Geico Insurance Went Up For No Reason

Policyholders across the nation are reporting sudden, unexplained premium hikes from GEICO. Many customers are left scrambling to understand the increases, with some reporting jumps of hundreds of dollars without any change in their coverage or driving record.

This unexpected surge in insurance costs from one of the country's largest providers raises serious questions about pricing practices and consumer transparency. GEICO has yet to issue a comprehensive statement addressing the widespread complaints.

Unexplained Hikes Leave Customers Reeling

Reports are flooding social media and consumer complaint forums. Individuals describe receiving renewal notices with drastically higher premiums, often exceeding their budgets and forcing them to seek alternative coverage.

“I’ve been with GEICO for over 10 years, and my rate just jumped $300 for absolutely no reason,” said Sarah Miller of Ohio in a post on X. “No accidents, no tickets, nothing has changed.”

Similar stories are echoing from coast to coast. The lack of a clear explanation from GEICO is fueling frustration and mistrust among its customer base.

Where is GEICO?

The widespread nature of these premium hikes suggests a systemic issue rather than isolated incidents. While individual circumstances can always influence insurance rates, the sheer volume of complaints points to a potentially larger trend.

Customers report spending hours on the phone with GEICO representatives, only to receive vague or contradictory answers. The company's customer service channels are reportedly overwhelmed with inquiries regarding the rate increases.

The absence of a transparent explanation is exacerbating the situation. Policyholders are left feeling powerless and uncertain about their insurance costs.

Consumer Advocates Sound the Alarm

Consumer advocacy groups are urging policyholders to carefully review their insurance policies and explore alternative options. They are also encouraging individuals to file complaints with their state's Department of Insurance.

“It’s crucial for consumers to understand their rights and hold insurance companies accountable,” stated a representative from the Consumer Federation of America.

Several state insurance regulators have confirmed that they are aware of the growing number of complaints against GEICO. They are actively monitoring the situation and considering potential investigations.

What's Next?

The immediate focus is on pressuring GEICO to provide a clear and transparent explanation for the rate increases. Consumers are demanding accountability and a return to fair pricing practices.

State insurance regulators will continue to investigate the matter and assess whether GEICO's pricing practices comply with state laws and regulations. This could lead to potential fines or corrective actions.

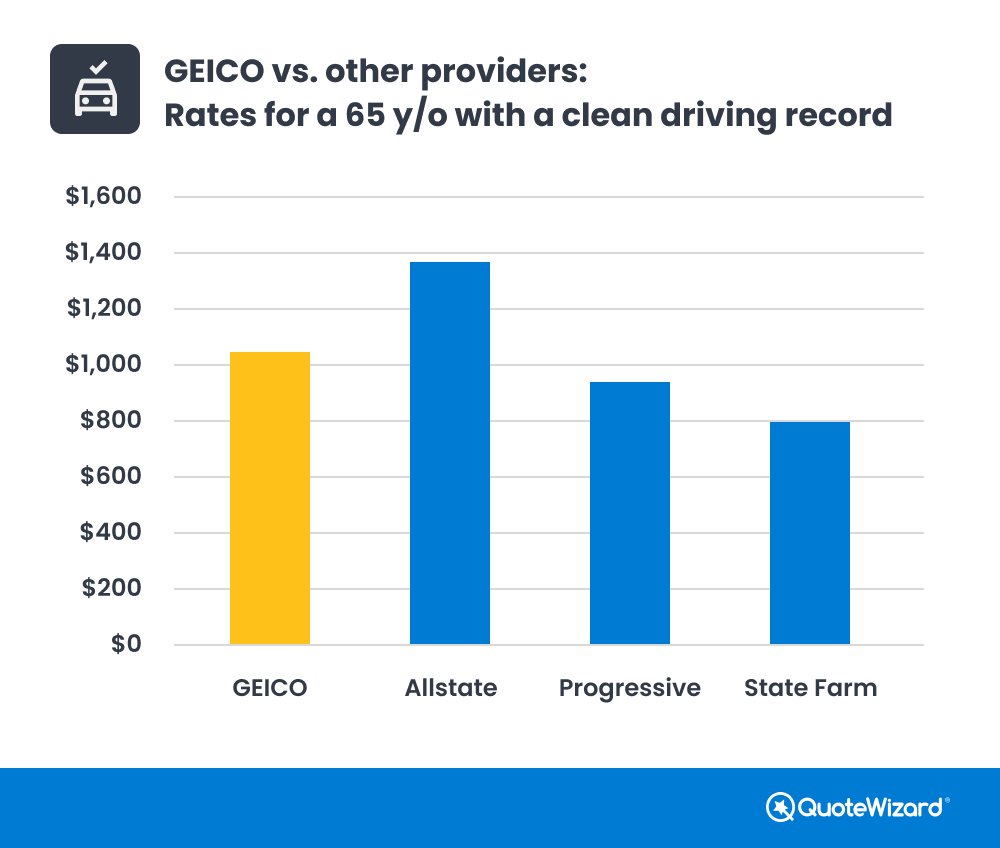

In the meantime, policyholders are advised to shop around for alternative insurance quotes. Comparing rates from multiple providers can help ensure they are getting the best possible coverage at a fair price. The situation remains fluid, and further developments are expected in the coming weeks.