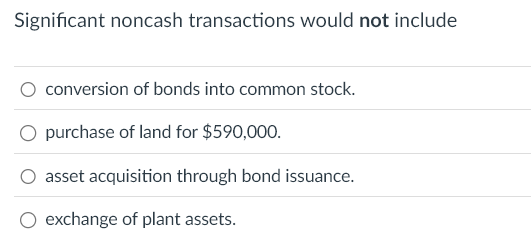

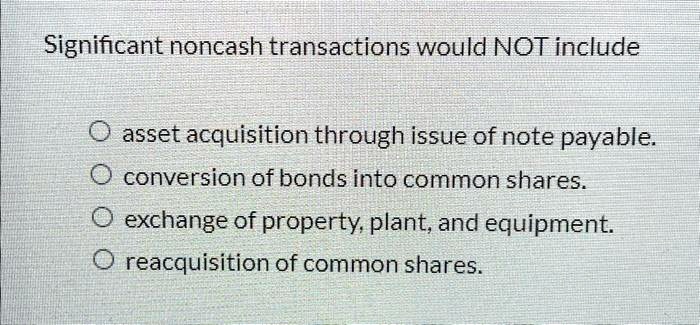

Significant Noncash Transactions Would Not Include

The landscape of corporate accounting is poised for a significant shift as discussions intensify around the definition and reporting of noncash transactions. Recent debates have centered on clarifying which activities should and should not be included in disclosures of significant noncash investing and financing activities.

The outcome of these discussions could profoundly impact how investors and stakeholders perceive a company's financial health and strategic direction. Ambiguity in this area can lead to inconsistent reporting practices and potentially obscure a company's true financial picture.

Understanding the Core Issue: What Qualifies as a Significant Noncash Transaction?

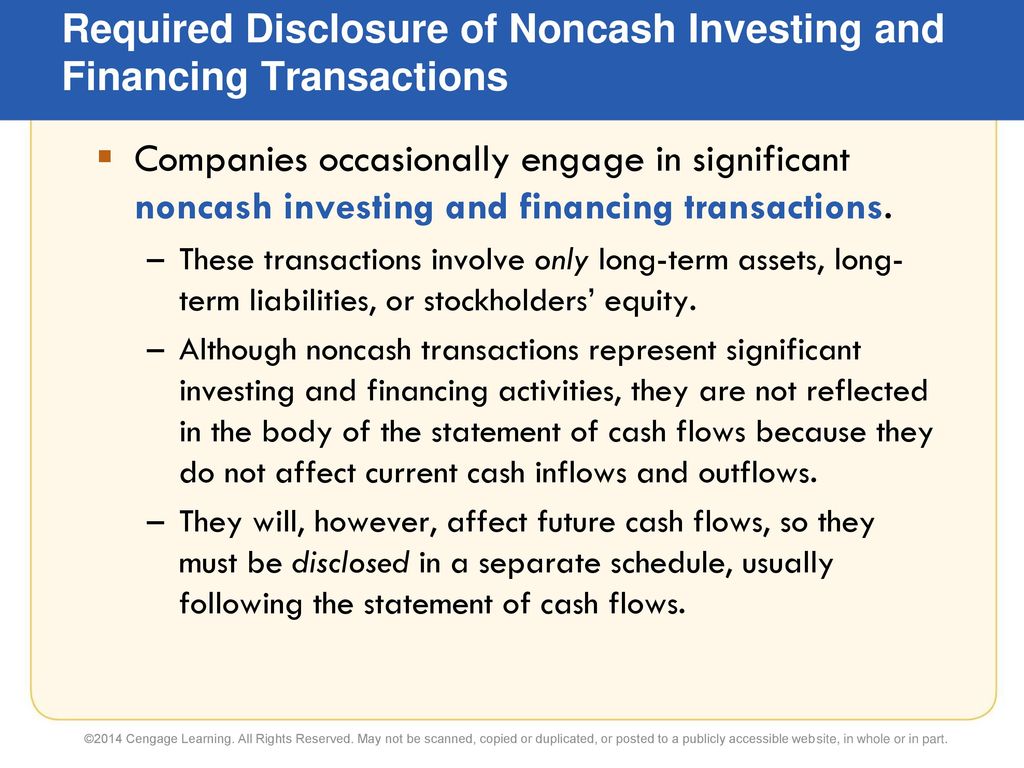

At its heart, the debate revolves around defining "significant" and "noncash." Specifically, the question is: what constitutes a noncash transaction that is substantial enough to warrant separate disclosure in a company's financial statements?

