A Manufacturing Company Calculates Cost Of Goods Sold As Follows

Breaking: Apex Manufacturing's unconventional Cost of Goods Sold (COGS) calculation sparks industry-wide concern. The company's valuation and financial stability are now under intense scrutiny.

Apex Manufacturing, a prominent player in the automotive parts sector, is facing backlash after its unique COGS calculation method was revealed. This revelation has triggered immediate investigations and raised questions about the accuracy of its reported profits.

Apex Manufacturing's COGS Calculation: The Details

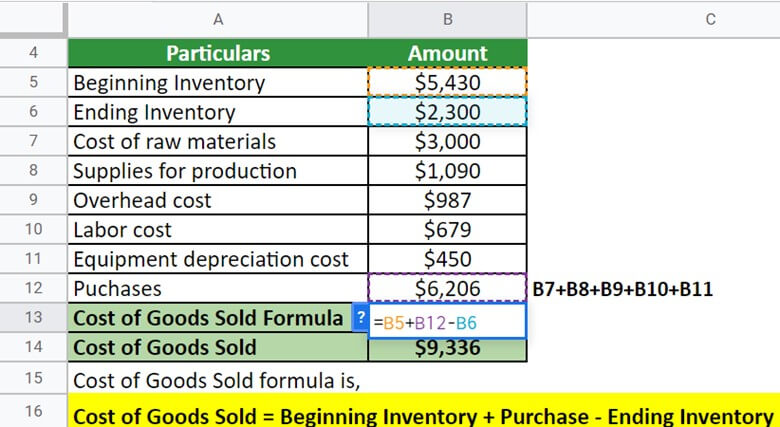

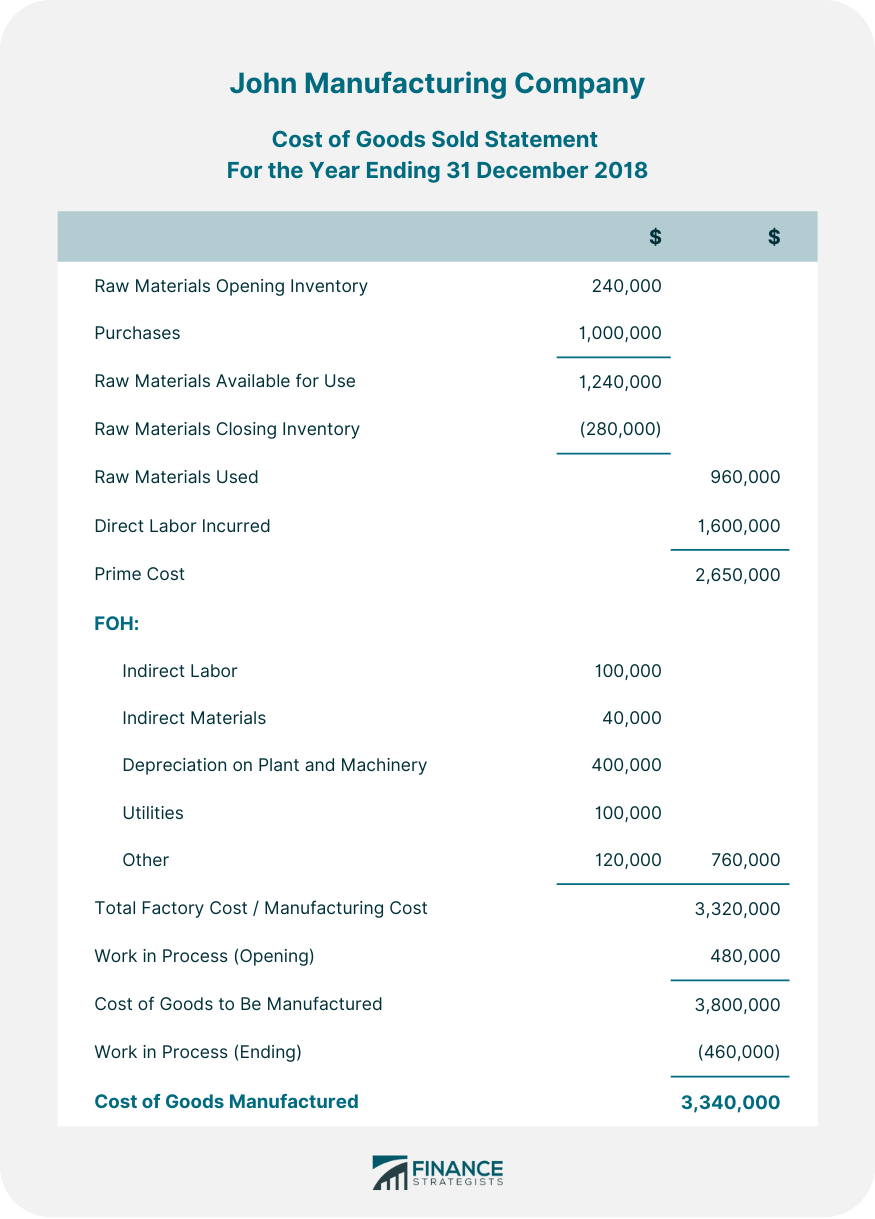

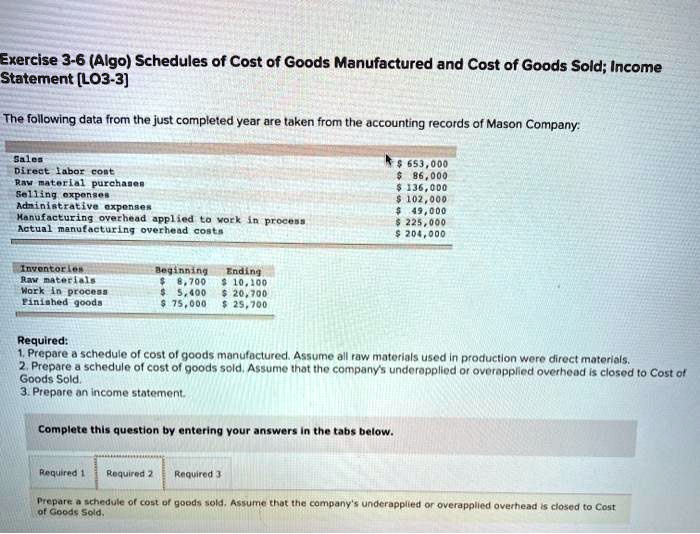

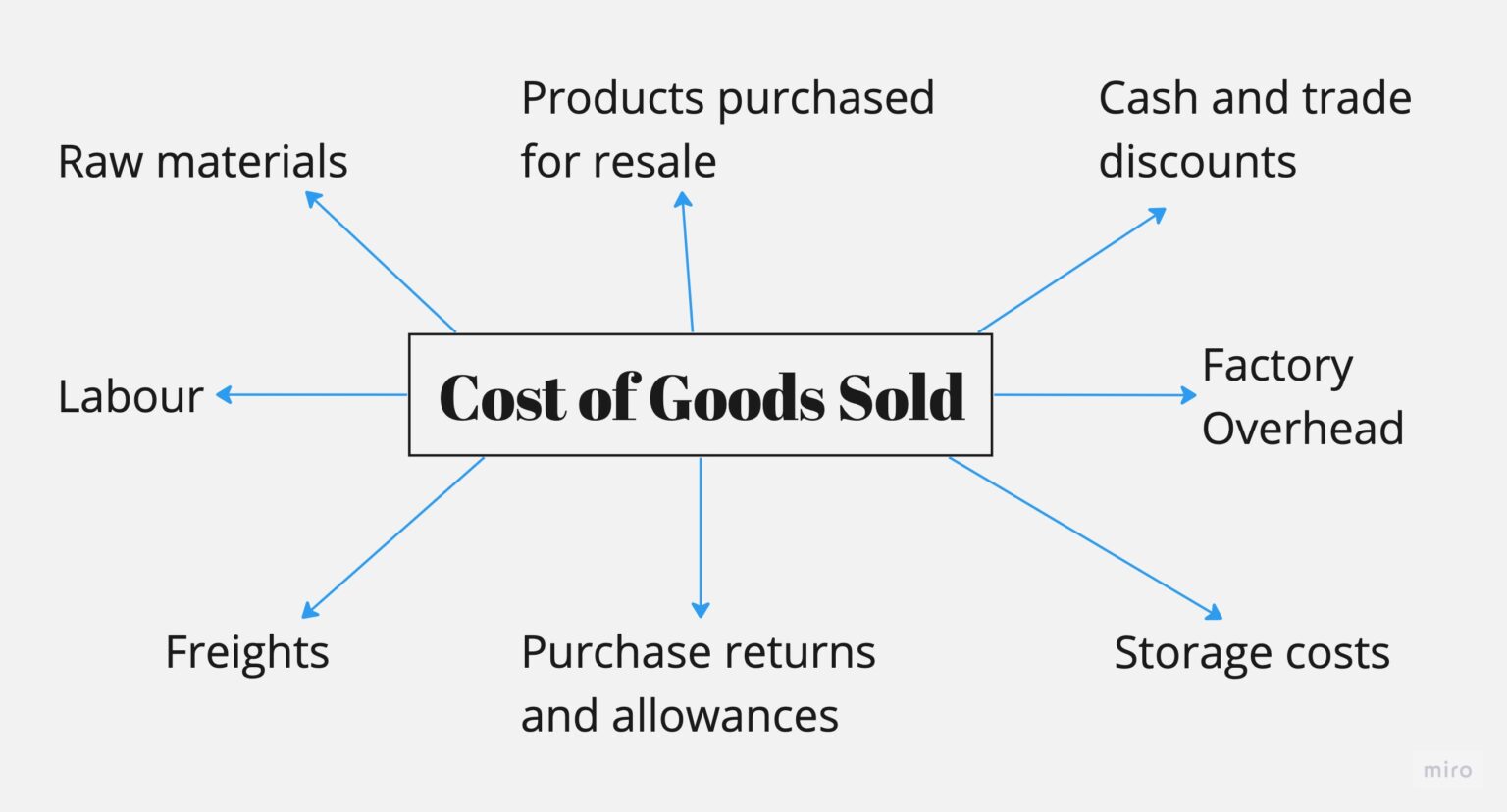

