Four Types Of Business Organizations

Choosing the right business structure is a pivotal decision that can significantly impact a company's legal liabilities, tax obligations, and overall operational flexibility. The landscape of business organizations offers diverse models, each with unique advantages and disadvantages.

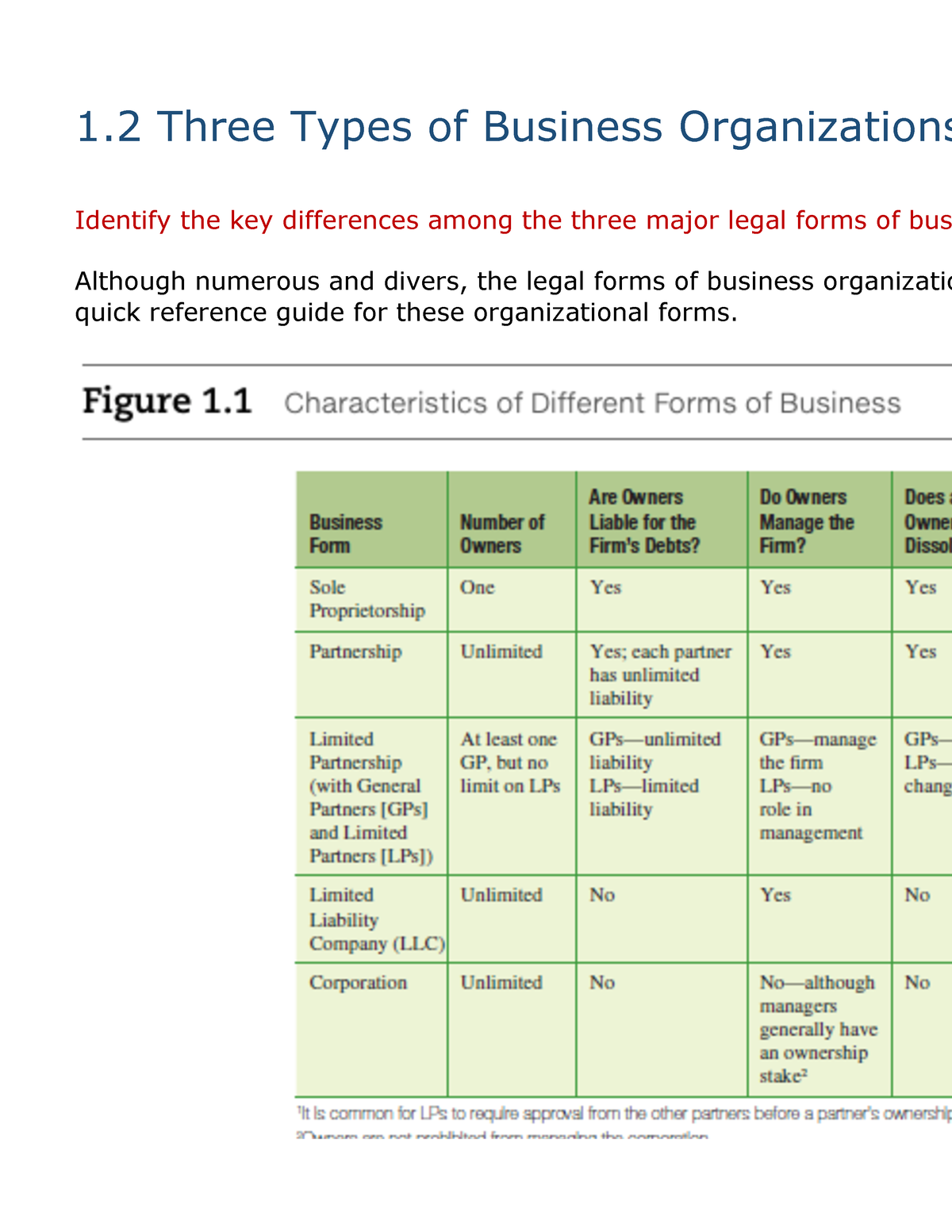

This article delves into four primary types of business organizations: sole proprietorships, partnerships, limited liability companies (LLCs), and corporations. Understanding the nuances of each structure is crucial for entrepreneurs and business owners aiming to establish a sustainable and legally sound foundation.

