Get Pre Approved For Citibank Credit Card

In an era defined by increasingly complex financial landscapes, securing favorable credit terms has become a cornerstone of responsible financial planning. For consumers navigating this terrain, understanding the nuances of pre-approval, particularly for major credit card issuers like Citibank, is paramount. The process can offer a significant head start, potentially unlocking better interest rates and higher credit limits.

This article delves into the intricacies of obtaining pre-approval for a Citibank credit card, clarifying its benefits, detailing the application process, and highlighting crucial considerations for applicants. We will examine the factors that influence pre-approval decisions and explore how this process fits into a broader strategy for credit management.

Understanding Credit Card Pre-Approval

Credit card pre-approval is essentially an invitation to apply for a specific credit card. It indicates that, based on a preliminary review of your credit profile, the issuer believes you are likely to be approved. Pre-approval is not a guarantee of approval, but it does suggest a higher probability compared to applying without prior indication.

Citibank, like other major issuers, uses a soft credit inquiry to assess eligibility for pre-approved offers. This type of inquiry doesn't impact your credit score, making it a risk-free way to gauge your chances of approval.

Benefits of Pre-Approval

One of the primary advantages of pre-approval is the reduced uncertainty. It gives applicants a clearer understanding of their approval odds before committing to a hard credit inquiry, which can slightly lower your credit score.

Pre-approved offers often come with exclusive perks or introductory bonuses. These could include higher reward rates, lower interest rates for a limited time, or a sign-up bonus after meeting certain spending requirements.

Furthermore, the pre-approval process can streamline the application itself. Information already gleaned from the soft inquiry might pre-populate parts of the application, saving time and reducing the potential for errors.

The Citibank Pre-Approval Process

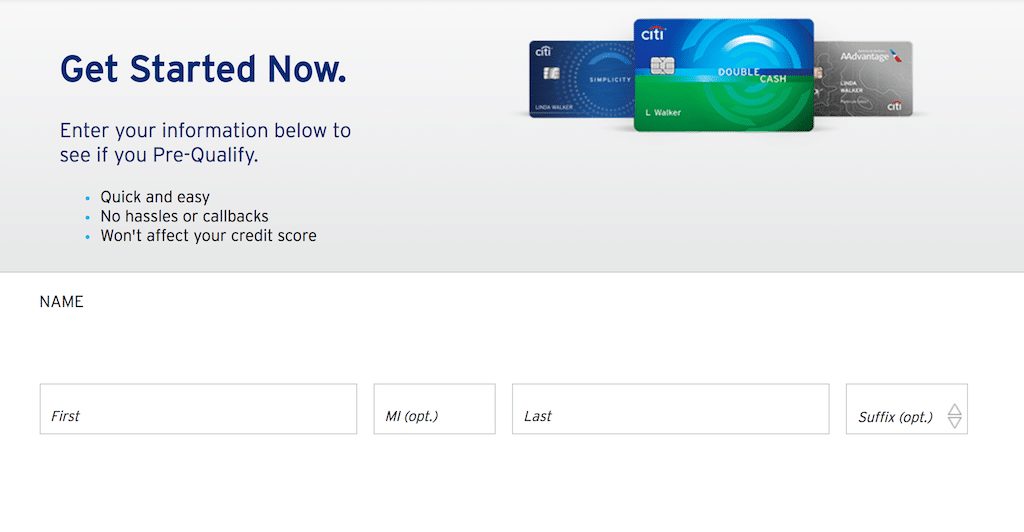

Citibank provides a straightforward online tool for checking pre-approved offers. The user typically enters basic personal information, such as name, address, and social security number, to allow Citibank to perform a soft credit check.

