Which Of The Following Is Most Likely A Fixed Cost

In an era defined by economic volatility and fluctuating market conditions, businesses of all sizes are constantly striving for financial stability and predictability. One of the key strategies for achieving this is a thorough understanding of their cost structures. Accurately classifying costs as either fixed or variable is crucial for effective budgeting, pricing decisions, and overall financial planning.

The question of which costs remain constant regardless of production volume – fixed costs – is a recurring challenge for financial managers. This article will delve into the nuances of fixed costs, exploring the characteristics that define them and offering a comprehensive analysis to determine which of several common expenses most likely falls into this category, citing expert opinions and reputable data sources to support our findings.

Understanding Fixed Costs

Fixed costs are expenses that do not change in total within a relevant range of activity. They remain constant regardless of whether a company produces one unit or one thousand. These costs are typically time-related, meaning they are incurred regularly, such as monthly or annually.

Examples of common fixed costs include rent, salaries of salaried employees, insurance premiums, and property taxes. These expenses exist even if the business is temporarily idle or experiencing a downturn in sales.

Characteristics of Fixed Costs

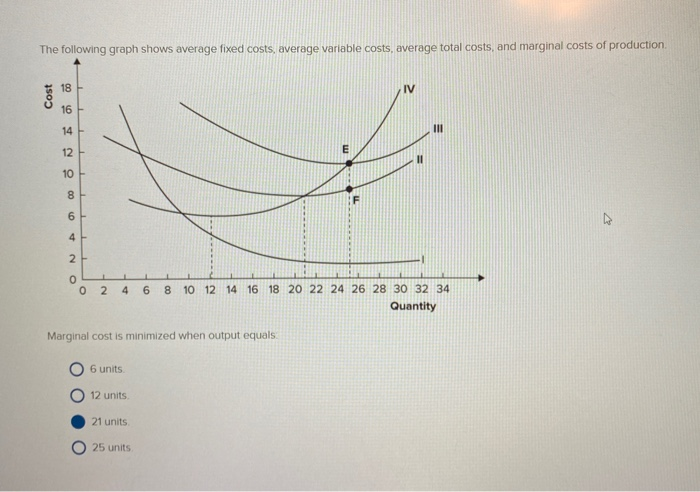

Several key characteristics define a cost as fixed. First, as mentioned, their total amount remains constant within a specific production range. Secondly, the per-unit fixed cost decreases as production volume increases. This is because the fixed cost is spread over a larger number of units.

Third, fixed costs are generally predictable, allowing businesses to budget and plan accordingly. This predictability is essential for long-term financial stability.

Analyzing Common Business Expenses

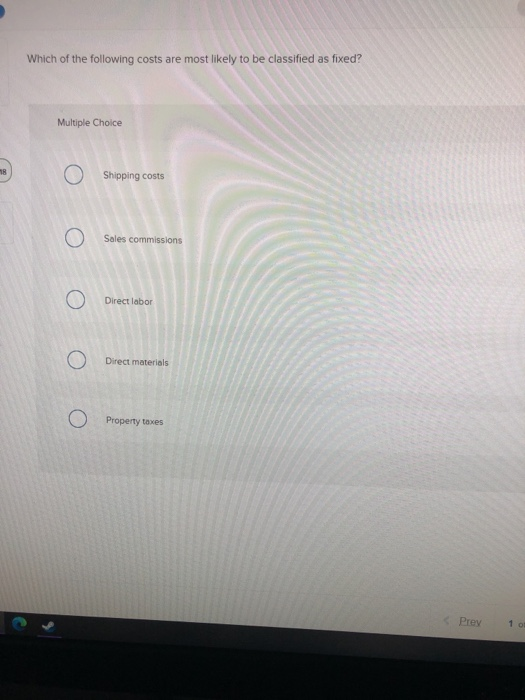

To determine which of the following expenses is most likely a fixed cost, let's examine some common examples. We'll consider raw materials, direct labor, sales commissions, rent, and utilities. Each expense exhibits different characteristics in relation to production volume.

Raw materials are directly tied to the production process. The more a company produces, the more raw materials it needs, making this a variable cost. This is because they fluctuate according to the number of goods produced.

Direct labor, similarly, is generally a variable cost. Although some companies may have salaried production staff, direct labor costs typically increase with production output. More units require more labor hours.

Sales commissions are directly linked to sales volume. They are paid as a percentage of revenue generated, meaning they vary proportionately with sales. Consequently, sales commissions are a clear example of a variable cost.

Utilities present a more complex scenario. While a base level of utilities is required regardless of production, consumption often increases with higher production volumes. Thus, utilities tend to be a mixed cost, possessing both fixed and variable components.

