Hdfc Hybrid Equity Fund Direct Growth Morningstar

HDFC Hybrid Equity Fund Direct Growth, a popular investment option for those seeking a blend of equity and debt, has been closely watched by investors and market analysts alike. Recent performance data and Morningstar ratings have spurred discussions about the fund's strategy, risk profile, and future prospects. This article delves into the details surrounding this fund, examining its performance, portfolio composition, and expert opinions.

The HDFC Hybrid Equity Fund Direct Growth aims to provide long-term capital appreciation and income by investing in a mix of equity and debt instruments. Its diversified approach seeks to balance risk and return, making it an attractive option for investors with a moderate risk appetite. The fund's performance is often benchmarked against similar hybrid equity funds and broader market indices.

Fund Performance and Morningstar Rating

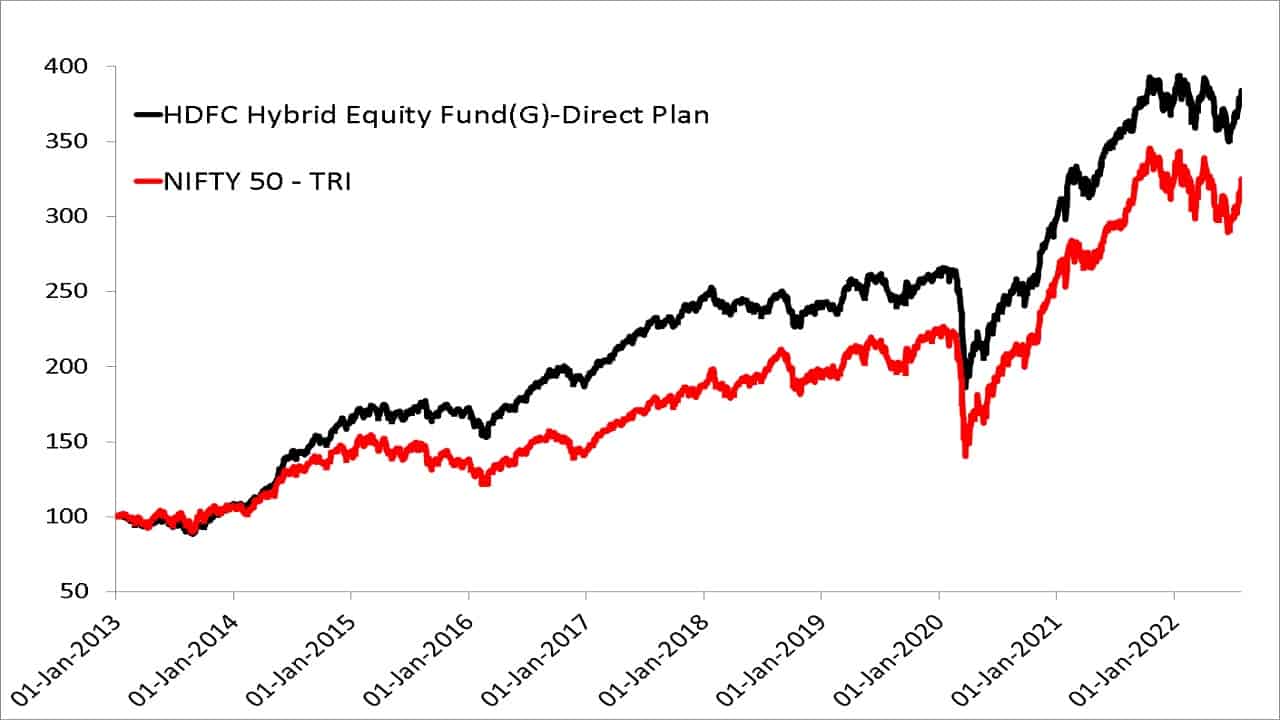

The fund's performance over the past year has been a key focus, with investors analyzing its returns relative to its benchmark and peers. Morningstar, a leading investment research firm, provides ratings that reflect a fund's risk-adjusted performance. These ratings are a significant factor influencing investor decisions.

The Morningstar rating for HDFC Hybrid Equity Fund Direct Growth is a widely consulted metric. It assesses the fund's performance based on factors such as returns, risk, and fees. A higher rating typically indicates better risk-adjusted returns compared to its peers.

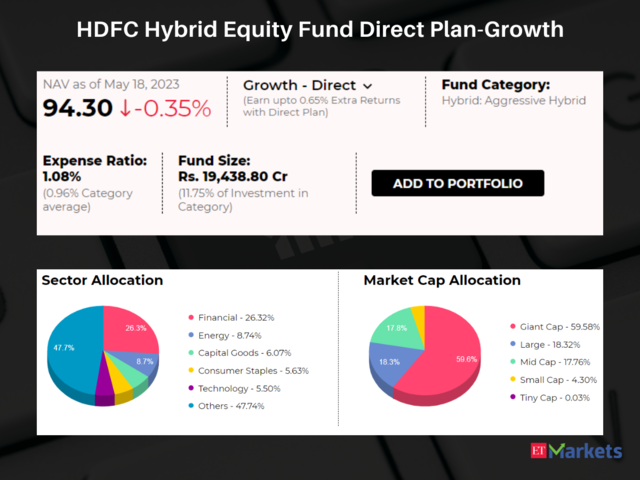

Recent data suggests fluctuations in the fund's Net Asset Value (NAV), influenced by market volatility and the fund's investment decisions. Analysis of the fund's historical performance provides valuable insights into its ability to navigate different market conditions.

Portfolio Composition and Investment Strategy

The fund's portfolio consists of a mix of equity and debt securities. The allocation between these asset classes is strategically managed to achieve the fund's objectives. The fund managers actively adjust the portfolio based on market outlook and economic conditions.

The equity component of the portfolio typically includes stocks across various sectors and market capitalizations. The debt component comprises government securities, corporate bonds, and other fixed-income instruments. The specific allocation strategy can influence the fund's overall risk and return profile.

Fund fact sheets and investor presentations provide detailed information about the fund's holdings and investment strategy. These resources offer transparency and help investors understand the fund's approach to managing risk and generating returns.

Expert Opinions and Market Analysis

Market analysts offer varying perspectives on the HDFC Hybrid Equity Fund Direct Growth. Some analysts emphasize the fund's consistent performance and diversified portfolio. Others highlight the importance of considering individual investor risk tolerance and investment goals.

Investment advisors often recommend this fund as part of a diversified portfolio strategy. They emphasize the benefits of hybrid funds in balancing risk and return. The fund's performance is often compared to other hybrid funds in the market.

Changes in market dynamics, such as interest rate movements and economic growth, can impact the fund's performance. Investors are advised to stay informed about market trends and their potential impact on their investments.

Potential Impact on Investors

The performance of HDFC Hybrid Equity Fund Direct Growth directly impacts the returns for its investors. The fund's ability to generate consistent returns is crucial for achieving long-term financial goals. Investors should carefully assess the fund's suitability based on their individual circumstances.

For investors seeking a blend of equity and debt, this fund can be a valuable addition to their portfolio. The fund's diversified approach can help mitigate risk and enhance returns. However, it's essential to consult with a financial advisor before making any investment decisions.

Ultimately, the success of an investment in the HDFC Hybrid Equity Fund Direct Growth depends on various factors, including market conditions, fund management decisions, and investor behavior. Ongoing monitoring and periodic review are crucial for ensuring that the fund continues to align with the investor's goals.