Which Of The Following Is Not True Of Life Settlements

The life settlement industry, a market that allows seniors to sell their life insurance policies for immediate cash, is increasingly under scrutiny. Misconceptions abound, leading to potential pitfalls for both policyholders and investors. Understanding the realities of these transactions is crucial for informed decision-making.

This article aims to dissect the common misunderstandings surrounding life settlements. It will present a clear picture of what life settlements are, how they work, and address a crucial question: Which of the following is not true of life settlements? We will explore various facets of the industry, from tax implications to suitability concerns, drawing on expert opinions and industry data to provide a balanced and accurate overview.

Understanding Life Settlements: The Basics

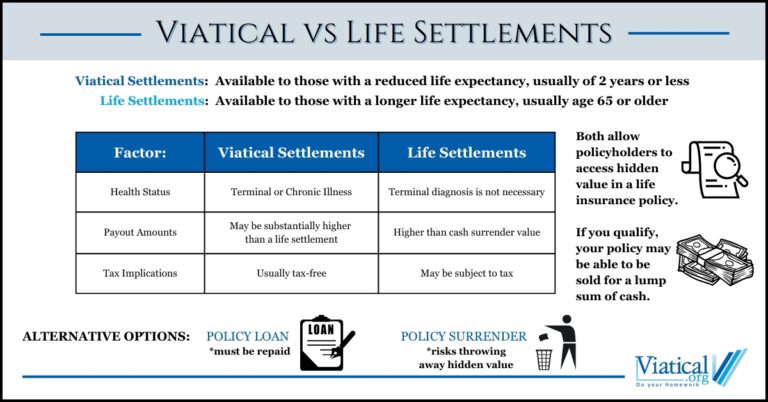

A life settlement is the sale of an existing life insurance policy to a third party for an amount greater than its cash surrender value, but less than its face value. The buyer becomes the new owner of the policy. They are responsible for paying future premiums, and they receive the death benefit when the insured individual dies.

These transactions can provide seniors with a lump sum of cash to cover medical expenses, improve their quality of life, or supplement retirement income. However, it's essential to consider the potential downsides and understand the complex financial and legal aspects involved.

Common Misconceptions and Realities

One of the primary misconceptions about life settlements is that they are only suitable for individuals with terminal illnesses. While this might have been true in the early days of the industry, the market has evolved. Policies from healthy seniors are often eligible, depending on factors like age, policy type, and coverage amount.

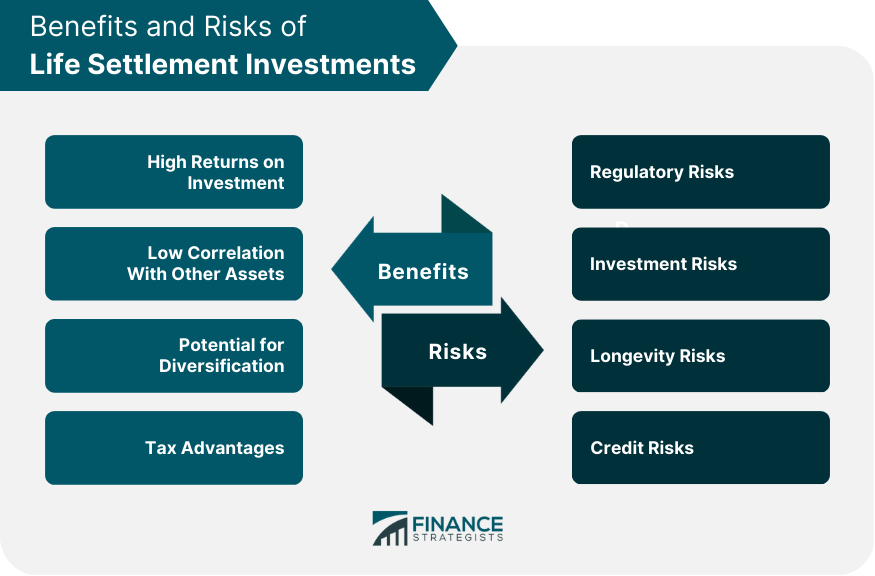

Another common misconception is that life settlements are only beneficial for the seller. While the seller receives a cash payout, investors also stand to gain from the death benefit. This creates a symbiotic relationship where both parties can benefit, albeit with different motivations and risks.

Key Considerations and Due Diligence

Tax implications are a crucial consideration in any life settlement transaction. The amount received for the policy might be subject to federal and state income taxes, depending on the cost basis of the policy and the amount exceeding that basis. Consulting with a tax advisor is highly recommended before proceeding.

