Does It Lower Your Credit Score To Check It

In today's credit-driven world, the question of whether checking your own credit score harms that very score remains a persistent concern. Many consumers are hesitant to monitor their credit health, fearing that the act of checking will somehow lower their standing with lenders. This fear, though widespread, is largely unfounded, but understanding the nuances behind it is crucial for responsible financial management.

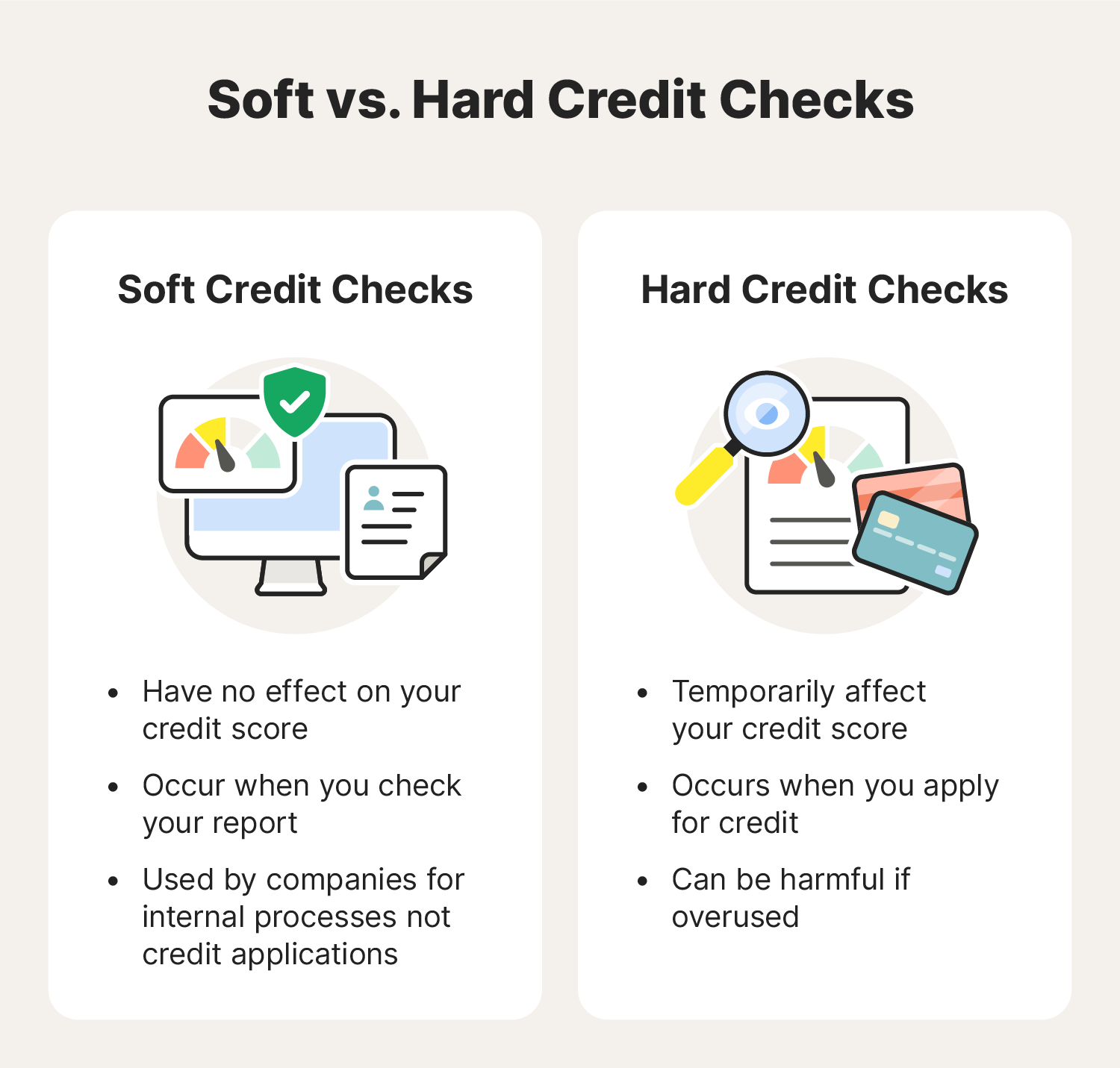

The crux of the matter lies in differentiating between soft inquiries and hard inquiries. While regularly monitoring your credit health is encouraged and won't hurt your score, certain types of credit checks can indeed have a negative impact, however small. This article dives into the details of these inquiries, explaining when and why they occur, and how to ensure you're staying informed without damaging your credit standing.