This distinction is crucial because it directly impacts the transparency and comparability of financial reports across different companies and industries.

The *Financial Accounting Standards Board* (FASB) plays a central role in establishing these standards.

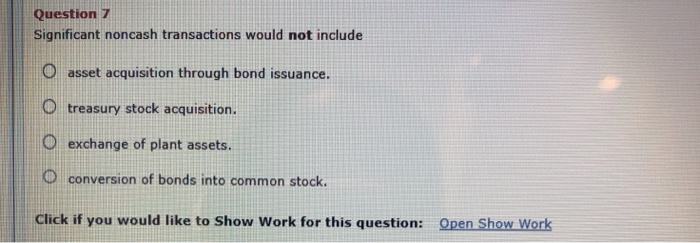

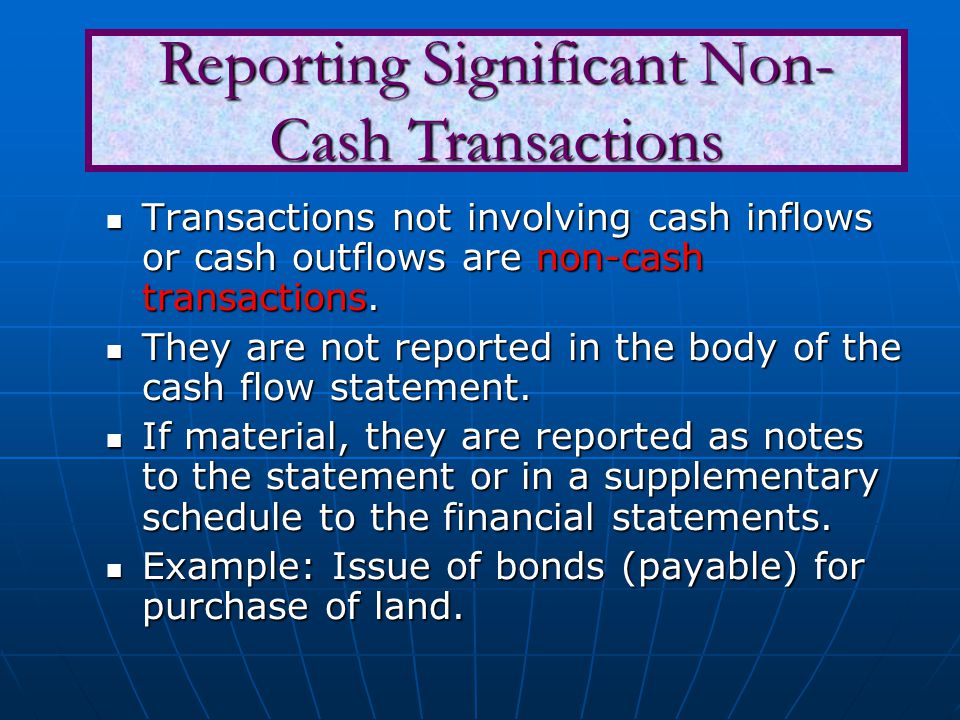

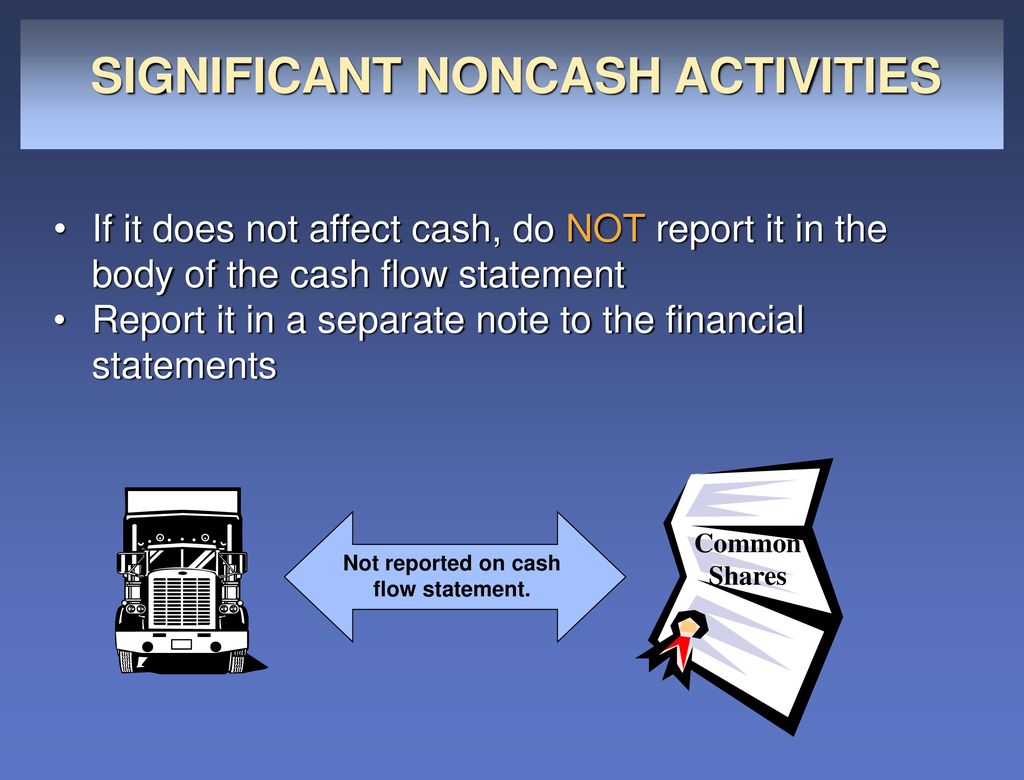

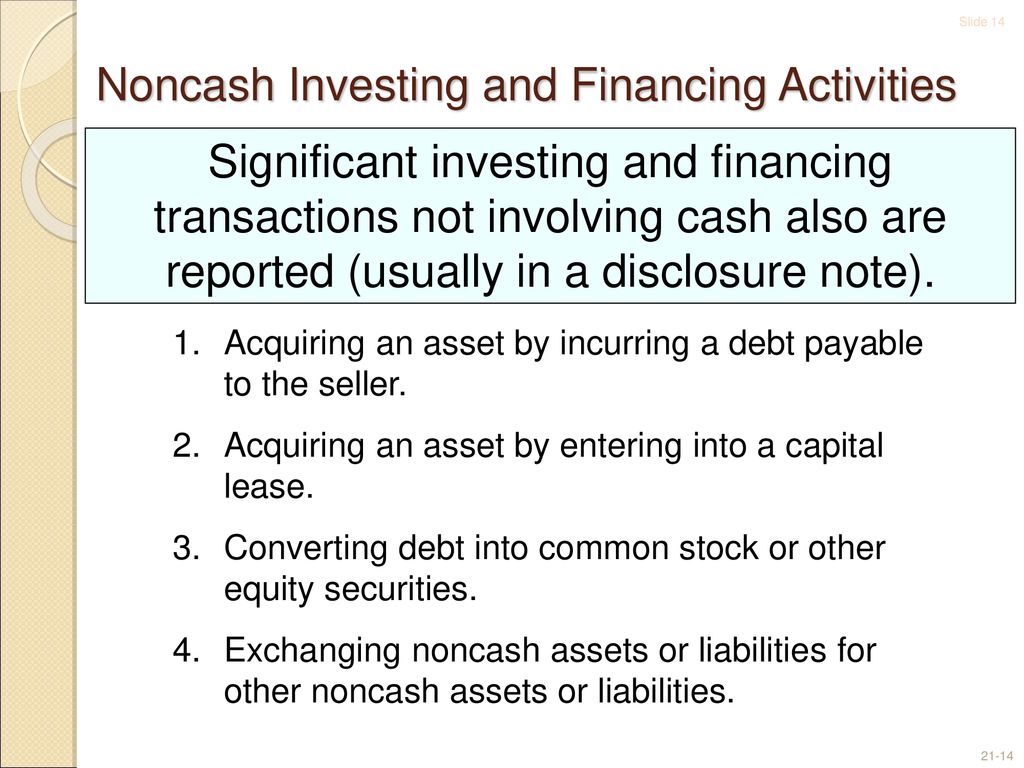

Transactions Typically Included

Generally accepted accounting principles (GAAP) already provide guidance on transactions that do qualify. These typically involve the exchange of assets or liabilities without the use of cash.

Examples include exchanging common stock for land, converting debt to equity, and issuing stock in exchange for another company in a merger or acquisition.

These transactions are considered significant because they represent substantial changes in a company's capital structure or asset base.

Focus: Transactions That Would *Not* Typically Qualify

However, the more nuanced discussion revolves around transactions that arguably fall into a gray area. It's important to pinpoint the specific types of transactions that would *not* be considered significant noncash transactions under tightened definitions.

Many internal accounting processes, although technically not involving cash, may lack the scale and strategic importance to warrant disclosure. This is where the line becomes less clear.

Internal Accounting Adjustments and Reclassifications

Certain internal accounting adjustments, such as reclassifications within the balance sheet that do not affect overall assets, liabilities, or equity, typically would not necessitate disclosure.

