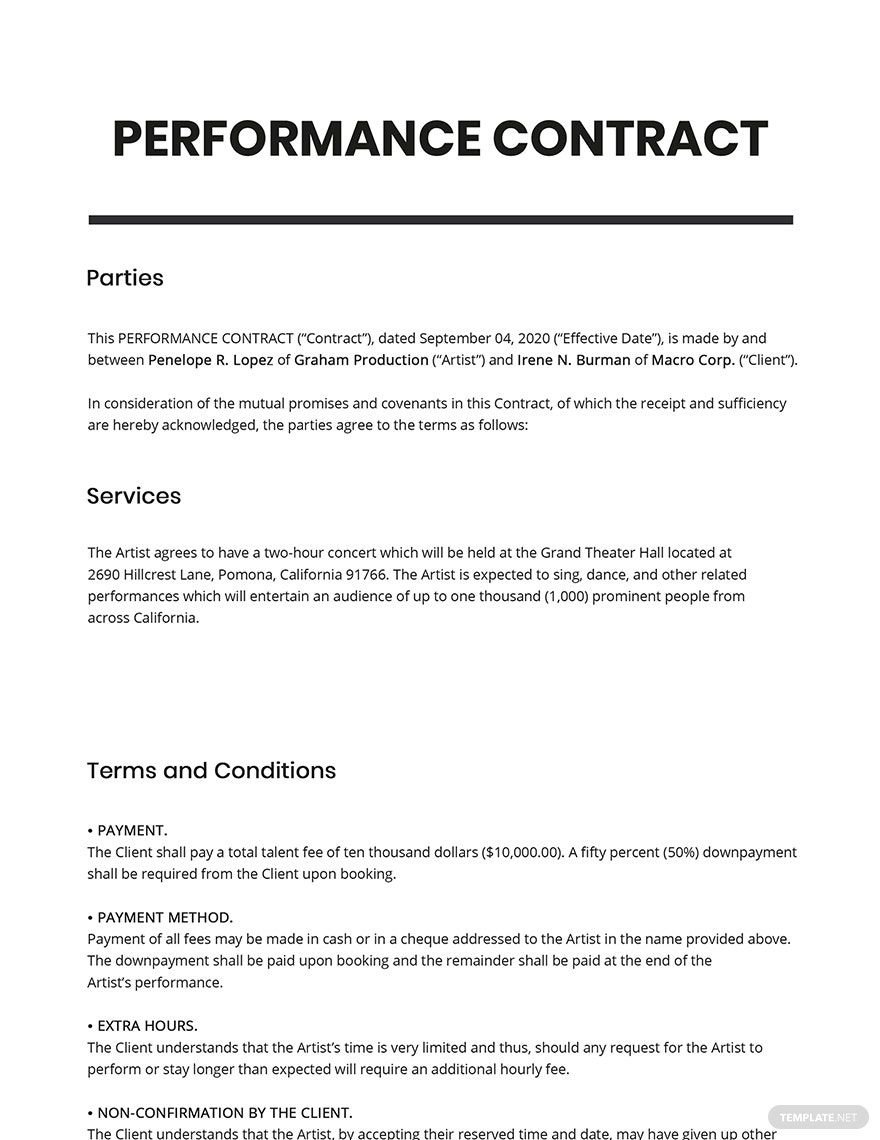

Identifying performance obligations might seem straightforward, but it can often be quite complex in practice. A performance obligation is a promise in a contract with a customer to transfer a good or service (or a bundle of goods or services) that is distinct.

A good or service is distinct if both of the following criteria are met: the customer can benefit from the good or service either on its own or together with other resources that are readily available to the customer; and the entity’s promise to transfer the good or service to the customer is separately identifiable from other promises in the contract. In essence, it needs to be something the customer could realistically use independently or with easily obtainable resources.

Consider a company that sells software and provides installation services. If the software is functional without the installation and the customer can readily find another installer, the software and the installation service are likely distinct performance obligations. However, if the software is highly specialized and requires the seller's proprietary expertise for installation, they may be considered a single performance obligation.

