Capital One Quicksilver Credit Score Required

The Capital One Quicksilver card, lauded for its simplicity and flat-rate rewards, has long been a popular choice for consumers seeking uncomplicated credit card benefits. However, understanding the credit score required to qualify for this card is crucial for potential applicants, as is navigating the sometimes opaque world of creditworthiness assessment.

This article delves into the credit score requirements for the Capital One Quicksilver card, examining the range typically needed for approval, exploring factors beyond credit scores that influence approval decisions, and offering guidance to those aiming to improve their credit profile to enhance their chances of being approved.

Credit Score Demystified: What You Need to Know

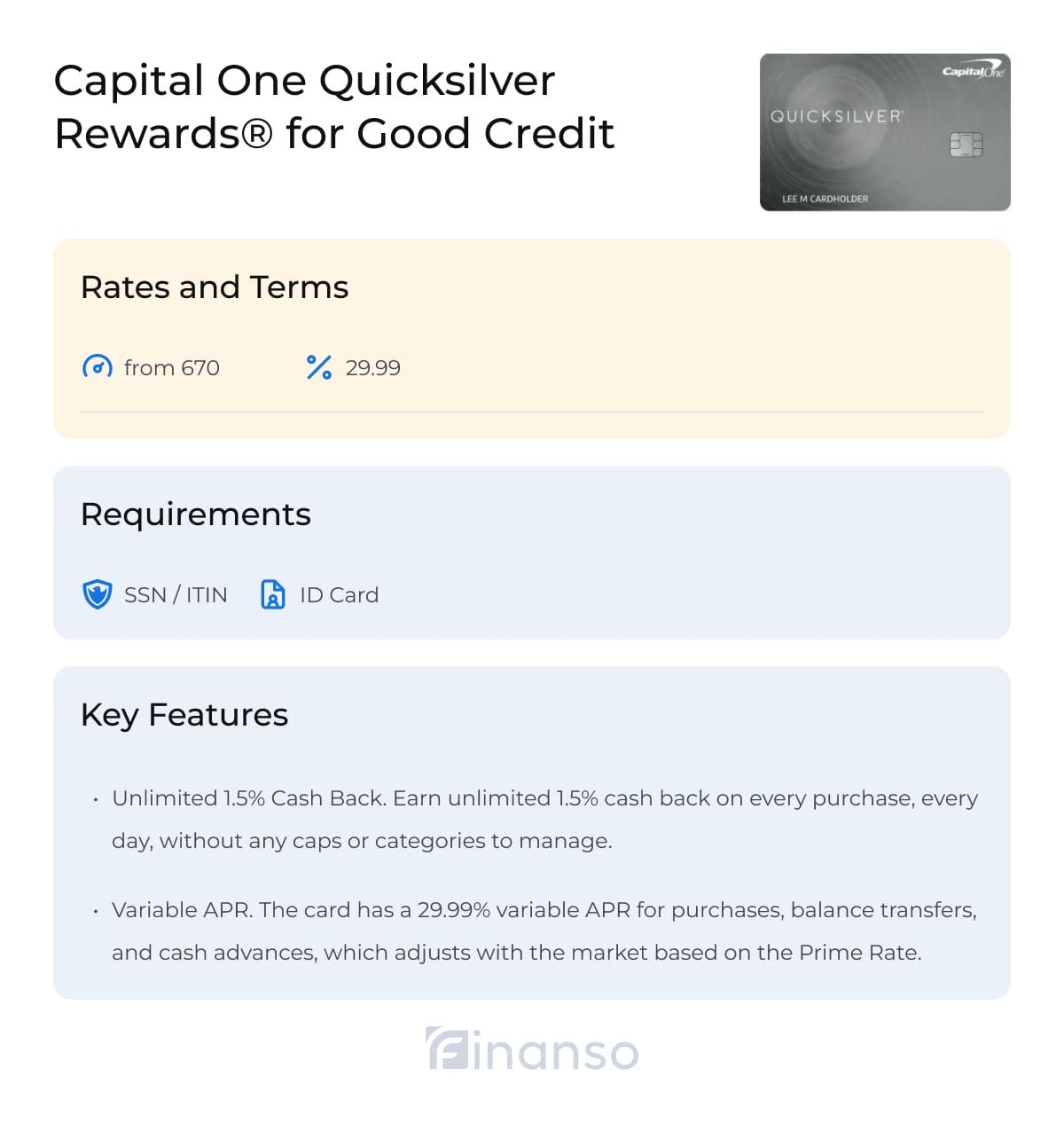

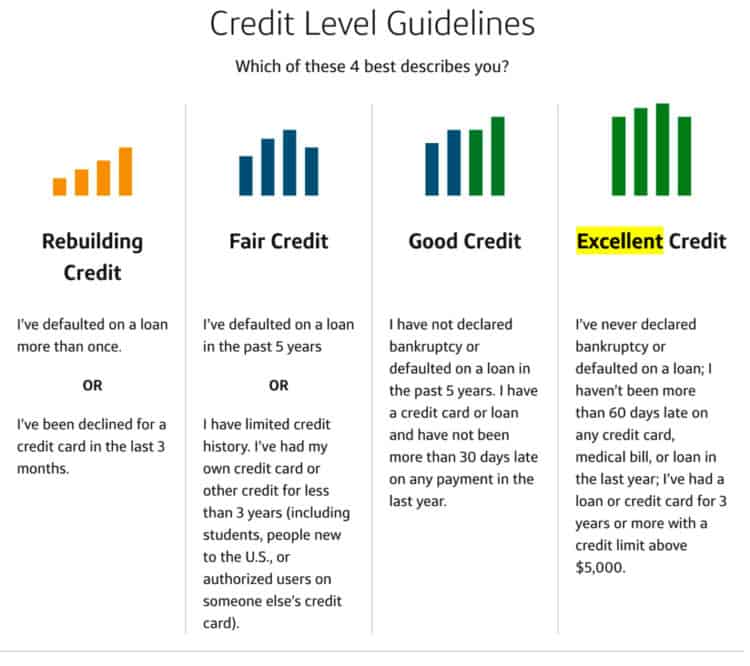

The Capital One Quicksilver card generally targets individuals with "excellent" or "good" credit. According to multiple credit score sources, this translates to a FICO score of 670 or higher. However, it's important to note that this is just a general guideline.

Experian, for example, defines a good credit score as one falling between 670 and 739. Excellent credit scores are typically considered to be between 740 and 799.

Beyond the Numbers: Factors Influencing Approval

While a good or excellent credit score significantly improves your chances, Capital One considers several other factors during the application process. These include your income, employment history, debt-to-income ratio, and overall credit history. A consistent employment record and a manageable debt load are highly valued.

A high credit score could still lead to denial if your income is insufficient to handle potential credit card debt. Similarly, a short credit history might be a deterrent, even with a solid score, as it doesn't provide a comprehensive picture of your borrowing habits.

Capital One's Stance: Official Insights

Capital One itself provides information about credit card eligibility, but does not give a specific cutoff score. Instead, they emphasize responsible credit management. They look for a track record of paying bills on time and avoiding excessive debt.

