Which Of The Following Is Not Included In Material Resources

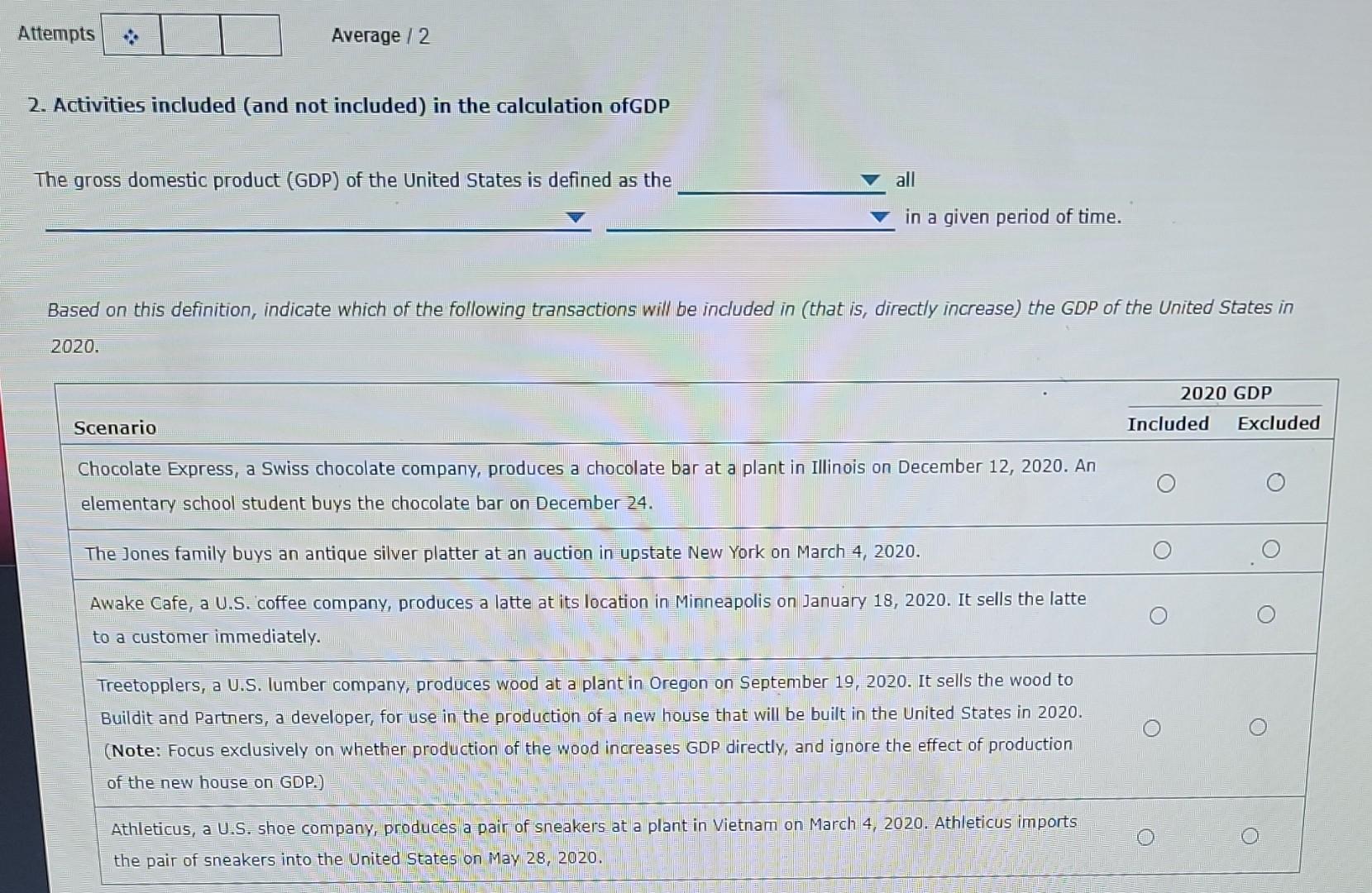

Urgent confusion surrounds a basic business concept: Material resources. The question, "Which of the following is not included in material resources?" is sparking debate across industries.