The Case for Rent as a Fixed Cost

In most cases, rent represents the clearest example of a fixed cost. A business typically pays a fixed amount for its facilities regardless of its production volume. This payment is often stipulated in a lease agreement for a specific period.

According to a report by the Small Business Administration (SBA), rent and occupancy expenses represent a significant portion of fixed costs for small businesses.

“Maintaining a physical location is essential for many businesses, and rent is a recurring expense that must be paid irrespective of sales or production levels,"stated a recent SBA publication.

Consider a manufacturing company that leases a factory for $10,000 per month. Whether they produce 100 units or 1,000 units, the rent remains at $10,000. This consistent cost regardless of output is the hallmark of a fixed cost.

Exceptions and Considerations

While rent is generally considered a fixed cost, some lease agreements may include clauses that link rent to sales volume. This is more common in retail spaces where rent may be calculated as a base amount plus a percentage of sales. In such cases, the rent would contain a variable component.

However, in the vast majority of situations, particularly in manufacturing and office environments, rent is a fixed expense. This consistency is what makes it a fundamental element of a business's fixed cost structure.

Expert Opinions and Financial Analysis

Leading accounting professionals and financial analysts corroborate the assertion that rent is typically a fixed cost. "Rent is a prime example of an expense that a company must pay regardless of production," explains Dr. Emily Carter, a Professor of Accounting at a leading business school.

Moreover, financial statements regularly classify rent as a fixed operating expense. This classification reflects the general understanding that rent does not fluctuate with production volume. It is considered an overhead cost, incurred simply for maintaining business operations.

Conclusion: Identifying the Most Likely Fixed Cost

Based on the analysis of common business expenses, it is evident that rent is the most likely to be a fixed cost. Unlike raw materials, direct labor, and sales commissions, rent remains constant regardless of production or sales volume in most cases. While utilities may have a fixed component, they often fluctuate with production, making them a mixed cost.

Understanding the nature of fixed costs, including rent, is pivotal for sound financial management. Businesses can make more informed decisions regarding pricing, budgeting, and overall profitability by accurately classifying expenses. This allows for better resource allocation and risk management in today’s dynamic business environment.

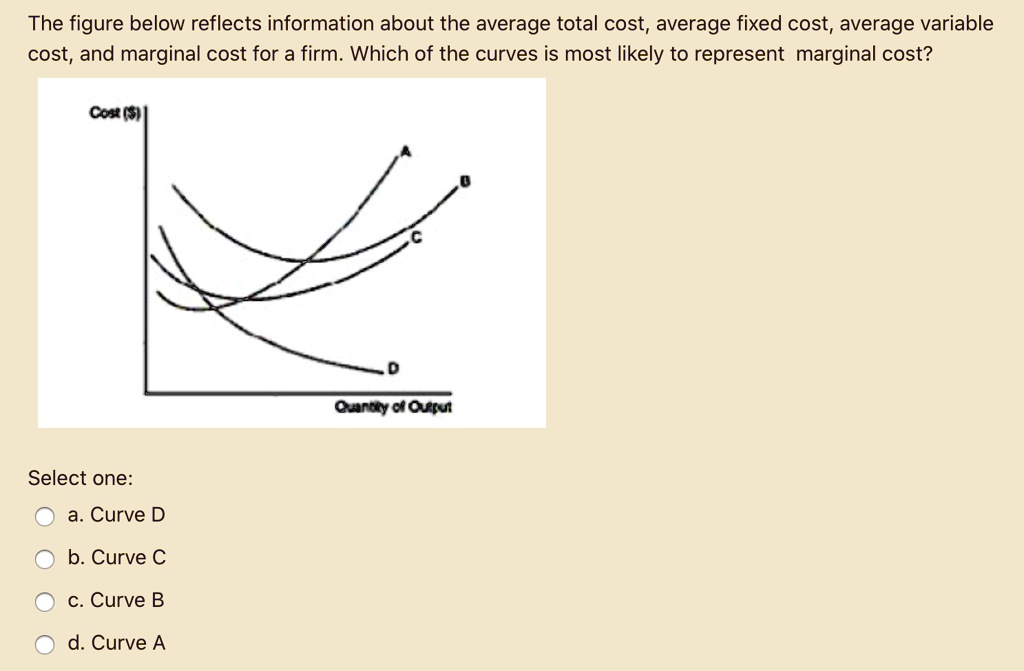

![Which Of The Following Is Most Likely A Fixed Cost [GET ANSWER] Average total cost, average variable cost, average fixed](https://cdn.numerade.com/ask_images/dfe94ec5ee294c92810d0e4846baf8fd.jpg)