Hdfc Credit Card Salary Eligibility Criteria

The pursuit of a credit card is often linked to financial flexibility, and for many, an HDFC Bank credit card is a coveted tool. But understanding the eligibility criteria, particularly the salary requirements, is paramount for potential applicants. This article delves into the specifics of HDFC Bank's salary eligibility norms for its credit cards, providing clarity for prospective cardholders.

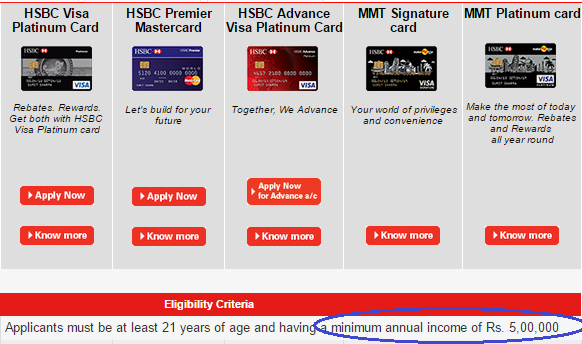

Gaining access to an HDFC credit card hinges on several factors, with income being a primary consideration. HDFC Bank, one of India's largest private sector banks, offers a diverse range of credit cards, each tailored to different income brackets and spending habits. The minimum salary requirement acts as a gateway, ensuring applicants possess the financial capacity to manage credit responsibly.

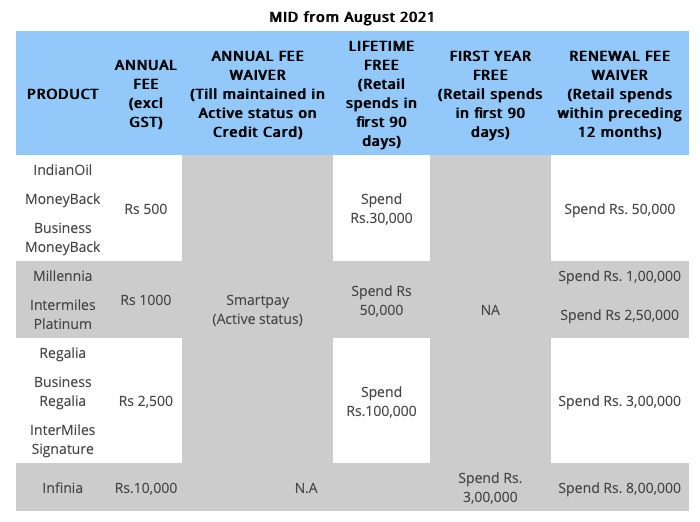

Salary Benchmarks for HDFC Credit Cards

The exact salary criteria vary significantly depending on the specific HDFC credit card being applied for. Entry-level cards generally have lower income thresholds compared to premium offerings with enhanced rewards and benefits. Information gathered from bank representatives and publicly available data suggests a general range, but direct confirmation from HDFC Bank is always recommended.

For basic cards, the monthly income requirement can start as low as ₹15,000 for salaried individuals. These cards often come with limited features but can be a good starting point for those new to credit. Higher-tier cards, such as those offering travel benefits or exclusive rewards, may require a monthly income of ₹50,000 or even higher.

Self-employed individuals typically face different documentation requirements, often needing to provide proof of income through income tax returns and bank statements. The assessed income will be considered by the bank when determining credit card eligibility.

Factors Beyond Salary

While salary is a key determinant, HDFC Bank also considers other factors. A good credit score is essential. A strong credit history demonstrates responsible financial behavior and increases the chances of approval.

The bank also assesses the applicant's employment history and stability. Length of time in the current job and overall work experience can influence the decision. Existing debt obligations are carefully evaluated to ensure the applicant can comfortably manage additional credit.

"HDFC Bank considers a holistic view of the applicant's financial profile, not just their salary,"a bank representative stated. "We aim to provide credit responsibly and ensure customers can manage their finances effectively."

How to Determine Your Eligibility

The most reliable way to ascertain eligibility is to visit the official HDFC Bank website or contact a bank representative directly. The website provides detailed information on each card's specific requirements.

Many online tools and eligibility checkers are available, but verifying information with the bank is always recommended. These tools can provide a preliminary assessment, but they should not be considered definitive.

Before applying, review your credit score and ensure all information provided is accurate and up-to-date. Gathering the necessary documentation, such as salary slips and bank statements, will streamline the application process.

Impact on Consumers

Understanding the salary criteria allows potential applicants to make informed decisions about which HDFC credit card to apply for. This saves time and avoids potential rejections. Meeting the eligibility requirements increases the likelihood of approval and access to the benefits the card offers.

Ultimately, responsible credit management benefits both the individual and the financial institution. Transparency in eligibility criteria promotes a healthy credit ecosystem.

In conclusion, while specific salary requirements differ based on the card type, understanding the general income thresholds, along with other factors like credit score and employment history, is crucial for anyone seeking an HDFC Bank credit card. Direct consultation with the bank remains the most reliable method to confirm eligibility and ensure a smooth application process.