High Velocity Sales Salesforce Pricing

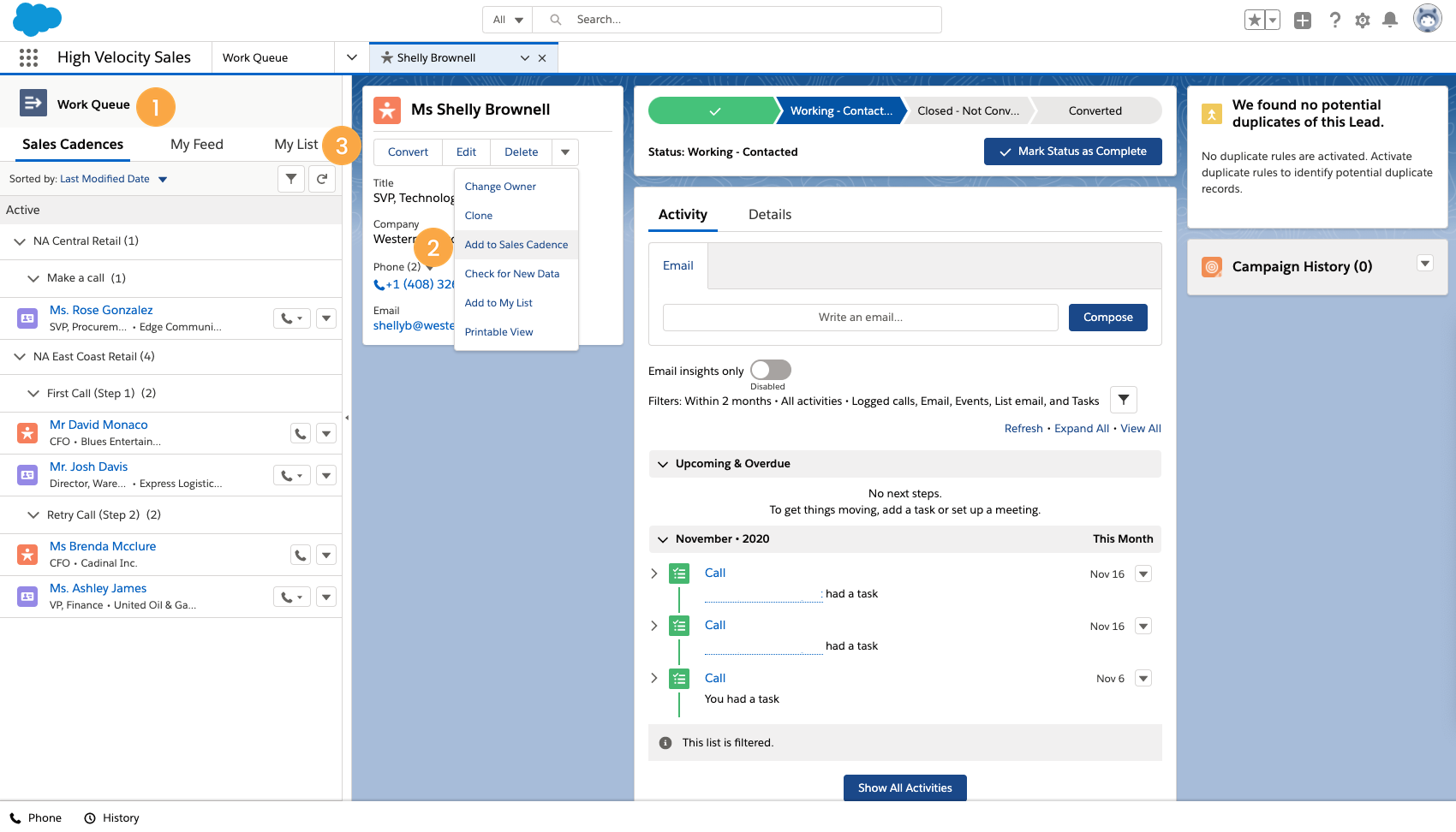

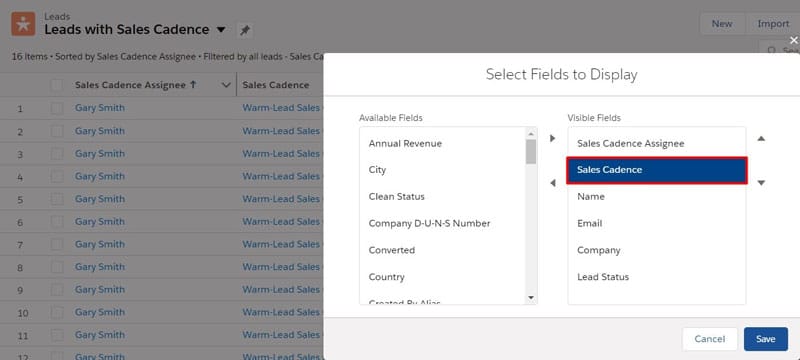

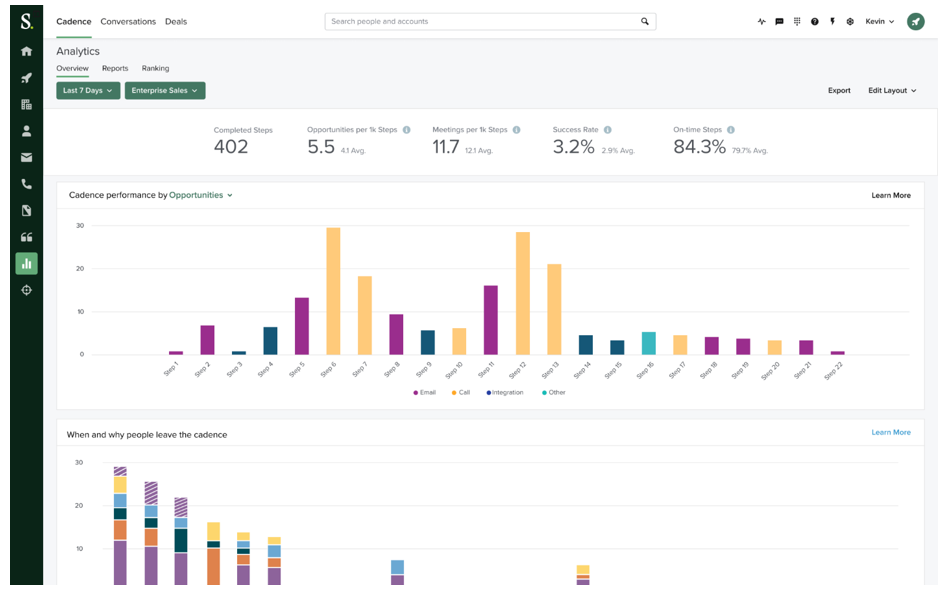

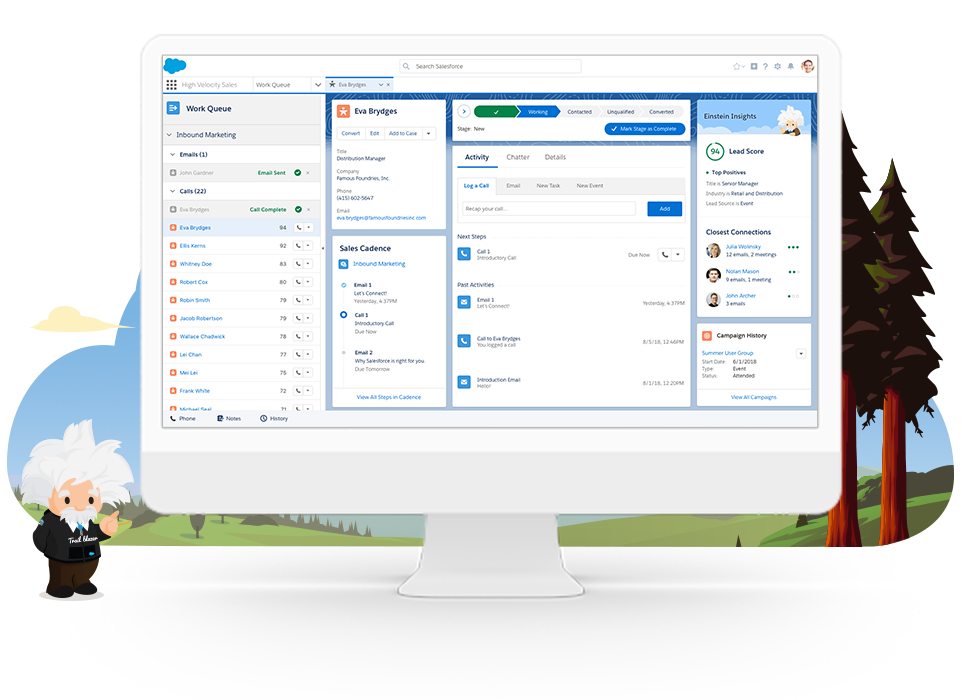

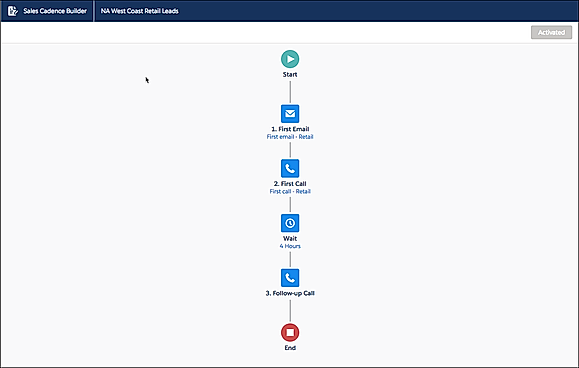

Salesforce's High Velocity Sales (HVS), a popular platform designed to accelerate sales processes for inside sales teams, has recently undergone a pricing structure shift, leaving many businesses reassessing their investments and strategies.

The pricing change, which took effect in [Insert Effective Date, e.g., Q3 2024], alters the cost per user per month, impacting organizations of varying sizes and sales models.

Understanding the Pricing Shift

The core of the update involves adjustments to the per-user monthly fees associated with HVS.

