Hdfc Mortgage Loan Interest Rate 2017

The year 2017 witnessed significant fluctuations and strategic recalibrations in India's housing finance sector, with HDFC, a leading mortgage lender, playing a pivotal role. Understanding the nuances of HDFC's mortgage loan interest rates during this period is crucial for comprehending the broader economic landscape and its impact on potential homeowners.

This article delves into a comprehensive analysis of HDFC's mortgage loan interest rates in 2017, examining the factors that influenced these rates, the competitive environment, and the overall implications for borrowers. It aims to provide a clear picture of the affordability and accessibility of home loans during that year, drawing on available data and expert commentary.

Interest Rate Trends and Influencing Factors

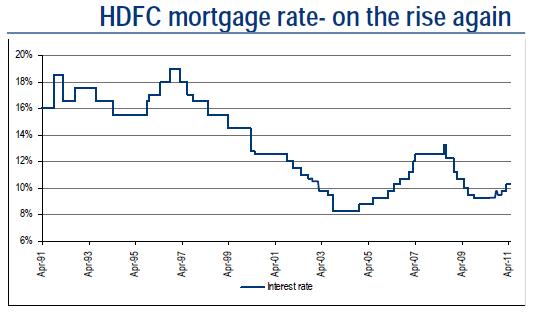

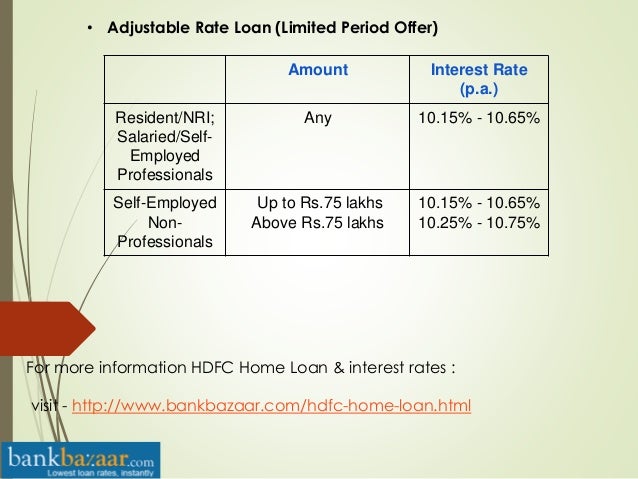

In 2017, HDFC's mortgage loan interest rates were subject to the prevailing economic conditions and monetary policy decisions by the Reserve Bank of India (RBI). The RBI's stance on key policy rates, such as the repo rate, directly influenced the cost of funds for lenders like HDFC.

Consequently, these fluctuations were passed on to consumers in the form of adjusted interest rates on home loans. Changes in inflation, economic growth, and liquidity in the market also played a significant role in shaping HDFC's interest rate strategy.

During the first half of 2017, interest rates generally followed a downward trend, reflecting the RBI's accommodative monetary policy stance aimed at boosting economic growth. However, towards the latter part of the year, there was some upward pressure due to rising inflation and global economic uncertainties.

Competitive Landscape

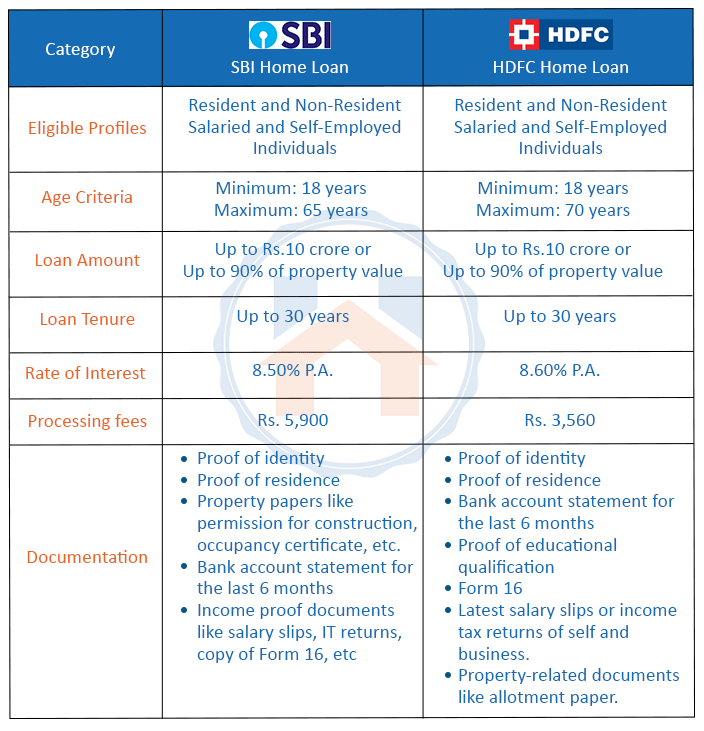

HDFC operated in a highly competitive mortgage market, facing competition from other major players like State Bank of India (SBI), ICICI Bank, and various housing finance companies. Each lender vied for market share by offering attractive interest rates and customized loan products.

HDFC's interest rate decisions were, therefore, heavily influenced by the strategies adopted by its competitors. To maintain its market position, HDFC had to carefully balance profitability with competitiveness in its interest rate offerings.

Often, lenders would offer promotional schemes or special rates for specific customer segments, such as first-time homebuyers or those with excellent credit scores. The competition also led to innovative loan features, such as longer repayment tenures and flexible repayment options.

Impact on Borrowers

The interest rate environment in 2017 had a direct impact on the affordability and accessibility of home loans for potential borrowers. Lower interest rates made homeownership more attainable, encouraging more people to enter the housing market.

Conversely, rising interest rates could increase the financial burden on borrowers, potentially dampening demand for home loans. The EMI (Equated Monthly Installment) burden on existing borrowers also varied with any changes to interest rates.

Furthermore, the interest rate environment influenced property prices and overall housing market activity. Periods of low interest rates often coincided with increased demand and rising property values.

Expert Opinions and Analysis

Financial analysts and real estate experts closely monitored HDFC's interest rate decisions and their impact on the housing market. Many analysts noted that HDFC's rates served as a benchmark for the industry.

In 2017, several experts highlighted the importance of borrowers carefully evaluating their financial capacity and considering various loan options before making a decision.

"It's always crucial for borrowers to compare interest rates, processing fees, and other charges offered by different lenders,"commented a financial analyst from a leading brokerage firm during an interview with Economic Times in July 2017.

Others emphasized the need for borrowers to assess their long-term financial goals and risk tolerance before taking on a home loan. Understanding the terms and conditions of the loan agreement was deemed vital for making informed decisions.

Conclusion and Forward Look

The mortgage loan interest rates offered by HDFC in 2017 reflected the complex interplay of economic factors, monetary policy decisions, and competitive pressures. Understanding these dynamics provides valuable insights into the housing finance market and its impact on borrowers.

Looking ahead, it's important to note that the housing finance landscape continues to evolve, with new technologies and innovative loan products transforming the industry. Borrowers should stay informed about current interest rate trends and carefully evaluate their options before making a home loan decision.

HDFC's role as a key player in the mortgage market will likely continue, and its interest rate decisions will continue to influence the housing sector. Careful monitoring of economic indicators and market trends will remain essential for both lenders and borrowers in navigating the evolving housing finance landscape.