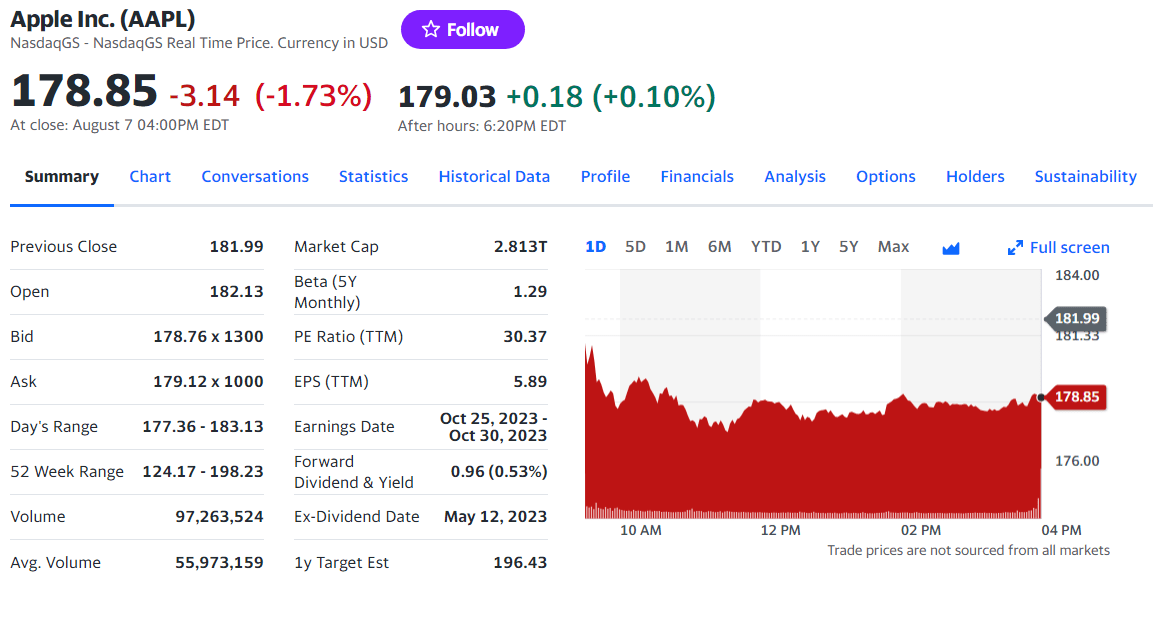

Gl Apr 11 2025 Stock Price

The market watched with bated breath as GlobalTech (GL) closed at $178.50 on April 11, 2025. This figure represents a significant downturn, triggering widespread analysis and speculation about the company’s future trajectory. Investors are now grappling with the implications of this shift, leading to a palpable sense of uncertainty across various sectors.

The GL stock price drop is not merely a blip on the radar. Instead, it serves as a critical indicator of underlying challenges facing the tech giant. Multiple factors, including increased regulatory scrutiny, intensifying competition in the cloud computing market, and a slower-than-expected adoption rate of their flagship AI product, are converging to impact investor confidence. Understanding these complex dynamics is crucial for stakeholders to navigate the current market volatility.

Immediate Market Reaction

The immediate aftermath of the GL stock announcement was marked by heightened trading activity and a surge in online discussions. Market analysts at Goldman Sachs issued a revised forecast, downgrading GL from a "Buy" to a "Hold" rating, citing concerns about the company’s near-term growth prospects. This further fueled negative sentiment and contributed to a sell-off in after-hours trading.

Several prominent investment firms also reduced their GL holdings, signaling a lack of confidence in the company's ability to rebound quickly. Small retail investors, often influenced by market trends, followed suit, further exacerbating the downward pressure on the stock. The volume of GL stock traded on April 11 was significantly higher than the daily average over the past quarter, indicating panic selling.

Analyst Perspectives

According to Dr. Anya Sharma, a leading tech analyst at Morgan Stanley, "The decline in GL's stock price reflects a growing unease about the company's ability to maintain its competitive edge in a rapidly evolving technological landscape." She emphasized the importance of GL demonstrating innovation and adaptability to regain investor trust.

Other analysts point to specific setbacks, such as the delayed launch of their new metaverse platform, which was initially projected to be a major revenue driver. Concerns over data privacy and security surrounding the platform also contributed to negative press coverage and dampened investor enthusiasm. Furthermore, the increasing success of rival companies like Innovate Corp in securing key government contracts added to the pressure on GL.

Underlying Challenges

One of the primary challenges facing GL is the increasing regulatory scrutiny over its anti-competitive practices. The European Commission has launched several investigations into GL's dominance in the search engine and online advertising markets, potentially leading to hefty fines and restrictions on its business operations.