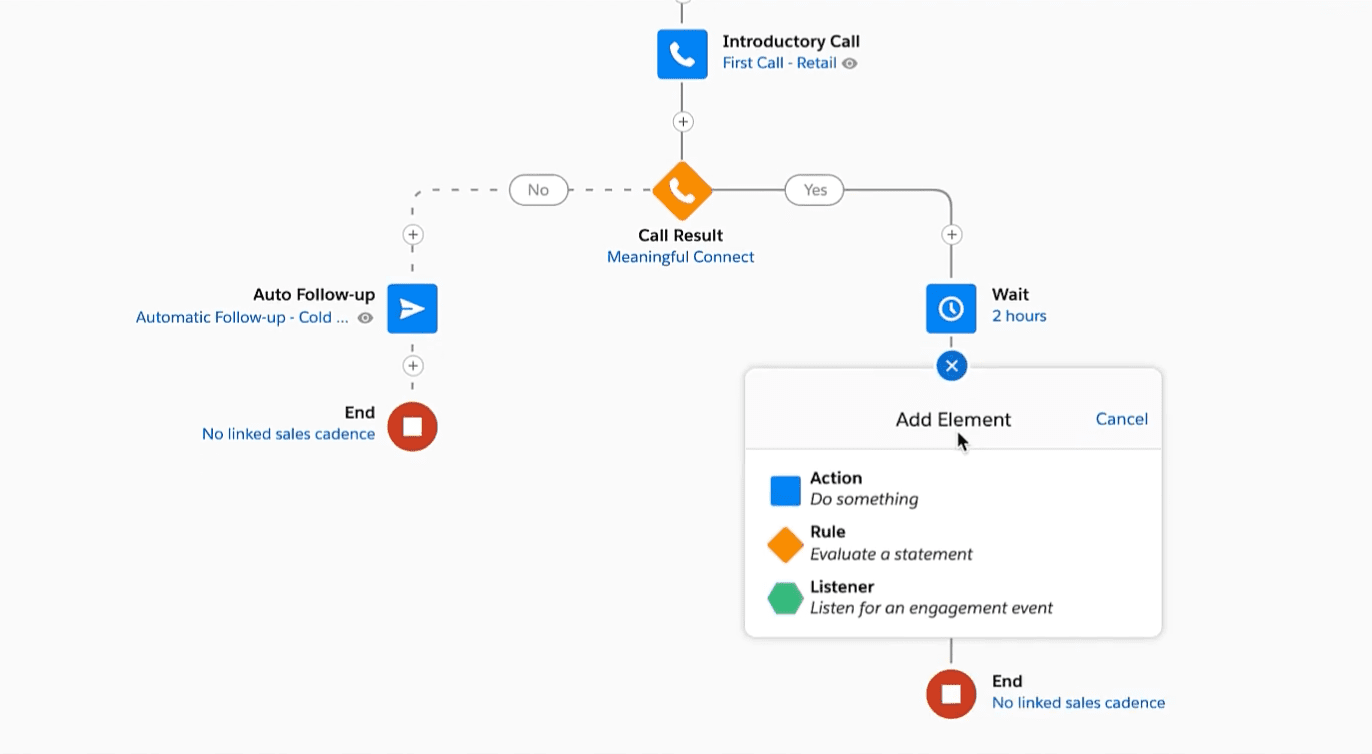

Previously, many companies utilized bundled pricing models, but the new structure seems to favor a more granular, feature-based approach. This has resulted in cost fluctuations depending on the specific HVS features a company utilizes.

Details of the New Pricing Structure

Salesforce has not released a comprehensive, publicly available pricing sheet outlining the changes.

Instead, the updated pricing is primarily communicated directly to customers through account representatives and during contract renewal discussions.

However, anecdotal evidence and reports from industry analysts suggest a possible increase for certain features and a shift towards add-on pricing for functionalities that were previously included in standard packages.

