Ftse Global All Cap Ex Us Index

The FTSE Global All Cap ex US Index, a widely tracked benchmark for international equity performance, continues to be a focal point for investors seeking diversification outside of the United States. Its composition and methodology have a significant impact on portfolio allocation and investment returns for millions of investors globally.

This article will delve into the key aspects of the FTSE Global All Cap ex US Index, examining its construction, performance drivers, and implications for investment strategies.

What is the FTSE Global All Cap ex US Index?

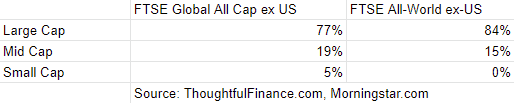

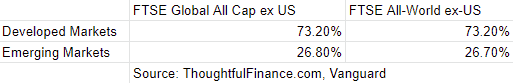

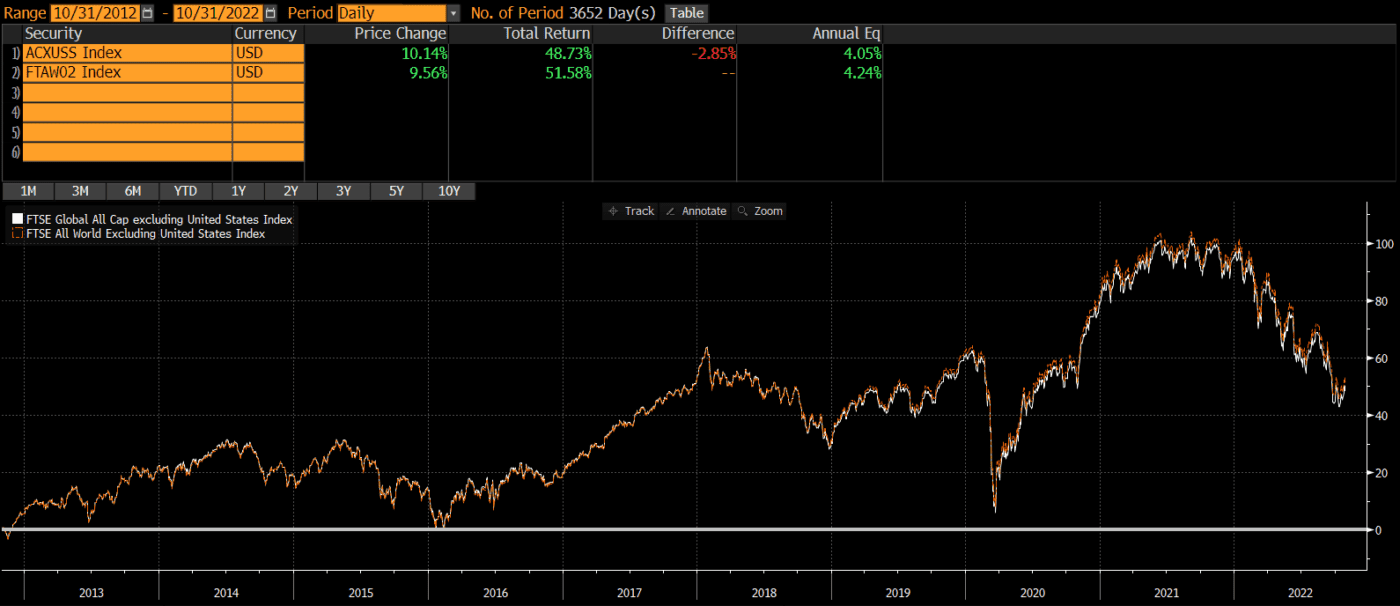

The FTSE Global All Cap ex US Index is a market-capitalization weighted index representing the performance of large, mid, and small cap stocks in developed and emerging markets, excluding the United States. It provides investors with broad exposure to the global equity market, minus the US component.

The index is designed to be comprehensive, covering approximately 98% of the investable market capitalization in each country included.

Index Construction

The index is constructed using the FTSE Global Equity Index Series (GEIS) methodology. This methodology ensures a consistent and transparent approach to stock selection and weighting.

Stocks are included in the index based on their free-float market capitalization. Free-float refers to the proportion of shares readily available for trading in the open market.

The index is rebalanced semi-annually in March and September to reflect changes in market capitalization and company eligibility.