The core issue revolves around the precise definition of material resources, a critical component in production and operational efficiency. This article aims to cut through the ambiguity and provide a clear answer based on established business and resource management principles.

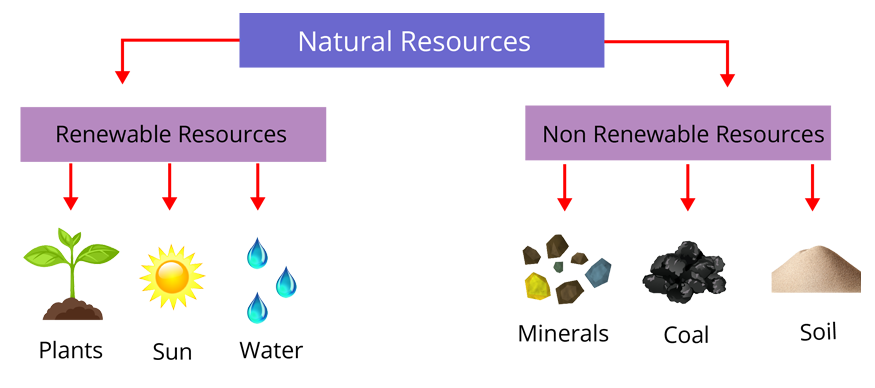

Defining Material Resources

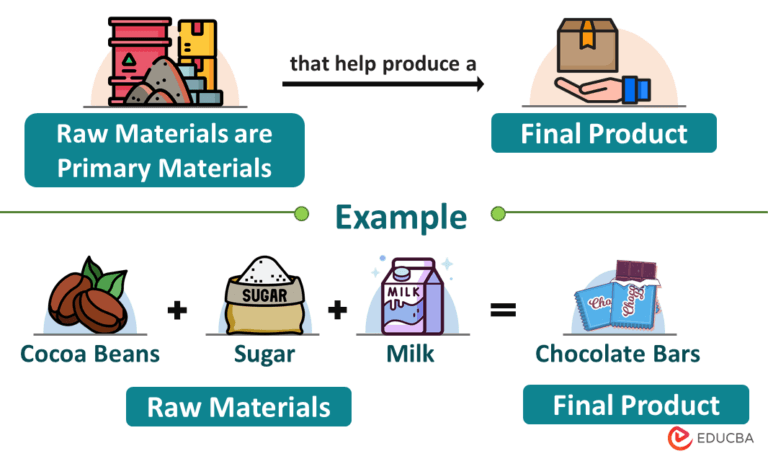

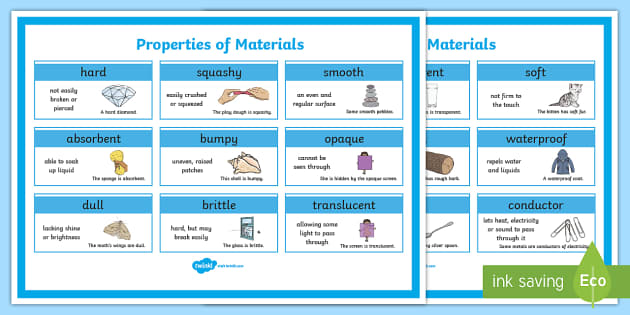

Material resources encompass the tangible assets a company uses to create its products or deliver its services. These are the physical inputs directly involved in the production process.