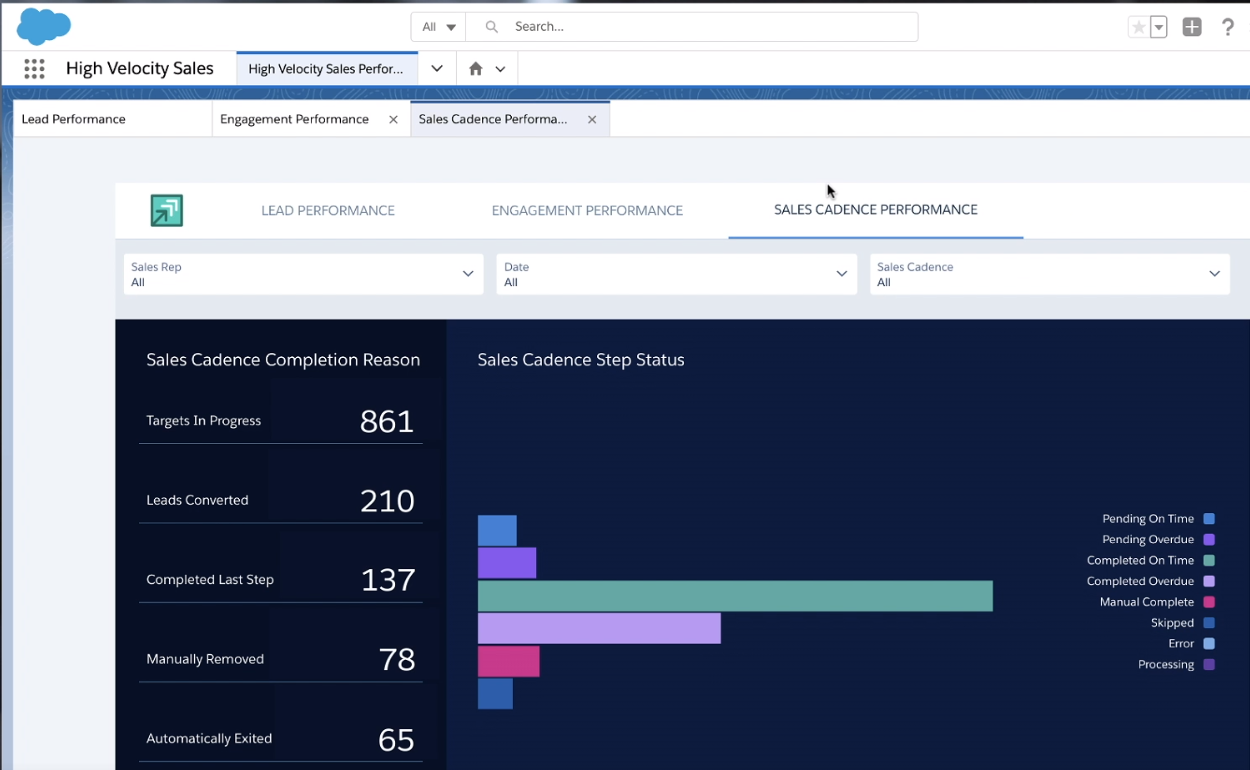

For example, advanced AI-powered features like lead scoring and opportunity insights, crucial elements for many high-velocity sales teams, may now come with additional costs. Salesforce has emphasized that this allows customers to tailor their HVS implementation to their specific needs and only pay for the features they use.

Impact on Businesses

The pricing change has triggered a wave of analysis and adjustments among businesses that rely on HVS.

Smaller companies with limited budgets are particularly concerned, as the increase in per-user costs could significantly impact their bottom line.

Larger enterprises, while potentially better equipped to absorb the increased expenses, are still scrutinizing their Salesforce contracts to optimize their investments and explore alternative solutions.

"We're reevaluating our entire sales tech stack," says John Doe, CEO of a mid-sized SaaS company. "The new HVS pricing has forced us to look at whether we're truly getting the ROI we need."

Potential Alternatives and Strategies

Businesses are exploring various options to mitigate the impact of the pricing changes.

Some are negotiating with Salesforce to secure more favorable terms. Others are investigating alternative sales acceleration platforms that offer comparable features at a potentially lower price point.

Another strategy involves streamlining sales processes and optimizing the utilization of existing HVS features to maximize efficiency and minimize the need for additional costly functionalities.

Training sales teams to leverage current tools more effectively can also help reduce reliance on expensive add-ons.

Salesforce's Perspective

Salesforce maintains that the pricing adjustments are designed to better reflect the value and capabilities of HVS and to provide customers with more flexibility and control over their investments.

The company asserts that the updated pricing structure aligns with its commitment to innovation and continuous improvement, enabling it to invest in new features and enhancements that will ultimately benefit its customers.

However, this explanation has not fully quelled concerns among some users who feel that the pricing changes are not transparent or justified.

Looking Ahead

The long-term impact of Salesforce's HVS pricing change remains to be seen.

It will likely depend on how businesses adapt to the new structure, whether they find alternative solutions, and how Salesforce responds to customer feedback.

One thing is certain: the pricing update has sparked a significant conversation about the value and cost-effectiveness of sales acceleration platforms, prompting companies to carefully evaluate their technology investments and strategies.