Understanding Soft Inquiries: The Safe Zone

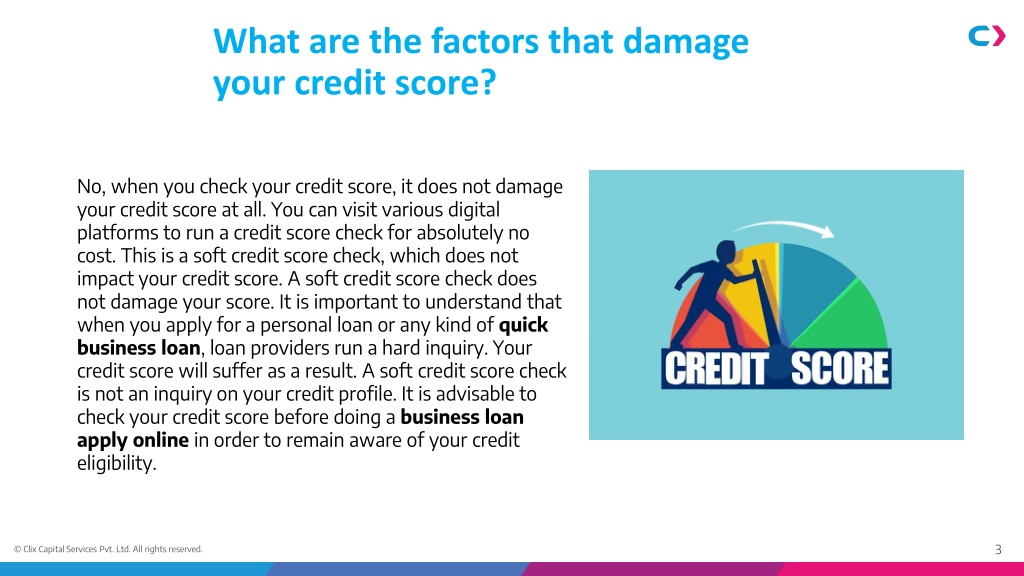

A soft inquiry, sometimes called a "soft pull," occurs when you check your own credit score, when a credit card company pre-approves you for an offer, or when a company runs a background check on you. These types of inquiries are invisible to lenders when they evaluate your creditworthiness.

Critically, soft inquiries do not affect your credit score. Credit bureaus understand the importance of consumers monitoring their own credit and factor this into their scoring models. This is why you can access your credit reports from sites like AnnualCreditReport.com without worry.

Examples of Soft Inquiries

Checking your credit score through services like Credit Karma or directly through the three major credit bureaus (Equifax, Experian, and TransUnion) results in a soft inquiry. Reviewing your credit report to identify errors or monitor for fraudulent activity also falls under this category.

Pre-approved credit card offers also trigger soft inquiries. These inquiries are used by lenders to target potential customers and do not reflect negatively on your credit profile.

Hard Inquiries: When Credit Checks Matter

A hard inquiry, also known as a "hard pull," occurs when you apply for new credit, such as a mortgage, car loan, or credit card. Lenders use hard inquiries to assess your creditworthiness and determine whether to extend you credit.

