H And R Block Refund Anticipation

The allure of instant gratification can be powerful, especially when it comes to tax refunds. For years, H&R Block offered Refund Anticipation Loans (RALs) and Refund Anticipation Checks (RACs), products designed to provide taxpayers with quick access to their expected refunds. However, these financial instruments, once a staple of the tax preparation industry, have faced increasing scrutiny and declining popularity due to their associated fees and potential risks.

This article delves into the history, mechanics, and current landscape of H&R Block's refund anticipation products. We will explore the criticisms leveled against them, the regulatory changes that have impacted their availability, and the alternative options available to taxpayers seeking faster access to their refunds. Understanding the complexities surrounding these financial products is crucial for making informed decisions during tax season.

The Rise and Fall of Refund Anticipation Loans

RALs were short-term loans secured by a taxpayer's expected refund. H&R Block, along with other tax preparation companies, partnered with banks to offer these loans. Taxpayers would apply for a RAL when filing their taxes, and if approved, receive the loan amount within a day or two, minus fees and interest.

These loans were particularly attractive to low-income individuals and families who relied on their tax refunds for essential expenses. However, the interest rates and fees associated with RALs were often exorbitant, effectively diminishing the value of the refund.

Concerns about predatory lending practices led to increased regulatory oversight. The IRS stopped providing tax preparers with Debt Indicator, which was used to determine whether the taxpayer owed the government money. This made it more difficult for lenders to assess the risk associated with RALs, ultimately leading to a decline in their availability.

Refund Anticipation Checks: A Different Approach

RACs, also known as "refund transfers," operate differently than RALs. With a RAC, the taxpayer's refund is deposited into a temporary bank account managed by a third-party bank.

The tax preparation fees are then deducted from the refund, and the remaining balance is disbursed to the taxpayer, usually via a prepaid card or check. While RACs don't involve a traditional loan, they still come with fees that can reduce the overall refund amount.

Despite not being a loan, RACs faced scrutiny due to the fees involved. Consumer advocacy groups argued that these fees disproportionately affected low-income taxpayers who could least afford them.

H&R Block's Current Stance

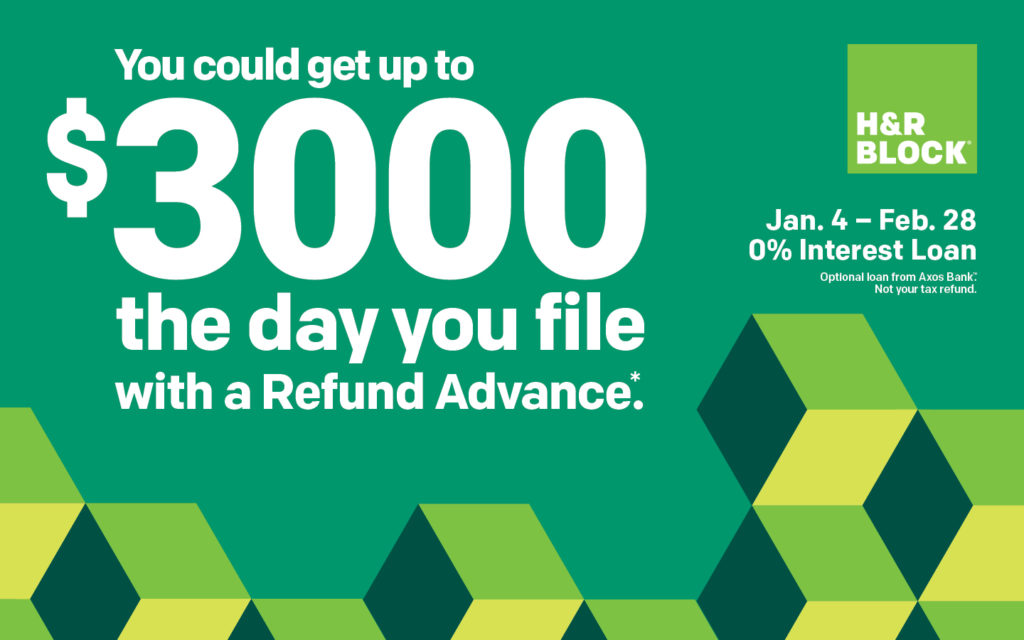

H&R Block no longer directly offers RALs. The company’s website focuses on promoting options for receiving refunds quickly via direct deposit and highlighting alternative financial products.

While RACs, or refund transfers, may still be available through third-party partners, H&R Block emphasizes transparency regarding associated fees. They encourage customers to compare the cost of a RAC with other options.

The company now focuses on faster refund options, such as direct deposit, and providing tools and resources for taxpayers to manage their finances.

Criticisms and Concerns

Both RALs and RACs have faced criticism for their potential to exploit vulnerable taxpayers. The fees associated with these products can significantly reduce the amount of the refund, effectively creating a high-cost financial service.

Consumer advocacy groups argue that taxpayers are often unaware of the true cost of these products. The allure of immediate access to funds can overshadow the long-term financial implications.

Furthermore, there are concerns that these products encourage taxpayers to rely on their refunds for essential expenses, rather than planning for their finances throughout the year.

Regulatory Changes and Industry Impact

Increased regulatory scrutiny has played a significant role in the decline of RALs. The IRS's decision to stop providing tax preparers with Debt Indicator information made it riskier for lenders to offer these loans.

The Consumer Financial Protection Bureau (CFPB) has also taken action against tax preparation companies for deceptive marketing practices related to refund anticipation products. These actions have further discouraged the use of RALs and RACs.

The industry has shifted towards promoting alternative options, such as direct deposit and prepaid cards, which offer faster access to refunds without the high costs associated with RALs and RACs.

Alternatives to Refund Anticipation Products

Taxpayers have several alternatives to RALs and RACs that can provide faster access to their refunds without incurring excessive fees. The most straightforward option is to file taxes electronically and choose direct deposit.

Direct deposit is the fastest way to receive a refund from the IRS, typically within 21 days. It is a secure and convenient method that eliminates the need for paper checks.

Another option is to adjust withholding throughout the year to receive a smaller refund. This can be achieved by working with your employer to update your W-4 form.

The Future of Refund Anticipation

The future of refund anticipation products appears to be limited. Increased regulatory scrutiny, growing consumer awareness, and the availability of faster, cheaper alternatives have all contributed to their decline.

H&R Block, like other tax preparation companies, is adapting to this changing landscape by focusing on providing value-added services and promoting faster, more affordable refund options.

Ultimately, the best approach for taxpayers is to plan ahead, file taxes early and electronically, and choose direct deposit to receive their refunds quickly and efficiently. Careful consideration of all available options and understanding associated fees is paramount to making informed financial decisions during tax season.