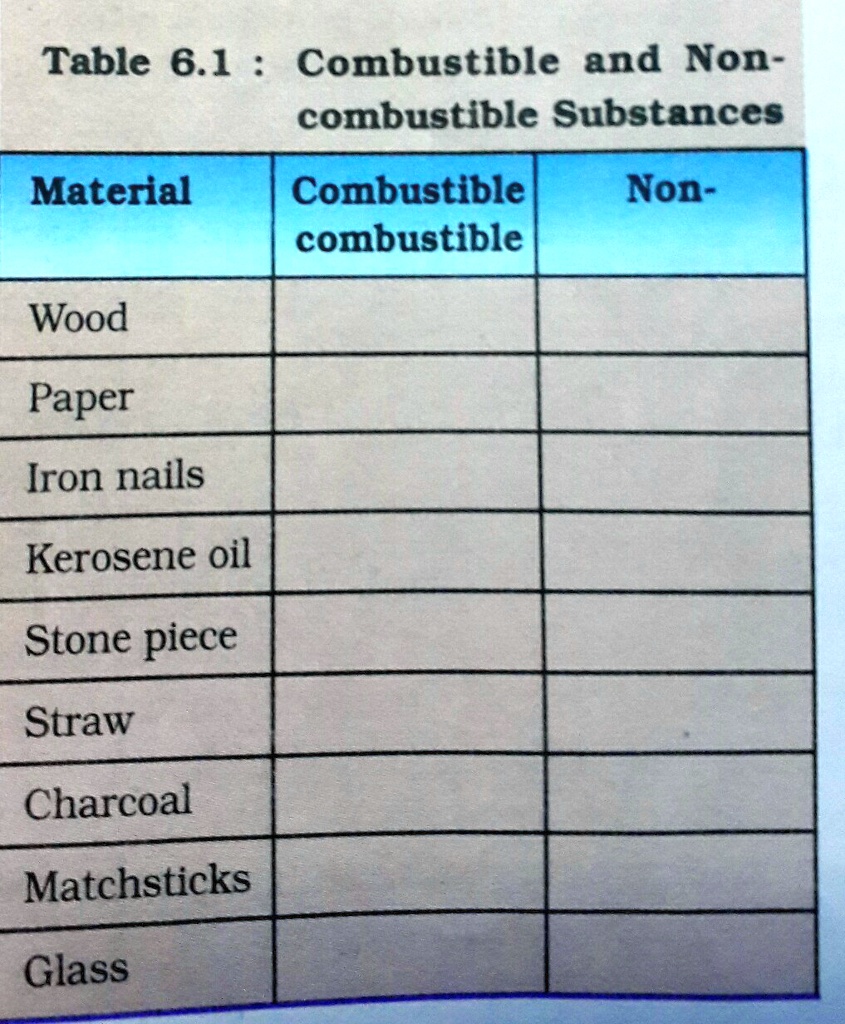

Examples of material resources include raw materials like wood, metal, and plastics. They also cover components, semi-finished goods, and supplies necessary for manufacturing.

What Qualifies as Material?

Generally, if an item is consumed or transformed during production, it’s considered a material resource. Think of the steel used to build cars, or the fabric used to make clothing.

Packaging materials, such as boxes and labels, also fall under this category. Even the energy used to power machinery can be considered a material resource in some contexts.

The Key Exclusion: Human Resources

The answer to the question "Which of the following is not included in material resources?" is unequivocally human resources. This is where the confusion often arises.

While essential for any organization, human resources (i.e., employees and their skills) are considered intangible assets. They are not physical inputs consumed in the production process.

Human resources provide the labor, knowledge, and expertise necessary to manage and utilize material resources effectively. They are a separate, vital component.