Sole Proprietorship: Simplicity and Direct Control

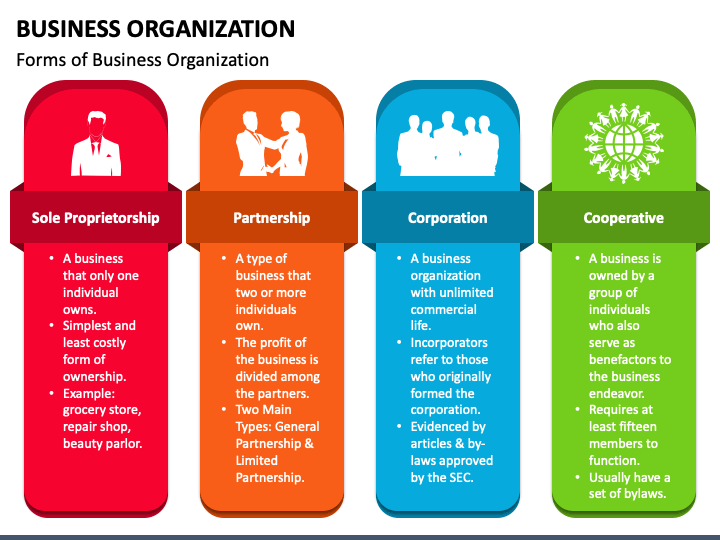

A sole proprietorship is the simplest form of business organization, owned and run by one person. It's characterized by its ease of setup, with minimal paperwork and regulatory requirements.

The owner directly receives all profits but is also personally liable for all business debts and obligations. This unlimited liability is a significant risk, as personal assets can be at stake in case of lawsuits or financial difficulties.

From a tax perspective, the business income is reported on the owner's personal income tax return. This pass-through taxation can be advantageous in the early stages of a business with lower profitability.

Partnership: Collaboration and Shared Responsibility

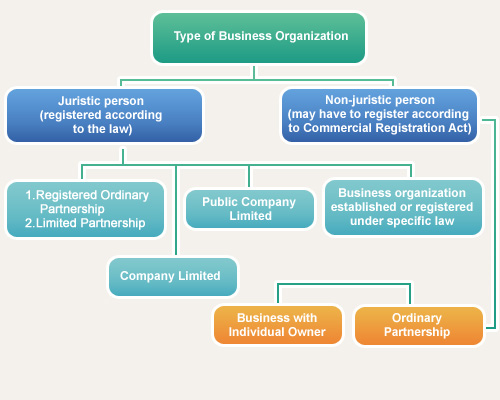

A partnership involves two or more individuals who agree to share in the profits or losses of a business. Partnerships can be general or limited, each offering distinct liability structures.

In a general partnership, all partners share in the management and are personally liable for the business's debts. A limited partnership, on the other hand, allows for limited partners with limited liability, often in exchange for less involvement in the business's operations.

Similar to sole proprietorships, partnerships benefit from pass-through taxation. However, a well-defined partnership agreement is crucial to avoid disputes and clarify responsibilities among partners.

Limited Liability Company (LLC): Blending Simplicity and Protection

A limited liability company (LLC) offers a blend of the simplicity of a sole proprietorship or partnership with the limited liability of a corporation. This structure protects the owner's personal assets from business debts and lawsuits.

LLCs offer flexibility in terms of taxation, as they can choose to be taxed as a sole proprietorship, partnership, or corporation. This flexibility allows businesses to optimize their tax strategy based on their specific circumstances.

However, the rules governing LLCs can vary significantly from state to state, requiring careful consideration of the legal and regulatory landscape.

Corporation: Separate Legal Entity and Potential for Growth

A corporation is a separate legal entity from its owners, offering the strongest protection against personal liability. Corporations can raise capital more easily through the sale of stock.

There are different types of corporations, including S corporations and C corporations. C corporations are subject to double taxation, where the corporation pays taxes on its profits, and shareholders pay taxes on dividends they receive.

S corporations, on the other hand, allow profits and losses to be passed through directly to the owners' personal income without being subject to corporate tax rates. Corporations are subject to more stringent regulatory requirements and compliance obligations.

Choosing the Right Structure: A Strategic Imperative

The selection of a business organization structure is a strategic imperative that requires careful consideration of various factors. These factors includes the owner's risk tolerance, financial goals, and the nature of the business.

As businesses evolve and grow, it may become necessary to re-evaluate the chosen structure to ensure it aligns with the changing needs and objectives. Consulting with legal and financial professionals is advisable to make informed decisions.

In conclusion, understanding the characteristics of sole proprietorships, partnerships, LLCs, and corporations is essential for building a solid and successful business. The right structure can lay the foundation for long-term growth and sustainability, while mitigating potential risks and liabilities.