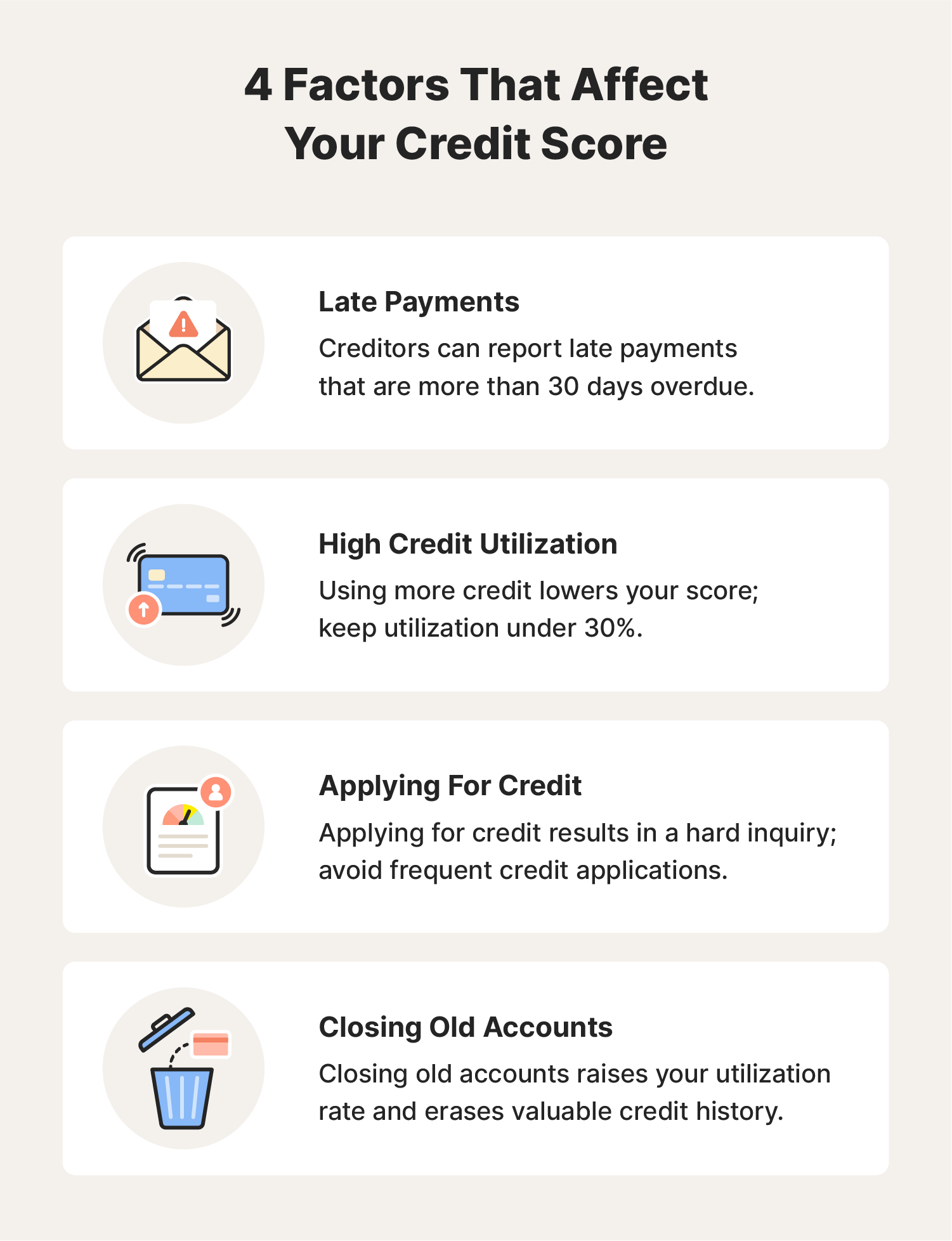

Unlike soft inquiries, hard inquiries can slightly lower your credit score. The impact is typically minimal, often just a few points, and usually fades within a few months.

Why Hard Inquiries Impact Your Score

Credit scoring models, like FICO and VantageScore, consider hard inquiries as an indicator of your credit-seeking behavior. Multiple hard inquiries within a short period can signal to lenders that you are potentially desperate for credit, which can be viewed as a higher risk.

However, it's important to note that the impact of hard inquiries diminishes over time. A single hard inquiry is unlikely to significantly damage your credit score, especially if you have a strong credit history.

How to Manage Credit Inquiries Wisely

While checking your credit score through soft inquiries is encouraged, managing hard inquiries is crucial for maintaining a healthy credit profile. Avoid applying for multiple credit products simultaneously, especially if you don't need them.

If you are shopping for a specific type of loan, like a mortgage, understand the "rate shopping" exception. Credit scoring models often treat multiple inquiries for the same type of loan within a short period (e.g., 14 to 45 days) as a single inquiry, minimizing the impact on your score.

Regularly review your credit reports from all three major bureaus to ensure accuracy and identify any unauthorized activity. You can access your free credit reports annually at AnnualCreditReport.com. Dispute any errors or inaccuracies you find to protect your credit standing.

Expert Opinions and Data

The Consumer Financial Protection Bureau (CFPB) consistently emphasizes the importance of monitoring your credit reports regularly. They state clearly that checking your own credit report will not lower your score.

FICO, a leading credit scoring company, has published numerous resources explaining the difference between hard and soft inquiries. Their data indicates that the impact of a single hard inquiry is generally small and temporary.

Conclusion: Stay Informed, Stay in Control

The myth that checking your credit score harms your credit is largely dispelled by understanding the distinction between soft and hard inquiries. Soft inquiries, which occur when you check your own credit, are harmless and encouraged for responsible financial management. Hard inquiries, triggered by applications for new credit, can have a minor and temporary impact.

By monitoring your credit through soft inquiries and managing your applications for new credit carefully, you can stay informed about your credit health without negatively impacting your score. Staying proactive and informed is the best way to maintain a strong credit profile and achieve your financial goals.

![Does It Lower Your Credit Score To Check It Short-Term Loans and Credit Ratings [What You Need to Know]](https://powerfinancetexas.com/wp-content/uploads/2019/12/PowerFinan_Avoid-a-Lower-Credit-Score-_inf-1-1.jpg)

:max_bytes(150000):strip_icc()/common-things-that-improve-and-lower-credit-scores2-f5cf389fdf4f46579ddcc49d8db40525.png)