Guaranteed Personal Loan Approval Direct Lender

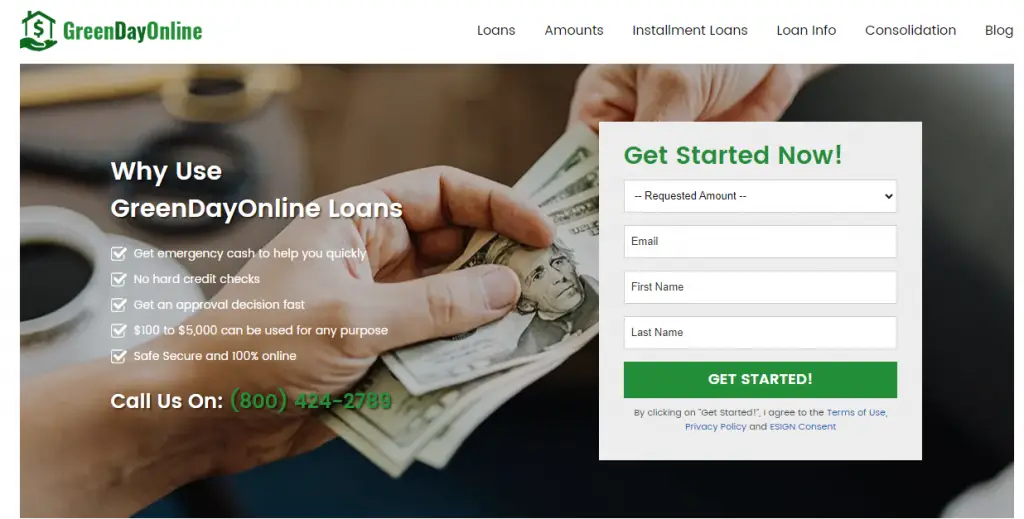

A surge in advertisements promising guaranteed personal loan approval from direct lenders is raising concerns among consumer advocacy groups. The advertised loans bypass traditional credit checks, potentially trapping vulnerable individuals in high-interest debt cycles.

This article investigates the phenomenon of "guaranteed approval" personal loans, examining the potential risks and outlining steps consumers can take to protect themselves.

The Allure of "Guaranteed" Approval

Direct lenders offering guaranteed approval often target individuals with poor credit histories or those facing urgent financial needs.

These lenders advertise easy access to funds, promising approval regardless of credit score.

However, this accessibility often comes at a steep price, disguised in the form of exorbitant interest rates and hidden fees.

What Are Direct Lenders?

Direct lenders are financial institutions that provide loans directly to borrowers, bypassing intermediaries like banks or credit unions.

This direct approach can offer faster processing times and potentially more flexible lending criteria.

However, it also means that borrowers must be diligent in researching the lender's reputation and legitimacy, particularly when dealing with offers of guaranteed approval.

The Fine Print: A Danger Zone

The term "guaranteed approval" is a major red flag. Legitimate lenders always assess risk, even if they cater to borrowers with less-than-perfect credit.

Loans marketed with guaranteed approval are nearly always characterized by significantly higher interest rates than conventional loans.

According to a recent report by the Consumer Federation of America, the APR (Annual Percentage Rate) on these loans can range from 36% to over 400%.

Predatory Lending Tactics

Several tactics employed by these lenders raise serious ethical and legal questions.

These include a lack of transparency regarding loan terms and conditions.

Additionally, high-pressure sales tactics are used to rush borrowers into accepting unfavorable loan agreements.

The Cycle of Debt

The combination of high interest rates and fees can quickly lead to a cycle of debt.

Borrowers struggle to repay the principal amount due to the excessive cost of borrowing.

This can result in late payment penalties, further damaging their credit score and limiting their future financial options.

Who Is at Risk?

Individuals with low credit scores, those facing unexpected expenses, and those unfamiliar with financial products are particularly vulnerable.

These demographics often feel they have no other options for accessing credit.

This desperation makes them prime targets for lenders offering "guaranteed" approval.

How to Protect Yourself

Consumers should exercise extreme caution when considering a loan with guaranteed approval.

It is crucial to thoroughly research the lender and check their reputation with the Better Business Bureau (BBB).

Always read the fine print and understand all the terms and conditions before signing any agreement.

Alternatives to "Guaranteed" Approval Loans

Explore alternative options, such as credit counseling, secured loans, or borrowing from friends or family.

Consider credit unions, which often offer more favorable terms than traditional banks or online lenders.

Improving your credit score through responsible financial management can open doors to more affordable credit options in the future.

Legal and Regulatory Scrutiny

Consumer advocacy groups and regulatory agencies are increasingly scrutinizing lenders offering guaranteed approval loans.

The Federal Trade Commission (FTC) has issued warnings about deceptive lending practices and is actively investigating companies that engage in predatory lending.

Several states have also enacted laws to cap interest rates and regulate the payday loan industry, which shares similarities with the guaranteed approval loan market.

Ongoing Developments

The issue of guaranteed approval loans is a complex and evolving one.

Consumer protection agencies continue to monitor the market and provide resources to help consumers make informed decisions.

Individuals who believe they have been victimized by a predatory lender should file a complaint with the FTC and their state's attorney general's office.

Next Steps for Consumers

If you are currently struggling with debt from a high-interest loan, seek help from a reputable credit counseling agency like Money Management International.

Learn about your rights as a borrower and understand the laws in your state regarding lending practices.

Remember, there is no substitute for careful research and informed decision-making when it comes to borrowing money.