Highest Rated Fidelity Funds Morningstar

Imagine strolling through a vibrant garden, each flower representing a different investment opportunity. Some blooms are radiant and thriving, while others are struggling to reach their full potential. For investors navigating the complex world of mutual funds, Morningstar serves as a trusted guide, illuminating the path to the most promising blossoms.

This article delves into the world of Fidelity funds that have earned top ratings from Morningstar, highlighting their performance, strategies, and what makes them stand out in a crowded field. These high ratings signal strong risk-adjusted returns and consistent performance, making them attractive options for investors seeking long-term growth.

Fidelity's Shining Stars

Fidelity Investments is a well-known name in the financial world, managing trillions of dollars across a wide array of investment vehicles. Several of their funds have consistently garnered high praise from Morningstar, earning coveted four- and five-star ratings.

These ratings are based on a fund's past performance relative to its peers, its risk profile, and the expertise of its management team. A high Morningstar rating indicates that a fund has historically delivered superior returns while managing risk effectively.

Understanding Morningstar Ratings

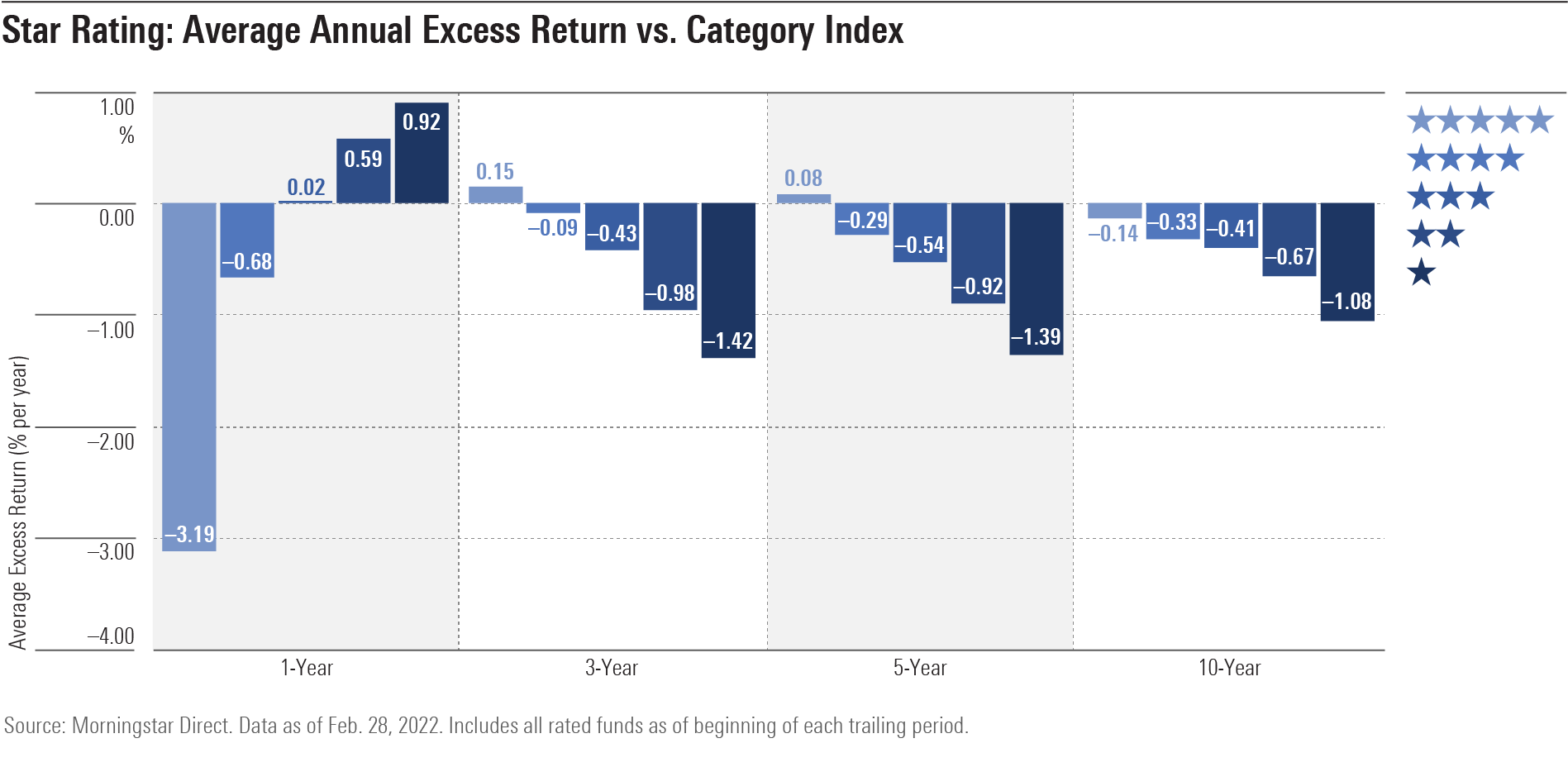

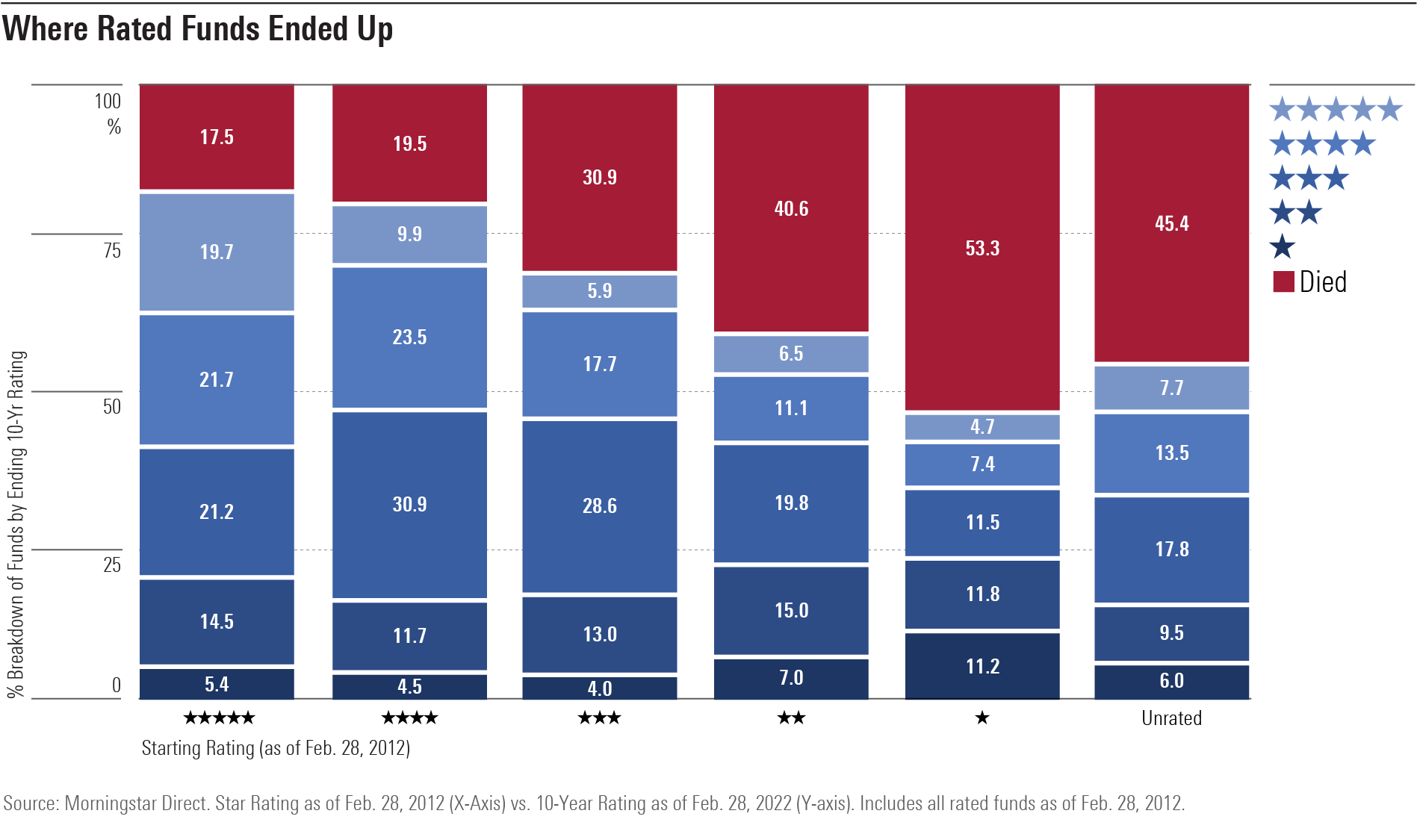

Morningstar's rating system uses a scale of one to five stars, with five stars representing the top 10% of funds in a particular category. The ratings are not a guarantee of future performance, but they provide a valuable framework for evaluating a fund's track record.

According to Morningstar's website, the ratings are calculated using a risk-adjusted return measure that takes into account both a fund's returns and its volatility. This helps investors identify funds that have not only generated high returns but have also done so in a relatively stable manner.

