How To Find A Bank Identification Code

Finding the correct Bank Identification Code (BIC), also known as a SWIFT code, is crucial for seamless international money transfers and other financial transactions. These codes, standardized globally, ensure that funds reach the intended bank accurately and efficiently.

This article outlines the various methods to locate a bank's BIC, helping individuals and businesses navigate the complexities of international banking. Understanding how to reliably obtain this information is essential for preventing delays and potential errors in financial dealings.

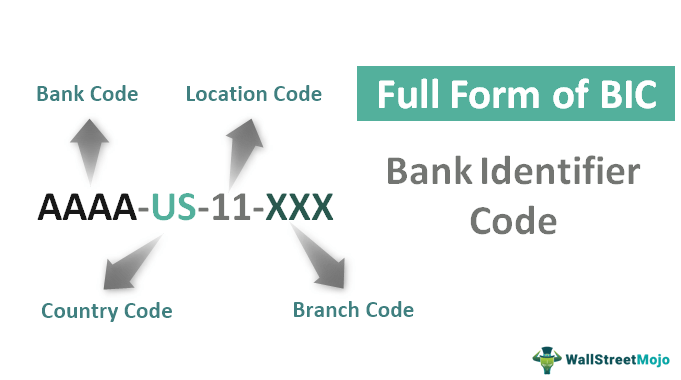

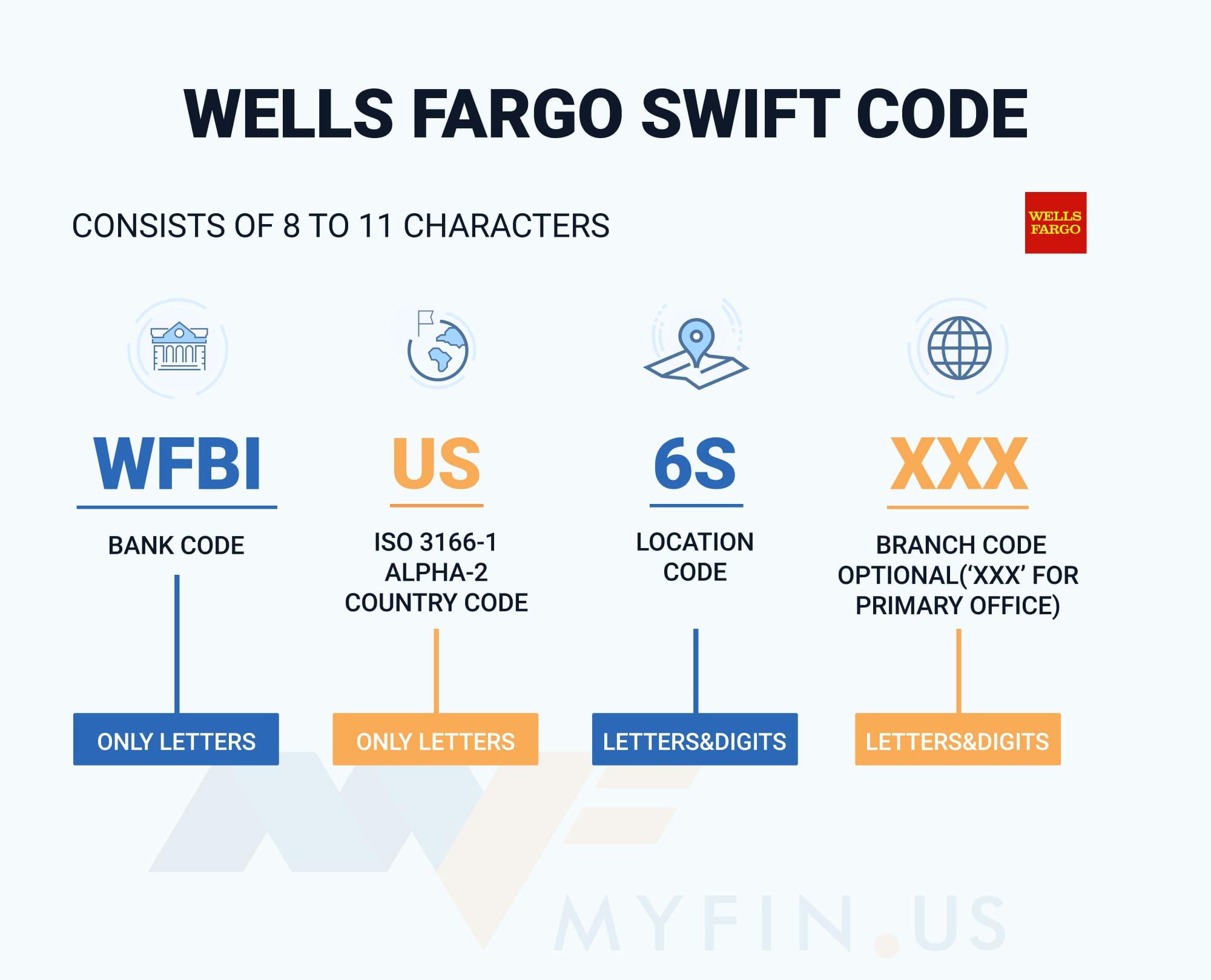

What is a BIC/SWIFT Code?