"We look at many factors, including your credit history and current financial situation, to determine if you're approved for a card,"

stated a Capital One representative, in a previous interview with ValuePenguin, regarding their credit card application assessment process.

Strategies for Approval: Building Your Credit Profile

If your credit score falls below the generally recommended range, there are steps you can take to improve your chances of approval. Regularly monitoring your credit reports from all three major bureaus (Equifax, Experian, and TransUnion) is crucial.

Dispute any inaccuracies you find, as errors can negatively impact your score. Paying your bills on time, every time, is paramount for credit score improvement. Avoid maxing out your existing credit cards, as a high credit utilization ratio can significantly lower your score.

Secured Cards and Other Alternatives

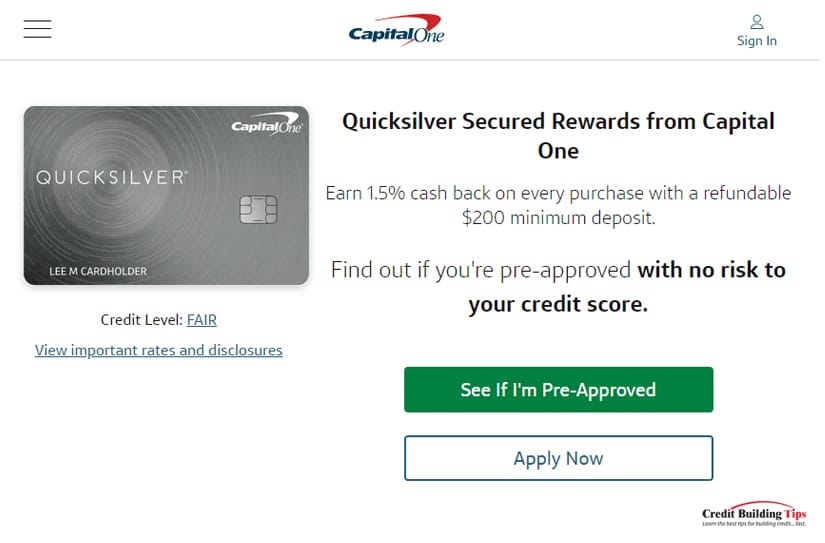

Consider starting with a secured credit card if you have limited or damaged credit. These cards require a security deposit that typically acts as your credit limit. Responsible use of a secured card can help you build or rebuild your credit.

Alternatively, explore cards specifically designed for individuals with fair or average credit. While these cards may have less attractive rewards programs compared to the Quicksilver card, they can serve as a stepping stone to building a positive credit history.

Looking Ahead: The Future of Credit Card Approval

The landscape of credit card approval is continually evolving, with lenders increasingly incorporating alternative data into their assessments. While traditional credit scores remain a vital factor, other factors such as banking history and bill payment patterns are gaining importance.

This shift could potentially benefit individuals with limited credit history, allowing them to demonstrate their creditworthiness through alternative means. Regardless, maintaining a good or excellent credit score will likely remain a key element in securing desirable credit cards like the Capital One Quicksilver card.

/capital-one-quicksilver-cash-rewards-credit-card-47b9b08278714647b59e8633c4f420b2.jpg)