H And R Block Assessment Test

The annual rush to file taxes is synonymous with one name for millions: H&R Block. But beneath the ubiquitous storefronts and television ads lies a critical, yet often overlooked, element: the assessment test. This exam acts as a gatekeeper, determining who gets to advise taxpayers and prepare their returns, impacting both the quality of service provided and the livelihood of aspiring tax professionals.

The H&R Block assessment test is a comprehensive evaluation designed to gauge a candidate's tax knowledge, analytical skills, and ability to apply tax laws effectively. Its results dictate whether an individual can become a tax preparer for the company, directly influencing their career path and the accuracy of tax returns filed nationwide. Understanding the test's structure, content, and impact is crucial for anyone considering a career with H&R Block and for the public relying on their services.

The Structure and Content of the Assessment

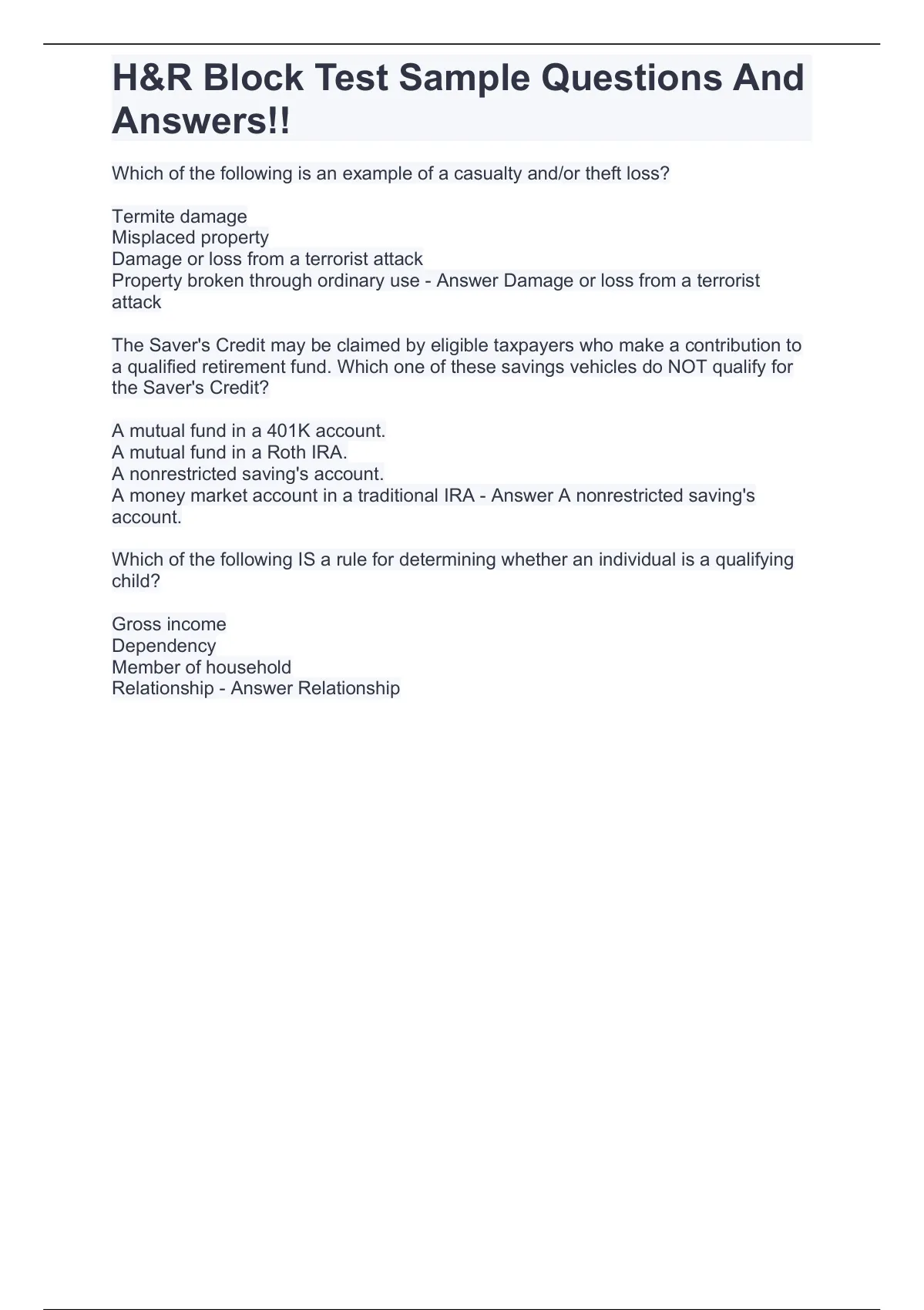

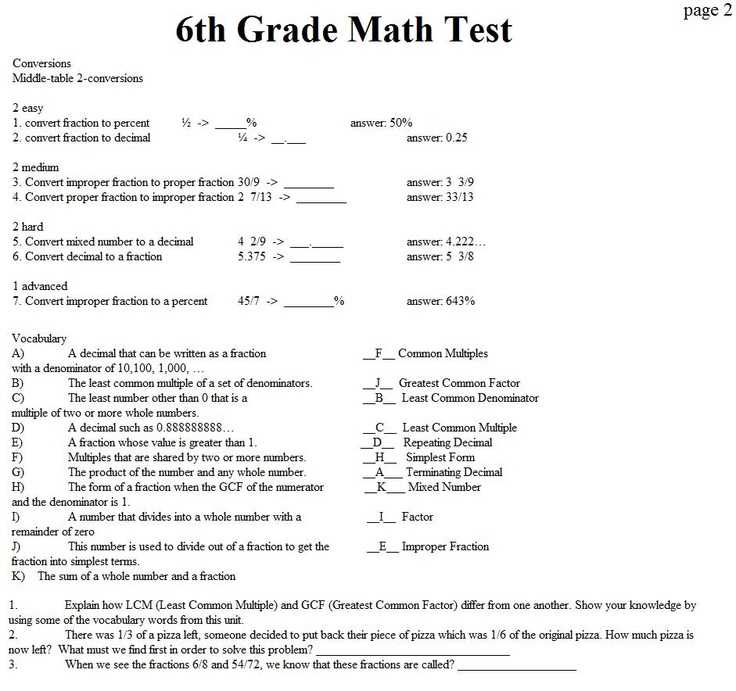

The H&R Block assessment test isn't just a simple quiz. It is a multifaceted examination encompassing various aspects of tax law. The test typically includes questions on federal income tax regulations, deductions, credits, and common tax scenarios.

Candidates can expect to encounter multiple-choice questions, scenario-based problems, and potentially even practical exercises. These practical exercises might involve completing sample tax forms or analyzing hypothetical financial situations.

According to H&R Block training materials, the test places significant emphasis on understanding changes in tax law. Tax law is constantly evolving, making continuous learning a necessity for tax professionals.