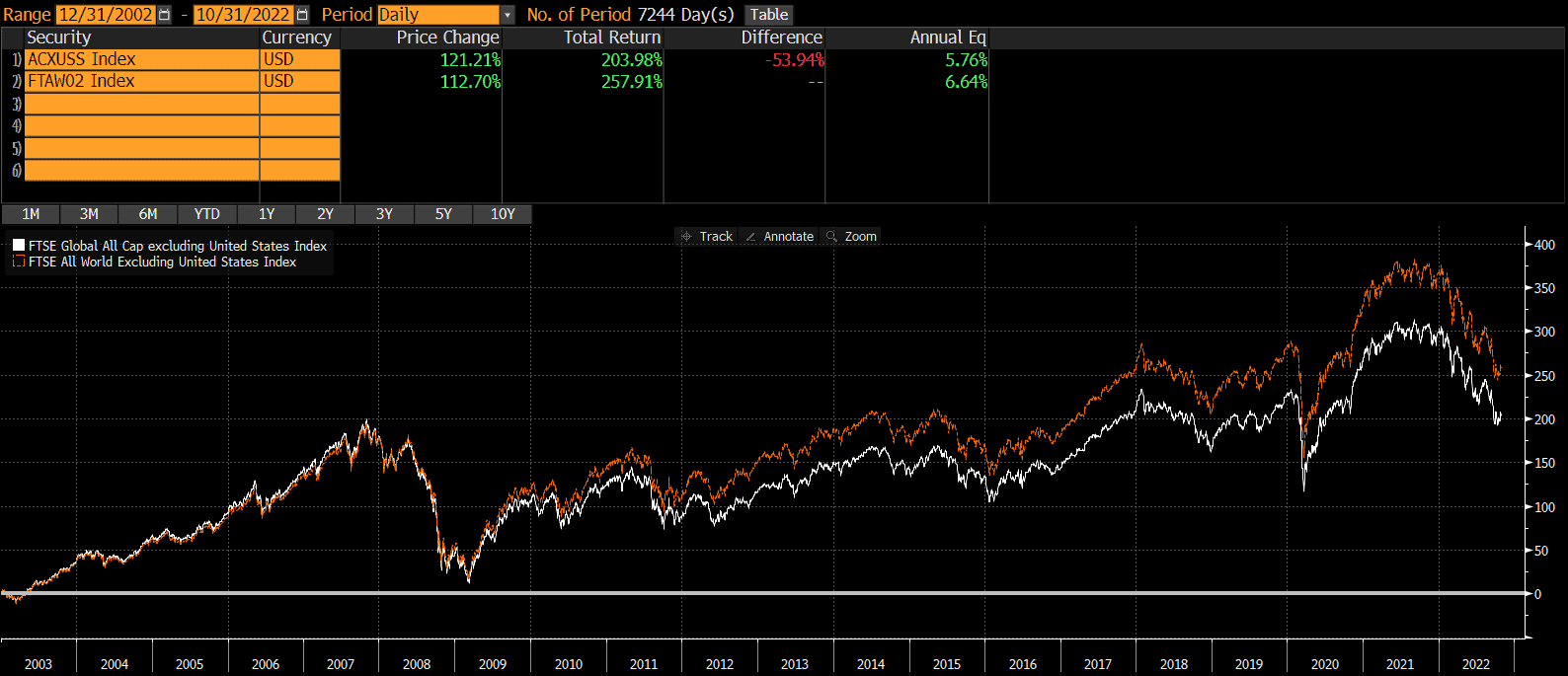

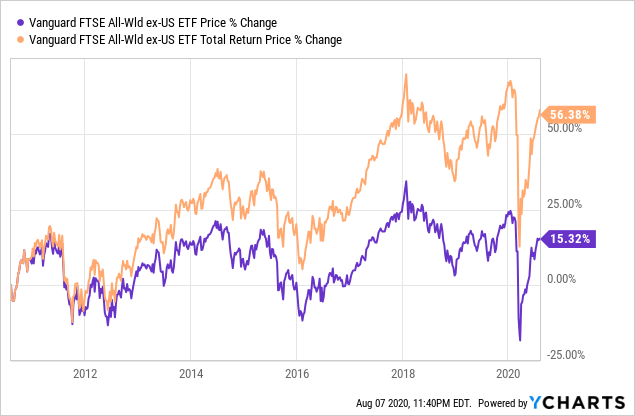

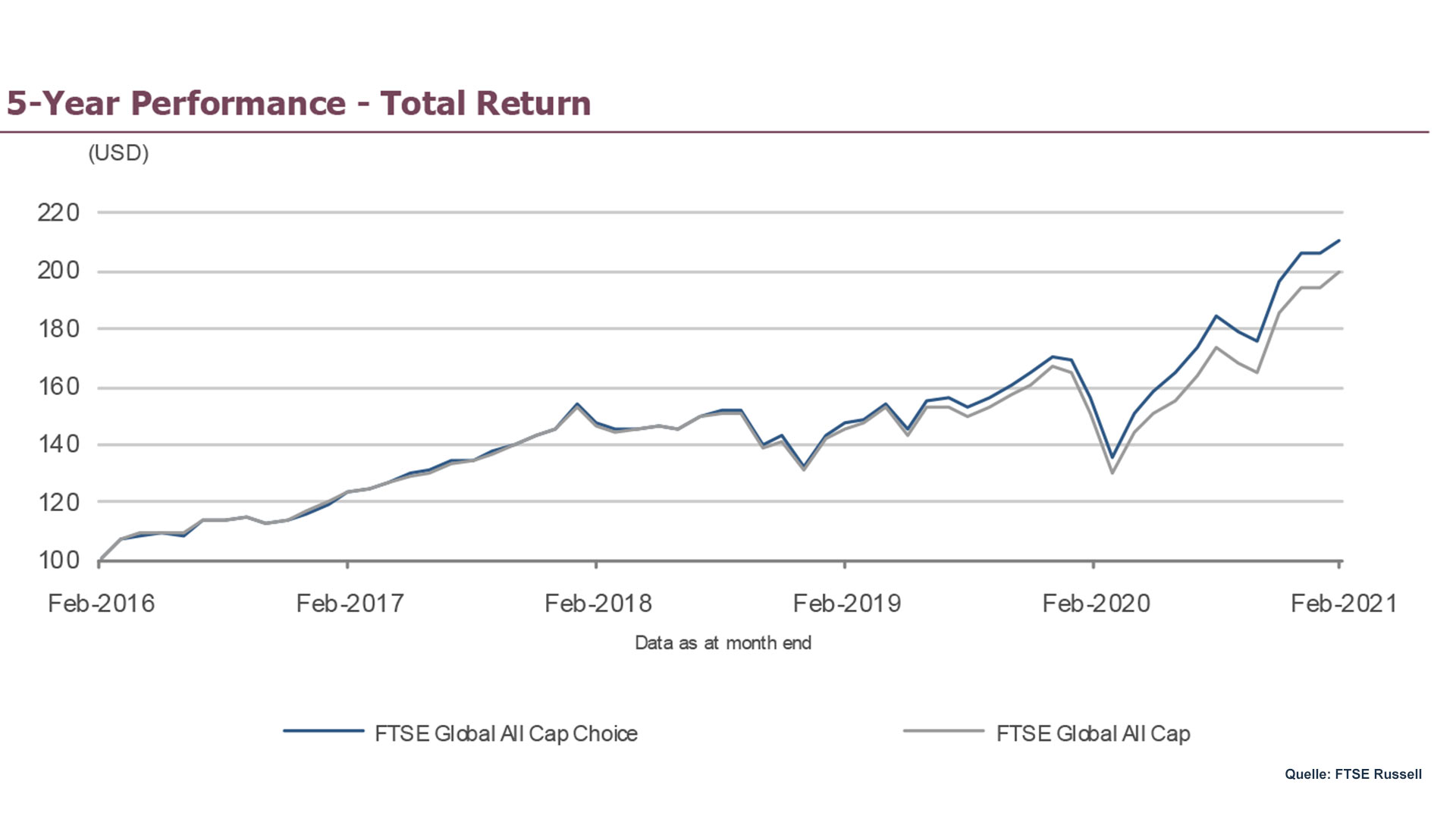

Performance and Drivers

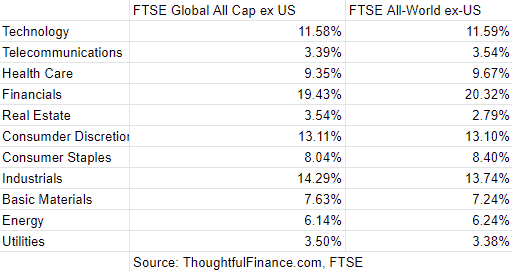

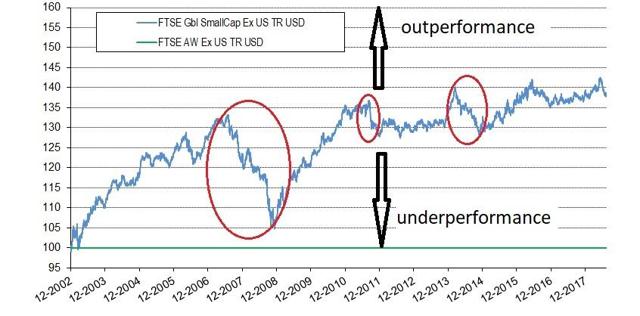

The performance of the FTSE Global All Cap ex US Index is influenced by a variety of factors, including global economic growth, interest rates, currency fluctuations, and geopolitical events. Regional and sector allocations also play a crucial role.