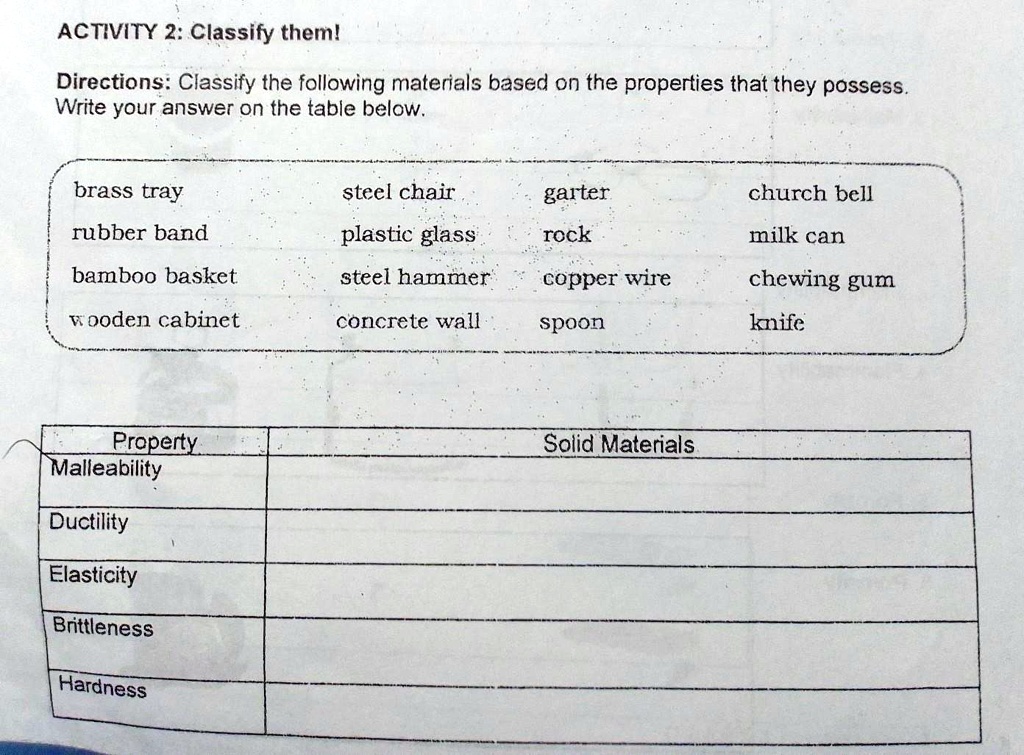

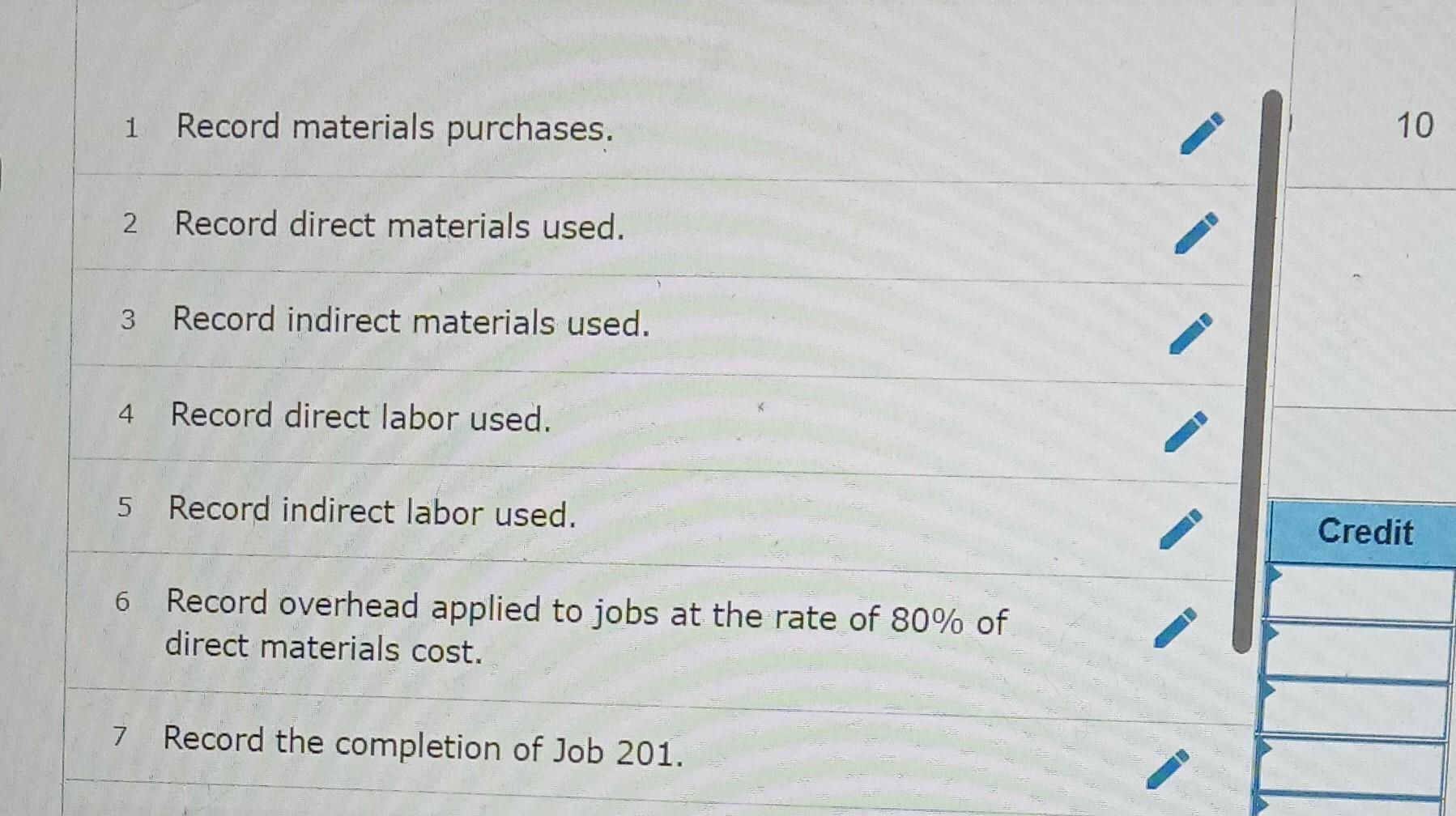

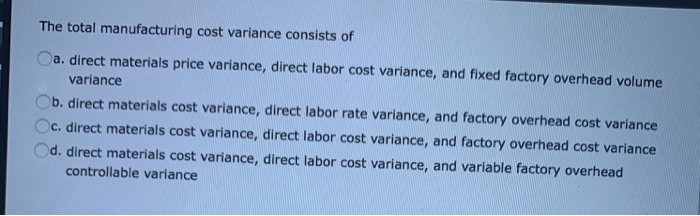

Differentiating Labor from Materials

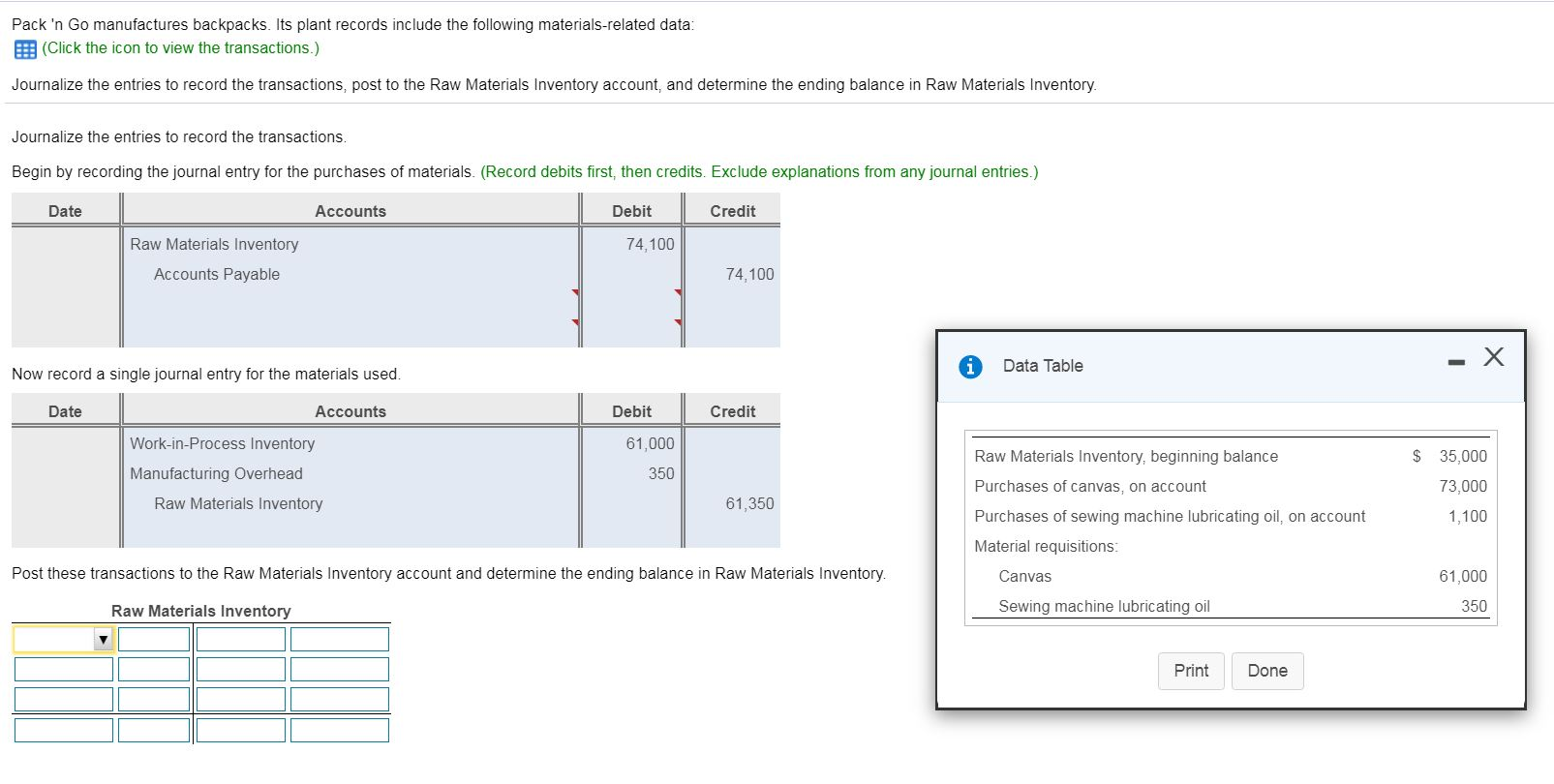

The distinction is crucial for accounting, inventory management, and overall business strategy. Misclassifying resources can lead to inaccurate financial reporting.

Consider the cost of wages: it is an expense associated with human resources. It is not a cost directly tied to the consumption of physical materials.

Properly categorizing resources is essential for accurate costing and pricing decisions. Separating labor from material is a standard accounting practice.

Other Potential Exclusions

Beyond human resources, other items that are *not* typically considered material resources include intellectual property. These include patents, trademarks, and copyrights.