Suitability is another essential aspect to consider. Selling a life insurance policy may not be the best option for everyone. Factors like the potential loss of death benefit protection for loved ones and alternative financial strategies must be carefully evaluated. A thorough financial assessment is crucial to determine if a life settlement aligns with an individual's overall financial goals.

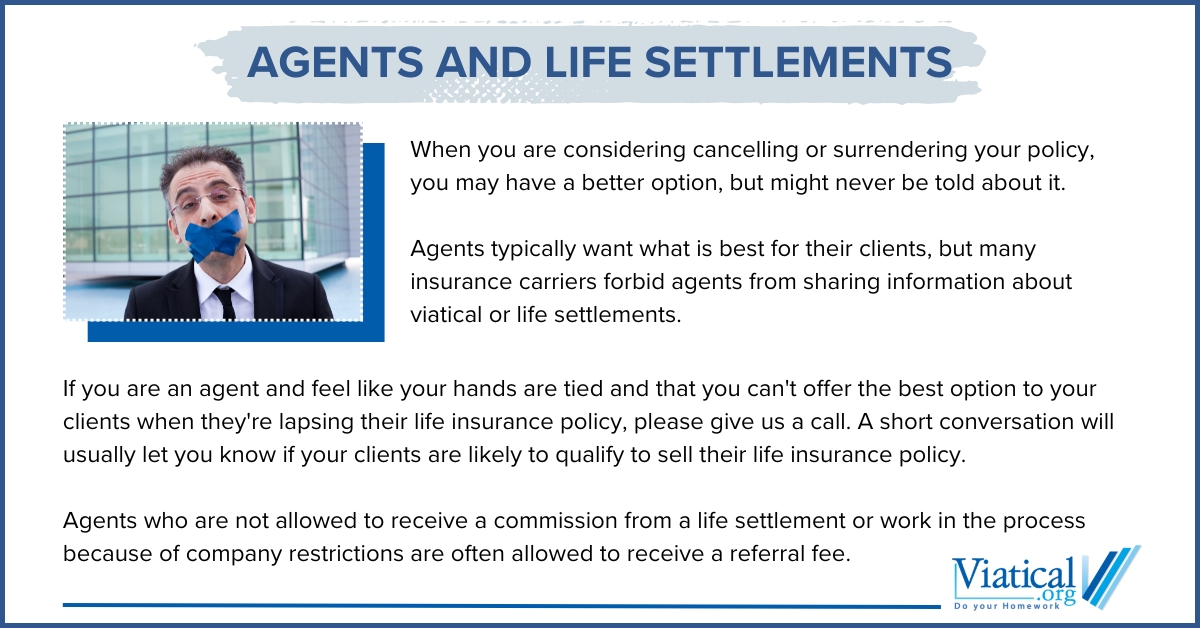

Finding a reputable and licensed life settlement broker or provider is paramount. These professionals can help navigate the complex process, ensure fair market value for the policy, and provide the necessary disclosures and documentation. Regulation varies by state, so it's crucial to verify the credentials of any broker or provider.

Which of the Following is NOT True of Life Settlements?

Here’s the critical question we set out to answer: Which statement about life settlements is demonstrably false? Let's examine common statements and identify the inaccurate one. Statement A: "Life settlements always provide the highest possible value for a life insurance policy." Statement B: "Life settlements are only an option for individuals with terminal illnesses." Statement C: "Life settlements can provide seniors with cash to address immediate financial needs."

After reviewing the key facts and debunking the above misconception, Statement B is the answer. The market has evolved from offering settlements for just terminally ill individuals.

Therefore, the answer is: Life settlements are only an option for individuals with terminal illnesses.

Looking Ahead: The Future of Life Settlements

The life settlement industry is expected to continue to grow as more seniors seek alternative sources of income and financial flexibility. As awareness increases and regulations become more standardized, the market is likely to become even more transparent and accessible.

However, ongoing education and consumer protection measures are essential to ensure that individuals make informed decisions and avoid potential scams or unfair practices. Increased scrutiny from regulatory bodies and industry watchdogs can help maintain the integrity of the market and protect the interests of both policyholders and investors.

In conclusion, life settlements can be a valuable financial tool for some seniors. However, it's crucial to approach these transactions with caution, seek professional advice, and understand the potential risks and benefits involved. Only with a thorough understanding can individuals make informed decisions that align with their financial goals and overall well-being.