How To Personal Finance Management

Financial stability is no longer a distant dream but a pressing necessity. Mastering personal finance is crucial to navigating today’s volatile economy and securing your future.

This article provides a concise guide to effective personal finance management, empowering you to take control of your money and build a secure financial foundation. We'll focus on immediate, actionable steps you can implement today.

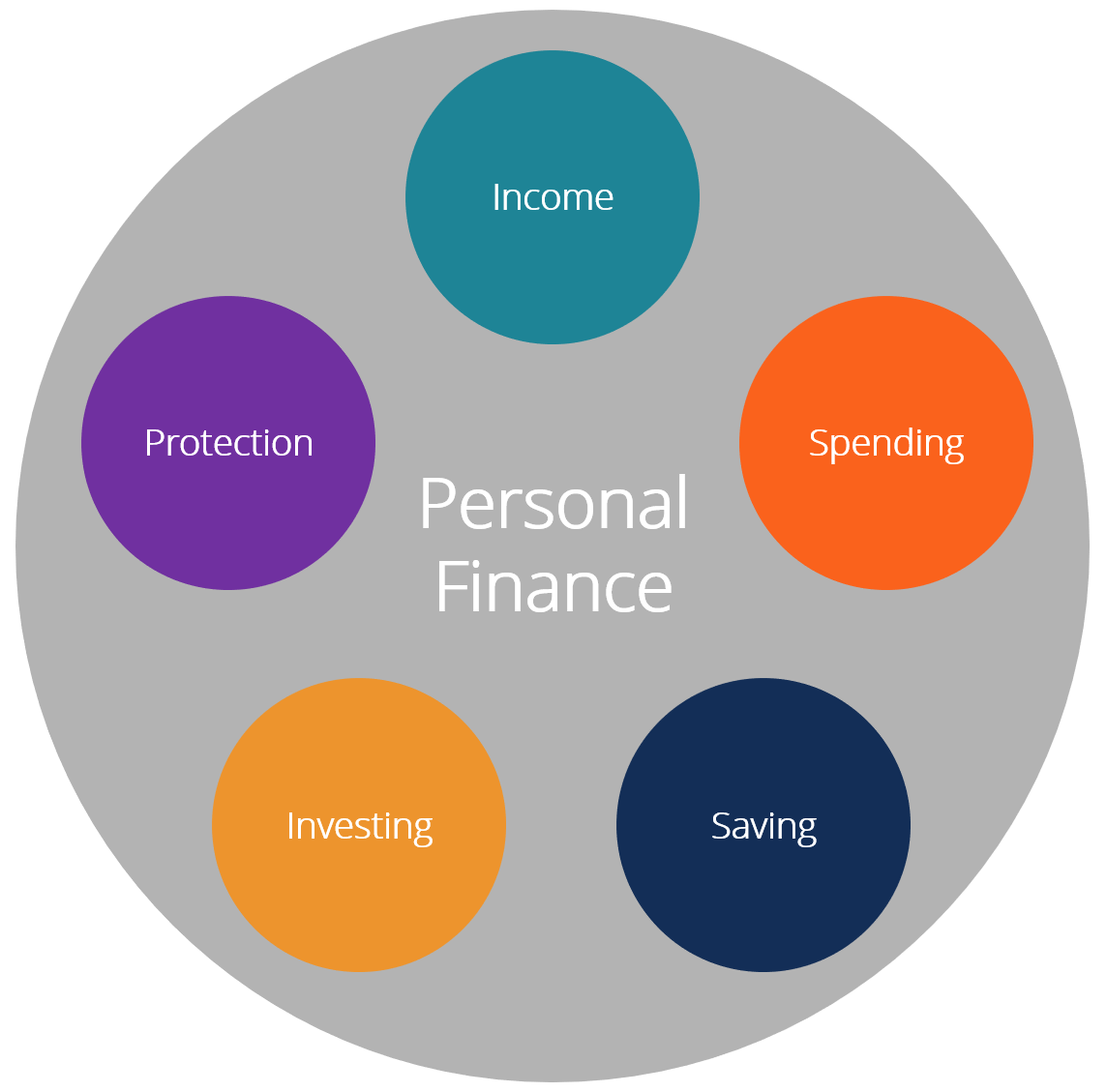

Understanding Your Current Financial Situation

First, calculate your net worth. This is simply your assets (what you own) minus your liabilities (what you owe).