Preparing for the Assessment

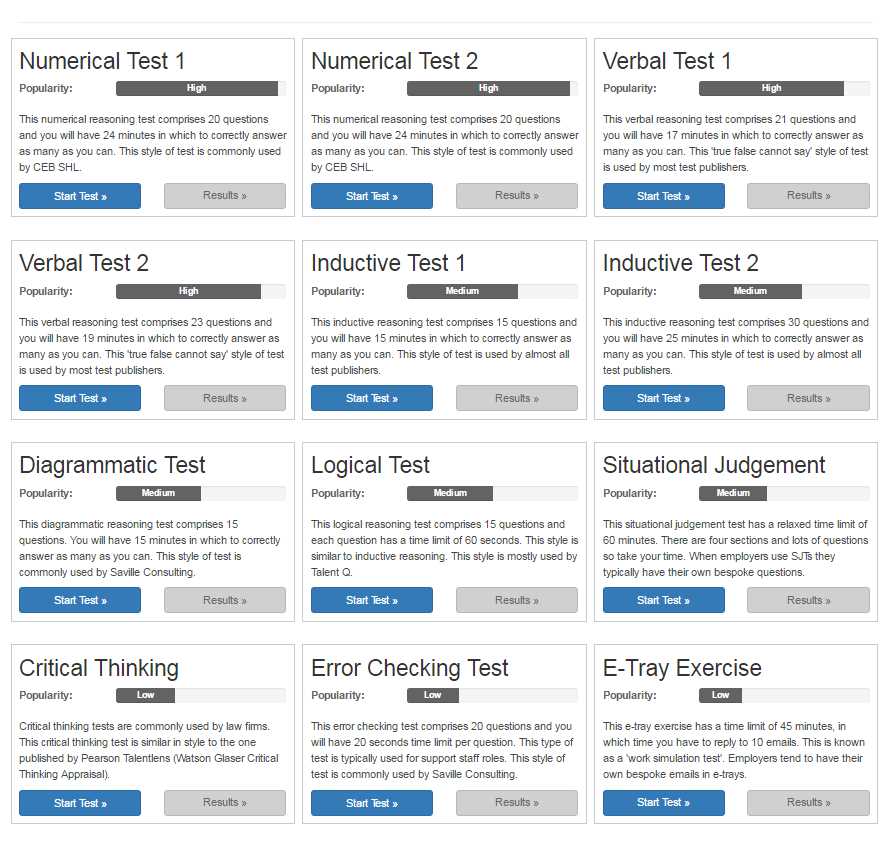

Given the test's complexity, adequate preparation is vital. H&R Block offers its own training programs designed to equip candidates with the necessary knowledge and skills. These programs often cover key tax concepts and provide practice tests.

Beyond company-provided resources, independent study is highly recommended. This can involve reviewing IRS publications, utilizing online tax resources, and practicing with sample tax returns.

"Familiarity with common tax forms and schedules is essential," emphasizes a former H&R Block tax professional. Understanding Form 1040 and its associated schedules (Schedule A, Schedule C, etc.) is a must.

The Impact on Tax Preparers

The assessment test serves as a significant filter in the hiring process. Those who pass are offered positions as tax preparers, while those who fail may be denied employment or required to undergo further training. The test results ultimately determine whether someone can provide tax preparation services under the H&R Block banner.

The pressure to pass the assessment can be substantial. H&R Block hires a large number of seasonal tax preparers each year, and competition for these positions can be intense.

However, the assessment also provides a level of quality assurance. It ensures that H&R Block's tax preparers possess a minimum level of competency in tax law.

The Impact on Taxpayers

The rigor of the assessment has a direct impact on the quality of tax services taxpayers receive. A well-designed and properly administered assessment helps to ensure that H&R Block's tax preparers are knowledgeable and capable.

A knowledgeable tax preparer is less likely to make errors, claim improper deductions, or overlook potential tax savings. This can translate to more accurate tax returns and better financial outcomes for taxpayers.

Conversely, a poorly trained or unqualified tax preparer can cause significant problems. Errors on a tax return can lead to penalties, interest charges, and even audits from the IRS.

Criticisms and Challenges

Despite its importance, the assessment is not without its critics. Some argue that the test focuses too heavily on rote memorization and not enough on critical thinking and problem-solving skills.

Others contend that the test is biased towards those with formal accounting or tax education, potentially excluding qualified candidates with practical experience.

"The test should be more practical and less theoretical,"according to an anonymous online forum dedicated to H&R Block employees.

Furthermore, maintaining the integrity and relevance of the assessment is an ongoing challenge. Keeping the test up-to-date with ever-changing tax laws requires constant vigilance and revision.

H&R Block's Perspective

H&R Block maintains that the assessment is a crucial tool for ensuring the quality of its tax preparation services. According to a company statement, "The assessment helps us identify individuals who possess the knowledge and skills necessary to provide accurate and reliable tax advice."

The company also emphasizes its commitment to providing comprehensive training and support to its tax preparers. This training is designed to supplement the knowledge assessed by the test and to keep tax preparers abreast of the latest tax law changes.

H&R Block regularly reviews and updates its assessment to ensure its relevance and effectiveness. This process involves incorporating feedback from tax professionals, monitoring changes in tax law, and analyzing the performance of tax preparers.

The Future of the Assessment

As tax law becomes increasingly complex and technology plays a larger role in tax preparation, the assessment will likely evolve to reflect these changes. Future versions of the test may incorporate more scenario-based questions, simulations, and technology-related components.

The use of artificial intelligence (AI) in tax preparation is also likely to impact the assessment. H&R Block may need to evaluate candidates' ability to work alongside AI-powered tools and to interpret the results generated by these tools.

Ultimately, the success of the H&R Block assessment depends on its ability to accurately measure a candidate's potential to become a competent and ethical tax professional. This will require ongoing evaluation, adaptation, and a commitment to continuous improvement.

![H And R Block Assessment Test Home [www.hrblock.ca]](https://publicsitecms-media.hrblock.ca/assets/Open_Graph_Image_H_and_R_Block_84d9e5fabf.webp)