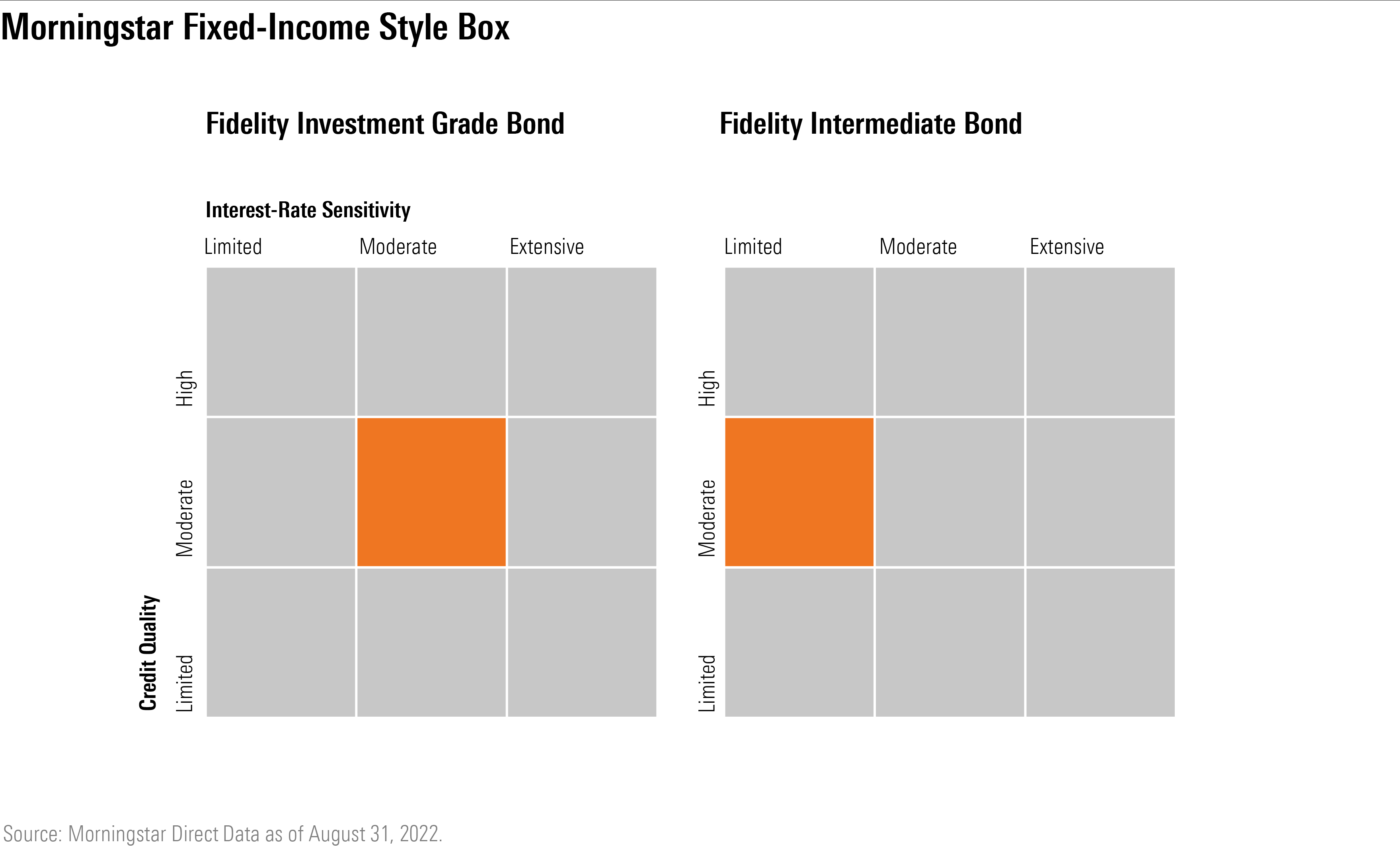

Factors considered include the fund's expense ratio, manager tenure, and the overall investment strategy.