For example, moving funds from one restricted cash account to another might not be considered a significant noncash activity if the total restricted cash remains the same.

Similarly, routine write-offs of small amounts of obsolete inventory, although impacting the inventory account, may not be deemed significant enough to require separate disclosure if they are part of normal business operations.

Accruals and Deferrals

The creation of accruals and deferrals, common in accounting, usually do not trigger the need for noncash transaction disclosure. This is because they represent estimations of future cash flows rather than actual exchanges of assets or liabilities.

An example is the accrual of salaries expense at the end of an accounting period. While this increases salaries payable, it's an accounting adjustment reflecting an obligation, not an exchange of value.

Deferrals, such as prepaid expenses, also fall into this category. The initial cash payment for insurance is disclosed as a cash outflow. The subsequent allocation of that prepayment to expense over time does not require additional noncash disclosure.

Depreciation and Amortization

Depreciation and amortization are noncash expenses that allocate the cost of an asset over its useful life. These are already reflected in the income statement and do not typically require separate disclosure as significant noncash transactions.

While they reduce the carrying value of assets, they are considered an integral part of the normal accounting for those assets.

The FASB is unlikely to mandate additional disclosures for routine depreciation and amortization.

The Importance of "Significance"

The term "significant" is inherently subjective. It necessitates professional judgment on the part of the company's management and auditors.

A transaction deemed significant for a small company may be immaterial for a large multinational corporation.

Materiality thresholds, often based on a percentage of total assets, revenues, or net income, are typically used to assess significance. However, qualitative factors should also be considered. Factors such as the transaction's strategic importance, potential impact on future cash flows, and its visibility to investors should be evaluated.

Potential Impact on Companies and Investors

Clarifying the scope of significant noncash transactions has several potential benefits. It could lead to greater consistency in reporting practices, making it easier for investors to compare companies' financial performance.

Reduced ambiguity could also lower compliance costs for companies by streamlining the disclosure process.

Furthermore, focusing on truly significant noncash transactions will ensure that investors receive information that is relevant and decision-useful, rather than being overwhelmed by a deluge of immaterial details. Increased accuracy and transparency benefits both companies and investors.

Looking Ahead

The debate surrounding noncash transactions underscores the ongoing need for accounting standards to adapt to evolving business practices.

As the FASB continues its deliberations, stakeholders are closely watching for further guidance that will provide clarity and consistency in this area.

The outcome will ultimately shape how companies report their financial activities and how investors interpret their performance.