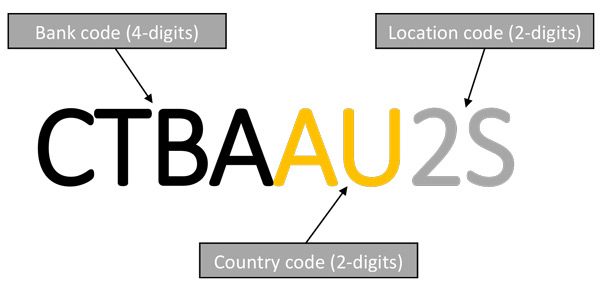

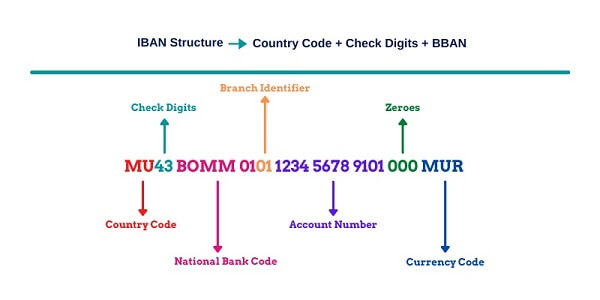

A BIC (Bank Identifier Code) or SWIFT code (Society for Worldwide Interbank Financial Telecommunication) is an 8 or 11-character alphanumeric code. SWIFT is the network used to transmit messages between banks, and the BIC is the address of the bank on that network.

The code identifies a specific bank or branch, allowing for the routing of international payments. It acts like an international postal code for financial institutions, ensuring money arrives at the correct destination.

Methods to Find a Bank's BIC

1. Bank Statements and Online Banking

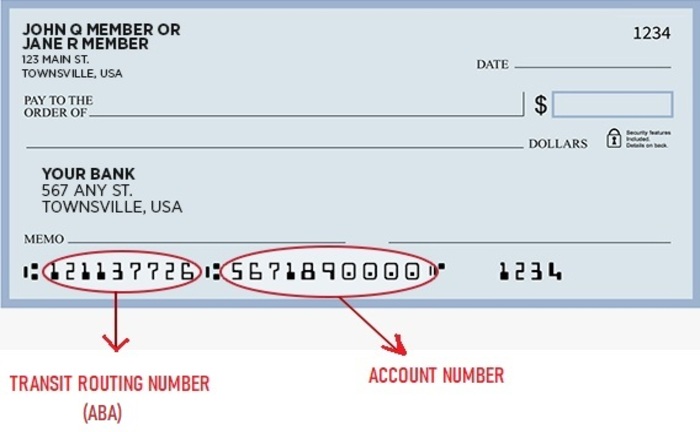

One of the most reliable sources is your bank statement. Many banks include the BIC prominently on account statements, both paper and electronic.

Similarly, logging into your online banking portal often provides easy access to your bank's BIC. Check account details or the profile section for this information.

2. Bank's Website

Most banks list their BIC on their official website. Look for a section dedicated to international transfers or payments, often found under the "About Us" or "Contact Us" pages.

Use the bank's search function to specifically search for "SWIFT code" or "BIC."

3. SWIFT Code Finders

Several online SWIFT code finder tools are available, allowing you to search for a BIC based on the bank's name and location. These tools aggregate information from various sources, providing a convenient search method.

Be cautious when using these tools, verifying the information against other sources. Some websites may not be regularly updated, potentially leading to inaccurate results.

4. Contacting the Bank Directly

The most direct method is to contact the bank directly, either by phone, email, or in person. A customer service representative can provide the correct BIC for your specific branch.

When contacting the bank, be prepared to provide your account details for verification purposes. This helps ensure that you receive the correct information and maintain account security.

5. Using the SWIFT Code Directory

SWIFT itself maintains a directory of BICs, although accessing the complete directory may require a subscription. Partial information can sometimes be found through searches on the SWIFT website.

This is generally the most authoritative source, but may not be readily accessible to all individuals.

Importance of Accurate BIC Information

Providing an incorrect BIC can lead to significant problems. Payments may be delayed, returned, or even sent to the wrong bank.

Incorrect BIC information could also result in additional fees charged by intermediary banks involved in the transfer process. Always double-check the BIC before initiating any international transaction.

Incorrect details can cause frustration and financial loss. Verifying the BIC with the recipient bank can prevent potential issues.

Potential Impact

Accurate BIC information is crucial for international trade, remittances, and various cross-border financial activities. Efficient and error-free transactions contribute to a stable global economy.

For individuals, knowing how to find and verify a BIC ensures they can send and receive money internationally with confidence. This simplifies financial interactions with family, friends, or businesses abroad.

Conclusion

Locating a bank's BIC requires diligence and the use of reliable resources. By utilizing the methods outlined above, individuals and businesses can confidently navigate international financial transactions.

Always prioritize verification to avoid errors and ensure smooth processing of funds. The accessibility of BIC information empowers individuals to engage in the global economy with greater ease and security.

:max_bytes(150000):strip_icc()/TermDefinitions_BankIDnumber-d39a1dfb247e45b2814f94900dfed98d.jpg)