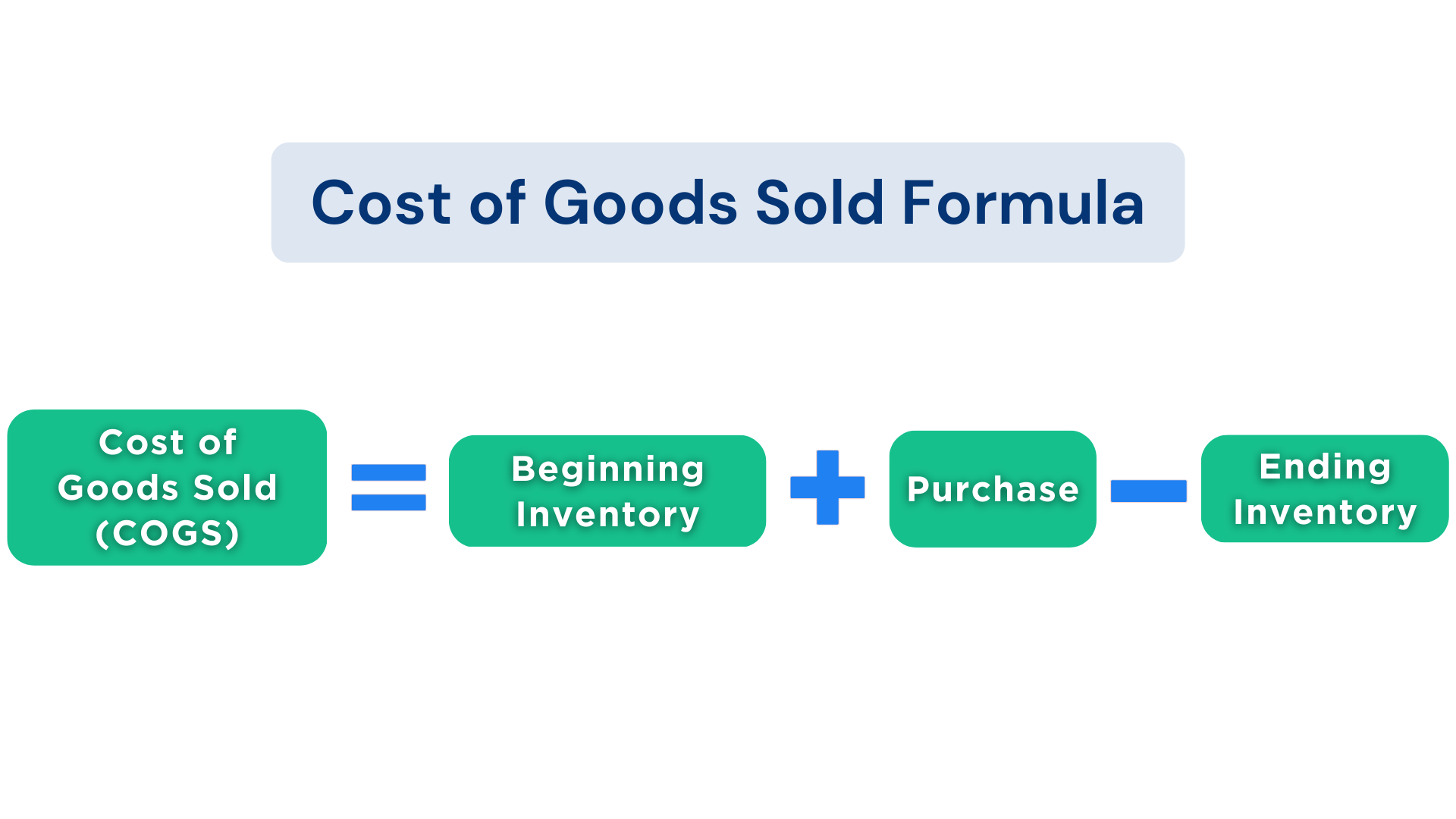

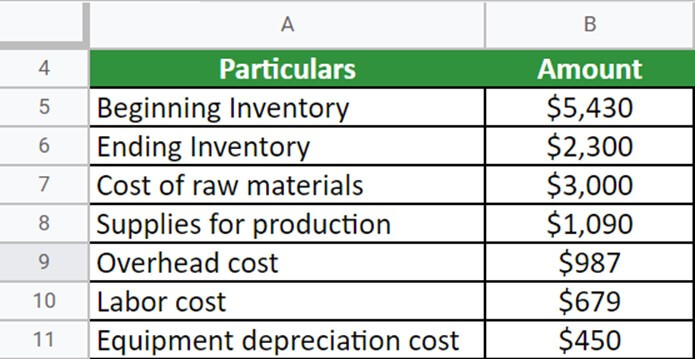

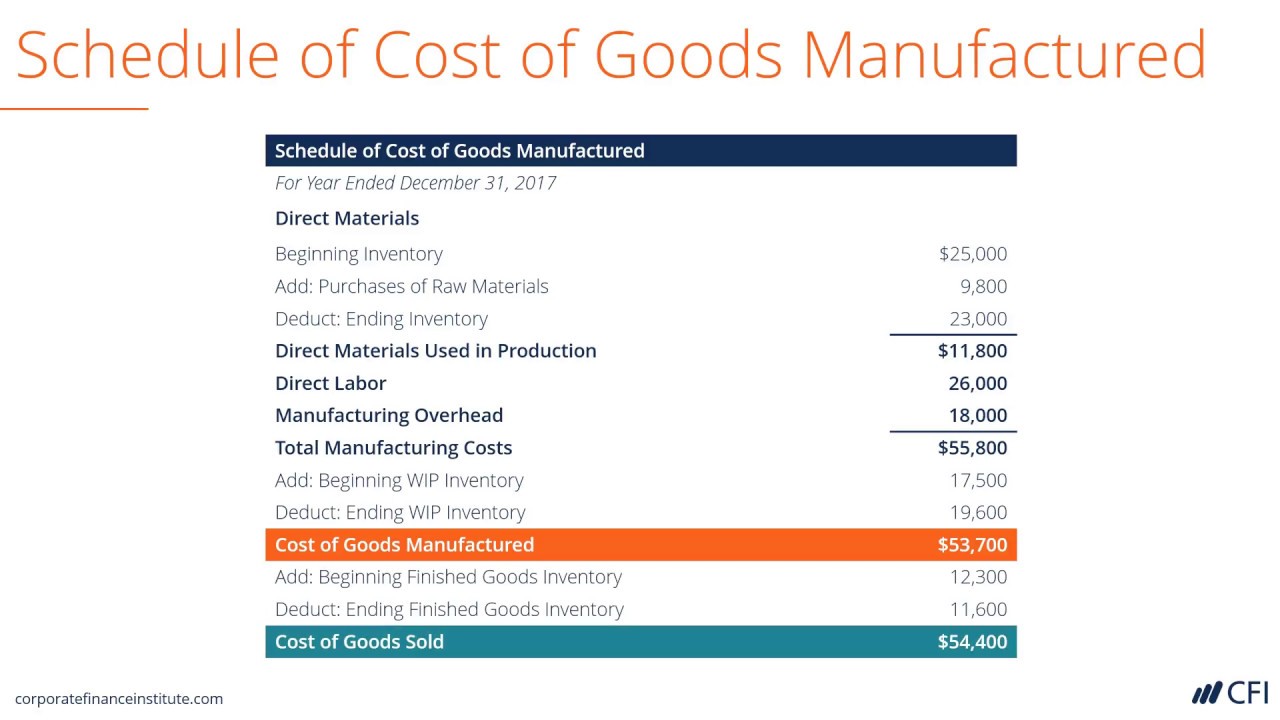

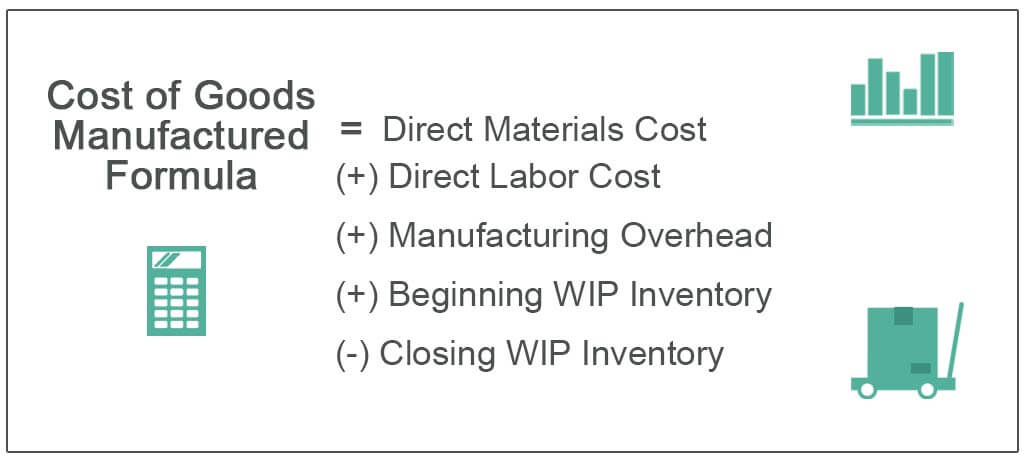

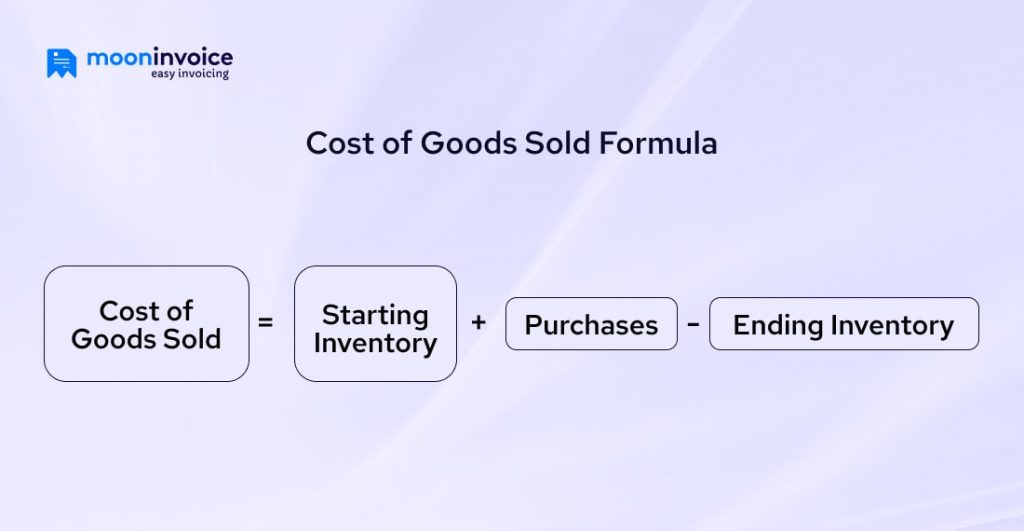

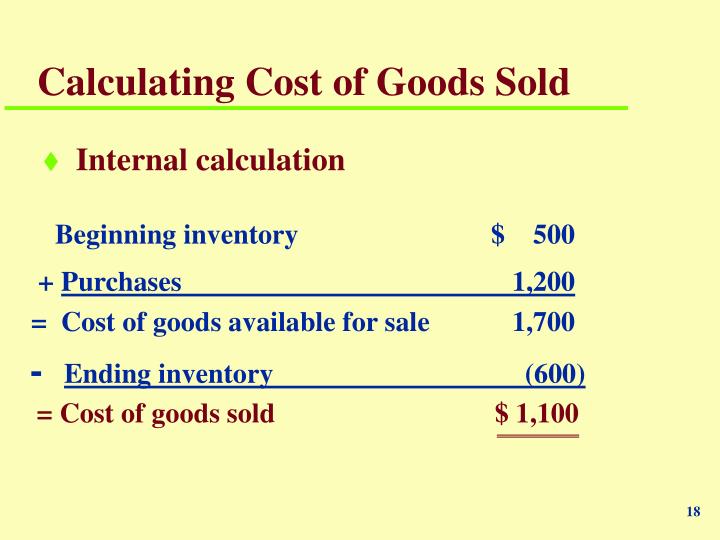

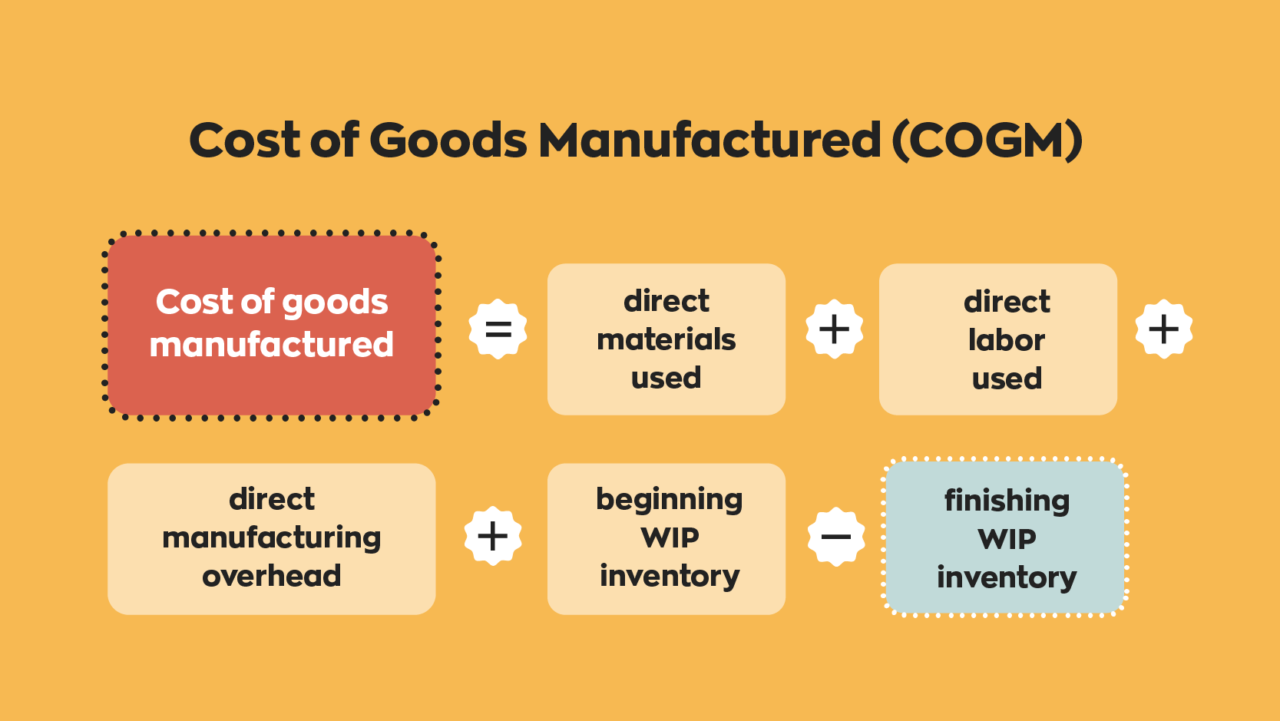

The core issue revolves around how Apex Manufacturing accounts for various expenses in its COGS. Traditional COGS calculations typically include direct materials, direct labor, and manufacturing overhead. Apex's approach deviates significantly from this established norm.

Specifically, Apex includes a substantial portion of its R&D expenses, typically considered operating expenses, within its COGS. This inflates the COGS figure and, conversely, potentially lowers reported profits.