Use online tools or spreadsheets to list everything from savings accounts and investments to loans and credit card debt. A clear picture of your financial health is the essential starting point.

Budgeting Basics

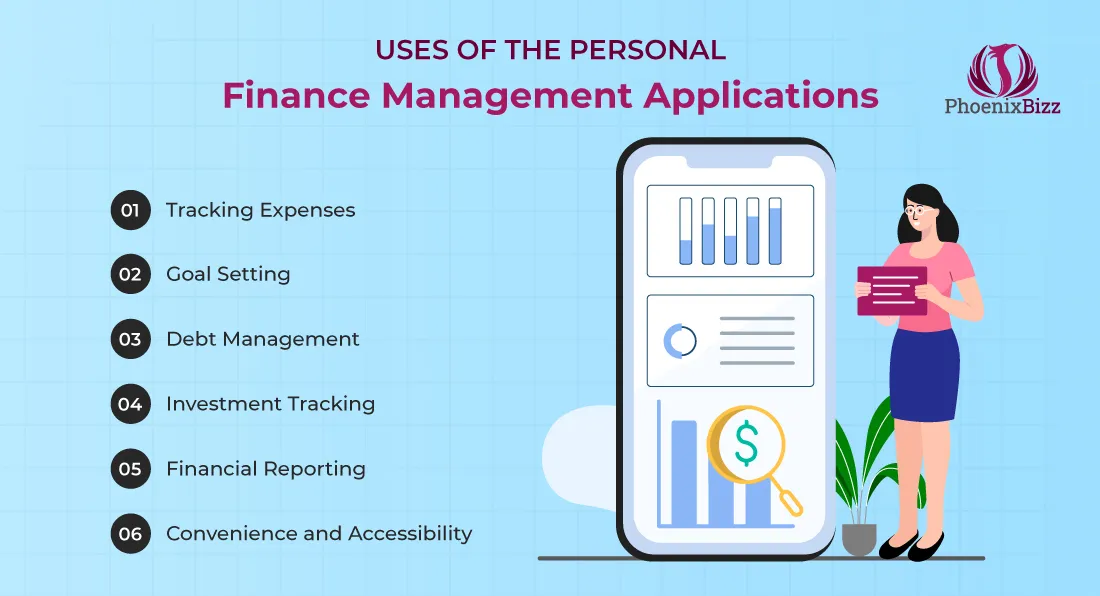

Next, create a budget. Track your income and expenses for at least one month. Several budgeting apps, like Mint or YNAB (You Need A Budget), can automate this process.

Identify where your money is going and pinpoint areas where you can cut back. The 50/30/20 rule is a helpful guideline: 50% of your income for needs, 30% for wants, and 20% for savings and debt repayment.