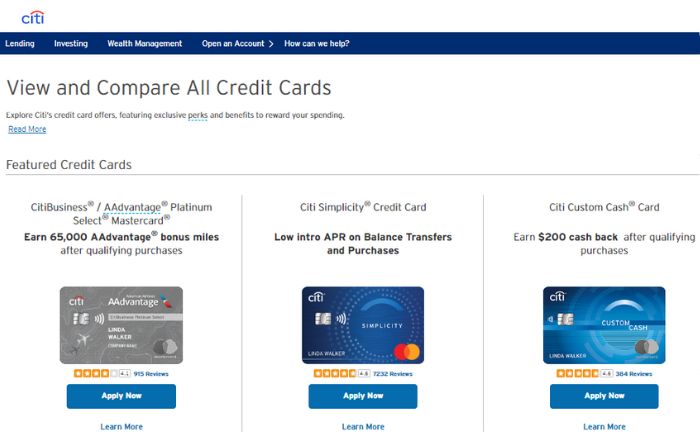

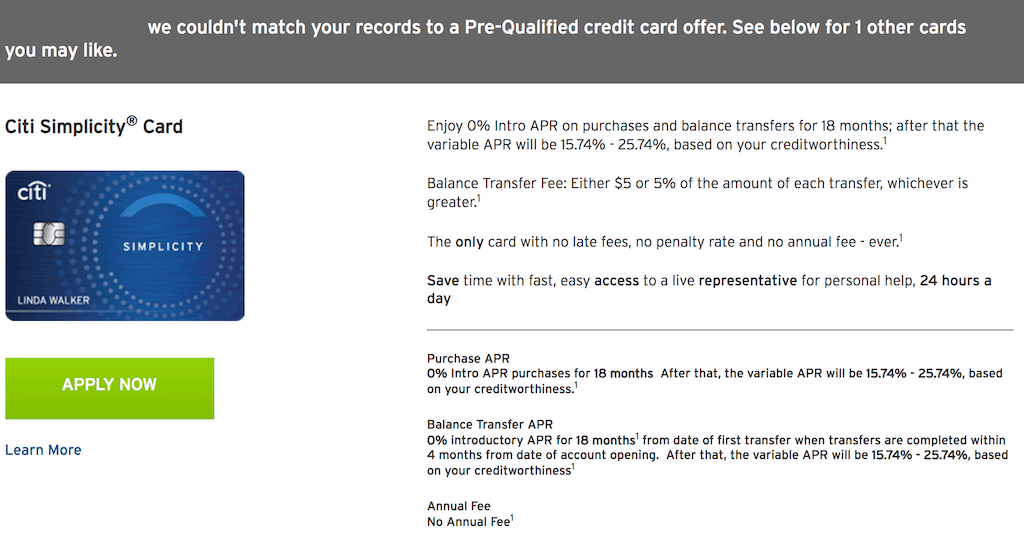

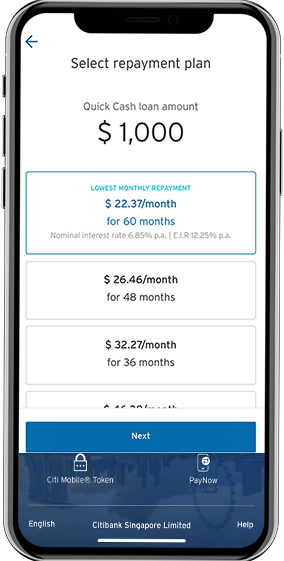

Within moments, the system displays any credit card offers for which the applicant is pre-approved. These offers typically include key details such as the annual percentage rate (APR), credit limit range, and any associated fees.

It's crucial to carefully review the terms and conditions of any pre-approved offer before proceeding. While pre-approval increases the likelihood of approval, it doesn't guarantee it.

Factors Influencing Pre-Approval Decisions

Several factors influence Citibank's pre-approval decisions. These include your credit score, credit history length, debt-to-income ratio, and payment history.

A higher credit score generally increases your chances of receiving pre-approved offers with more favorable terms. A long and positive credit history also demonstrates responsible credit management.

Citibank also considers your debt-to-income ratio, which is the percentage of your gross monthly income that goes towards debt payments. A lower ratio suggests you're less likely to overextend yourself financially.

What Happens After Pre-Approval?

If you decide to pursue a pre-approved offer, you'll need to complete the full application process. This typically involves providing more detailed information about your income, employment history, and other financial obligations.

Citibank will then conduct a hard credit inquiry to verify the information provided and make a final decision on your application. This inquiry will be reflected on your credit report and may slightly lower your credit score.

Even with pre-approval, there's a chance your application could be denied. This could happen if your financial situation has changed since the pre-approval process or if Citibank uncovers discrepancies in your application.

Beyond Pre-Approval: Responsible Credit Management

Obtaining pre-approval is just the first step towards responsible credit management. It's essential to use credit cards wisely and pay your bills on time and in full each month.

Avoiding excessive debt and maintaining a healthy credit utilization ratio (the amount of credit you're using compared to your total credit limit) are crucial for building and maintaining a strong credit score.

"Building a solid credit history is a marathon, not a sprint,"explains a financial advisor at a reputable firm.

Regularly monitoring your credit report can also help you identify and address any errors or fraudulent activity that could negatively impact your credit score.

The Future of Credit Card Pre-Approval

As technology continues to evolve, the pre-approval process is likely to become even more sophisticated. Issuers like Citibank may leverage artificial intelligence and machine learning to better predict applicant risk and tailor offers to individual needs.

Consumers can expect a more personalized and seamless experience, with pre-approved offers becoming increasingly targeted and relevant. However, the importance of responsible credit management will remain paramount.

Ultimately, securing pre-approval for a Citibank credit card can be a valuable tool for accessing credit and achieving your financial goals. However, it's crucial to understand the process, weigh the benefits and risks, and prioritize responsible credit management practices.