It's not always about physical products either. Consider a subscription service offering different tiers with varying features. Each tier might represent a separate performance obligation if customers can independently benefit from the features in each tier.

Allocating the Transaction Price: Fair Value is Key

Once the performance obligations are identified, the next step is to allocate the transaction price to each obligation. The transaction price is the amount of consideration an entity expects to be entitled to in exchange for transferring promised goods or services to a customer, excluding amounts collected on behalf of third parties (e.g., sales tax).

The allocation is generally based on the relative standalone selling prices of each performance obligation. The standalone selling price is the price at which an entity would sell a promised good or service separately to a customer. Determining standalone selling prices can be challenging, especially when a good or service is not sold separately.

In such cases, companies may need to use estimation techniques, such as adjusted market assessment, expected cost plus a margin, or a residual approach. The goal is to allocate the transaction price in a manner that reflects the relative fair values of the various performance obligations.

Practical Examples and Industry Variations

The application of these principles varies significantly across industries. Let’s look at a few examples.

Telecommunications: A mobile phone provider might bundle a phone with a service plan. The phone and the service plan are typically considered separate performance obligations. The company needs to allocate the contract price between the sale of the phone and the provision of the monthly service.

Software: A software vendor might sell a software license, provide implementation services, and offer ongoing technical support. Each of these could be a distinct performance obligation, depending on the specific terms of the contract and the customer's ability to benefit from each component separately.

Construction: A construction company might enter into a contract to build a building and also provide ongoing maintenance services. The construction of the building and the maintenance services are usually considered separate performance obligations.

Real Estate: A real estate developer might sell a property and also offer property management services. The sale of the property and the property management services would typically be separate performance obligations.

The Impact on Financial Reporting

Accurately identifying and accounting for multiple performance obligations has a significant impact on a company’s financial statements. It affects the timing of revenue recognition, which in turn impacts reported revenue, profit margins, and other key financial metrics. Companies must be diligent in documenting their judgments and estimations related to performance obligations and standalone selling prices.

Companies need to disclose significant judgments made in applying these principles. This transparency allows investors and analysts to better understand the company's revenue recognition policies and their impact on financial performance.

"The accurate identification and allocation of performance obligations is not just a compliance exercise; it's about providing stakeholders with a true and fair view of a company's financial performance," explains Dr. Anya Sharma, a professor of accounting at the University of California, Berkeley.

Challenges and Common Pitfalls

Despite the clarity provided by ASC 606 and IFRS 15, companies still face challenges in applying these standards. Some common pitfalls include:

Failing to properly identify all performance obligations: Overlooking implied promises or bundled services can lead to inaccurate revenue recognition.

Incorrectly determining standalone selling prices: Relying on inaccurate or unreliable data for standalone selling price estimations can distort the allocation of the transaction price.

Inadequate documentation: Failing to adequately document the rationale behind performance obligation identification and transaction price allocation can make it difficult to support the accounting treatment during an audit.

To avoid these pitfalls, companies should establish robust internal controls and processes for revenue recognition. They should also invest in training and education for their accounting staff to ensure they have a thorough understanding of the relevant standards.

Looking Ahead: Continuous Refinement and Interpretation

Revenue recognition is an evolving area, and the accounting standards boards continue to provide guidance and clarifications on various aspects of ASC 606 and IFRS 15. The application of these standards requires ongoing assessment and adaptation as business models and contract terms evolve.

Companies must stay informed of the latest developments and interpretations to ensure they are applying the standards correctly. Engaging with accounting professionals and industry experts can provide valuable insights and support.

Ultimately, a thorough understanding and diligent application of the principles governing multiple performance obligations are essential for accurate financial reporting and building trust with stakeholders. By embracing these principles, businesses can provide a more transparent and reliable picture of their financial performance, fostering greater confidence in the market.

.jpg)

.jpg)

.jpg)