Furthermore, the company amortizes capital expenditures related to factory equipment over a significantly shorter period compared to industry standards. This accelerated depreciation artificially boosts COGS.

"The way Apex is allocating expenses is highly unusual," stated Sarah Chen, a senior financial analyst at Veritas Analytics. "It raises serious red flags about transparency and earnings management."

Impact on Financial Statements

The immediate consequence of Apex's COGS calculation is a potential misrepresentation of its financial health. Inflated COGS can mask operational inefficiencies and create a distorted picture of profitability.

Analysts are now scrambling to reassess Apex's past financial statements and project future performance. The revised figures could significantly impact the company's stock price and credit rating.

MarketWatch reports that Apex's stock (APMX) has already fallen by 15% since the news broke. Further declines are anticipated as investors digest the implications of the COGS controversy.

Regulatory Scrutiny and Legal Ramifications

The Securities and Exchange Commission (SEC) has launched a formal inquiry into Apex's accounting practices. This investigation could lead to significant penalties and legal repercussions for the company's executives.

"The SEC takes matters of financial misrepresentation extremely seriously," commented David Miller, a former SEC enforcement attorney. "Apex could face hefty fines and potential criminal charges."

Several shareholder lawsuits have already been filed, alleging that Apex misled investors about its financial performance. These lawsuits seek substantial damages and demand greater corporate accountability.

Who, What, Where, When, How

Who: Apex Manufacturing, a leading automotive parts manufacturer.

What: An unconventional COGS calculation method that includes R&D expenses and accelerated depreciation.

Where: The company's headquarters are located in Detroit, Michigan.

When: The COGS calculation methodology has been in place for the past five fiscal years, coming to light this current quarter.

How: By allocating R&D and using accelerated depreciation on assets within COGS, which differs from standard industry practices.

Expert Opinions and Industry Reactions

Industry experts are divided on the motivation behind Apex's COGS calculation. Some suggest it may be a deliberate attempt to manipulate earnings, while others argue it could be a misguided effort to optimize tax liabilities.

Other manufacturing companies are closely monitoring the Apex situation and reassessing their own accounting practices. The incident has prompted a broader discussion about transparency and standardization in financial reporting.

"This situation underscores the importance of rigorous auditing and independent oversight," emphasized Emily Carter, a professor of accounting at the University of Chicago.

Next Steps and Ongoing Developments

The SEC investigation is ongoing, and its findings are expected to be released within the next few months. Apex has hired an independent accounting firm to conduct an internal review of its financial statements.

The outcome of the shareholder lawsuits will likely hinge on the SEC's findings and the extent to which Apex can demonstrate good faith. The stock price of APMX remains highly volatile.

Investors and industry stakeholders are urged to closely monitor developments in this case, as it has significant implications for the future of Apex Manufacturing and the broader financial reporting landscape.