What Is Paymode X Used For

Imagine a world where invoices don't pile up, payments flow smoothly, and the dreaded reconciliation process becomes a breeze. Businesses, large and small, have long sought a solution to streamline their accounts payable processes, yearning for efficiency and security in their financial operations. This quest for a better way to manage payments has led many to discover the transformative power of Paymode-X.

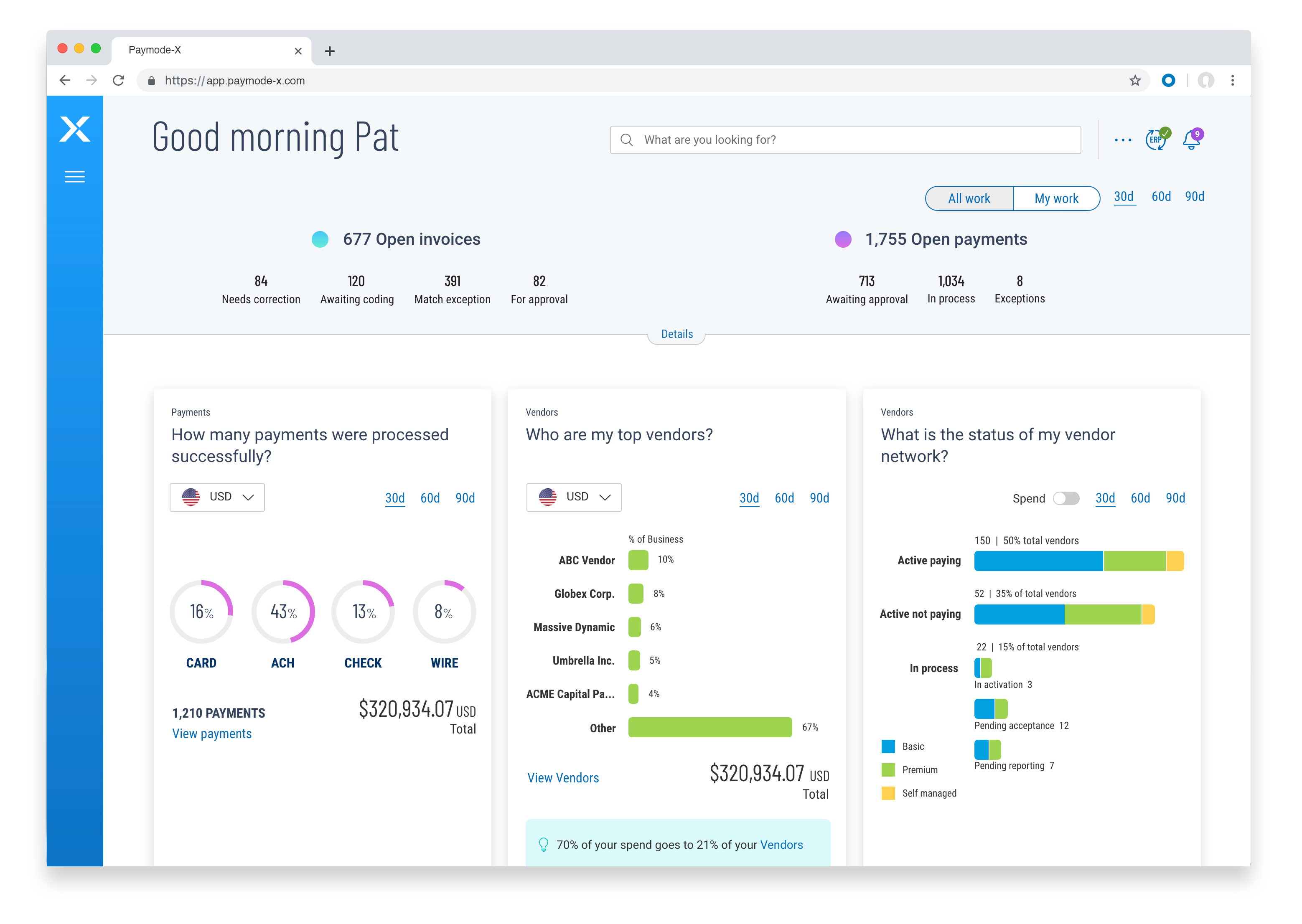

Paymode-X is a comprehensive accounts payable automation solution designed to streamline and secure business-to-business payments. More than just a payment platform, it's an ecosystem that connects businesses with their vendors, facilitating electronic payments and providing enhanced visibility and control over the entire payment process. Its impact on businesses of all sizes is substantial, freeing up resources and reducing the risks associated with traditional payment methods.

