Future Generali Heart And Health Insurance Plan Review

In an environment where healthcare costs are steadily rising, comprehensive insurance plans are increasingly vital for financial security and peace of mind. Future Generali India Insurance Company Limited has recently updated its Heart and Health Insurance Plan, prompting a closer look at its features, benefits, and potential impact on consumers.

This review examines the key components of the updated plan, analyzing its coverage scope, eligibility criteria, and potential advantages and disadvantages for prospective policyholders. Understanding these elements is crucial for individuals seeking to make informed decisions about their health insurance needs. This article will delve into these aspects based on publicly available information and expert analysis.

Coverage and Key Features

The Future Generali Heart and Health Insurance Plan is designed to provide financial protection against a range of cardiac ailments and other critical illnesses. The updated plan reportedly includes coverage for a specified list of heart-related conditions, such as heart attack, bypass surgery, and valve replacement.

Beyond cardiac coverage, the plan extends to other critical illnesses, offering a lump-sum payout upon diagnosis of conditions like cancer, kidney failure, and stroke. The exact number of illnesses covered and the corresponding payout amounts vary based on the specific plan variant and sum insured chosen by the policyholder.

One notable feature is the potential for a waiting period before certain benefits become active, which is a standard practice in the insurance industry. Prospective buyers should carefully review the policy wording to understand the waiting period applicable to different illnesses and procedures. The plan also offers optional riders to enhance coverage, such as a critical illness rider.

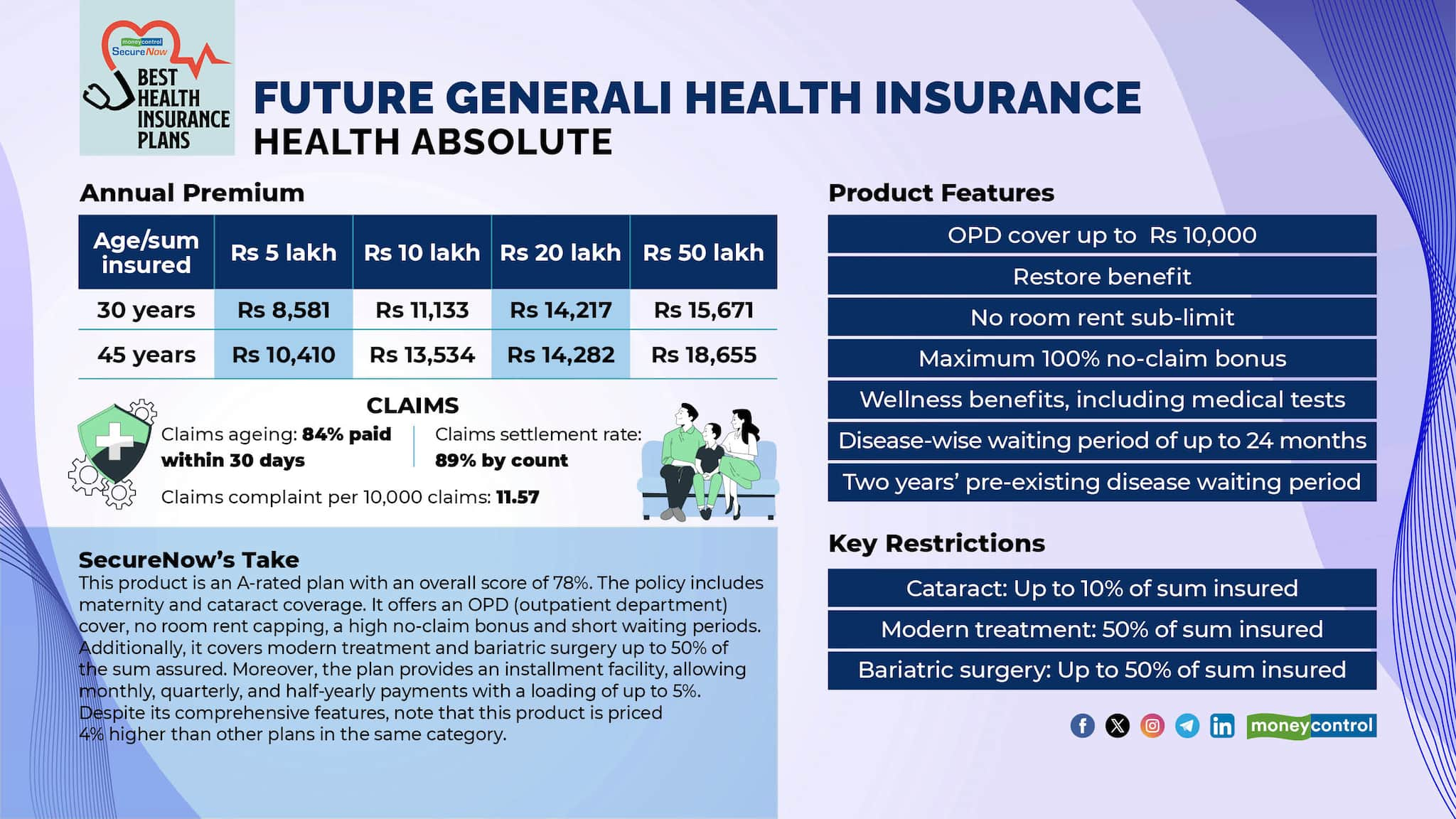

Eligibility and Premiums

Eligibility for the Future Generali Heart and Health Insurance Plan generally depends on age and health status. Applicants are typically required to undergo a medical examination to assess their risk profile. The age entry criteria can vary, but usually caters to a broad demographic range.

Premium amounts are determined by factors such as age, sum insured, coverage options, and pre-existing health conditions. Individuals with a history of heart disease or other critical illnesses may face higher premiums or certain exclusions from coverage. Future Generali offers various premium payment options including monthly, quarterly, half-yearly and annually. It is important for potential policyholders to compare premium rates and coverage benefits across different insurers.

Benefits and Limitations

The primary benefit of the Future Generali Heart and Health Insurance Plan is the financial security it provides in the event of a serious illness. The lump-sum payout can help cover medical expenses, lost income, and other related costs. Policyholders can use this lump-sum benefit as per their needs.

However, it's essential to acknowledge the plan's limitations. The coverage is restricted to the illnesses explicitly listed in the policy document. Pre-existing conditions may not be covered or may be subject to a waiting period. Also, the definition of “critical illness” and the criteria for diagnosis play a crucial role in claims acceptance.

Potential Impact and Considerations

The Future Generali Heart and Health Insurance Plan could offer valuable protection to individuals concerned about the rising costs of cardiac care and other critical illnesses. By providing a lump-sum payout, the plan can alleviate financial burdens during a challenging time.

Prospective policyholders should carefully evaluate their individual needs and circumstances before purchasing this or any insurance plan. It’s advisable to compare different plans from various insurers to find the best fit. Consulting with a financial advisor can also help individuals make informed decisions.

Ultimately, the Future Generali Heart and Health Insurance Plan is a financial tool designed to mitigate risk and provide peace of mind. Understanding its features, benefits, and limitations is crucial for making an informed decision about its suitability.