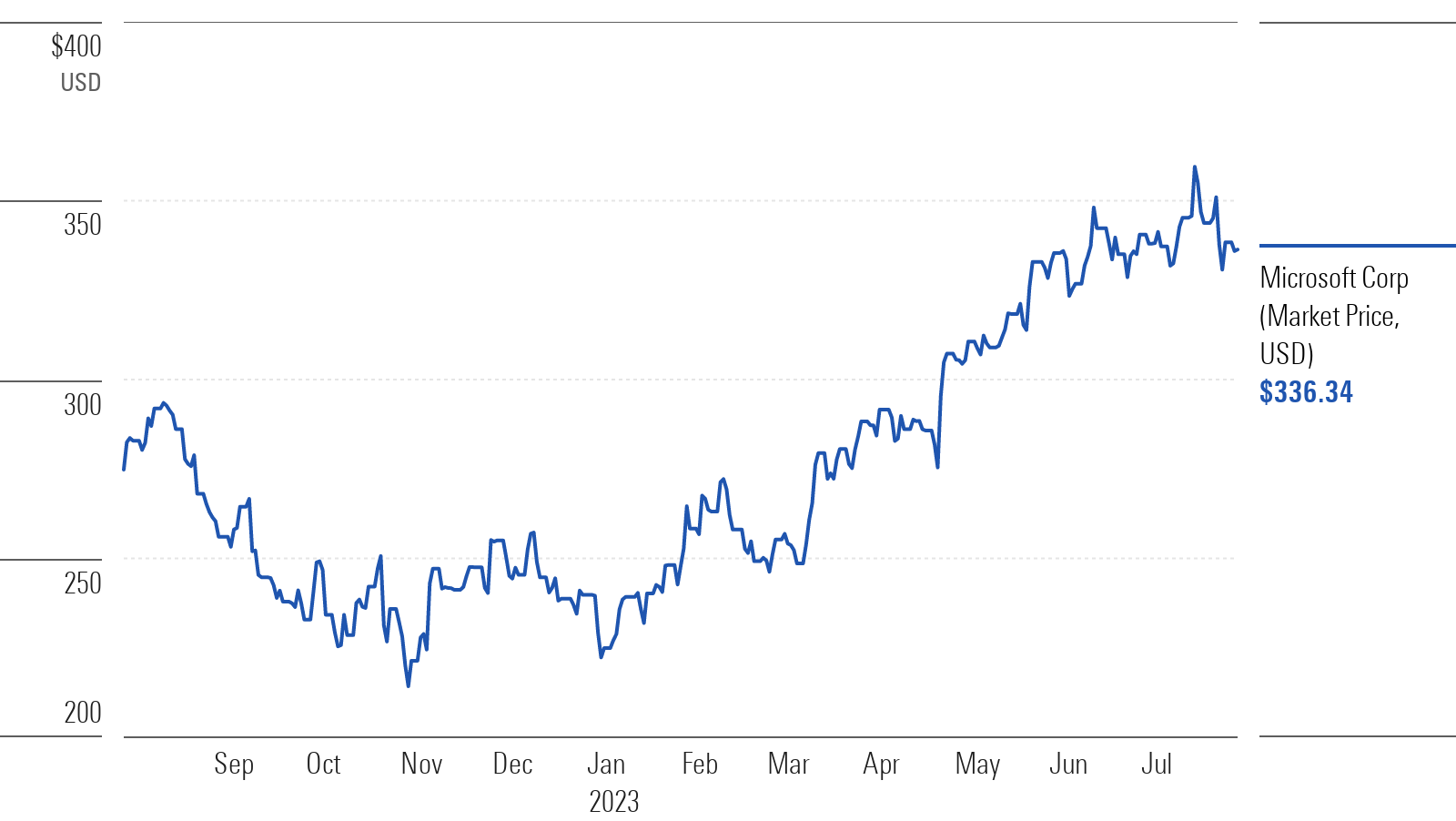

Moreover, the company’s cloud computing division, GL Cloud, is facing stiff competition from Amazon Web Services (AWS) and Microsoft Azure. While GL Cloud has shown steady growth, it has struggled to capture market share at the same pace as its rivals. This competitive pressure is forcing GL to invest heavily in infrastructure and pricing, impacting profitability.

The slower-than-expected adoption of GL's flagship AI product, AI Vision, has also contributed to the stock price decline. Despite significant investments in research and development, AI Vision has faced challenges in meeting customer expectations and integrating seamlessly into existing business workflows. This has led to lower-than-anticipated revenue generation and a reassessment of the product's potential.

Company Response and Future Strategies

In response to the market downturn, GL’s CEO, Mark Thompson, issued a statement reaffirming the company's commitment to innovation and long-term value creation. He outlined several key initiatives aimed at addressing the underlying challenges and regaining investor confidence.

These initiatives include a renewed focus on research and development, particularly in areas such as AI and quantum computing. GL also plans to streamline its operations and reduce costs by optimizing its workforce and supply chain. The company intends to proactively engage with regulatory bodies to address concerns about anti-competitive practices.

Furthermore, GL is exploring strategic partnerships and acquisitions to expand its product offerings and reach new markets. The company's leadership believes these measures will position it for sustainable growth and long-term success. However, the effectiveness of these strategies remains to be seen, and investors are closely monitoring the company's progress.

Potential Scenarios

Several potential scenarios could unfold in the coming months. A successful turnaround strategy, marked by innovative product launches and improved financial performance, could lead to a rebound in the stock price. Conversely, continued challenges and regulatory headwinds could further erode investor confidence and drive the stock price even lower.

Another possibility is that GL could become a target for acquisition by a larger technology conglomerate or a private equity firm. The company’s vast intellectual property portfolio and extensive user base make it an attractive asset, despite its current challenges. The likelihood of an acquisition will depend on the evolving market conditions and the willingness of potential suitors to take on the associated risks.

Conclusion

The GL stock price drop on April 11, 2025, underscores the dynamic and often unpredictable nature of the technology market. While the immediate reaction has been negative, the company's future trajectory will depend on its ability to navigate the challenges it faces and execute its turnaround strategy effectively. Investors should carefully assess the risks and opportunities before making any decisions regarding GL stock.