The Genesis of a Payment Solution

The story of Paymode-X begins with a recognition of the inherent challenges in traditional accounts payable processes. Businesses were often burdened with manual tasks, such as printing and mailing checks, reconciling payments, and managing vendor information. This was not only time-consuming but also prone to errors and fraud.

As technology advanced, the need for a more efficient and secure payment solution became increasingly apparent. Bottomline Technologies, a leading provider of financial technology, recognized this need and developed Paymode-X to address these pain points. This platform leverages electronic payment methods to automate accounts payable processes and enhance security.

Initially, adoption was slow, as businesses were hesitant to embrace new technology. However, as the benefits of Paymode-X became more evident, adoption rates began to climb. Businesses realized that the platform could save them time and money while also reducing the risk of fraud.

How Paymode-X Works: A Closer Look

At its core, Paymode-X is a network that connects businesses with their vendors, enabling them to exchange payment information securely and efficiently. The platform facilitates electronic payments, eliminating the need for paper checks and manual reconciliation. It also provides enhanced visibility into the payment process, allowing businesses to track payments in real time.

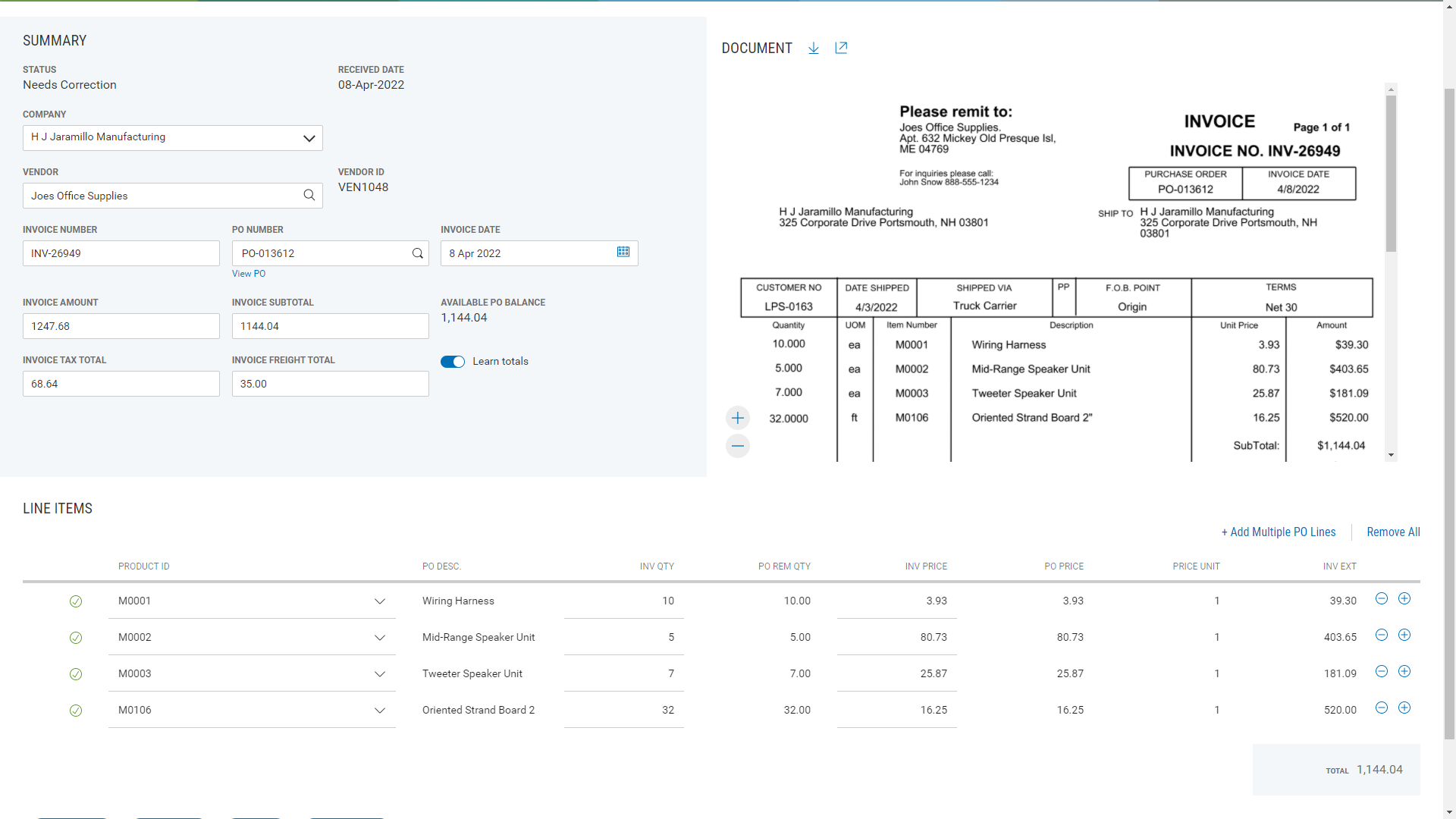

The platform's functionality can be broken down into several key areas:

- Vendor Enablement: Paymode-X provides tools to help businesses onboard their vendors onto the platform. This includes providing vendors with information about the benefits of electronic payments and assisting them with the enrollment process.

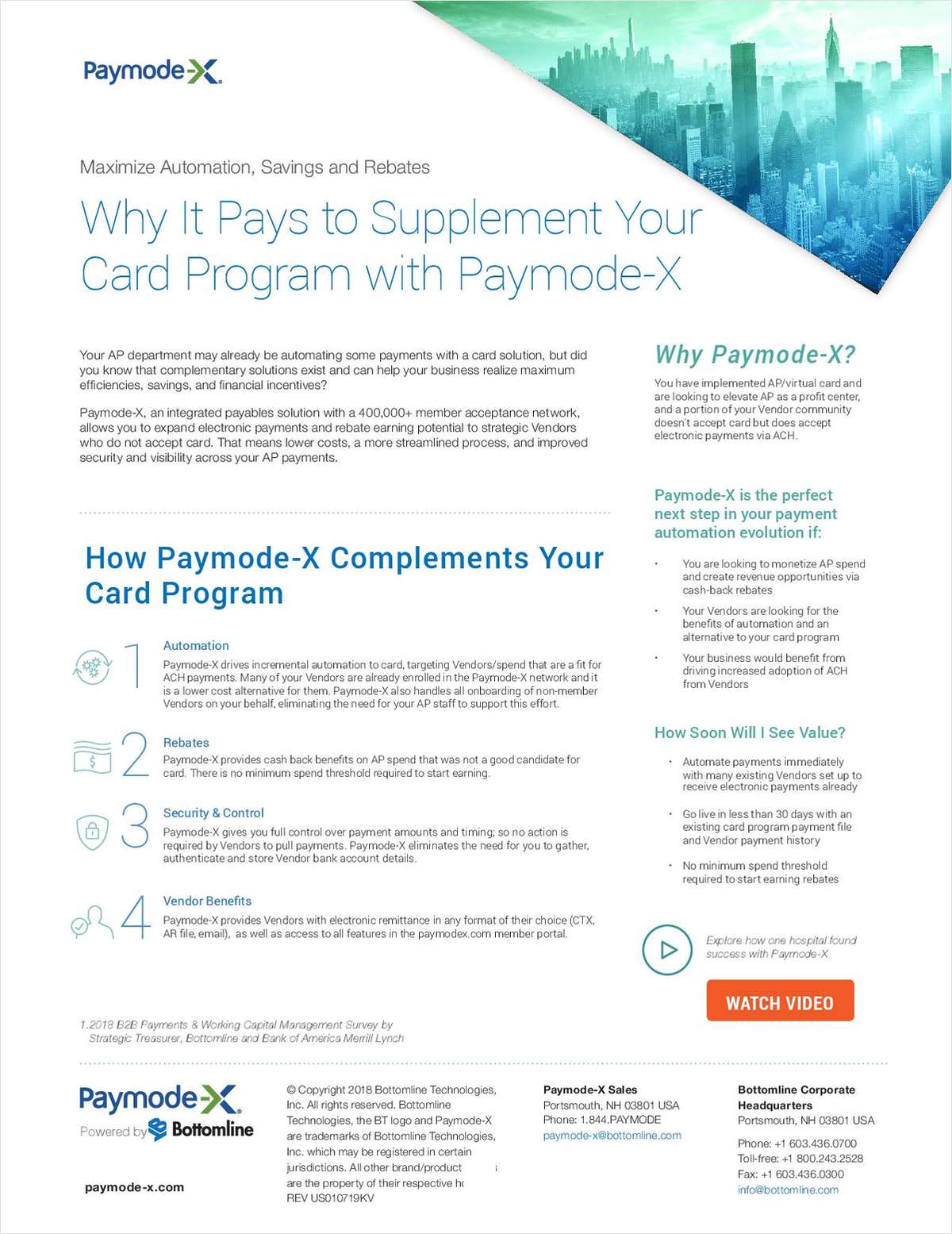

- Payment Processing: Once vendors are enrolled, businesses can use Paymode-X to process payments electronically. The platform supports a variety of payment methods, including ACH, wire transfer, and virtual card payments.