Services, such as consulting or marketing, are also excluded. These are intangible activities, rather than physical inputs.

Finally, capital assets, like buildings and equipment, are not classified as material resources. These are long-term investments used *to* manage material resources.

Impact and Implications

Understanding the correct definition of material resources is fundamental for business operations. It directly impacts inventory management and supply chain optimization.

Accurate resource classification allows for better cost control and more efficient production processes. Businesses can streamline their supply chains by precisely tracking material flow.

Furthermore, accurate resource allocation ensures resources are being effectively used, which is vital for business profitability. It allows better inventory management and supply chain optimization.

Moving Forward

This clarification is a first step towards promoting better business practices. Educational resources will be updated to reflect the correct definitions.

Consult with accounting and business professionals for specific guidance relevant to individual industries. Ongoing assessment of resource management strategies is highly recommended.

Expect further updates and resources aimed at improving understanding of material resources. Watch for upcoming workshops and online tutorials.

![Which Of The Following Is Not Included In Material Resources [ANSWERED] Which of the following materials are used as fibers in fiber](https://media.kunduz.com/media/sug-question-candidate/20230608173021291070-5281891.jpg?h=512)

![Which Of The Following Is Not Included In Material Resources 9 Classes of Hazardous Materials [IMDG] - 10 min summary](https://images.surferseo.art/e4994a82-f970-4189-983d-00301cd99e9f.jpeg)