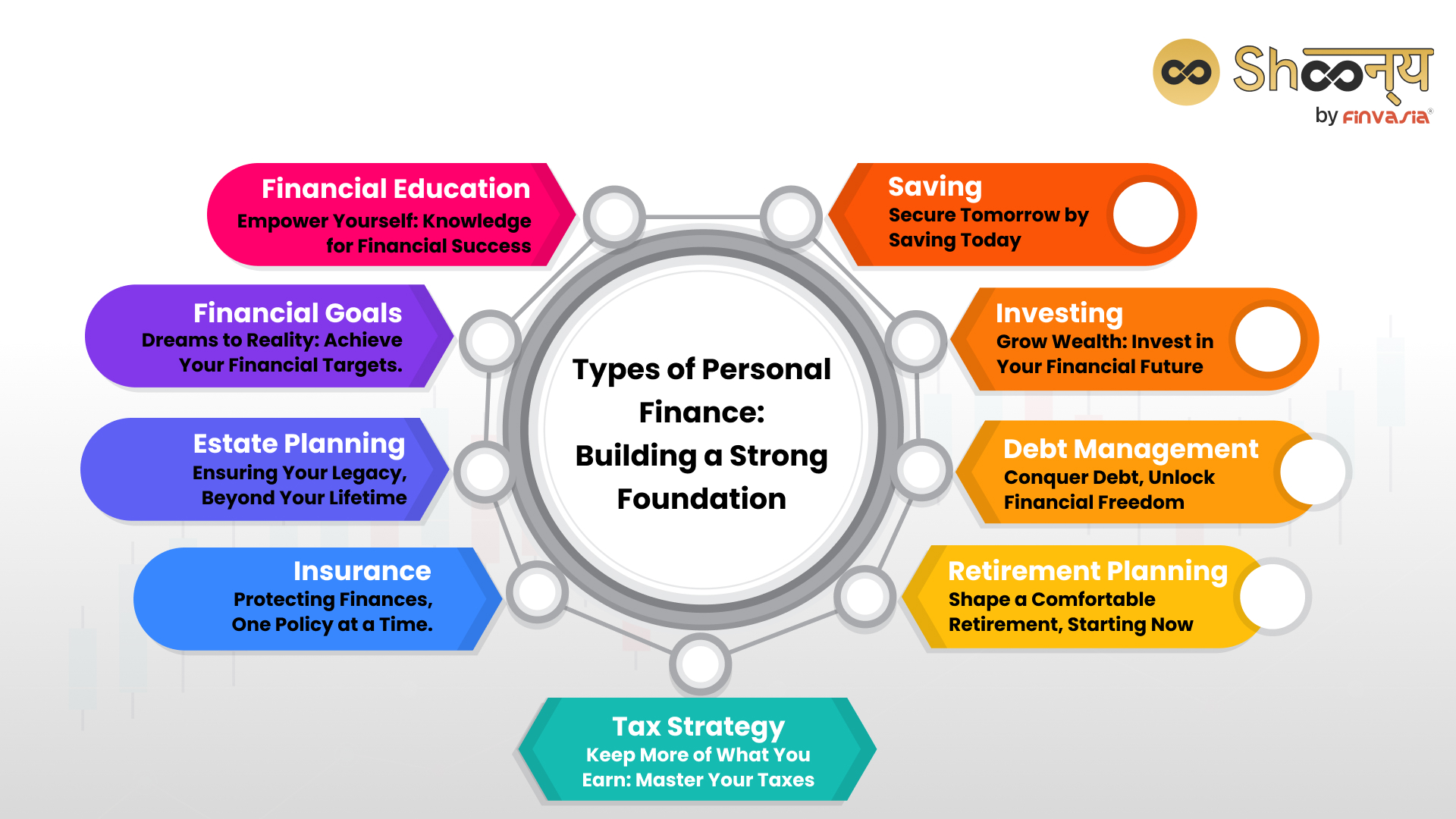

Debt Management Strategies

Prioritize paying off high-interest debt, such as credit card balances. Consider strategies like the debt snowball method (paying off the smallest debt first for motivation) or the debt avalanche method (paying off the debt with the highest interest rate first to save money).

Negotiate lower interest rates with your creditors. Explore options like balance transfers to reduce overall interest costs.

Saving and Investing for the Future

Now, build an emergency fund. Aim for 3-6 months’ worth of living expenses in a readily accessible account. This will protect you from unexpected financial setbacks like job loss or medical emergencies.

Start investing early, even if it's a small amount. Take advantage of employer-sponsored retirement plans like 401(k)s, especially if they offer matching contributions. "Compound interest is your best friend," according to Warren Buffet.

Consider opening a Roth IRA or traditional IRA for tax-advantaged retirement savings. Diversify your investments across different asset classes, such as stocks, bonds, and real estate, to manage risk.

Protecting Your Assets

Ensure you have adequate insurance coverage, including health, life, and property insurance. Review your policies annually to ensure they meet your current needs.

Create a will and estate plan to protect your assets and ensure your wishes are followed. Consult with a financial advisor or estate planning attorney for personalized guidance.

Continuously Learning and Adapting

Financial literacy is a lifelong journey. Stay informed about personal finance topics by reading books, articles, and blogs. Attend workshops or seminars to enhance your knowledge.

Review your financial plan regularly and make adjustments as needed to reflect changing circumstances.

Finally, don't be afraid to seek professional advice. A financial advisor can provide personalized guidance and help you develop a comprehensive financial plan tailored to your unique goals. According to a recent study by the Certified Financial Planner Board of Standards, individuals who work with a financial advisor are more likely to achieve their financial goals.

Taking control of your finances starts with simple steps. Begin implementing these strategies today to build a secure and prosperous future. Don't delay; your financial well-being depends on it!

![How To Personal Finance Management [ May 16th 2020] Topic: Personal Finance – Tec – One Family](https://tienganhtaytuu.files.wordpress.com/2021/11/a3a13-tips-to-manage-your-money-better-infographic.jpg?w=1024)