- Reconciliation: Paymode-X automates the reconciliation process, matching payments to invoices and providing detailed reports. This eliminates the need for manual reconciliation, saving businesses time and money.

- Security: Security is a top priority for Paymode-X. The platform uses advanced security measures to protect payment information and prevent fraud.

According to Bottomline Technologies, Paymode-X incorporates multiple layers of security to protect against fraud. This includes encryption, fraud detection algorithms, and multi-factor authentication. These measures help to ensure that payments are processed securely and that sensitive information is protected.

The Benefits Unveiled: Efficiency, Security, and Savings

The advantages of adopting Paymode-X are multifaceted, impacting various aspects of a business's financial operations. Perhaps the most immediate benefit is the increased efficiency gained from automating accounts payable processes. Manual tasks such as printing and mailing checks, reconciling payments, and managing vendor information are significantly reduced, freeing up valuable time and resources for other critical business activities.

Security is another major advantage. Paymode-X employs robust security measures to protect against fraud, including encryption, fraud detection algorithms, and multi-factor authentication. This provides businesses with peace of mind, knowing that their payments are being processed securely.

Cost savings are also a significant benefit. By eliminating the need for paper checks and reducing manual labor, businesses can save money on printing, postage, and labor costs. Additionally, Paymode-X can help businesses negotiate better payment terms with their vendors, leading to further cost savings.

Real-World Impact: Case Studies and Testimonials

The true measure of Paymode-X's success lies in the positive impact it has on businesses that have embraced the platform. Numerous case studies and testimonials highlight the tangible benefits that businesses have experienced.

One example is a large healthcare organization that implemented Paymode-X to streamline its accounts payable processes. Prior to implementing Paymode-X, the organization was processing a high volume of paper checks, which was both time-consuming and costly. After implementing Paymode-X, the organization was able to automate its payment processes, reduce its check volume, and save a significant amount of money. According to the organization, Paymode-X has also improved its vendor relationships by providing vendors with faster and more reliable payments.

Another example is a manufacturing company that implemented Paymode-X to improve its security and reduce the risk of fraud. The company had previously experienced several instances of check fraud, which had resulted in significant financial losses. After implementing Paymode-X, the company was able to eliminate check fraud and improve its overall security posture. The company also reported that Paymode-X has helped it to improve its compliance with industry regulations.

The Future of Paymode-X: Innovation and Integration

Paymode-X continues to evolve, incorporating new technologies and features to meet the changing needs of businesses. Bottomline Technologies is committed to investing in the platform and ensuring that it remains at the forefront of accounts payable automation.

One area of focus is integration. Paymode-X is increasingly being integrated with other business systems, such as ERP systems and accounting software. This allows businesses to streamline their financial processes and improve data visibility. Integration with accounting software like QuickBooks and NetSuite is particularly valuable for smaller businesses.

Another area of focus is artificial intelligence (AI) and machine learning (ML). Bottomline Technologies is exploring ways to use AI and ML to further automate accounts payable processes and improve fraud detection. These technologies have the potential to revolutionize the way businesses manage their payments.

Beyond Automation: Building Stronger Vendor Relationships

While automation and efficiency are key benefits, Paymode-X also fosters stronger relationships between businesses and their vendors. The platform provides vendors with a secure and convenient way to receive payments, improving their satisfaction and loyalty.

By providing vendors with faster and more reliable payments, businesses can improve their relationships and negotiate better terms. This can lead to further cost savings and improved supply chain efficiency. A happy vendor is often a reliable vendor, and Paymode-X helps facilitate that positive dynamic.

Furthermore, the transparency and visibility offered by Paymode-X build trust and confidence between businesses and their vendors. Vendors can track the status of their payments in real time, reducing the need for inquiries and improving communication.

Conclusion: Embracing the Future of Payments

Paymode-X represents a significant step forward in the evolution of accounts payable automation. It's more than just a payment platform; it's a comprehensive solution that streamlines processes, enhances security, and fosters stronger relationships between businesses and their vendors. As businesses continue to seek ways to improve their efficiency and reduce costs, Paymode-X is poised to play an increasingly important role in the future of payments.

The journey towards a more efficient and secure financial future is an ongoing one, and Paymode-X provides a powerful tool for businesses to navigate this path. By embracing technology and adopting innovative solutions, businesses can unlock new levels of productivity and achieve their financial goals. The transformation is not just about payments; it's about building a stronger, more resilient financial foundation for the future.