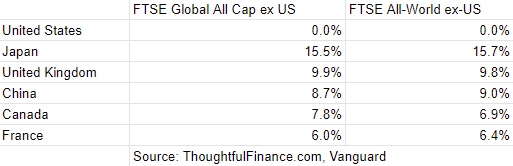

Emerging markets often have a significant weighting in the index, making it sensitive to economic and political developments in those regions. For instance, a slowdown in China's economic growth could negatively impact the index's performance.

Currency fluctuations can also significantly affect returns. A strengthening US dollar can reduce the returns for US-based investors when converted back to dollars.

Significance for Investors

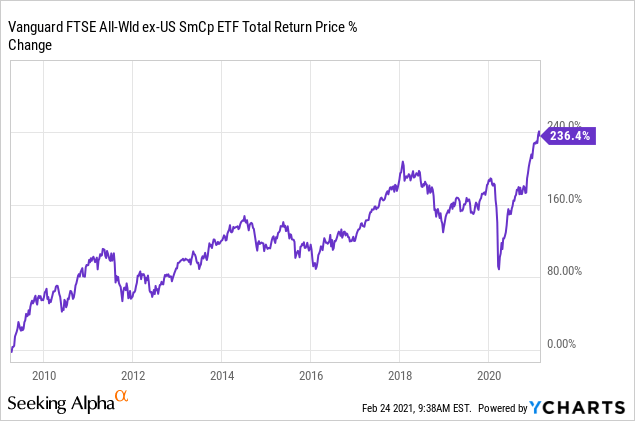

The FTSE Global All Cap ex US Index serves as a benchmark for numerous investment products, including exchange-traded funds (ETFs) and mutual funds. These products aim to replicate the index's performance, providing investors with easy access to a diversified portfolio of international stocks.

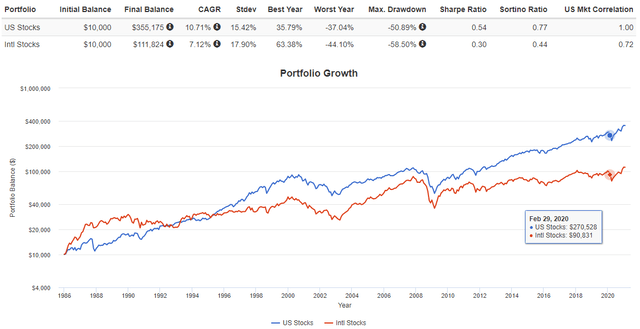

It is a crucial tool for investors seeking to diversify their portfolios beyond the US market. Diversification can help reduce overall portfolio risk by spreading investments across different geographies and sectors.

By investing in the FTSE Global All Cap ex US Index, investors can potentially benefit from faster economic growth in emerging markets, as well as from different investment cycles in developed economies outside the US.

Potential Impact and Considerations

While the index offers diversification benefits, investors should be aware of the potential risks associated with international investing. These risks include currency risk, political risk, and regulatory differences.

Emerging markets, in particular, can be more volatile than developed markets. They are often subject to greater political and economic instability.

Investors should also consider the costs associated with investing in international ETFs and mutual funds, such as expense ratios and trading fees.

The index's exposure to specific countries and sectors can change over time. Investors should regularly review their investment holdings to ensure that they align with their overall investment objectives and risk tolerance.

Human-Interest Angle

Consider Mrs. Eleanor Vance, a retiree who uses a low-cost ETF tracking the FTSE Global All Cap ex US Index as a core holding in her retirement portfolio. Her decision stems from a desire to reduce her reliance on the US stock market and benefit from potential growth in other parts of the world.

Mrs. Vance emphasizes the importance of understanding the risks and rewards of international investing. She dedicates time to researching the underlying holdings of the ETF and monitoring global economic trends.

Her story highlights the real-world impact of the FTSE Global All Cap ex US Index, demonstrating how it can be used by individual investors to achieve their financial goals.

Conclusion

The FTSE Global All Cap ex US Index is a vital tool for investors seeking broad diversification beyond the US equity market. Understanding its construction, performance drivers, and associated risks is essential for making informed investment decisions.

As global markets continue to evolve, the index will likely remain a key benchmark for international equity performance. Keeping abreast of its changes and their potential impact is crucial for investors seeking to build well-diversified portfolios.

Before making any investment decisions, individuals should consult with a qualified financial advisor to assess their specific circumstances and risk tolerance.