Spotlight on Top-Rated Funds

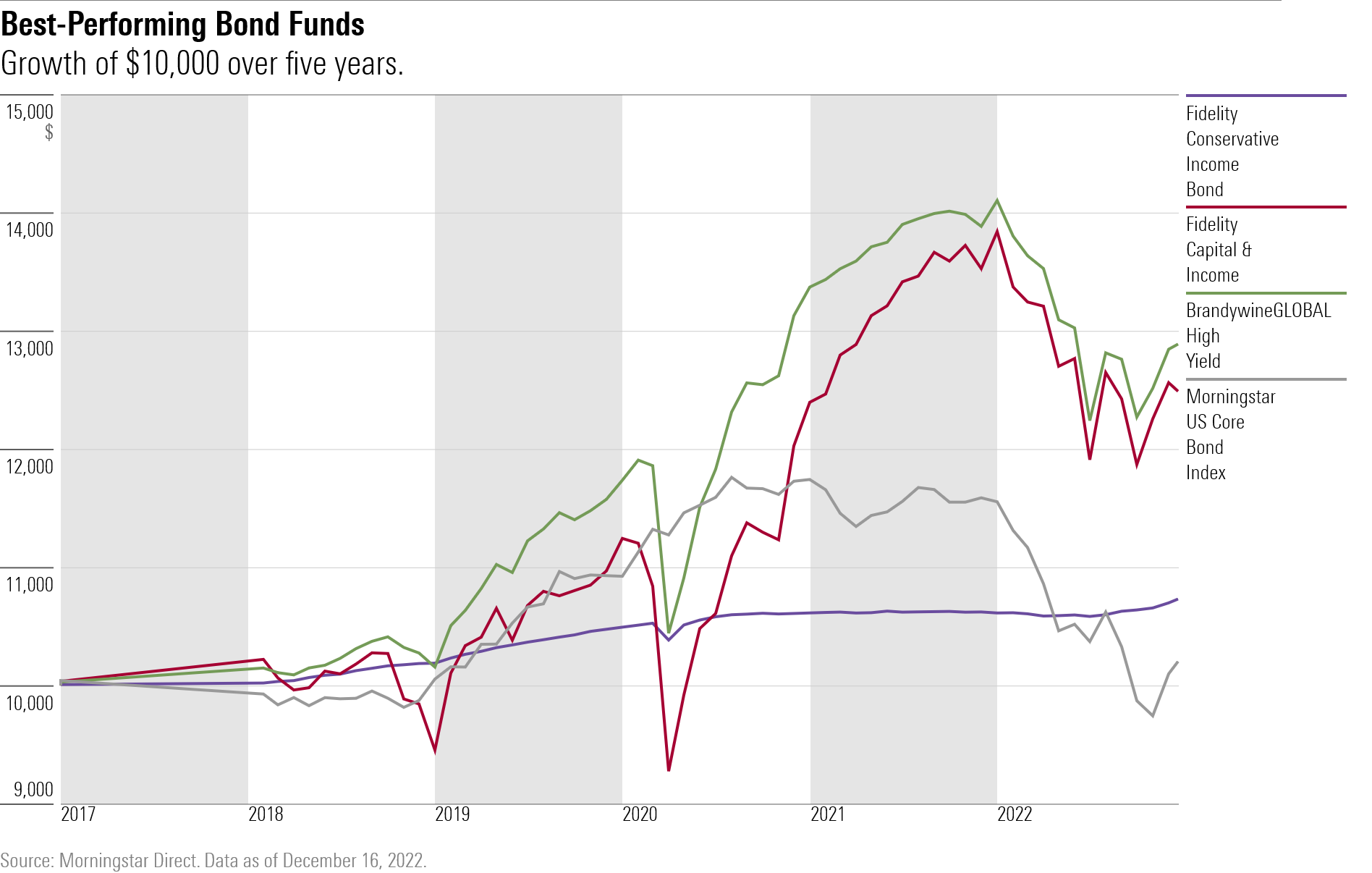

While specific fund recommendations fluctuate and are subject to change, a consistent element across highly rated Fidelity funds is strong management and a well-defined investment philosophy.

For example, the Fidelity Contrafund (FCNTX), managed by Will Danoff, has a long history of strong performance. The fund focuses on large-cap growth stocks, seeking companies with strong earnings potential and innovative business models.

Another notable example is the Fidelity Low-Priced Stock Fund (FLPSX). This fund seeks capital appreciation by investing in undervalued companies with market capitalizations similar to those of companies in the Russell 2000 Index. This shows their diverse approach.

The Significance of Active Management

Many of Fidelity's top-rated funds benefit from active management, where experienced portfolio managers make investment decisions based on in-depth research and analysis.

This active approach allows fund managers to adapt to changing market conditions and identify opportunities that passive investment strategies might miss. This can lead to better long-term performance, though it also comes with higher fees compared to passively managed index funds.

However, the potential for outperformance often justifies the higher cost for investors seeking to beat the market. Diversification is crucial as always.

Investing Wisely

It's important to remember that past performance is not indicative of future results. While Morningstar ratings can be a helpful tool, investors should conduct their own due diligence before making any investment decisions.

This includes carefully reviewing the fund's prospectus, understanding its investment objectives and strategies, and assessing its risk profile. Consider your own financial goals, risk tolerance, and investment timeline.

Consulting with a qualified financial advisor can also provide valuable guidance and help you make informed decisions that align with your individual needs. Always remember, investment involves risk.

A Path Forward

Navigating the world of mutual funds can feel overwhelming, but Morningstar ratings offer a valuable starting point for identifying promising investment opportunities. By focusing on funds with strong track records, experienced management, and well-defined investment strategies, investors can increase their chances of achieving their financial goals. Ultimately, the most successful investment strategy is one that is well-researched, carefully considered, and aligned with your individual circumstances.

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/WXZRQL6CVVEKTL4O3K3C4XEKAE.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/UFA3QEDO75HYJONS452ZQEUW54.png)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/OMVK3XQEVFDRHGPHSQPIBDENQE.jpg)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/7CDN2KTLNRHDXEYERM3RHNK5SE.png)